RiverNorthPhotography

investment thesis

T. Rowe Price (NASDAQ: TROW) is a fundamentally sound asset management company that has outperformed relative benchmarks over the long term, leading to continued growth in assets under management.Despite the short-term challenges posed by rising interest rates The rate hikes that have resulted in net outflows over the past few years, and I believe rate cuts will follow in 2024, should help TROW navigate these short-term challenges. TROW has a shareholder-friendly management team with a healthy balance that can help the company navigate any macroeconomic environment. Based on the DCF valuation, I think TROW is worth holding as I estimate the stock will return 10% annually over the next five years.

Company Profile

T. Rowe Price is one of the world’s largest investment management companies, offering proprietary mutual funds and consultation service. The business makes money through management fees, which are based on the amount of assets managed by institutional and retail clients. TROW’s business model has proven to be sustainable as the company has been around for 80 years, but it does face competition from rivals such as Blackrock (black) and Vanguard, which offers low-cost index funds, and asset manager Fidelity.

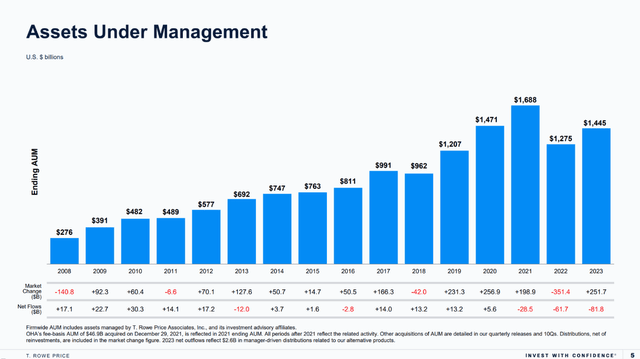

Manage asset turnover

As shown in the figure below, TROW’s assets under management from 2008 to 2023. We can see that assets under management have been on an upward trend during this period, increasing from $276 billion in 2008 to $1,445 billion in 2023. We can see that TROW’s assets under management peaked in 2021 with $1,688 billion in assets under management, and then declined significantly in 2022. I believe this significant decline is due to two key reasons.The first reason is that the market has had a rough year in 2022, with the S&P 500 returning -18.11%. As a result, assets under management also fell as the market fell. The second reason for the sharp decline is a change in monetary policy that has led to rising interest rates. As interest rates rise, demand and the amount of liquidity investors can put into funds like TROW decreases.

TROW 2023 Fourth Quarter Financial Report

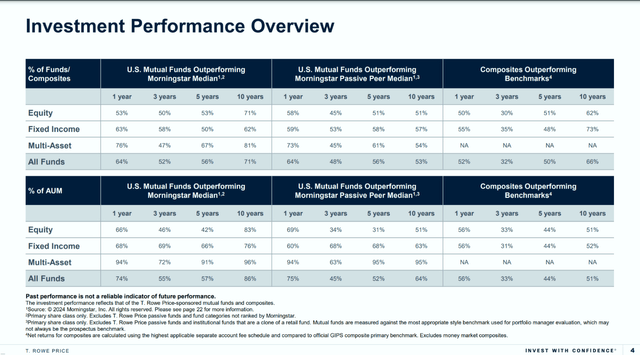

As the chart below shows, a large portion of TROW funds have consistently outperformed relative benchmarks over time, including equity funds, fixed income funds, and multi-asset funds. I believe that as long as TROW’s funds continue to outperform relative benchmarks, both institutional and retail investors will want to be among the outperforming players. This will eventually bring net traffic back to TROW.

TROW 2023 Fourth Quarter Financial Report

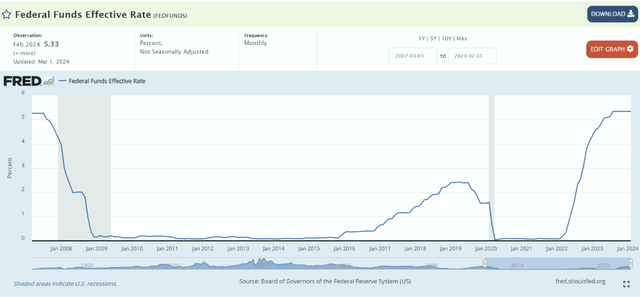

Additionally, another reason why I think net flows will improve is that I think a federal reversal is likely to begin cut interest rates Later in 2024. As available liquidity increases, interest rate cuts may entice investors to reinvest in TROW funds, thereby providing a positive boost to assets under management.

