The three financial statements are the income statement, balance sheet, and cash flow statement. In the video series available at ASM, financial reporting is introduced in the context of building the three-statement model, which provides the foundation for the most in-depth financial analysis and valuation work. The purpose is not just to explain what they are, but to show how they connect to each other.

I studied some accounting in college, but there was a problem. Accounting was introduced as the language of business, but this approach made it difficult to see the forest for the trees. It wasn’t until I built my first three-statement model as an investment banker that I felt like I had a true grasp of the big picture. It was a lightbulb moment, which is why I chose to teach it this way at ASM.

Over the years, I have heard similar stories from thousands of students who have studied our content at ASM. As the recommendations below illustrate, it can feel overwhelming at first. But I promise it will come together by the end of the series.

Testimonials: “After taking a few accounting courses, it seemed strange initially to view the entire model in an Excel spreadsheet. It seemed like there was too much information in one place or on one page, which made me a little uncomfortable, but by the end of part two I found this to be the most effective way I have ever learned accounting.”

Even if you have worked with the three major financial statements before, I encourage you to review this series. The lessons are divided into the following chapters (When this course is updated, additional lessons will be included):

(Note: Major updates pending! All videos and notes in this series will be updated shortly. At that time, the old footage will be available at the bottom of this article.)

accounting equation

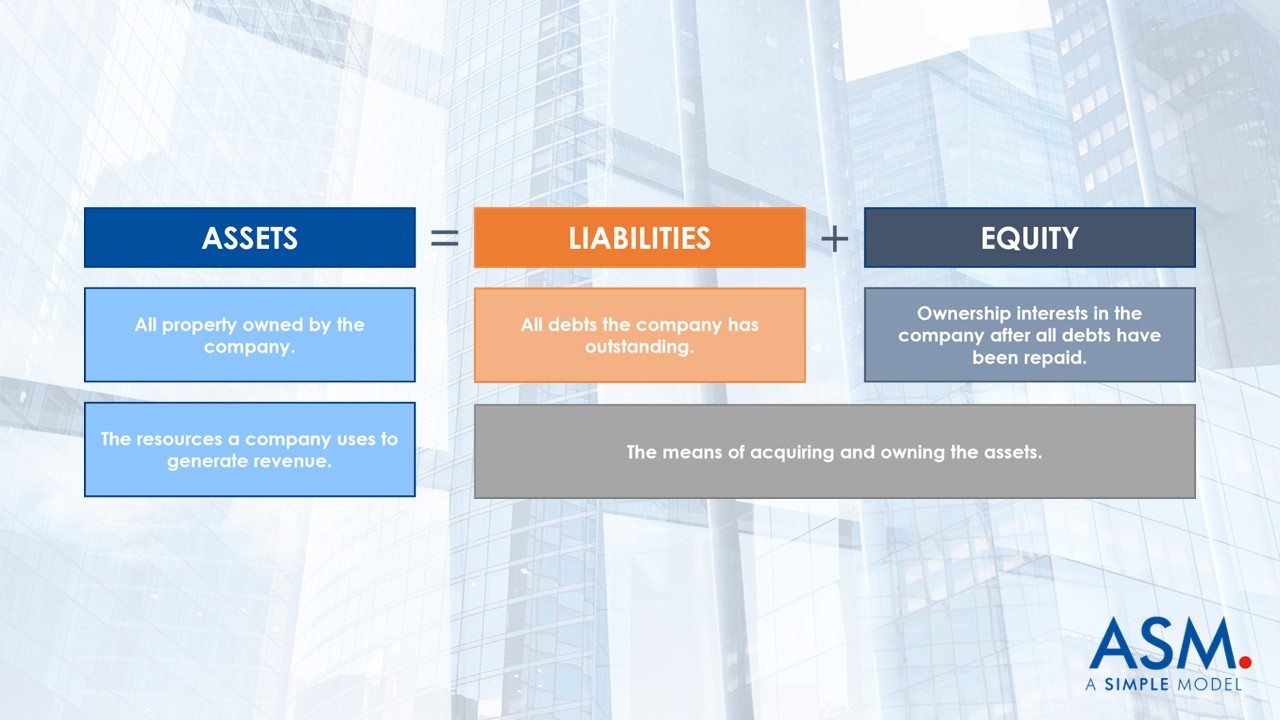

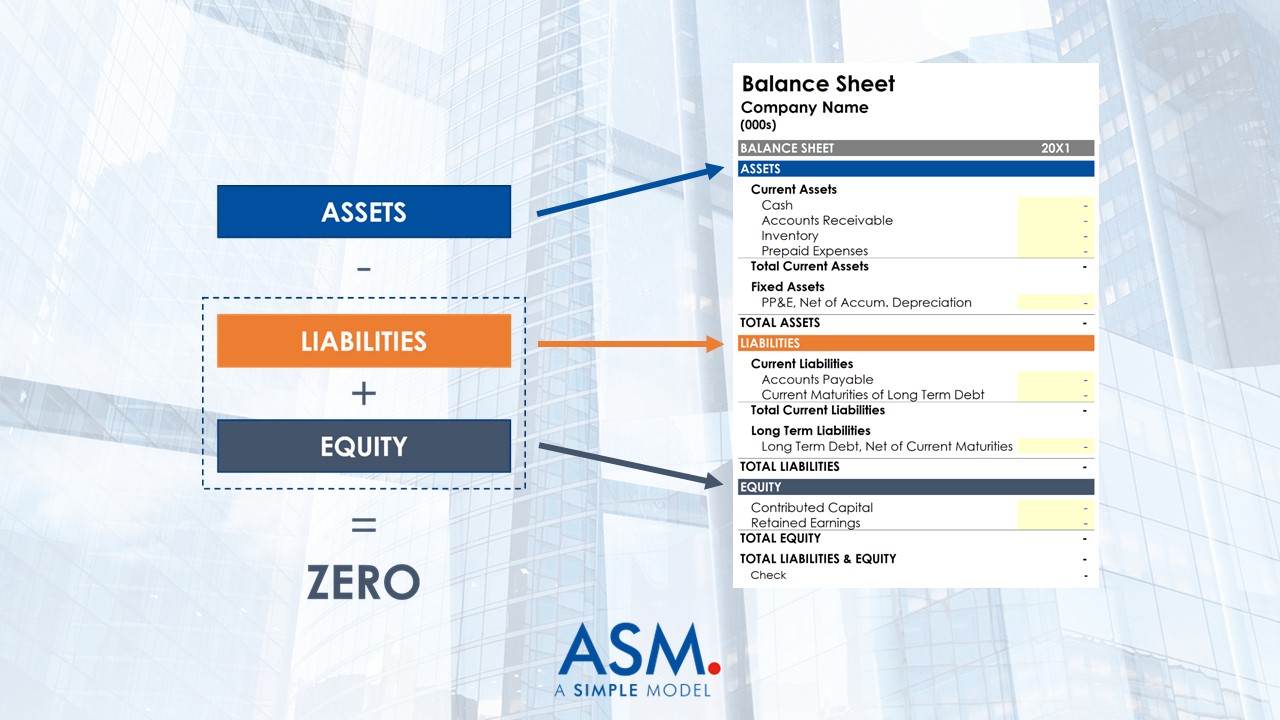

The accounting equation is the first concept you need to master. It is the foundation upon which you build a range of valuable knowledge and skills. Simply put, the accounting equation shows that the value of a company’s assets equals the sum of its liabilities and equity.

More precisely, a company uses its assets to generate revenue; together these represent everything the company owns. Liabilities and equity represent the means of acquiring and owning these assets. So, on the left side of the equation (assets), you own everything the company owns, and on the right side of the equation, you own everything the company owes its creditors or owners.

This video explains how accounting equations relate to building financial models. It also provides a rough overview of double-entry accounting, the system most commonly used by businesses to record financial information. The film concludes by pointing out that the balance sheet is just a more formal statement of the accounting equation.

balance sheet

A company’s balance sheet shows its financial position at a specific moment. Think of it as a “photograph” of your business. You can see the value of everything the company owns (its assets) and owes (its liabilities and equity).

