Kelvin Murray

paper

The SPDR Blackstone Senior Loan ETF (SRLN) is a fixed income exchange-traded fund. This instrument has an interesting name, which stands for “Senior Loan,” and it forms the underlying collateral for this ETF:

SPDR Blackstone The Senior Loan ETF (the “Fund”) seeks to provide current income consistent with the preservation of capital. To achieve its investment objective, the Fund generally invests at least 80% of its capital and seeks to outperform the Markit iBoxx U.S. Dollar Liquid Leveraged Loan Index (the “Primary Index”) and the Morningstar LSTA U.S. Leveraged Loan 100 Index (the “Secondary Index”). The net worth of its senior loans (plus any borrowings for investment purposes). For purposes of the 80% test, a “senior loan” is a first lien senior secured floating rate bank loan.

The fund provides investors with the expertise provided by Blackstone, a premier investment management firm.Although Blackstone specializes in Private equity fund managers also operate some ETFs and CEFs.

Generally speaking, large asset managers that both make direct investments and manage credit tend to have unique streamlined platforms that in some cases benefit end investors.

In this article, we’ll take a closer look at SRLN, its construction, historical performance and analysis, and provide our opinion on what actions retail investors should take when considering the leveraged loan asset class.

Underlying Collateral – Overweight Single “B” Loan

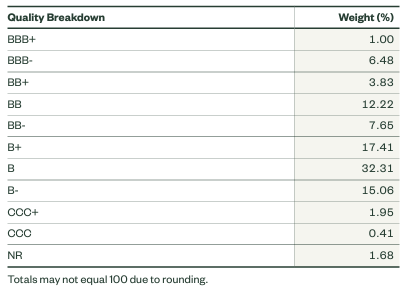

This ETF is overweight to single-B leveraged loans, accounting for over 60% of the portfolio:

Rating (fund website)

However, the fund does not take on excessive risk through its CCC category, which accounts for just 2.36%. The portfolio is otherwise a middle-of-the-road portfolio:

Details (Fund Fact Sheet)

The fund is very granular, with over 545 names, a maximum concentration of 1.8% per issuer, and an average portfolio price close to par.

Due to rising SOFR/LIBOR levels (sourced directly from federal funds), the weighted average overall interest rate is currently 8.61%.

Analysis – Lagging ETF Peers

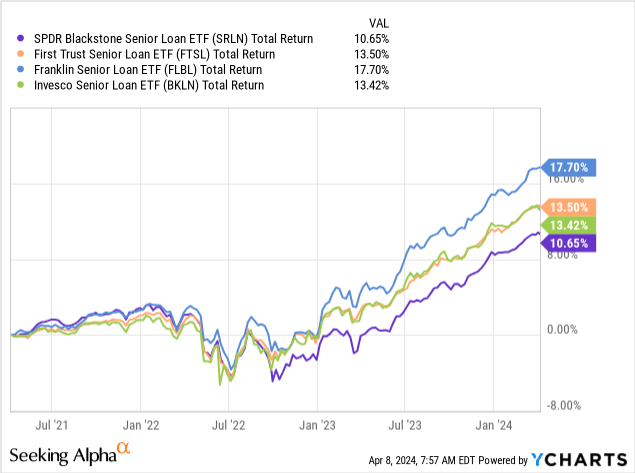

When analyzing SRLN, we must look at the fund’s analysis, especially when comparing it to similar funds:

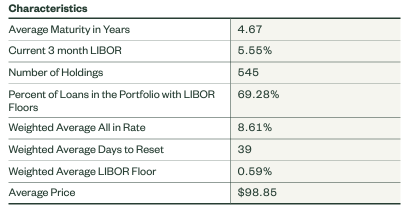

Analysis (Author/Morningstar)

SRLN isn’t cheap, and the ETF’s expense ratio of 0.7% is close to the highest rates charged by its peers. In terms of risk and return, this fund has the lowest Sharpe ratio (investors should hope for a high Sharpe ratio) and the highest drawdown in 2022. On a standard deviation basis, the fund’s name compares favorably to similar funds. The ETF has a huge volatility gauge.

