river rocks photos

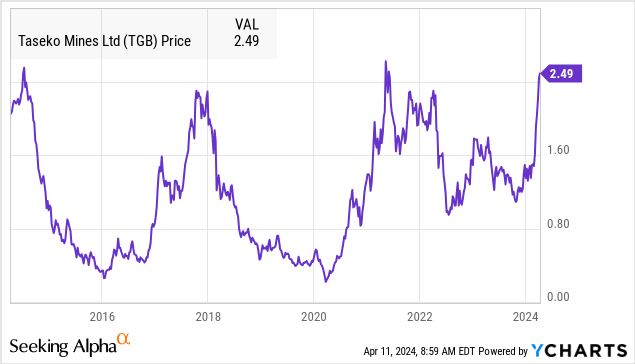

Tashi Valley Mining Co., Ltd. (NYSE:TGB) has emerged as a big winner, with shares up more than 75% year to date, climbing to their highest level in the past decade.

Despite tumultuous history, the North American mining company is now posting profitable growth At the same time, it benefited from the new wave of copper prices. We believe TGB’s prospects are stronger than ever, worthy of investors’ attention, and that there is room for the share price to rise.

What does the Tashi Valley Mine do?

Taseko operates the “Gibraltar Mine”, considered Canada’s second-largest open-pit copper resource and generating significant free cash flow in the current environment.

Construction is also progressing on Taseko’s second asset, with production expected to begin next year. “Florence” Project Expected to be in Arizona, USA Transformative for the company, annual copper production capacity increased by more than 85 million pounds.

Production across the company will increase by nearly 80% by 2026 compared to Gibraltar’s production of 123 million pounds last year

Source: Company IR

TGB Financial Review

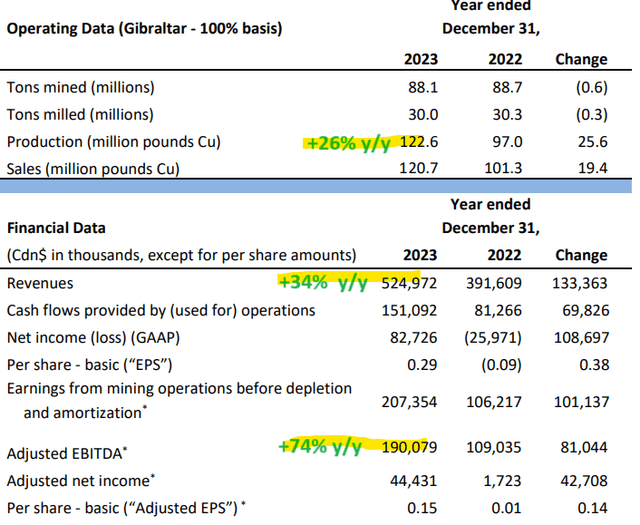

The company reported that 2023 results Overall earnings per share in March were $0.15, and adjusted net income was $44.4 million, a significant improvement from $1.7 million in 2022. Likewise, adjusted EBITDA in 2023 was $190 million, an increase of 74%.

In 2023, Taseko acquired the remaining 12.5% minority stake in Gibraltar and currently owns 100% of the business. By consolidating the mine’s total output of 123 million pounds of copper, total revenue increased 34% year over year and average realized prices also increased.

Another important development is the decline in operating costs, which will fall to $2.37 per pound from $2.98 in 2022. Notably, fourth-quarter cash costs were just $1.91, providing a roadmap for continued strong earnings in 2024.

Source: Company IR

In terms of guidance, management expects 2024 copper production of approximately 115 million pounds, factoring in some planned maintenance outages. The latest news from Florence is that all permits have been obtained and construction will begin in the second quarter, with commissioning and initial production planned for the fourth quarter of 2025.

Taseko ended the quarter with a cash balance of $97 million and available liquidity, including lines of credit, totaling approximately $176 million. On the plus side, net leverage at year-end was 2.6x, down from 4.2x in 2022.