This course introduces the balance sheet by asking you to imagine the resources needed to start a business (see diagram below), and then imagine the methods of obtaining those resources (raising debt and equity). By reorganizing these resources, you can see how they fall into one of three categories: assets, liabilities, and stockholders’ equity.

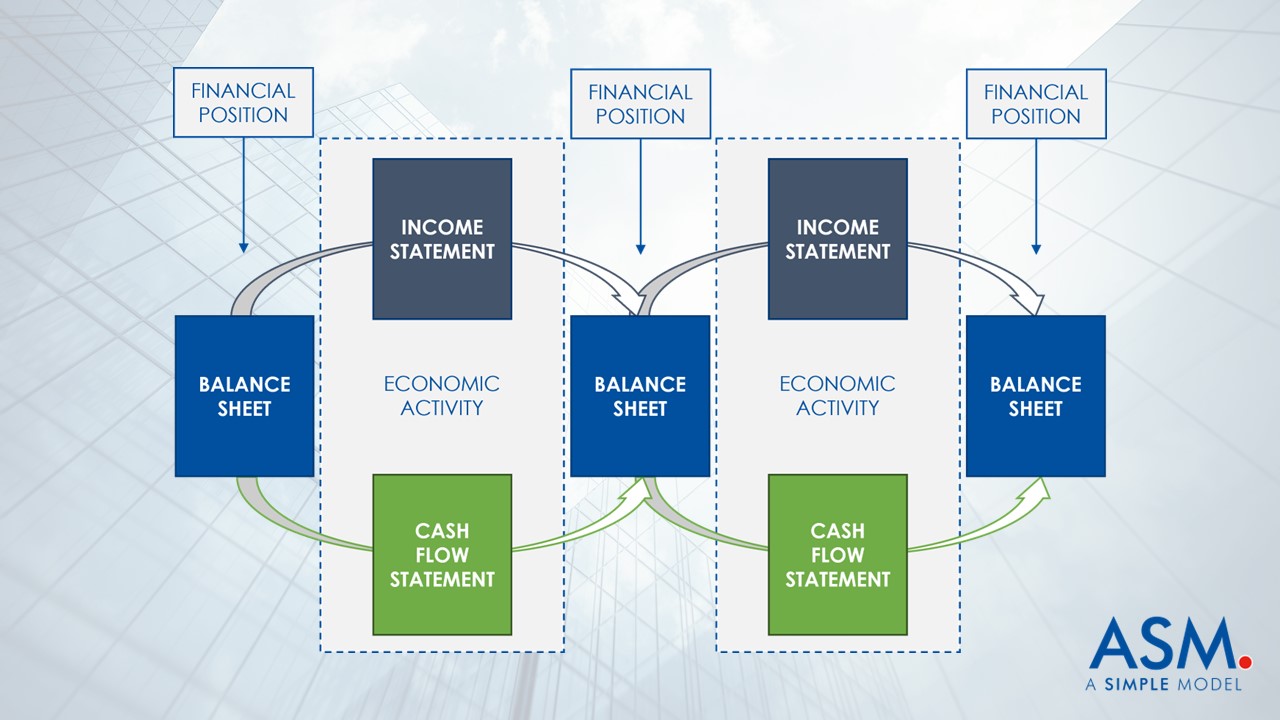

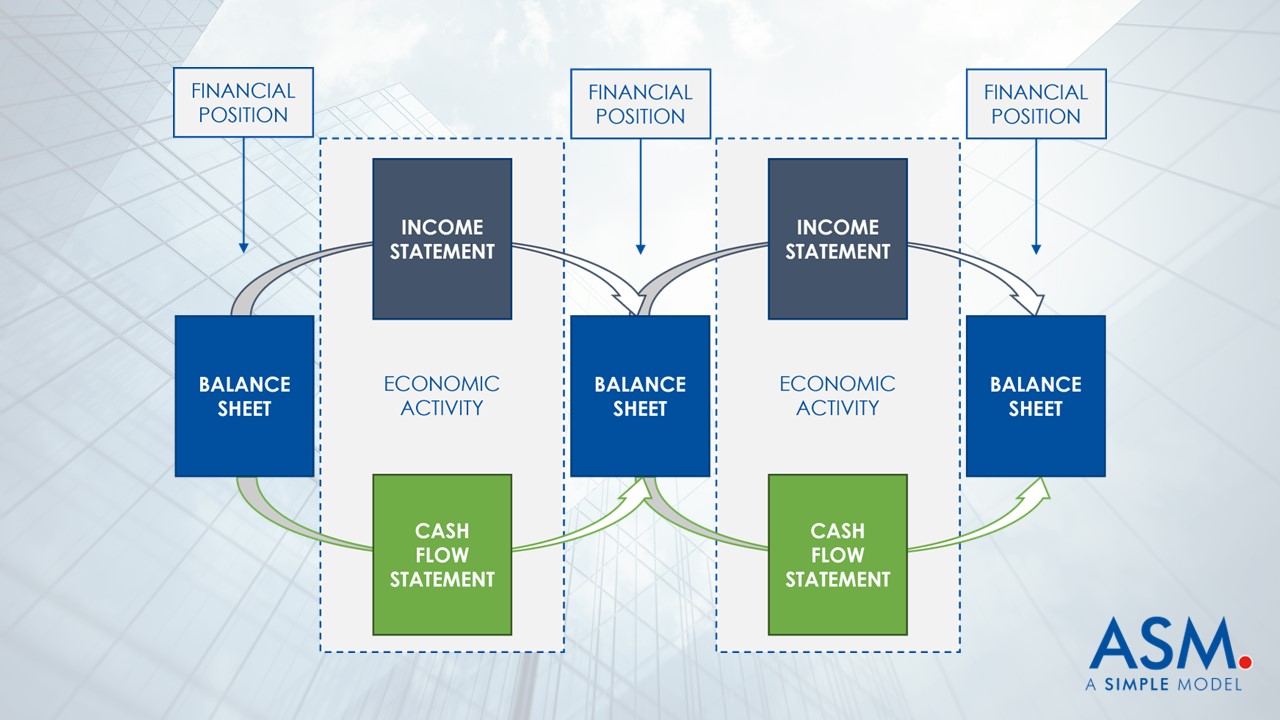

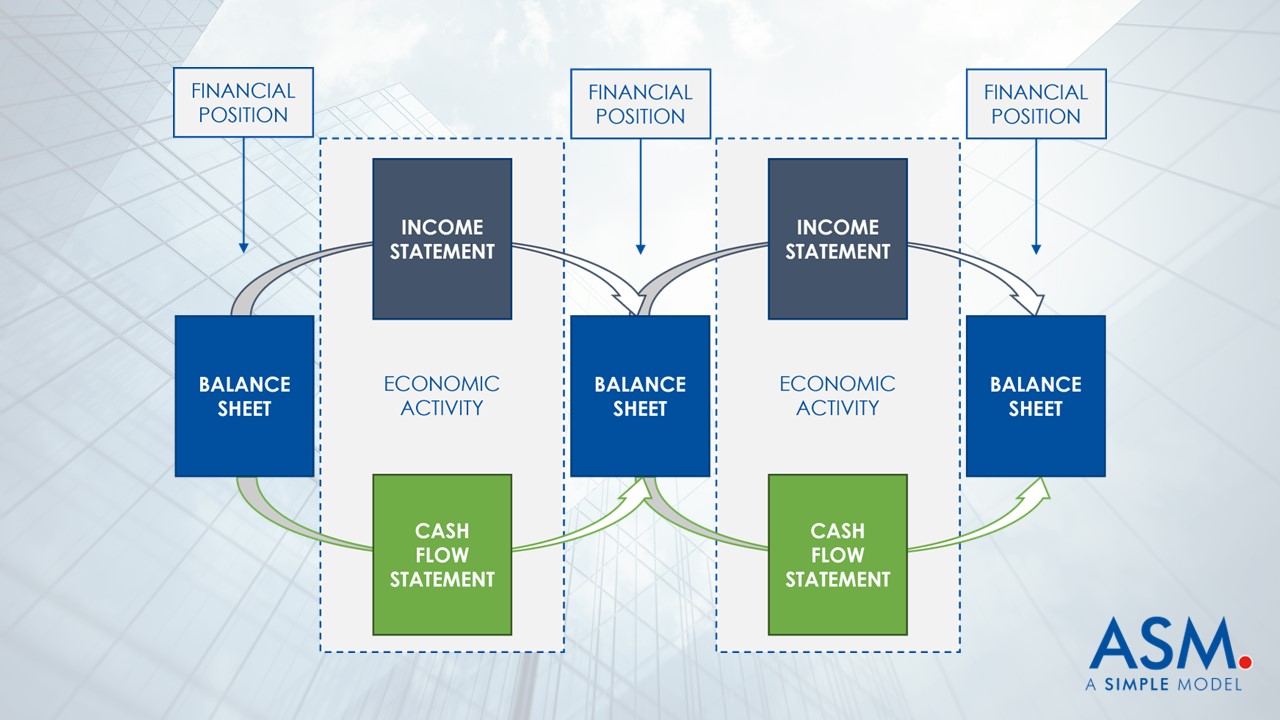