Federal Reserve Bank of St. Louis

In my view, based on TROW’s long-term outperformance relative to the benchmark and a potential rate cut later this year, I see net flows improving and expect TROW’s assets under management to continue turning a profit.

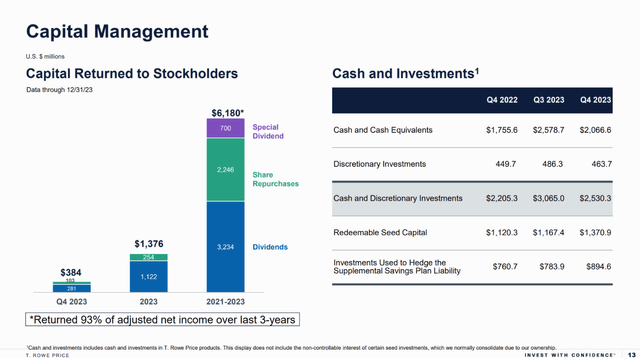

Shareholder friendly management team

The real positive thing about TROW is their shareholder-friendly management team, who have delivered 93% of adjusted net income Over the past three years, we have rewarded shareholders through a combination of dividends, share buybacks and one-time special dividends, as shown in the chart below.

TROW 2023 Annual Meeting of Shareholders

This commitment to return capital to shareholders demonstrates the company’s commitment to returning profits generated within the business to shareholders. The chart below shows TROW’s dividends per share from 2015 to 2023. We can see that the dividend payment has gradually increased year by year, starting at $2.08 per share in 2015 and reaching $4.88 per share in 2023. The company also likes to pay special dividends in years of increased profitability, and they paid an additional $3 per share in 2021.

Tikkel Pier

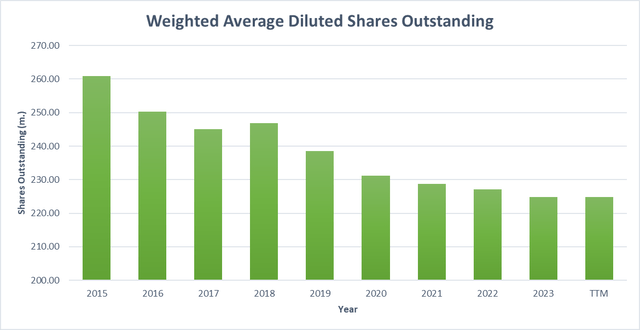

The chart below highlights TROW’s share count over the last nine calendar years. We can see that diluted shares outstanding have fallen from just over 260 million shares to approximately 225 million shares over the past 12 months. As a result, the number of outstanding shares decreased by a total of 13.5%.

Created by author

Overall, the management team clearly prioritizes shareholders and is committed to returning the majority of net profits to the owners of the business.

financial analysis

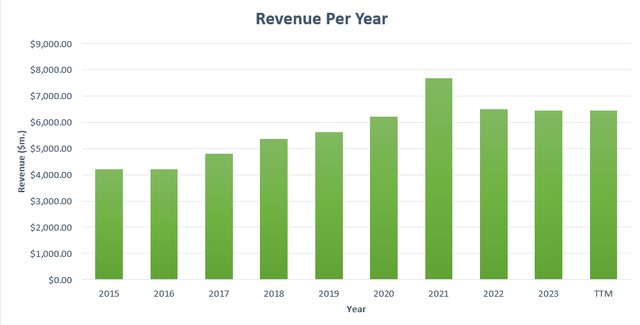

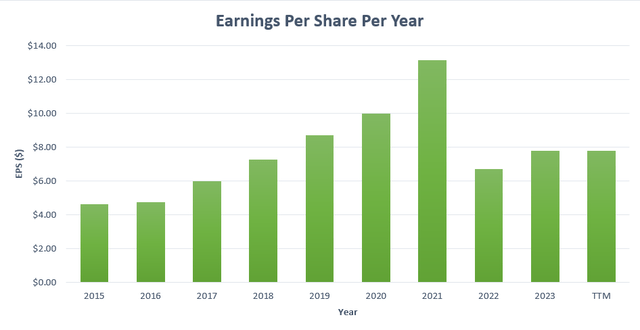

TROW’s revenue has grown slowly, from US$5.3726 billion in 2018 to US$6.4605 billion in the past 12 months, with a compound annual growth rate of approximately 4%. Earnings per share have been almost flat over the past five years, falling from $7.27 in 2018 to $7.76 in the trailing 12 months.

