Empirical research finds that at moderate levels, debt can promote growth, but at high levels (thresholds between 75% and 100%) it can be destructive (if high ratios fail to resolve and persist) – Debt can become a drag on economic growth. (See 2011 study “The real impact of debt“2013 Research”Has high public debt been holding back economic growth? “ 2020 Research”Debt and Growth: A Decade of Research” and 2021 research”The impact of public debt on economic growth” and”Public debt and economic growth: panel data evidence from Asian countries“)

Explanations for the negative impact on the economy include: higher interest rates (investors, especially foreign investors, may demand increased risk premiums), higher taxes (which reduce revenue), restrictions on the future provision of countercyclical fiscal policy to respond The ability of the economy to decline (causing greater economic volatility), crowding out private sector investment (reducing innovation and productivity), and rising interest payments consume increasing amounts of the federal budget, leading to increased spending on R&D, infrastructure, and education. Public investment declines.

Congressional Budget Office (an independent agency established in 1974) estimateAs of the end of 2023, the U.S. debt-to-GDP ratio was 98% and is expected to reach 181% in 30 years. With these predictions in mind, authors of the September 2023 study Roberto Cram, Howard Kung and Hanno Lustig”Can the U.S. Treasury market increase or decrease?,” analyzed all (15,533) CBO cost releases for all bills introduced in Congress from 1997 to 2022. Their goal is to determine the impact of increased spending on interest rates. Here is a summary of their key findings:

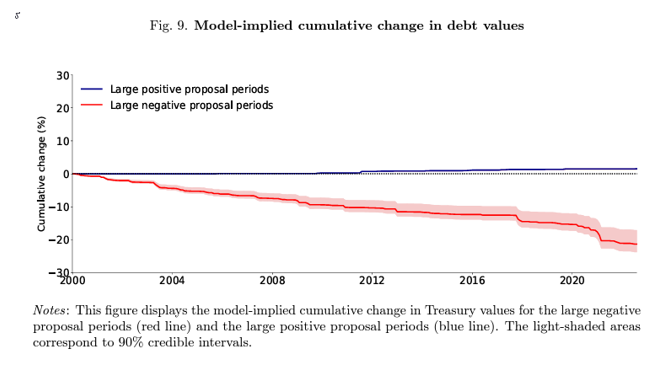

- Between 1997 and 2022, the cost of publishing large numbers of negative cash flow forecasts reduced the valuation of all outstanding U.S. Treasury securities by more than 20%. Cost releases allow investors to understand the negative drift of earnings policy. The massive negative cost release resulted in a significant revision in expectations, leading to a systemic negative reaction in the value of Treasury securities.

In agreement with John Cochrane fiscal theory of the price levelIn the daily event window around large negative proposal days, market expectations for inflation also increase across periods, especially in the longer term.

The impact of adverse fiscal news on government bond valuations was concentrated on bonds with longer maturities, with long-term nominal yields overall rising by 4%. The growth was driven by rising term premiums and inflation expectations, as well as falling Treasury facility yields, the value investors place on liquidity and safety attributes.

The authors note: “During their sample period, Fed policy attributed the long-term downward trend to long-term bond yields. Over the same sample period, the cumulative change in the 10-year nominal yield on the day of the FOMC meeting was -3.18%. The FOMC announcement effectively offsets the full impact of the cost release.”

Their findings lead the authors to conclude: “In daily event windows, we find that cost releases for large proposals expected to increase future deficits significantly reduce Treasury valuations.”

They use their estimation model to infer that a 1 percentage point unexpected increase in the supply of Treasury securities (expressed as a share of GDP) would be equivalent to a 31 basis point increase in the 10-year nominal yield and a decrease in the convenience yield on the 10-year note. 7.5 basis points. The Congressional Budget Office estimates that the debt-to-GDP ratio will increase by 83 percentage points (from 98% to 181%), and the cost of government debt will increase dramatically, which will also have a huge negative impact on the economy. grow.

Important points for investors

The Congressional Budget Office’s cost projections for future deficits contain valuable budget news that allow bond investors to understand the trajectory of the debt-to-GDP ratio. The takeaway for investors is that their financial plans should consider the negative impact that increased debt could have on economic growth and potentially lead to lower equity returns. Slowing potential economic growth and rising inflation risks, coupled with historically high valuations for U.S. stocks, including the S&P 500, should be cause for concern at the very least. Prudent investors plan for these risks. For example, they adjust their forecasts of future returns to reflect current valuations and yields (rather than relying on historical returns). They may also consider increasing allocations to fixed-income assets less vulnerable to inflationary shocks, such as TIPS and floating-rate debt, and raising Treasury discount rates.They may also consider increasing exposure to risky assets that have lower correlations with economic growth and inflation risks, such as reinsurance (using interval funds, e.g. SRIX and Xilin SX) and long-short factor strategies (such as AQR’s QSPRX and QRPRX).

Larry Swedroe is director of financial and economic research at Buckingham Strategy Wealth, LLC and Buckingham Strategy Partners, LLC.

Provided for informational and educational purposes only and should not be construed as specific investment, accounting, legal or tax advice. Some information is based on third-party data and may be outdated or superseded without prior notice. Third-party information is deemed reliable, but its accuracy and completeness cannot be guaranteed. The views expressed here are his own and may not accurately reflect the views of Buckingham Strategic Wealth LLC or Buckingham Strategic Partners LLC (collectively, Buckingham Wealth Partners). Neither the U.S. Securities and Exchange Commission (SEC) nor any other federal or state agency approved, determined the accuracy, or confirmed the adequacy of this article. LSR-23-617