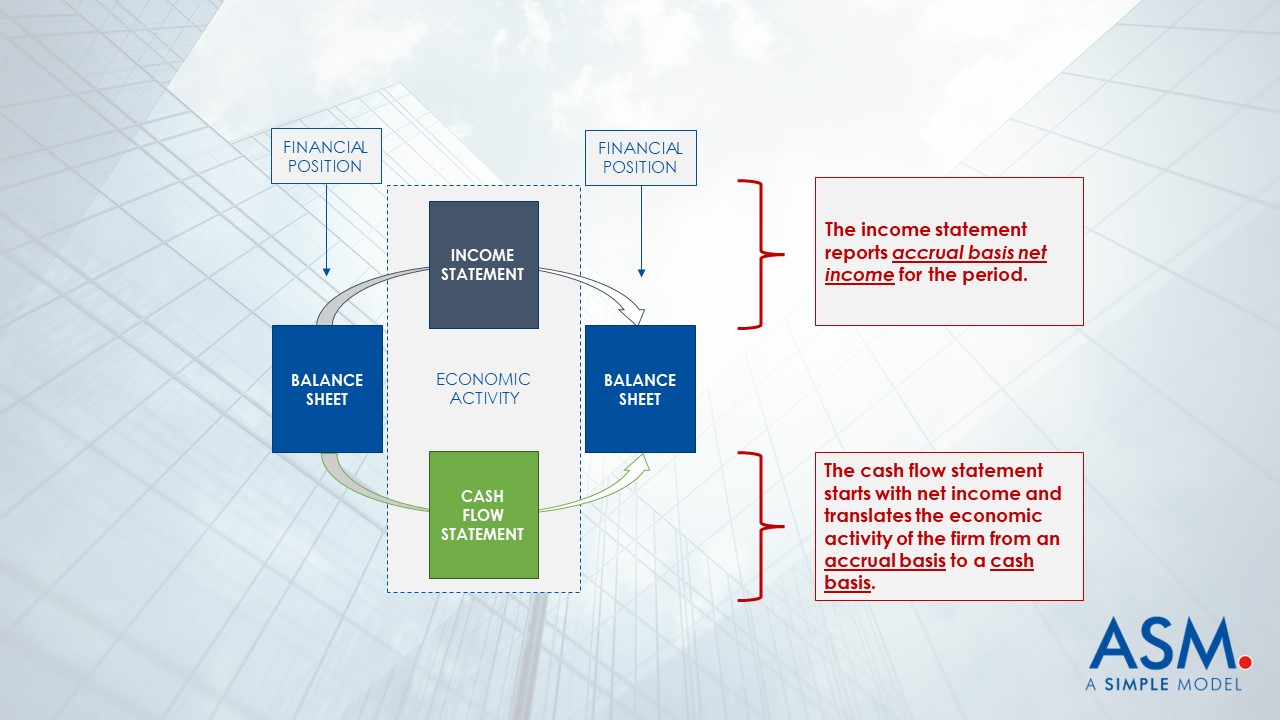

The film then highlights that the balance sheet details a company’s financial position at any given time, while the income statement and cash flow statement detail economic activity between different periods.

