Alexei Bakhalev

Shipping has been one of the best-performing industries in recent years, benefiting from a widespread shortage of large ships after years of sluggish industrial investment.Tanker industry strong on shortage Due to the geopolitical and economic collapse of certain trade relations, particularly oil exports from Russia to Europe and the ongoing Chaos in the Red Sea.

As profitability improves, Teekay Tankers Ltd. (NYSE: TNK) significantly reduced debt, giving way to huge free cash flow. Currently, TNK’s free cash flow yield is as high as 30%.Of course, we have to take into account that its revenue is not expected to remain stable at current levels over the next few years, as it has benefited from a series of events that have significantly Increase tanker freight rates. That said, if the various economic and geopolitical trends driving this situation persist, Teekay will likely maintain its current highly profitable position.

I am very bullish on TNK in 2020, but downgraded TNK to “Hold” last year due to continued concerns about the petrodollar system. To me, investors should continue to weigh how the BRICS’ efforts to distance themselves from the U.S. system could hinder global trade, especially oil trade. As geopolitical conflicts intensify in the Middle East, risks appear to have diminished significantly as major exporters such as Saudi Arabia and Qatar struggle to keep their oil economies afloat.

TNK’s valuation is significantly higher than last April, with gains particularly strong since October as the company may be viewed as a hedge against Middle East markets. Basically, as the Red Sea trade collapses, demand for the long-distance transport Teekay provides is likely to increase. Additionally, we continue to see an increase in U.S.-European oil trade on both sides of the Atlantic, opening the door to a potential long-term supply and demand imbalance in the tanker market. With this in mind, now seems like a good time to reanalyze Teekay’s economic position and valuation.

Expect strong profits in the coming years

Like most shipping stocks, Teekay faces significant cyclical risk, as shipping demand changes more dramatically with global economic cycles. Since both supply and demand curves are inelastic, slight supply and demand imbalances in the market can cause large fluctuations in freight rates. In other words, the recession reduced oil import demand, but only modestly and smaller than most changes during recessions. Furthermore, increases in freight rates do increase the supply of shipping vessels, but only over a few years because of the time and resources required to build new tankers. Therefore, if there is a shortage in the market, this shortage will persist, mainly if external issues such as geopolitics affect the market.

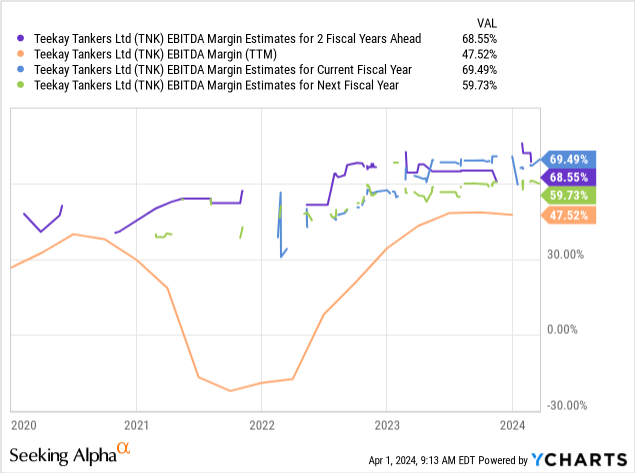

The company’s consensus earnings per share in 2024 are $13.75, and its forward “P/E ratio” is 4.25 times. Its earnings per share are expected to remain near this high until at least 2026, according to analyst consensus, meaning other analysts expect the tanker shortage to continue. It is expected that its EBITDA profit margin will climb from 47% TTM level to 60-70% in the next two fiscal years. see below:

Consensus suggests TNK will earn total earnings of about $40 per share over the next three years. Assuming its earnings per share will be sustained beyond 2026, TNK will likely recoup all of its current market capitalization by 2028-2029, suggesting that its current valuation is very low. That being said, TNK also regularly loses money, and this could happen again if the supply-demand imbalance is resolved.

