Abnormal factory

Most companies derive the vast majority of their revenue from providing goods and services to other businesses or consumers. There are many companies that do both. But these aren’t the only two customer segments.one The main customers will be government agencies. There are many businesses that serve these types of customer needs, most of which involve defense, research, or other types of technology.There are few players in this market like Scientific Applications International Corporation (NASDAQ:SAIC).

In recent years, Science Applications International has achieved mixed financial performance. Revenues have been a bit inconsistent, while profits have grown significantly. But when you look at other profitability indicators, all you see is weakness.Still, the share price can only get so cheap for it to make sense to consider Buy. On March 18, the stock price fell 9.3% news comes out Regarding fourth-quarter earnings and 2025 guidance, now may be the best time for investors to consider taking a stake in the business.

International Overview of Scientific Applications

I first learned of Science Applications International’s existence several years ago when someone recommended a book called The SAIC Solution: How We Built an $8 Billion Employee-Owned Technology Company. Author John Robert Beyster founded the company in 1969. From humble beginnings, the company has grown into a behemoth in the sales world. Although the company today is very different from the imagination of its founders, there is no denying that it is successful. Operationally, the company serves customers through approximately 1,900 available contracts and task orders and has approximately 25,000 employees.

Over the years, management has positioned the company as a provider of “technology, engineering and enterprise information technology solutions” and provides these products to all branches and agencies of the Department of Defense. It also provides services to NASA, the U.S. Department of State, the Department of Justice, the Department of Homeland Security, and multiple unnamed intelligence agencies. Specific products offered revolve around engineering, technology integration, IT modernization, ground and offshore system maintenance, logistics, training and more.

complex pictures

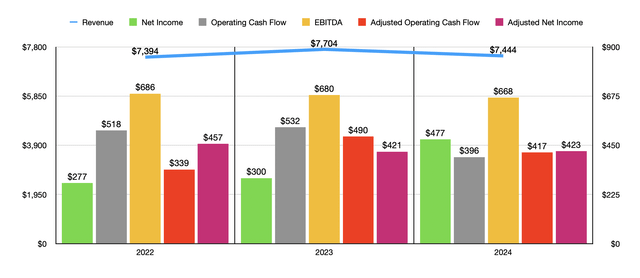

Author – SEC EDGAR Data

Science Applications International’s financial performance over the past three years has been mixed. For example, revenue increases from $7.39 billion in 2022 to $7.7 billion in 2023.

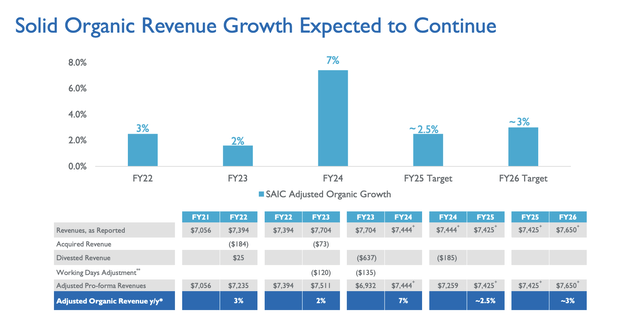

Management just announced financial results for the final quarter of fiscal 2024. Full-year revenue was $7.44 billion. But it is worth noting that we should consider the company’s various measures. For example, in fiscal 2023, the company’s revenue fell by a total of $637 million due to divestiture activity. It also made other adjustments totaling $135 million. If we adjust this, organic Over this three-year period, the company’s revenue will continue to grow.

Science Applications International

Ultimately, the situation becomes more complex. In fact, net profit will increase significantly from $277 million in 2022 to $477 million in 2024. But this is largely a mirage. To be clear, the company does benefit from some major improvements. For example, cost of sales as a percentage of revenue fell from 88.5% to 88.3%. While that may not sound like much, when applied to revenue generated in 2024, it will represent an additional $22 million in profit. However, the largest contributor to profit expansion in 2023-2024 will be $240 million in proceeds from divestitures. This involves selling the company’s supply chain business in exchange for $356 million in cash.

Once we make some adjustments to the bottom line results, we see a very different picture. Adjusted net income will decline from $457 million in 2022 to $423 million in 2024. Fortunately, the 2024 numbers are slightly higher than the 2023 numbers, so there is some evidence of steady development. However, other profitability indicators are also facing downward pressure. Although operating cash flow has been underperforming, it fell from $518 million to $396 million. But once we adjust for changes in working capital, we see that our revenue continued to decline year over year, from $539 million to $417 million. At the same time, the business’s EBITDA fell from $686 million to $668 million.