The note concludes by highlighting the relationships between the balance sheet and other financial statements, which need to be kept in mind when building financial models.

Profit and loss statement

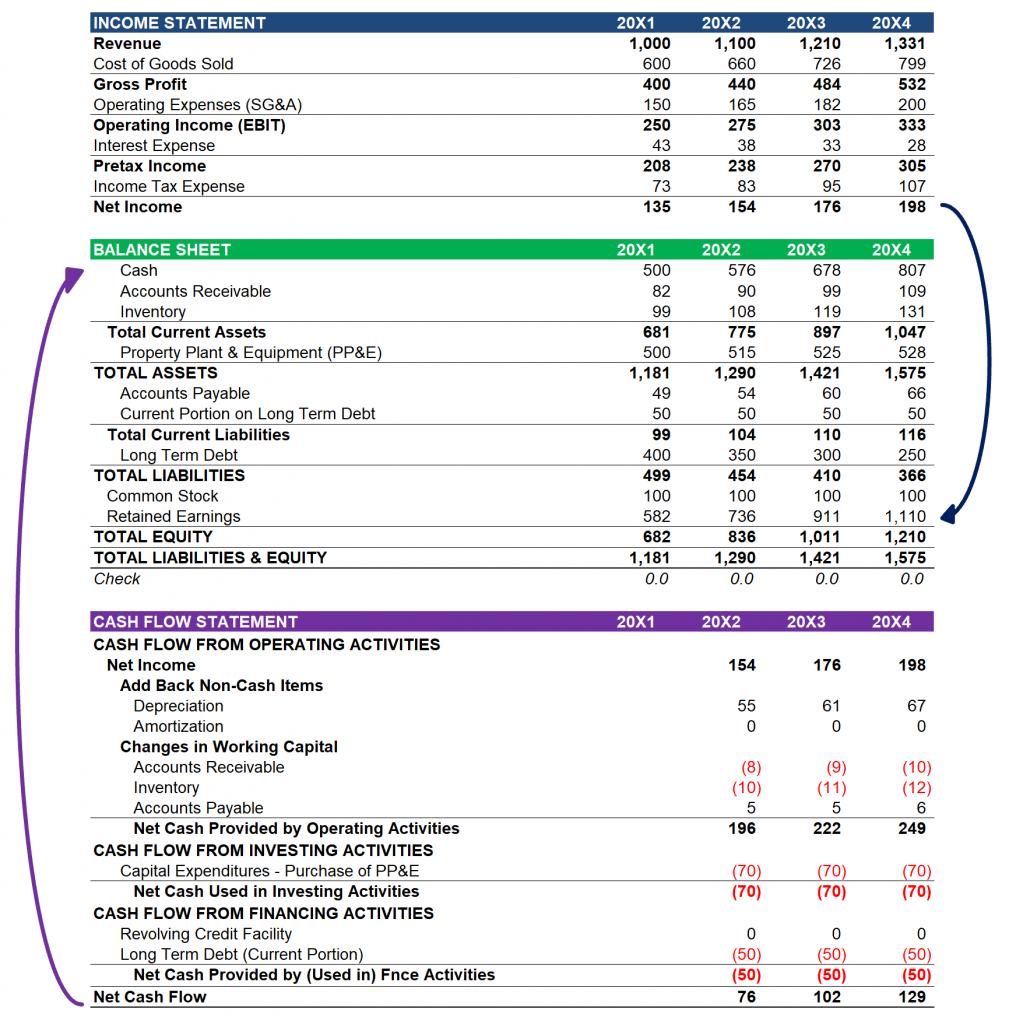

The income statement shows a company’s revenue (the payments it receives for goods and services) minus its expenses (the cost of providing those goods and services). As a result, the literal bottom line is net profit.

