Xiaolu Chu

Tesla (NASDAQ: Tesla) has gotten a huge boost in recent months, but Wall Street has ignored it.Another major player in the self-driving industry faces a series of safety concerns and may be downsizing Ambition. General Motors (General Motors) Cruise ship accept In August, it received approval to launch a round-the-clock robotaxi service in San Francisco. After pedestrian accidents and other issues, the company decided to withdraw all 950 robotaxis across the country.GM loses more than Cruise investment in 2023 is US$3 billion.Bloomberg reported Cruise plans to resume robotaxi testing after pause. However, Cruise is unlikely to regain its position in this space after previous layoffs and the exit of key senior executives.Tesla faces cost pressure The rise of Chinese automakers Having a strong market share in autonomous driving should help the company improve margins and create differentiation. Mercedes and Baidu are trying to build their own self-driving capabilities, but they face very similar problems to General Motors.

Google (GOOG) Waymo, on the other hand, has been very successful in launching robotaxis and continues to enjoy recognition regulators and the public. This suggests that, like many other industries, the self-driving business may be monopolized by a handful of large technology companies. Currently, the main players are Tesla, Google’s Waymo and Amazon’s (AMZN) Zoox. They each have their own strengths that will allow them to build and maintain significant market share in the autonomous driving industry.

If Tesla’s current expansion plans are successful, the company will have more than 100 million vehicles on the road within a decade. Tesla’s ability to test its self-driving software puts it ahead of other rivals. The autonomous driving trend will have a significant impact on other lucrative trucking industries as well as last-mile delivery for e-commerce businesses. Tesla may be the only automaker with mature self-driving capabilities, which should give the company better pricing power and profits compared to other automakers.

Cruise’s challenges change everything

Cruise’s rapid growth and the massive resources General Motors has invested show that companies other than big tech companies can enter the self-driving industry. However, Cruise’s recent problems will reduce the incentive for other non-tech companies to get into the self-driving business. This shows the scale of investment required to establish a foothold in the industry. No other company or startup other than the big tech companies has the resources to absorb these losses. Argo to be backed by Ford (F) and Volkswagen in 2022 closure After billions of dollars in losses.Benz Also under construction Its self-driving technology will also face the same problems as General Motors and Ford.Recently Baidu in China Had a reality check and had to replace key senior executives.

Another major new startup in the industry is Aurora Innovation, Started recently Driverless route between Dallas and Houston. The company has a market value of $4 billion and has an early team working on Google’s self-driving business. However, the road to monetization is still long, and the startup will have difficulty sustaining investment during this time. There are a few other startups working on this problem, but due to the heavy demand for investment in the early stages, we could see consolidation in the industry.

Only three big tech companies will survive

It has been more than ten years since the large-scale testing of the autonomous driving industry began. The business shows great promise, but regulatory approval has been difficult to obtain. Even a minor incident can derail billions of dollars of investment by major companies. Few companies are willing to risk this level of resources. In my opinion, even Apple (AAPL), which has a lot of resources Won’t Being able to successfully enter the autonomous driving industry requires a lot of time and resources in the early stages of software development and testing.

It’s becoming increasingly clear that much of the self-driving business is likely to be monopolized by three major tech companies—Tesla, Google’s Waymo and Amazon’s Zoox. Despite the challenges faced by Cruise, Google’s Waymo continues to receive support from regulators and its self-driving taxis have received positive reviews from the public.

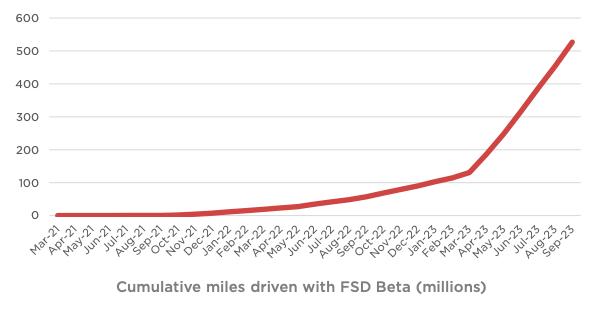

Tesla also has great advantages in this industry. The company can quickly and immediately update any software defects on its FSD systems.This allowed Tesla to accumulate Over 500 million miles By the third quarter of 2023.