Created by author

Notably, earnings per share peaked in 2021, at $13.12 per share, due to historically low interest rates and huge demand for growth-focused funds like TROW. As interest rates rise, demand from retail investors decreases, resulting in a loss of assets under management, which in turn affects earnings per share. I believe EPS will turn around and return to growth in 2024, and falling interest rates could be a tailwind for TROW as it looks toward the end of 2024.

Created by author

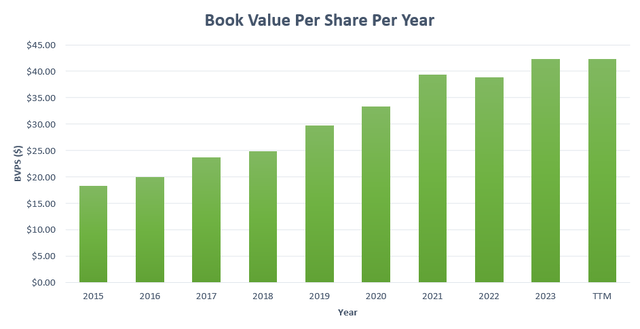

Book value per share (BVPS) has also grown, from $24.80 per share in 2018 to $42.28 per share currently. This metric has a CAGR of approximately 11%, showing that the company’s intrinsic value has increased over the years.

Created by author

As for liquidity, cash and cash equivalents in the latest quarter were $2,066.6 million. The company’s long-term debt totals $89 million, which is manageable. The current ratio is 1.79, which I think is healthy for TROW’s short-term financial health. Overall, TROW has a very strong balance sheet and debt is not an issue.

Looking ahead, I think financial performance will improve over the previous two years as I expect TROW to return to earnings growth driven by the likely impending fall in interest rates, which will drive more liquidity back into TROW’s funds, thereby increasing Income related to management fees.

Valuation

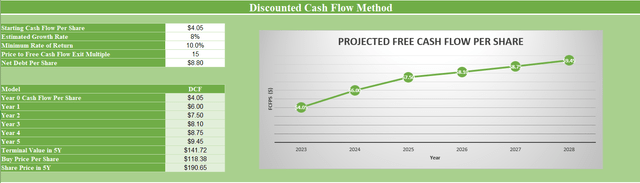

As of the fourth quarter of 2023, TROW currently has free cash flow per share of $4.05. Given my belief that TROW’s assets under management will resume growth, I expect TROW’s free cash flow per share to grow at 8% annually over the next five years. I believe free cash flow per share growth of 8% will be driven by a combination of two main factors. The first factor is that I expect their funds will continue to outperform, which will attract additional net flows and thus increase TROW’s assets under management. The second factor is that I expect share buybacks to continue, which will reduce the share count over the next five years and thus become a driver of free cash flow per share. Taking into account this growth, TROW is expected to have free cash flow per share of $9.45 by the fourth quarter of 2028.

Using an exit multiple of 15 (based on TROW’s average price to free cash flow ratio over the past decade), the stock’s estimated five-year price target would be $190.65. So if you invested in TROW at the current share price of $118.33, based on these calculations, the expected CAGR over the next five years would be 10%. So based on this valuation, I think TROW is worth holding as there is no margin of safety at the current share price.

Created by author

in conclusion

I think TROW is a solid asset management company. They face short-term challenges from net capital outflows over the past few years, which has put pressure on assets under management. However, TROW’s funds have a strong long-term history of beating relative benchmarks, which should help entice investors to reinvest in their funds, especially when we are likely to see interest rate cuts later in 2024. I believe that once rates come back up, this will be a positive driver for TROW’s assets under management. TROW also has a capable management team focused on returning capital to shareholders through dividends and stock buybacks. Based on current valuations, I think TROW is worth holding as I expect annual returns of 10% over the next five years.

Huge Games Selection

Huge Games Selection