Stephen McCarthy/Sportsfile via Getty Images

In my quarterly update on my investment thesis on Telefônica Brasil (NYSE: VIV), I upgraded my recommendation from Buy to Strong Buy after the company reported solid fourth-quarter results, ultimately Financials improve strongly in 2023.

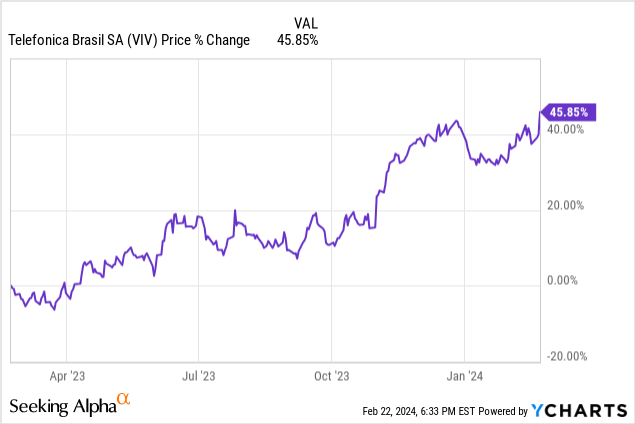

Although the Telefónica Brasil share price is up 45% in the past 12 months, I reiterate my optimism on an investment thesis that combines defensiveness, dividends and growing cash flows.

Telefônica Brasil has significantly accelerated its organic growth by consolidating solid execution in the mobile phone industry. In addition, the company has accelerated the growth of its fiber optic business, combining access expansion with ARPU growth.

As I’ve reported in previous articles, Telefónica Brasil and its Spanish parent Telefónica (TEF) promise to generate strong returns for their shareholders.This commitment was reaffirmed In the fourth quarter earnings announcement, 100% profit-sharing payouts will continue through 2026 through dividends, buybacks, interest on equity capital (“JCP”) and capital reductions. This strategy should generate very attractive double-digit shareholder returns over the next few years. In my opinion, this makes Telefónica Brasil an ideal income stock for a dividend-focused portfolio.

Telefónica Brazil fourth-quarter profit results

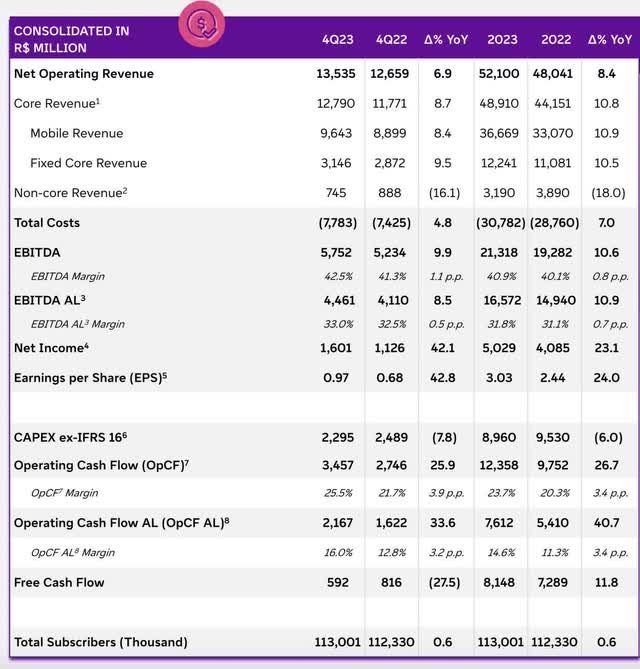

Telefônica Brasil announced a net profit of 1.601 billion reais in the fourth quarter of 2023, an increase of 42.1% compared with the same period in 2022. Consensus expectations were for net profit of 1.41 billion reais for the period, according to S&P Global Intelligence on the Koyfin platform.

Telefonica Brasil’s IR

EBITDA in the fourth quarter of 2023 totaled 5.752 billion reais, an increase of 9.9% compared with the fourth quarter of 2022. This was due to the solid performance of core revenue, with an annual growth of 8.7%, and a 4.8% increase in cost control in this quarter. Between October and December last year, EBITDA margin reached 42.5%, up 1.1 percentage points from the margin in the fourth quarter of 2022.

The strong net profit was driven by net income, which reached 13.5 billion reais in the fourth quarter of last year, an increase of 6.9% compared with the same period in 2022 and exceeding Brazil’s current inflation rate of 3.5%. This growth was mainly due to an 8.7% annual increase in mobile services revenue.