Author – SEC EDGAR Data

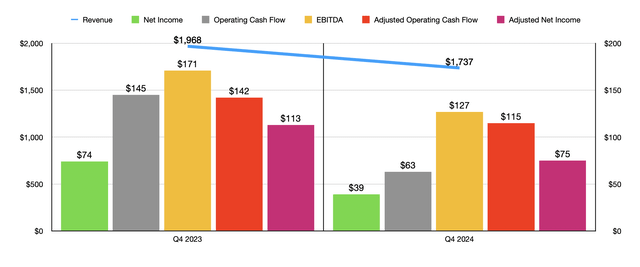

Unfortunately for those who own the stock, but perhaps fortunately for those who don’t yet but want to, SAIC’s share price plummeted on March 18 and is down as of this writing about 9.3%. This cut comes in response to management reporting results for the final quarter of 2024. For example, revenue was $1.74 billion. This was down 11.7% from the $1.97 billion reported a year ago. However, its revenue did beat analysts’ forecasts by about $100 million.

Despite the decline, the company actually reported organic sales growth of about 7.7%. The asset sales mentioned above, plus a few other adjustments such as adding an extra five working days in the prior year and unconsolidating joint ventures it owns, all need to be removed from the equation in order to generate organic revenue.

Ultimately, the sight is harrowing. Management reported profit of $0.74 per share. That’s down sharply from the $1.34 reported a year ago and $0.42 per share lower than analysts expected. Even if we make certain adjustments, the company still reported a profit of $1.43. That was significantly lower than the $2.04 per share reported in the same period a year ago and $0.01 below analysts’ expectations. This meant that adjusted net income fell to $75 million from $113 million. The decrease in adjusted profit was due to higher expenses related to selling, general and administrative activities and provisions for customer receivables related to programs completed prior to fiscal 2022. The increase in stock-based compensation resulted from accelerated stock grants as a result of some restructuring activities at the company and some shake-ups at the top of the business.

Other profitability indicators have followed suit. Operating cash flow fell to $63 million from $145 million. After adjustments, it fell to $115 million from $142 million. Finally, the business’s EBITDA fell from $171 million to $127 million.

Author – SEC EDGAR Data

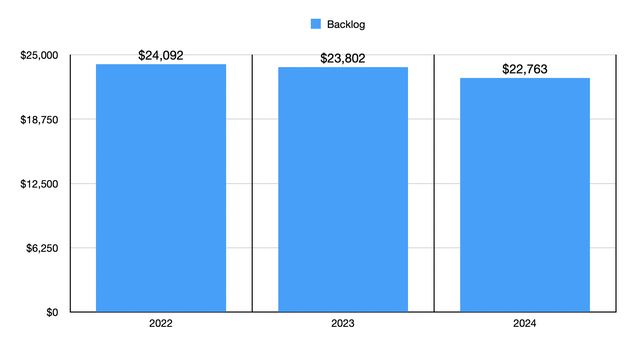

After looking at all of this financial performance, I’m tempted to take a more cautious approach to this business. That’s because, in addition to these pain points, the business has also reported a decline in backlog over the past few years. The order backlog has increased from $24.09 billion in 2022 to $22.76 billion in 2024. However, I feel more optimistic as management is working hard to improve the bottom line.

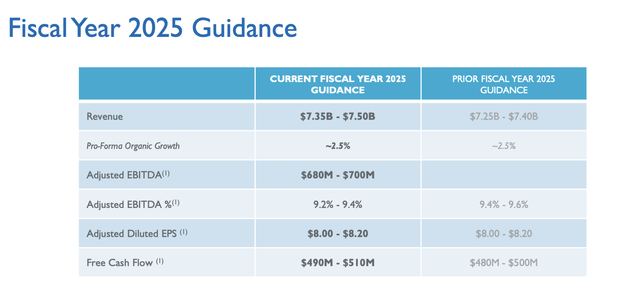

For example, consider current guidance for fiscal 2025. Management expects revenue to be in the range of $7.35 billion to $7.5 billion. The midpoint would be down from the $7.44 billion reported in 2024. On the other hand, the company expects adjusted earnings per share to be in the range of $8 to $8.20. That translates into an adjusted profit of $427 million at the midpoint. That’s $10 million more than the revenue the company will generate in 2024.

Science Applications International

That’s not the only improvement in earnings expectations. Operating cash flow is expected to be in the range of $520 million to $540 million. If it were at the high end of that range, it would be the highest level the business has seen in at least four years. Meanwhile, EBITDA is expected to total between $680 million and $700 million. At the midpoint, that would be slightly higher than the company’s results over the past three years.