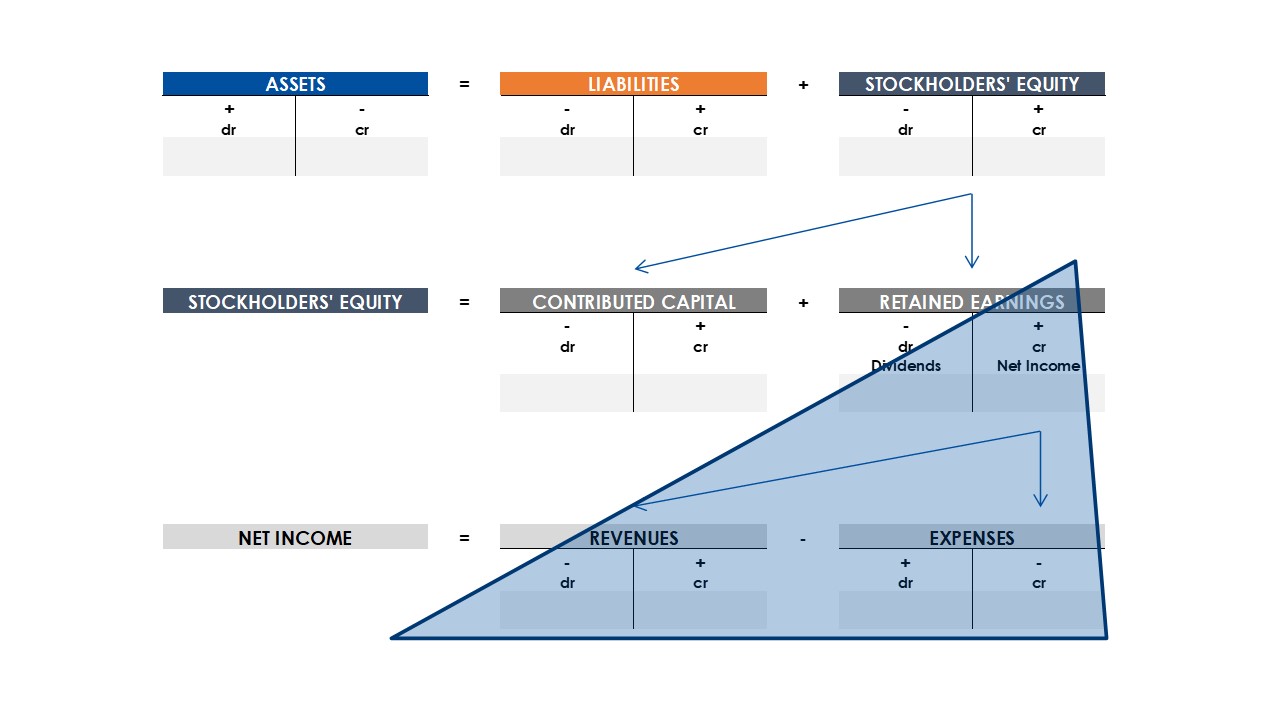

This course introduces the income statement starting with the most concise brief and expanding on the number of line items. Following this introduction, we’ll revisit the accounting equation to help illustrate the interrelationship between the balance sheet and income statement (blue triangle in the image below – the most important relationship highlighted is that shareholders’ equity grows with net income ).

Next, the purpose of the income statement is defined and two important accounting concepts are introduced: the comparison principle and depreciation.