The total number of visits from the customer base was 113 million, of which 99 million were from mobile, maintaining Vivo’s position as the market leader ahead of Claro and Tim Brasil. In the postpaid space, Telefônica Brasil had 1.4 million visits in Q4 2023, while churn reached an all-time low of 0.97%.

Total costs (excluding depreciation and amortization) for the quarter were 7.783 billion reais, an increase of 4.8% year-on-year. Meanwhile, net financial results for the fourth quarter of 2023 showed negative R$631 million, with financial losses increasing by 4.5% compared to the same period in 2022.

In the fourth quarter of 2023, capital expenditures reached 2.295 billion reais, a year-on-year decrease of 7.8%, accounting for 17.0% of net income in the quarter, a year-on-year decrease of -2.7 percentage points. These investments focus on strengthening the company’s mobile network, emphasizing 5G coverage in 173 cities (covering 47% of the Brazilian population) and expanding fiber optic networks. Therefore, Telefônica Brasil continues to perform well in terms of signal quality in Brazil through Vivo.

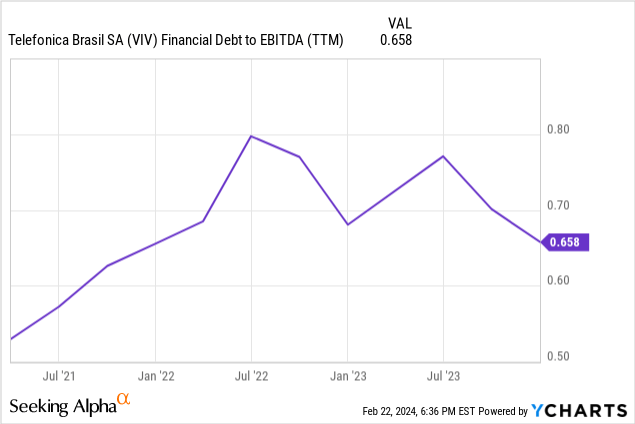

Finally, net debt fell by 13.3% compared to the same period in 2022, with Telecom Brasil recording R$14.17 billion, and the net debt/EBITDA ratio remained at 0.6 times.

Strong shareholder returns over the next few years

One of the pillars of my investment thesis on Telefónica Brasil is its potential as a strong income stock, given the company’s commitment to returning dividends to its Spanish parent, Telefonica.

At the end of 2023, Telefonica Brasil’s financial position was very solid, with approximately R$4.359 billion in cash and equivalents and operating cash of R$18.78 billion. Net profit increased 23% from the previous year to R$5 billion in 2023, and free cash flow generated double-digit growth to R$8.1 billion. The improvement in the company’s cash position, coupled with the payment of senior debt and 5G licensing obligations, resulted in a significant reduction in financial net debt compared with the previous year, with debt repayments of R$4.45 billion.

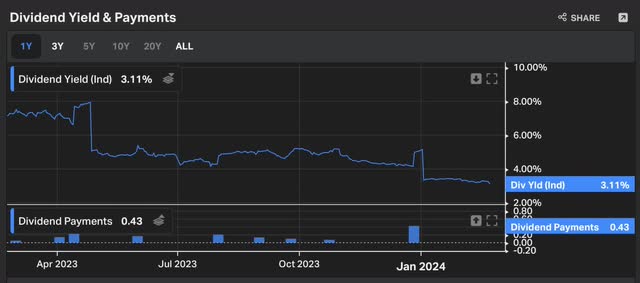

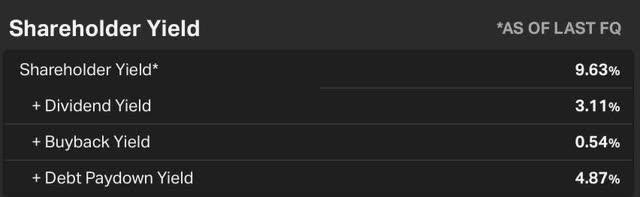

As a result, the company’s net profit for the year to 2023 was R$5.04 billion. Throughout 2023, Telefonica Brasil distributed capital interest of 2.5 billion reais and dividends of 1.8 billion reais, and implemented a share repurchase plan of nearly 500 million reais, with total shareholder compensation of 4.8 billion reais. Yar. Even after these distributions, the company ended the year with a dividend yield of just 3.11%.

coyfin

However, this yield is likely to become strong again in 2024 and in the coming years.

