Stocks with the biggest gains at noon: TSLA, GEHC, COIN | Private Equity Weekly

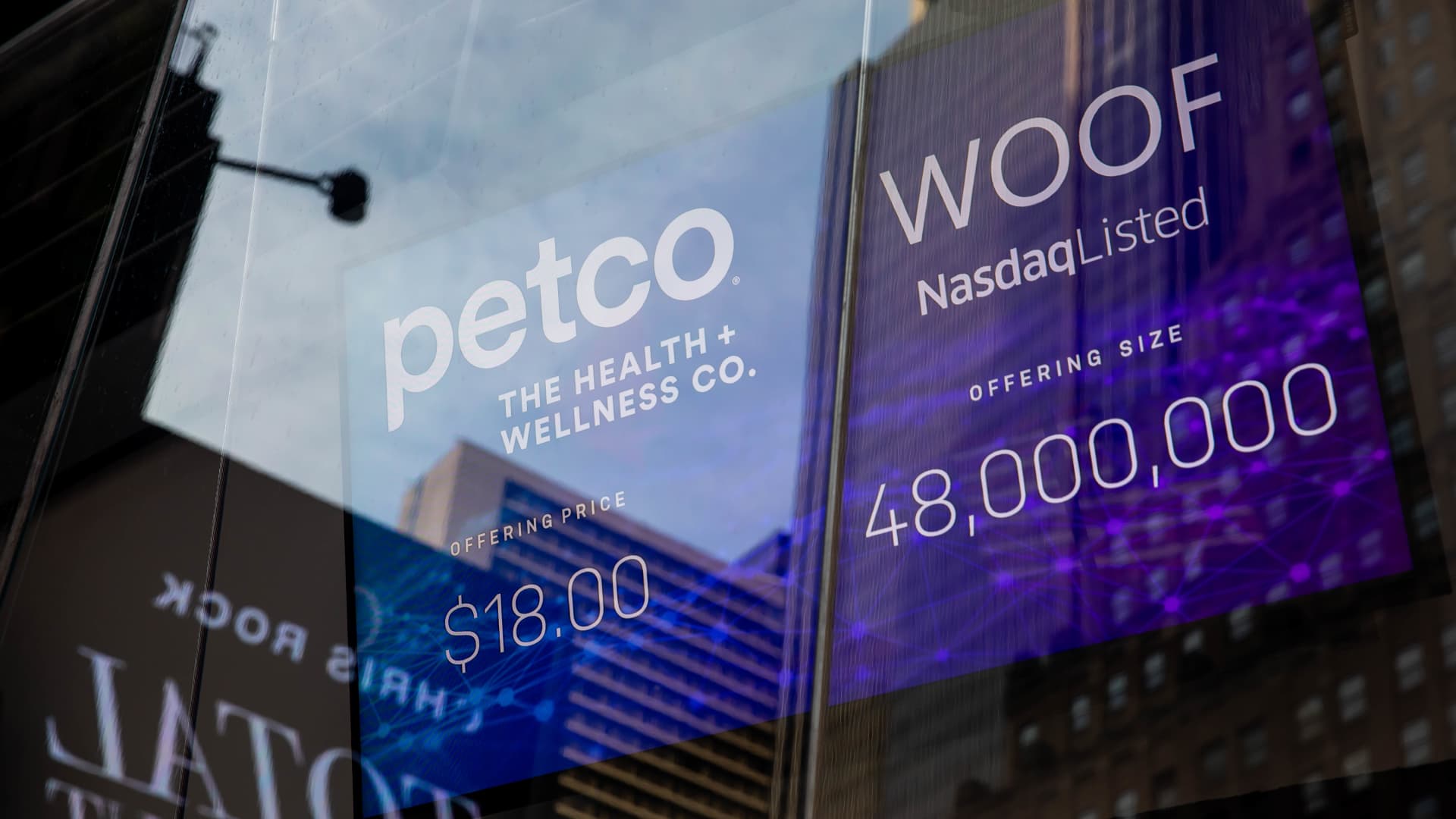

Take a look at the companies making headlines in midday trading. CRYPTO STOCKS – Stocks that correlate with the price of Bitcoin rose as the cryptocurrency hit new records for a third straight day. Cryptocurrency exchange Coinbase rose about 3%, and Bitcoin agency MicroStrategy surged nearly 10%. In the cryptocurrency mining sector, Marathon Digital, Riot Platforms and Iris Energy all rose more than 2%. CleanSpark rose about 7%. Texas Roadhouse — The restaurant chain gained nearly 3% after Baird upgraded its stock to outperform. The company said the Kentucky-based chain should be able to continue climbing even though its shares are near all-time highs. Moelis & Co. — Goldman Sachs raised its rating on the investment bank to neutral from sell and said the company is a “huge beneficiary of the start of cyclical upswings” after a post-earnings pullback, with shares rising nearly 4%. Tesla — Shares fell 3.5% after Wells Fargo downgraded the electric car maker to underweight from equal weight, noting that “the impact of price cuts is fading, leading to volume risks.” Nvidia, Advanced Micro Devices, Micron Technology — Shares of chipmakers fell on Wednesday as artificial intelligence-related gains continued to retreat this week. Nvidia shares fell 3%. Micron fell 3.8% and AMD fell 4.2%. Dollar Tree — Shares of the discount retailer fell more than 13% after releasing a disappointing quarterly report. Dollar Tree reported fourth-quarter adjusted earnings per share of $2.55 on revenue of $8.64 billion. Analysts polled by London Stock Exchange Group (LSEG) expected earnings of $2.65 per share on revenue of $8.67 billion. The company also announced that it has identified 970 Family Dollar stores that may close. Dollar General — Shares of the discount retailer fell 3% after rival Dollar Tree’s quarterly results fell short of expectations. Dollar General is scheduled to release its own earnings before the market opens on Thursday. It’s up more than 14% this year. GE Healthcare – Shares of GE Healthcare fell 3% after the medical technology company announced a secondary offering of 13 million shares. GE Healthcare Technologies was spun off from General Electric Co. in early 2023. Legend Biotech – Shares rose 4.6% after Raymond James initiated coverage on the commercial-stage biotech company with an outperform rating. The company is bullish on Legend Biotech’s Carvykti therapy, which treats multiple myeloma. Royal Caribbean, Carnival — Both cruise companies saw their shares rise after Goldman Sachs gave their shares a buy rating, saying it sees pricing power and pent-up demand for cruise stocks. Royal Caribbean shares rose about 2%, while Carnival shares rose 3.3%. Petco Health & Wellness — Shares of Petco Health & Wellness fell 6% after the troubled pet retailer announced it was looking for a new chief executive. The company reported fourth-quarter revenue on Wednesday that beat expectations, with adjusted earnings of 2 cents per share on revenue of $1.67 billion. Analysts had expected LSEG to earn 2 cents per share on revenue of $1.62 billion. —CNBC’s Alex Harring, Brian Evans, Samantha Subin, Yun Li, Lisa Kailai Han, Pia Singh and Michelle Fox contributed reporting.