Author – SEC EDGAR Data

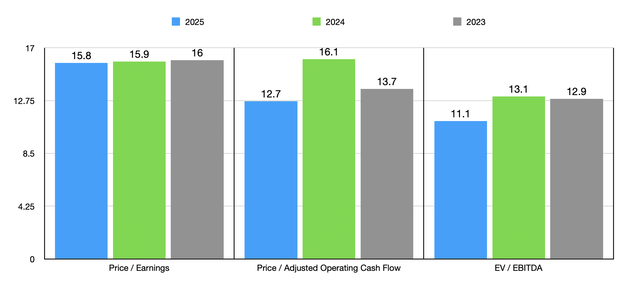

Using these numbers, we can easily value the company, as shown in the image above. This is not an area that I would consider very cheap. But it’s pretty close to an objectively attractive price. Meanwhile, in the chart below, we can see that its share price is very cheap compared to the five companies I decided to compare. Scientific Applications International is ultimately the cheapest of the group, whether on a P/E basis or EV to EBITDA basis. When it came to the price of the operating cash flow method, we ultimately found only one company out of five that was cheaper.

| company | price/yield | Price/Operating Cash Flow | Enterprise value/interest, tax, depreciation and advance profit |

| Science Applications International | 15.9 | 16.1 | 13.1 |

| Leidos Holdings (LDOS) | 89.2 | 15.1 | 20.6 |

| KBR | 28.2 | 25.3 | 107.5 |

| CACI International (CACI) | 22.4 | 26.3 | 13.9 |

| Parsons (PSN) | 57.5 | 23.0 | 22.1 |

| Booz Allen(BAH) | 46.7 | 54.2 | 24.1 |

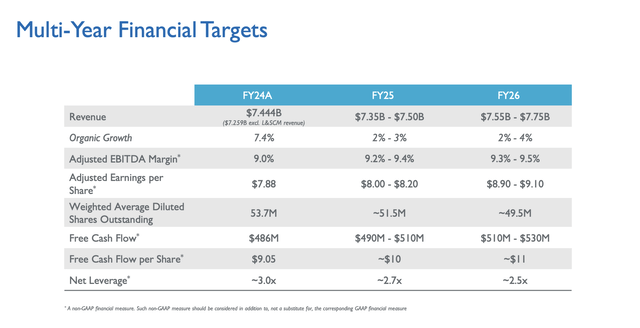

That alone isn’t enough for me to be bullish on the business, given the company’s track record. Even after looking at relative valuation, I’d still rate it a Hold. However, when digging deeper, I found that management has plans to further improve operations. For example, management is making a concerted effort when making investments aimed at improving operational efficiency. We target to increase the business’s adjusted EBITDA margin from 9% in 2024 to 9.4% in 2026. If applied to this year’s expected revenue, this would represent an additional $29.7 million in net profit. Beyond that, management is targeting revenue of $7.55 billion to $7.76 billion in 2026. Assuming the company achieves its profitability targets, this would increase EBITDA by $30.6 million.

But even if we ignore that, the chart in this article showing how the stock is priced on an absolute basis suggests that, looking out to 2025, the stock is already more attractive than we would have gotten using 2024 data. So even just achieving guidance for this fiscal year would be a big help to shareholders.

Science Applications International

In addition to forecasting higher revenue and profits, management is committed to buying back stock. The company has a long history in this area. Over the past three fiscal years, management has repurchased $826 million worth of stock. This reduces its share count by 9.3% from 58.1 million shares to 52.7 million shares by the end of 2025, against management’s forecast of 51.5 million shares. By the end of 2026, they expect this number to fall further to 49.5 million.

The company also appears intent on buying back stock in the process. If they hit the midpoint of their EBITDA guidance and achieve their net leverage target, we will see a leverage ratio of 2.5 compared to where we are today at a leverage ratio of 3. This represents a reduction in net debt of approximately $207 million from the end of fiscal 2024 to the end of 2026.

take away

Based on the data presented, I can understand why the market isn’t happy with Scientific Applications International Inc. stock. In many ways, the company has been mediocre over the past few years. Granted, some of the numbers we looked at need to be adjusted, and once those adjustments are made, the business will look better. But it’s never a good thing to see cash flow decline and the stock not quite be within the bargain’s range.

The good news is that the stock does look cheap relative to similar companies, and management is working hard to improve operations. Assuming this comes to fruition, I’d say the worst is over and the dip in price could represent a good buying opportunity for those who believe the business is moving forward. Therefore, I decided to make a soft “buy” on the company.