Recently, in addition to the 13 million shares canceled in February 2023, in December last year, the company canceled another 11 million shares, equivalent to 0.5% of the company’s total share capital. In November 2023, the company issued formal guidance to the market, committing to pay shareholders equal to or higher than 100% of net profit in 2024, 2025 and 2026.

Add the dividend yield to the buyback yield of 0.5%, plus the debt service yield of 4.87%, and we get a shareholder yield of 9.63%, which is quite attractive.

Koyfin, data from S&P Global Intelligence

This distribution will continue over the next few years through dividends, capital interest, capital reductions and share repurchases. After announcing its results, the company also announced that the first phase of capital reduction of R$1.5 billion had been approved at the extraordinary shareholders’ meeting held in January this year. Payment will be made before the end of July 2024.

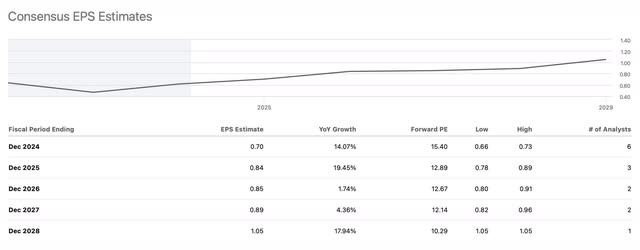

With consensus pointing to 14% EPS growth in 2024, net income is expected to rise by R$5.819 billion in the face of a more promising scenario of more moderate inflation and lower interest rates in Brazil (which could grow by 9% by the end of the year). . The consensus also recommends growth of 19% in 2025, which would bring the company’s net profit to R$6.945 billion, indicating a dividend yield of between 7% and 8%.

Seeking Alpha

Expected improvements in profitability over the next few years, combined with generous moves to compensate shareholders for at least the next three years, should deliver shareholder yields in the double digits in 2024 and 2025.

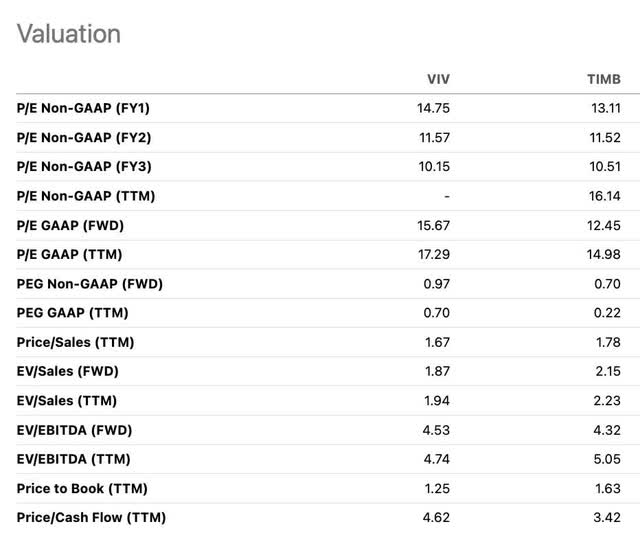

Valuation: Nothing to worry about

Telefônica Brasil’s forward price-to-earnings ratio is 14.7 times, in line with the industry average of 15.1 times and slightly higher than the historical average of 13.2 times. Compared with its main US-listed domestic peer TIM SA (TIMB), the company’s price-to-earnings ratio is 13.1 times, indicating a premium to its peers.

Seeking Alpha

This valuation premium is justified because Telefônica Brasil is a more mature company than Tim SA and has a clearer shareholder remuneration policy. However, investors should be aware that a slightly higher valuation could be a minor drawback to the investment thesis. This is due to risks from the state of Brazil’s economy, with potential increases in inflation potentially impacting the company’s operating costs and reducing profits and earnings – although this is not the prevailing view at the moment.

Nonetheless, Telefônica Brasil’s earnings growth is assumed to remain at similar levels to this year in 2026. In this case, the company’s P/E ratio of 10x is well below the industry average and almost in line with Tim SA.

bottom line

Telefónica Brasil delivered another solid quarterly result, continuing a trend seen in recent quarters, delivering above-inflation growth and expanding margins. The company executed its action and fixed services strategies effectively while delivering a good dividend.

Positive profit growth trends are expected in 2024 and 2025 due to a more favorable macroeconomic situation in Brazil, including lower interest rates and more controlled inflation.

As the company continues to distribute total profits, shareholder returns are expected to exceed double digits for at least the next two years. Although its valuation is in line with the industry average, I upgrade my stance to Strong Buy considering Telefónica Brasil is an excellent income stock to include in a portfolio.