Management believes its balance sheet position, in addition to recurring free cash flow from Gibraltar, has committed financing in excess of the $232 million expected to be completed for remaining capital expenditures on the Florence project.

What’s next for TGB?

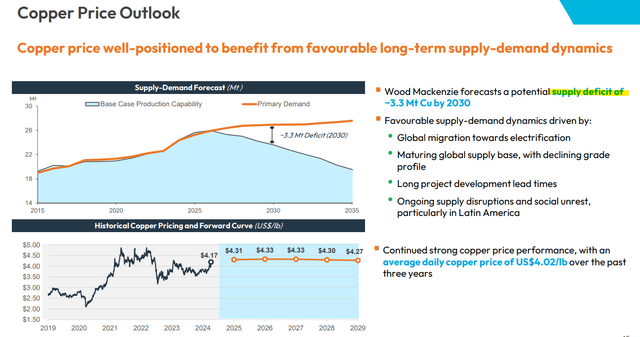

What we like about Taseko is its focus on copper extrusions in a world-class North American jurisdiction. We mentioned that copper prices have climbed above $4.20/lb, up 20% from a low of about $3.55 last October. Of course, earnings in 2024 will capture a higher pricing environment as a catalyst for the stock.

Taseko highlighted research from consultancy Wood Mackenzie, which noted that copper faces a widening supply shortage over the next decade.Amid resilient global economic conditions, recent developments have been improving China macro datathe world’s largest copper consumer.

In March, it was reported that an industry group composed of China’s top smelters agreed inhibit production Solve the shortage of copper concentrate in the local market. The headlines represent tailwinds for copper, while metals and energy commodities are also broadly higher.

Source: Company IR

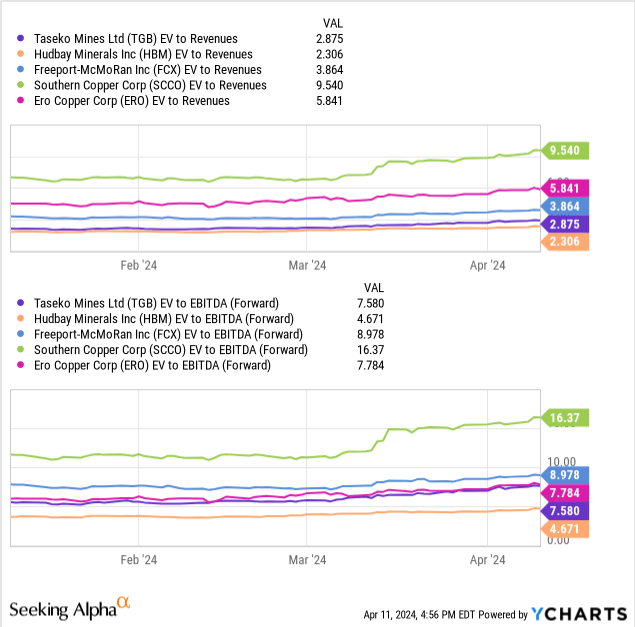

In terms of valuation, TGB trades at 3x, which we think is attractive relative to Freeport-McMoran Inc. (FCX)’s 4x or Ero Copper Corp.’s (ERO) 6x . We think it’s also compelling that TGB trades at EV, lowering its EBITDA multiple below 8x.

The key here is that with the eventual launch in Florence, Taseco will be one of the industries with the highest production and revenue growth potential over the next five years. By this measure, the stock would need to command a growth premium from current levels to support further upside from its current market cap of $725 million.

final thoughts

We rate TGB a Buy and its shares are a good choice for investors looking to learn about copper market fundamentals from a quality North American small-cap producer. The setup here is for a set of strong quarterly earnings, which we believe could top expectations as copper prices remain bid.

It is important that the company continues to make progress towards the completion of the Florence project, given a number of risks that need to be considered. If copper prices fall back below $3.50 per pound, it will force us to reassess our profit outlook. Monitoring points to 2024 include trends in operating cash costs and output levels.