The most inclusive metric here is the Sharpe ratio, which compares an investment’s return to its risk. Sharpe basically normalizes various asset classes into one indicator. For this reason, for example, when you purchase high-yield securities, one expects to receive higher compensation due to the higher probability of default compared to investment grade. But is this compensation enough to justify the risk? This is what Sharp takes into account and presents as a normalized ratio. The higher the sharpness, the better. On this metric, FLBL looks best. When coupled with a low expense ratio (one of the lowest in its class, to this point), FLBL is the standout name here.

Drawdowns are also important to some investors, as many are reluctant to see negative numbers in their brokerage accounts, even if those numbers are temporary. This asset class is generally a low-duration asset class, so drawdown levels in 2022 will be low.

Performance – Historical compensation matched by poor analytics

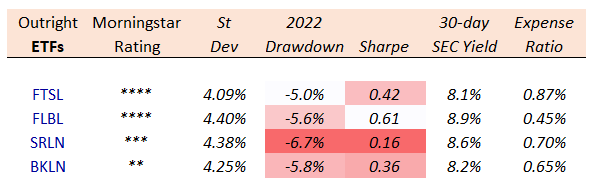

The fund’s historical total returns match its poor analysis:

In the three-year review, SRLN ranks near the bottom compared to First Trust Senior Loan ETF (FTSL), Franklin Senior Loan ETF (FLBL), and Invesco Senior Loan ETF (BKLN).

Most of the time, total returns match the fund’s analysis, and unless there are significant changes to the portfolio manager or strategy, one can expect this to continue.

In the leveraged loan space, when comparing a group of similar funds, it comes down to the choice of individual names. Blackstone hasn’t done a good job of picking winners and selecting credits that beat the market. Unless there is a change in how individual names are chosen, the weakness relative to peers is expected to persist.

This fund is an example of a collateral manager who doesn’t do a good enough job compared to peers or even the index it wants to outperform:

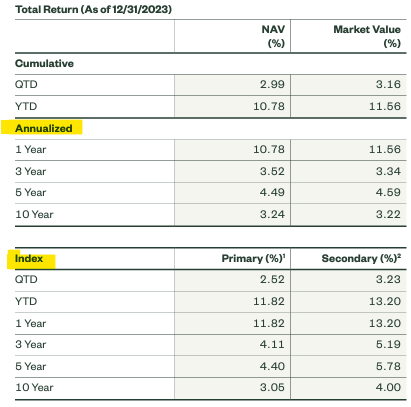

Performance (Fact Sheet)

The table above is taken from the fund fact sheet, in which managers present their performance relative to the index. In addition to lagging its peers, the fund also lagged the index on one- and three-year reviews.

Leveraged loans look attractive ahead of Fed rate cuts

It’s been an interesting year, with the economy stronger than expected and markets now delaying the total number of rate cuts the Fed will make this year. As long as federal funds are high, leveraged loans offer high dividend yields. Even if the Fed cuts interest rates three times and SOFR decreases by 75 basis points, the yield on leveraged loans will still be close to 8%.

The economy has been strong so far, so it’s a good idea to move to floating rate asset classes until we see a significant deterioration in leading economic indicators.

While we have established that SRLN ranks near the bottom among its peers, the fund is a Hold in the current environment and its yield risk remains attractive.

in conclusion

SRLN is a fixed income exchange-traded fund. This instrument is managed by the renowned Blackstone Asset Management, but unfortunately, given its pedigree, it failed to outperform the market. The ETF has poor analytical capabilities compared to its peers and even underperformed the Leveraged Loan Index over the 1- and 3-year lookback periods. New funds looking to allocate to the leveraged loan ETF space would be better off focusing on FLBL, which we cover here, while existing shareholders can hold on until the Fed starts cutting interest rates.