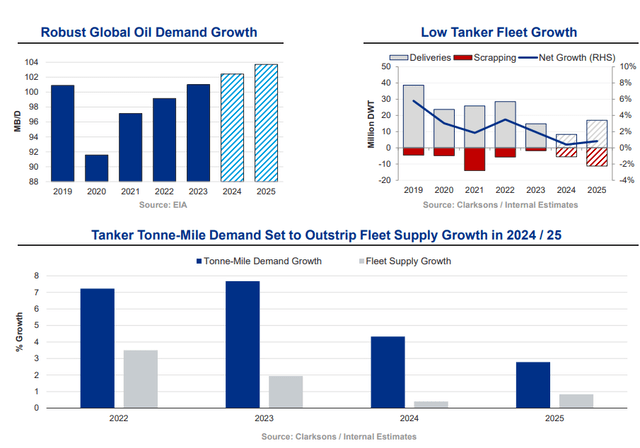

That said, there is more evidence of a growing net shortage rather than a return to the excesses of the 2010s. First, the growth rate of the global tanker fleet will continue to decline this year and next. Demand growth may also slow down, but the overall supply and demand gap may then expand. see below:

Teekay Tankers – Tanker Supply and Demand Outlook (Teekay Tankers Q2 Presentation)

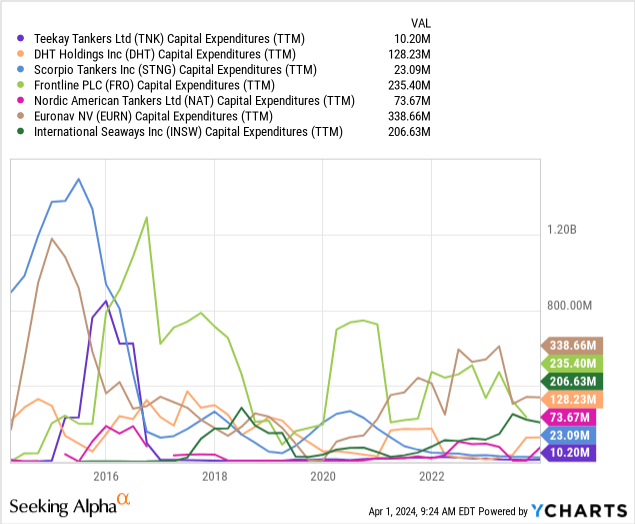

At the very least, these data suggest that the trend towards a net tanker shortage will continue (albeit at a slower pace) through 2026. We would normally expect tanker companies to increase spending on new ships, given their very high profit margin levels. Still, many seem reluctant to do so in an unstable trading environment, not to mention the fact that most are paying down debt incurred during the oversupply period from 2015 to 2020. As a result, capex levels for most tanker companies remain generally low, rising only slightly since 2020. See below:

As long as these companies don’t significantly increase capital spending, we won’t see a significant increase in tanker supply. Even so, due to the time lag in production, it will still take more than a year to have an impact on the market.

The decline in high demand growth offset the impact of low supply growth. The demand side of the equation is difficult to predict because it is susceptible to various events in and between key countries. If things stabilize, I expect little demand growth as countries focus on using cheaper oil pipelines to trade oil, Oil demand barely grows worldwide.

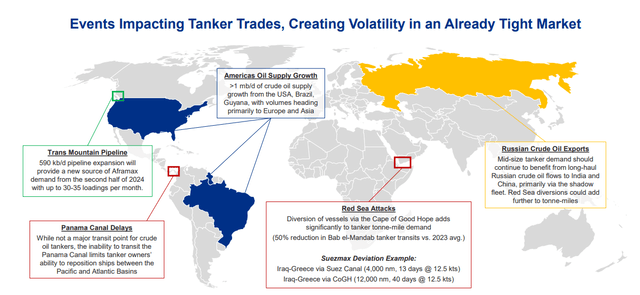

Still, the geopolitical environment has created a good market for Teekay. The oil embargo disrupted the flow of Russian oil. see below:

Global Tanker Geopolitical Demand Drivers (Teekay Q2 Investor Briefing)

In reality, the oil embargo did not prevent Russia from exporting oil or earning profits from the Kremlin. Instead, Russia sells oil to countries that resell it, artificially increasing the length of trade routes.With the Red Sea attack and Panama Canal DroughtGlobal trade begins to look more like it did centuries ago, with the distances ships can sail around the South Cape increasing dramatically and the number of free ships decreasing.

