Piranha

introduce

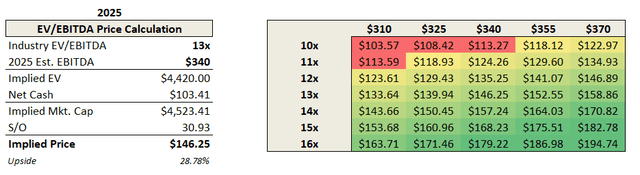

Sterling Infrastructure Corporation (NASDAQ: STRL) is a small construction and engineering firm that provides infrastructure services and solutions to a wide range of clients.with expected exponential growth Among projects related to artificial intelligence, electric vehicles and semiconductors, Sterling’s electronic infrastructure division Have the necessary tools to make this growth feasible. In addition, its strategic focus has shifted from low-profit projects to high-profit, high-growth opportunities, laying a solid foundation. Even though the share price is up about 200% since the start of 2023, I believe STRL still has significant room to grow. I recommend buying Sterling Infrastructure with a price target of $146 and upside potential of approximately 29%. My target is based on 2025 EBITDA of $340 million and 13x EBITDA.

Company Profile

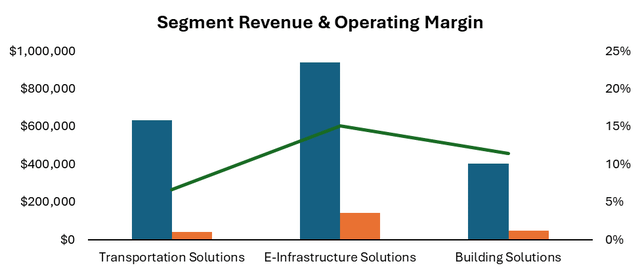

The British pound works in the following ways: Three main parts: Electronic infrastructure solutions, transportation solutions and construction solutions. The electronic infrastructure segment accounts for 48% of total revenue and operations accounts for 15% Profit margin is the fastest growing part. It serves large blue-chip end-users in e-commerce, data centers, manufacturing and power generation. It has secured several large-scale projects in the fields of electric vehicles and solar energy. The Transportation Solutions segment, driven primarily by government spending, accounted for 32% of total revenue and had an operating margin of 7%. The company has undergone significant changes since 2016, moving away from low-priced heavy highway projects and toward higher-margin projects including airports. In 2016, these low-margin items accounted for 79% of revenue, but now account for only 15%. Finally, Building Solutions, which operates primarily in Dallas-Fort Worth, contributed 20% of the company’s revenue and had an operating margin of 11%. Management expects continued decline in the commercial segment of the sector, offset by strong momentum in the residential sector as a result of continued population growth and housing shortages.

STRL Investor Presentation – Sidoti January Microcap Conference

financial positioning

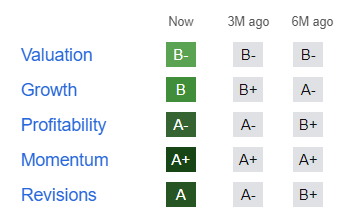

While some believe the recent share price run is unsustainable, I think it brings the company closer to industry norms while still maintaining an attractive valuation. I don’t see a single data point that could be considered overvalued compared to the construction and engineering industry. From a debt perspective, its debt to free cash flow ratio is 2.9, compared with the industry median of 10. From a capital structure perspective, its debt-to-equity ratio currently stands at 64%, compared with the industry median of 80%. Talking about margins, STRL further demonstrates its strong positioning, with FCF margins of approximately 20%, making it the highest in the industry. This is all supported by price multiples that are either in line with or below comparable companies. I discuss relative valuation in detail at the end of this article, and you can see the breakdown below.

Revenue (thousands of dollars) (Excel)

Adjustment of strategic focus

Management has clear plans to move away from lower-margin heavy-duty highway and water treatment projects and toward the higher-margin, high-growth areas of electronics infrastructure and construction solutions. This can be seen in the recent $18 million divestiture of Myers and the acquisitions of Concrete Construction Services of Arizona LLC and Professional Plumbers Group, both of which are moving into the more profitable residential market . This transformation supports a sustainable growth trajectory by increasing gross margins and diversifying revenue streams. Unlike many of its competitors, which spread their efforts across a wide range of projects, STRL now remains focused on high-quality projects that expand profits.

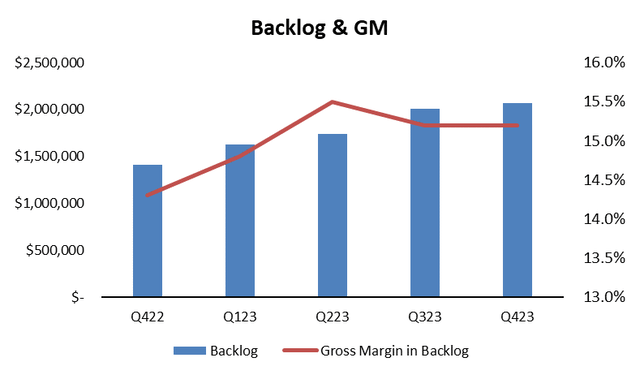

Backlog of orders is sufficient

To gain more insight into the sustainability of Sterling’s growth, we can look at its backlog, which stood at $2.07 billion at the end of 2023, up from $1.41 billion the year before. Additionally, the quality of these projects has improved significantly, as evidenced by gross margin reaching 17% in 2023, compared with 15% in 2022. This robust workflow, supported by improved operational efficiencies, demonstrates STRL’s positioning within the industry. space. Management expects approximately 65% of the backlog to be completed by 2024. Other competitors saw significantly lower backlog growth during the same period: Construction Partners, Inc. (ROAD) grew just 14%, Comfort Systems USA, Inc. (FIX) grew just 26%, and Dycom Industries (DY) grew just 13%. Comparing this with Sterling’s 46% backlog growth further demonstrates the sustainability of its competitive advantage.

