Thibault Leonard

In the past few years, investors have paid more attention to the space sector. Billionaires like Elon Musk and Jeff Bezos have poured significant amounts of their own capital into the space.

this has been done The aerospace industry has the potential to grow faster than when it was driven primarily by NASA investment. In recent years, we have seen the fruits of these efforts pay off as areas such as Earth observability and satellite communications have grown in prominence.

Recently, there was another wave of excitement when an American spacecraft landed on the moon. For the first time ever, this is a private company, intuitive machine (LUNR), which led to the successful moon landing. LUNR shares quadrupled on excitement about the news.

I have been paying attention to the development of the situation aerospace industry. I predict that compelling investment opportunities will emerge in this area over the coming decades as humanity continues to grow its economic output and find new frontiers. There are only a limited number of industries that can absorb large amounts of investment capital – space seems to be one of the most natural areas for large-scale investment in the future.

One of the space companies I follow is Terran Orbit (NYSE: LLAP). This is a small satellite manufacturer. I found it attractive because it already had significant commercial revenue. The company has 2022 revenue of $94 million and expects full-year 2023 revenue to top $130 million (fourth-quarter results were delayed but are expected to be released this week). This level of annualized revenue is quite interesting given that the overall business is currently valued at approximately $250 million.

Terran also has an important partner Lockheed Martin (LMT), one of the company’s clients, owns 28.3% of Terran’s outstanding shares.

I think Lockheed Martin is a great validator that the company’s technology is valuable, it’s commercially proven, and it can be scaled. If Lockheed thinks it’s worth your time as a customer and investor, then it’s worth my attention.

While I find parts of the Terran story compelling, I personally haven’t owned the stock to date. Like many publicly traded space companies, Terran doesn’t have a strong balance sheet. It needs more capital to expand operations and become profitable. As share prices fall, it becomes more difficult to obtain new capital and causes dilution to be a greater drag on performance.

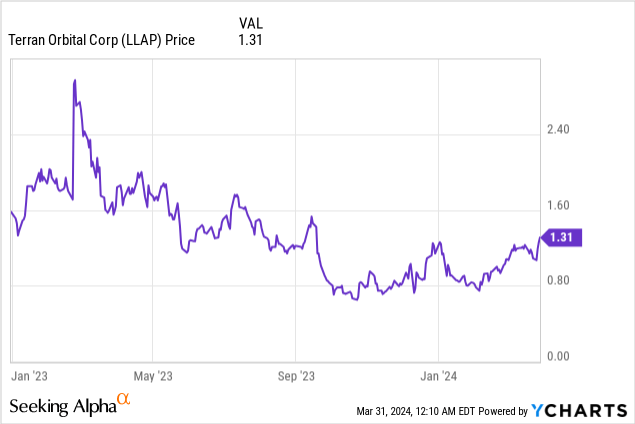

It looks like the company’s problems may be resolved in early 2023, when they announce a huge deal with Rivada Space Networks for a 300-satellite order. This will generate $2.4 billion in revenue. It looks like this deal will almost catapult Terran into the big leagues overnight. When the deal was first announced, the stock price nearly doubled. It looks like a game-changer for the company. However, the stock price failed to hold on to these gains and fell to new lows:

This is largely because we don’t know much about Rivada. It’s a small company and hasn’t been particularly public about its business plans or sources of financing.There have been many questions and worry As Terran expands manufacturing capabilities to fulfill this large order, it will be interesting to see if and when Rivada pays the agreed-upon milestone fees.

LLAP stock continued to decline late last year as problems mounted. There were rumors that the company would be sold, but the CEO has tried to quash those reports. There has been speculation that the company is trying to raise capital. Activist investors are also getting involved. In short, this is a huge headache.

Then a partner showed up. Lockheed Martin offered to buy all of Terran it didn’t already own for $1.00 per share. The offer values Terran as a whole at approximately $600 million, which also includes $70 million in cash for the disposal of LLAP warrants and the assumption of $313 million in Terran Orbital debt.