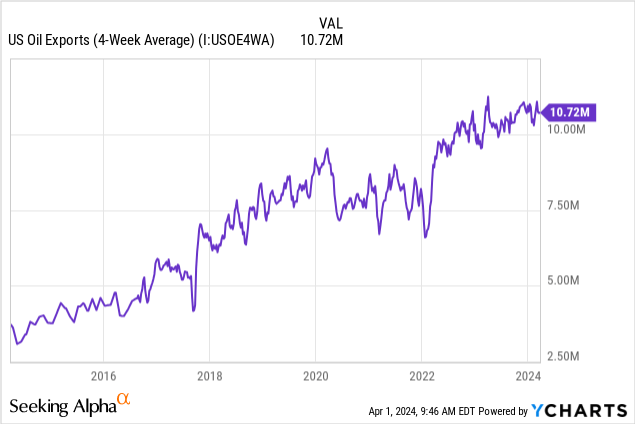

Additionally, U.S. oil exports have increased significantly in recent years, primarily due to increased European demand offsetting lower Russian imports. see below:

In my view, the key question is whether these demand drivers will continue to drive the market, or if they will persist. When I last covered Teekay, most analysts and I agreed that shipping demand was unlikely to remain high for long, given the eventual normalization of the situation in Russia and Ukraine. That was a year ago and a lot has changed since then. It seems unlikely that the situation will normalize, especially now that the Middle East and Africa are also facing internal and external conflicts.

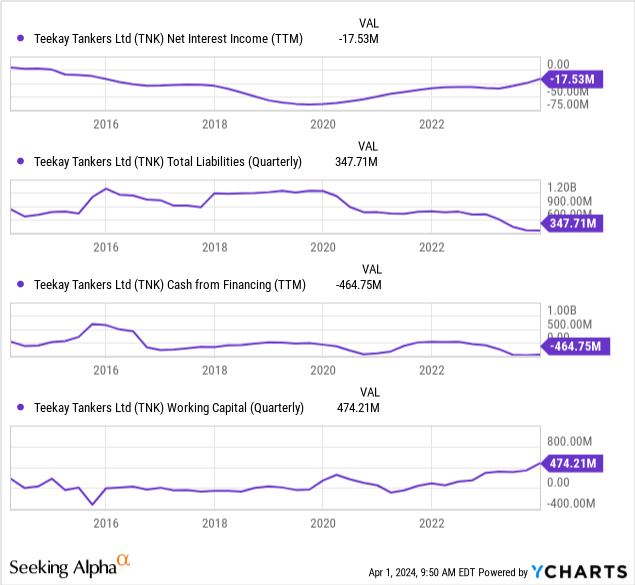

Until then, Teekay’s balance sheet quality will improve significantly as a result of its efforts to reduce debt, increasing its value even if the macroeconomic backdrop worsens. In 2020, Teekay faced the risk of bankruptcy due to high debt, negative working capital and soaring interest costs due to years of negative cash flow. Today, its interest costs are almost negligible and its debt is down about 70%, thanks to a strong focus on paying down debt (see Financing Cash). More importantly, its working capital has reached US$474 million, of which US$365 million is cash. see below:

Today, Teekay has a solid balance sheet. The company is no longer at risk of bankruptcy as it focuses on using profits to reduce burdens rather than paying dividends or adding ships. Since its total liabilities are low and its liquidity position is strong, it could survive a period of negative earnings. In fact, its growing cash reserves are also of great value to investors, as they may eventually be paid out as dividends or used to make income-enhancing investments.

bottom line

Overall, I am cautiously optimistic about TNK today. It trades at 4 times forward earnings per share based on two-year forecasts, which has been typical for the company in recent years. That said, its debt is much lower, and even if economic fundamentals manage to change dramatically, it’s still trading at a “high bankruptcy risk” valuation, which is already shallow right now. In fact, I believe the macroeconomic fundamentals will remain largely unchanged, with tanker shortages not increasing at TNK’s low valuation point, but not abating either.

At current prices, TNK’s overall upside is well below where it was when I first became bullish in 2020. That said, with the geopolitical environment entrenched, TNK’s prospects are much more stable today than they were then or even in 2023. This will increase oil trading volumes and its balance sheet will continue to improve. With a “P/E” ratio so low compared to market capitalization and working capital so high, I think TNK is undervalued and represents a solid long-term investment.

Still, TNK investors are at risk due to potential changes in the geopolitical environment, especially if major Middle Eastern countries distance themselves from the United States, which I still think is more likely than many would like to admit. In addition, a global recession that could reduce oil trading and harm TNK’s profitability may be one of the more significant risks TNK currently faces.