Tesla Documents

Figure: Accumulated mileage using FSD Beta.

Future improvements in Tesla vehicle productivity should further accelerate the increase in autonomous driving miles. This provides Tesla with a wealth of data to experiment with new methods in FSD.Waymo, on the other hand, successfully Less than 5 million miles Fully autonomous driving. In the long run, most automakers are reluctant to use Tesla’s FSD because it gives Tesla a huge competitive advantage. We could see Waymo gain greater acceptance among traditional automakers.Even ride-sharing leader Uber Announcing a partnership With Waymo.

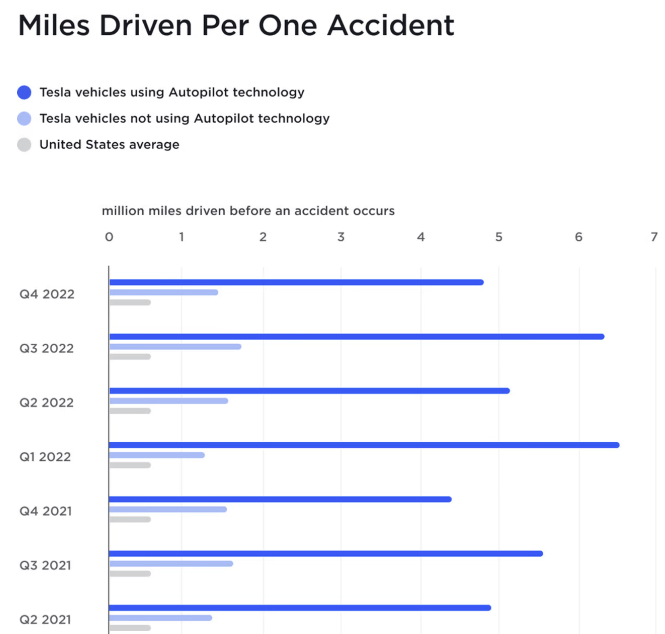

Tesla Documents

Picture: Tesla’s safety record published.

Tesla published regularly Safety record, it clearly shows the huge advantages of using Autopilot.

Better pricing power and increase in total addressable market

It will still be several quarters before we see autonomous vehicles reach critical mass. However, this technology may exhibit an S-shaped curve similar to what we see in other contexts. The turning point for the autonomous driving business may come sooner than currently estimated. Robot trucks and robot taxis are prime targets for this technology. A significant score Half of the total costs in the transportation sector are labor costs. This cost reduction should lower the price of goods for the end customer. In addition to robot trucks and robo-taxis, we should also see a significant increase in the use of autonomous technology for last-mile delivery in e-commerce. This will reduce package fulfillment costs, thereby improving overall e-commerce demand.