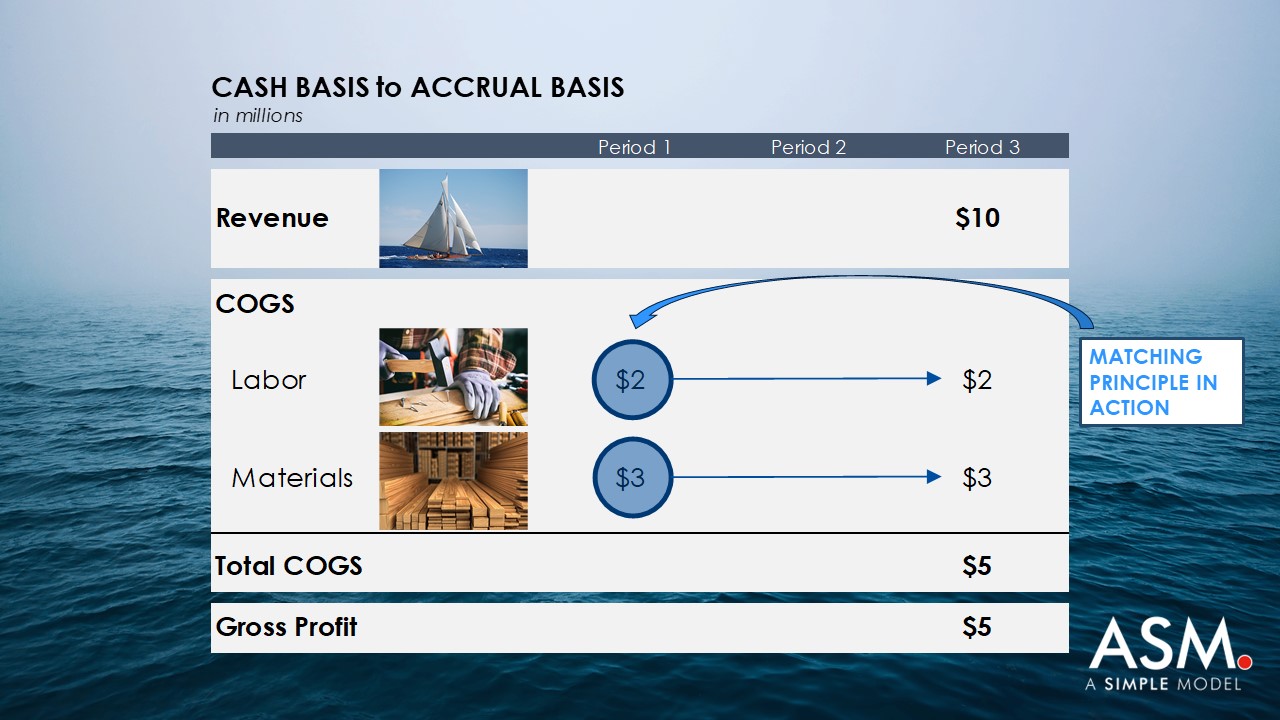

The video concludes by emphasizing the relationship between the income statement and cash flow statement, and highlighting the differences between accrual and cash basis accounting.

cash flow statement

This lesson introduces the cash flow statement, which is perhaps the simplest of the three major financial statements. Both the income statement and the balance sheet reflect the accrual basis of accounting, while the cash flow statement starts with net profits and converts a company’s economic activities from an accrual basis to a cash basis.

To illustrate the differences, the film describes the purchase of large equipment on both accrual and cash basis, providing visuals to help solidify these concepts.

The film also details the three different types of cash inflows and outflows: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities. This video highlights the importance of measuring cash through these three categories and explains why the GAAP profitability measure alone is insufficient to determine a business’s financial health.

After completing the presentation of all three financial statements, the film then explains how the three financial statements work together to maintain the accounting equation. The first relationship highlighted is that the cash balance calculated on the cash flow statement relates to the cash on the balance sheet (see the arrow on the left side of the image below). In this way, the cash flow statement adjusts the assets portion of the balance sheet for each successive accounting period. As a reminder, the video then shows net income adjusted to the equity account (retained earnings) for each accounting period (see the arrow on the right side of the image below).

With this in mind, remember that a balance sheet is simply a formal representation of the accounting equation. If the cash flow statement adjusts the company’s current cash flow through the left side of the equation, or assets, and the income statement adjusts through net income, the right side of the equation, or shareholders’ equity, then the cash flow statement starting with net income is adjusted so that the accounting equation established. This is how the accounting equation balances in a financial model, and how the balance sheet balances in a financial model.

For a sample of the updates included in this video series update, click on the video below.

New Video Example: Accounting Equations

Older films from the original film series: coming soon.