Backlog (in thousands of U.S. dollars) (Excel)

Electronic infrastructure opportunities

Sterling has a clear and strong positioning in the infrastructure sector, further supported by a diverse and high-quality project selection. I see the greatest opportunity in electronic infrastructure, which provides the necessary tools for data center, semiconductor, and electric vehicle projects, all of which will continue to grow exponentially.this US data center market The compound annual growth rate is expected to reach 14% by 2032 The U.S. government has announced plans Spending US$11 billion on semiconductor research and development, electric vehicle market The compound annual growth rate is expected to reach 17% by 2028. Sterling Infrastructure provides the picks needed to mine this gold.Still, many people think we’re in an AI bubble, similar to the dot-com bubble, but I don’t think that’s case. Artificial intelligence will change all walks of life, and the phenomenon of strong demand and insufficient supply is obvious.The current barrier to this growth is inadequate infrastructure information Center and energy support. This creates an immediate market opportunity for GBP to exploit. STRL has announced contracts with leading companies including Rivian, Meta and Amazon to build data centers and next-generation manufacturing sites. These relationships will only create more network benefits and allow Sterling to gain significant market share over the next 10 years. Although there are many strong players in the space, demand for electronic infrastructure solutions still far outstrips supply, creating ample scope for further opportunities.

relative valuation

Based on a multiple of 13x EBITDA, my relative valuation estimates 2025 EBITDA of $340 million. For comparable companies, I looked at the Construction & Engineering Industrials sub-industry and what management considered comparable companies in their most recent 10-K; both produced relatively similar results. In terms of EV/EBITDA, the average range is 14x to 16x, with STRL currently at 13x. While the 2025 EBITDA consensus is $321 million, only one Wall Street analyst covers the stock, creating a higher chance for estimates to change. My $340 million EBITDA implies a margin of approximately 14%, driven by exponential growth in technology-related projects supported by margin expansion in the transportation solutions segment. Furthermore, based on the competitive landscape, I think 13x is very reasonable. STRL’s Seeking Alpha Quant rating of 4.93 further supports this valuation.

Excel Seeking Alpha

absolute valuation

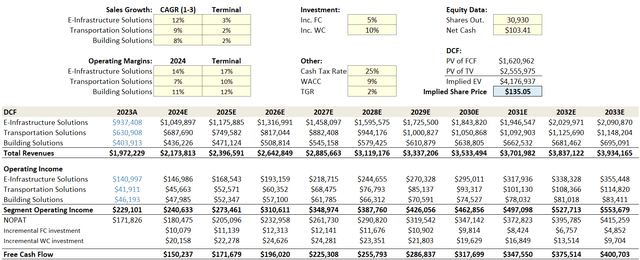

For my DCF valuation, I assume a stable 3-year CAGR in revenue that tends to decline toward the terminal value. For operating margins, I assume further margin expansion primarily in electronic infrastructure and transportation solutions. When considering reinvestment, I chose incremental assumptions based on changes in sales. The greater need for working capital comes from the nature of its backlog and contracts. The WACC of 9% is calculated based on a 10/90 split of debt and equity, where the cost of equity is 9.6% and the cost of debt is 5%. While arguments can be made against these assumptions, there is still plenty of room for value creation, supported by Electronic Infrastructure’s margin expansion and bullish revenue growth opportunities. My DCF price target is $135.05, implying an upside of approximately 20%.

Excel

risk

The most notable risk is implied volatility, as it was considered a microcap stock prior to 2020 and only recently surpassed a $1 billion market cap. Currently, its one-month implied volatility is around 45%, while the SPDR S&P 500 ETF Trust (SPY) is around 11%. This means that major changes in expectations, or lower-than-expected profits, could result in large price changes. Additionally, as a small-cap stock, it has less access to affordable capital and a smaller market share than its competitors with international reach. In addition to this, any negative changes in electronic infrastructure customer spending will result in lower valuations. Artificial intelligence also has the potential to trigger a bubble, but I think the risk is small. Notably, the stock has gained nearly 200% in the last year and is currently trading at a new 52-week high. Downside risks are also likely to rise if we experience any macroeconomic recession, as infrastructure spending will fall significantly. On a final note, only one Wall Street analyst covers the stock and currently rates it a Hold.

in conclusion

Although STRL’s share price has risen significantly, I don’t see any significant overvaluation. In contrast, STRL has an excellent capital structure and continues to deleverage, has industry-leading margins, and trades at a discounted EV/EBITDA multiple. From a fundamental perspective, margins in the transportation sector have expanded significantly, and the electronics infrastructure sector continues to show strength with clear industry drivers. From a financial perspective, its backlog of high-margin projects is growing and there are no obvious areas of difficulty. Overall, I see strong long-term growth opportunities, further supported by margin expansion. Volatility in the stock may provide a better entry point over the next two years, but either way, I see plenty of opportunities ahead.