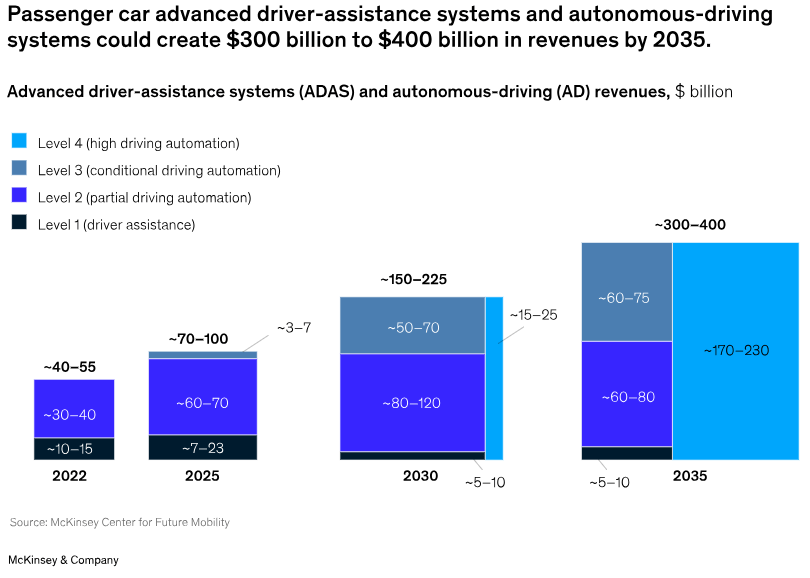

There are various estimates of the future potential market for autonomous driving business.McKinsey & Company Recently published By its own estimates, these systems will generate $300 billion to $400 billion in revenue by 2035.

McKinsey & Company

Figure: Autonomous driving revenue in the next few years.

It is also important to evaluate the possible business models and profitability of the industry.Warren Buffett has previously Examples given One person in the aviation industry has said many times that large revenue growth for an industry does not necessarily equate to good business or investment.

One of the core reasons why the self-driving business is showing promise after Cruise’s collapse is that there are likely to be few other competitors willing to build their own self-driving operations from scratch. In the aviation industry, a new competitor can enter the industry by leasing a few aircraft, with an initial investment of millions of dollars. However, the self-driving business has shown that the investment required to map different locations and rigorous safety testing can easily reach billions of dollars, and there is no guarantee that the company will reach the profitability stage. Only a few companies can venture into such investments.

This factor brings huge positive factors to Tesla’s investment in the field of autonomous driving. If the future market is divided into three giants, and Tesla is one of them, the long-term profitability of this segment may be more resilient than expected.

Impact on Tesla stock

The future direction of Tesla stock will largely depend on what the company can offer its customers. Autonomous driving is a key component of Tesla’s services, and with more regulatory approvals, the monetization rate of this business will increase significantly. After developing customized products for these markets, Tesla may offer its own robotaxis and robot trucks. The automobile industry is a low-profit industry, and Tesla needs to demonstrate high-profit services to relieve some of the cost pressure it faces in production.

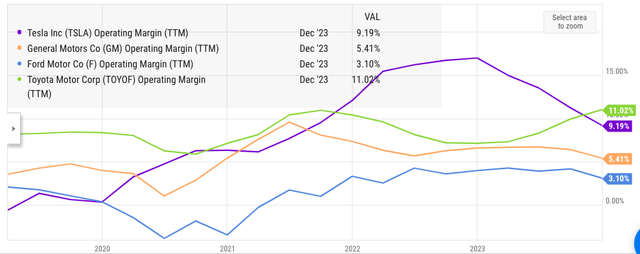

Y chart

Figure: Tesla’s operating profit margin has declined in recent quarters.

FSD can do for Tesla what AWS did for Amazon. Without AWS, Amazon wouldn’t be able to increase its investment in logistics and invest in new growth areas.

The business model of the autonomous driving industry is still unclear, but Tesla will gain product differentiation by having its own autonomous driving capabilities. No other automaker can boast it, except those that license the technology from Google or Amazon. The failures of GM’s Cruise and earlier Ford’s Argo illustrate the difficulty of successfully rolling out self-driving capabilities. Tesla’s monetization of its FSD services could help the company gain access to higher-margin services as it competes with traditional automakers.

Investor takeaways

We’re seeing significant consolidation in the autonomous driving business. Cruise’s recent failure, despite GM’s strong support and billions of dollars of investment, shows that the industry’s barriers to entry are very high. It is likely that only three major technology companies can monopolize most of the market share in the autonomous driving industry. They are Tesla, Google’s Waymo and Amazon’s Zoox.

With FSD technology, Tesla will gain huge product differentiation advantages over other traditional automakers. The service is likely to be better monetized in the coming quarters, which would also give Tesla high-margin services revenue. This will improve the company’s operating margins and compete effectively in an environment where the automotive industry has cut costs in recent quarters.