While this proposal makes more sense in the context of Terran’s entire balance sheet, it’s still quite surprising. At the time of the announcement, LLAP stock was trading at approximately $1.08 per share. Therefore, Lockheed’s move seems rather opportunistic and not particularly generous to existing Terran shareholders.

However, Lockheed may be able to exert influence here. It already owns 28.3% of Terran’s outstanding shares. It is a significant player in the industry and there is no doubt that it manages the company’s assets and contracts well. At this point, Lockheed’s existing space and satellite division has annual revenue of approximately $12 billion.

All of this suggests that this deal would be a natural acquisition for Lockheed. It brings a different satellite design to the company and skilled employees that can be integrated into existing operations. This is a perfect fit for Lockheed Martin for strategic reasons. The question is whether compensation is acceptable.

Currently, Terran Orbital stock is trading at about $1.30 per share, well above Lockheed’s $1.00 offer. Since the stock trades at a 30% premium to the current offer, it suggests traders and arbitrageurs are feeling fairly confident and optimistic about what will happen – either Lockheed comes in with a higher offer, or some other suitor Make a higher bid.That said, given Lockheed’s large stock holdings and As an important customer of mankind, Lockheed is the most natural acquirer here.

I think LLAP stock is a pretty risky trade for Terran shareholders today. This is because the current trajectory leads to meaningful negative outcomes. If nothing else, Terran shareholders will receive $1.00 per share from Lockheed, which would represent a significant loss compared to today’s stock price.

If the Lockheed deal falls through, I imagine Terran may need more money. The company had $70 million in cash on hand at the end of 2023. With an annual cash burn of about $100 million, Terran won’t have much wiggle room in 2024 if there are any issues with subsequent Rivada contract payments.

Additionally, any bitter dispute between Lockheed and Terran could result in Lockheed selling its LLAP stock, putting pressure on the stock price and potentially harming the commercial relationship between the two companies.

I’d also like to mention Lockheed’s strategy here. I emphasize that this is one of the reasons why I became a shareholder of LMT. I believe that in the coming decades, space will become a huge industry with a long-term growth runway. Lockheed’s annual space business already exceeds $12 billion.

It has also taken this venture-capital style approach to the industry with partnerships and, in a fair number of cases, acquired stakes in smaller aerospace companies. This gives it access to newer technologies and skilled employees working on innovations in other companies. It also allows Lockheed to acquire stakes in smaller companies that may emerge as the aerospace industry booms.

The challenge today is that there are not many publicly traded space companies, and the ones we do have tend to have a limited revenue base and are not yet profitable. Meanwhile, companies like SpaceX and Blue Origin have yet to go public.

Having Lockheed Martin invest in space on behalf of its shareholders is an interesting concept. Additionally, it’s convincing that they can negotiate hard with a company like the Terrans.

Terran has been in trouble amid rumors of a sale or stock offering and uncertainty over a possible delisting as the stock price fell below $1. All of this happened because of the lack of human capital. The technology is there and the revenue is expanding. Terran is winning meaningful contracts. It’s not just the controversial Rivada contract. In March of this year, Terran received new contracts with the U.S. Space Force and NASA.

Terran has proven product market fit. The problem is that it went public via a SPAC before it had a balance sheet, profitability or cash flow and couldn’t achieve the financial numbers without additional funding. If Lockheed can step in and take over a company like this when the stock price is depressed, that’s a significant value-add for its shareholders in the long run.

Given Lockheed’s various ventures across the industry, I believe the company will be able to make other such opportunistic deals. Over time, Lockheed can consolidate some of the smaller aerospace companies and expose itself to newer technologies and intellectual property in the industry that are well-established in Lockheed’s larger legacy aerospace industry. Too much business.

As for Terran, perhaps shareholders will get a higher bid. I can imagine Lockheed being forced to raise its offer slightly. However, keep in mind that buying shares at $1.30 per share is quite risky when the price of a pending tender offer is only $1.00 per share. While Terran has compelling technology and a fast-growing business, its fragile balance sheet makes it vulnerable to M&A deals, such as the one Lockheed Martin is currently trying.