Christmas treasure

investment thesis

Toast (NYSE code: TOST) is a cloud-based POS platform that provides services to small and medium-sized restaurants. Toast continues to maintain strong growth through fiscal 2023 as the total number of merchants continues to grow rapidly, thereby increasing its annual recurring revenue (ARR) Revenue as Fintech (payment solutions business). Losses have also improved over the past few quarters through strong operating leverage. Additionally, the company has a strong balance sheet with no debt. In my view, Toast’s premium valuation is justified given its stronger fundamentals.

financial analysis

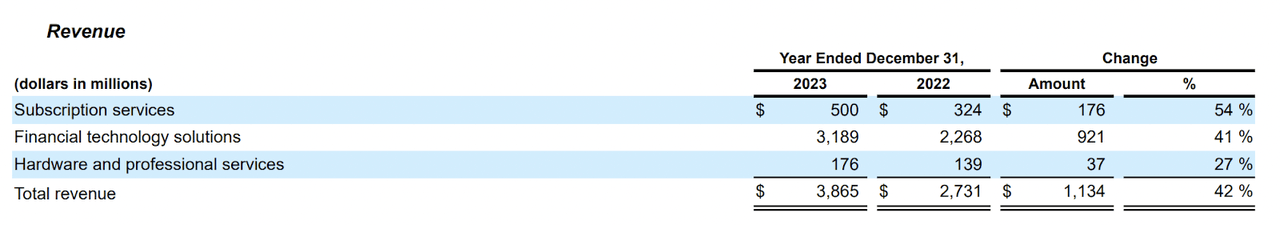

Toast FY23 10-K

1) Subscription revenue:

High-margin subscription revenue generated by its cloud-based POS platform increased 54% annually to $500 million in fiscal 2023. Much of this revenue was driven by the addition of new merchants and expansion of revenue from existing merchants.Of the total number of merchants on Toast, 43% have adopted more than There are 6 products in fiscal 2023, an increase from 32% in fiscal 2021.

In the current economic climate of rising costs and tight budgets, Toast has been aggressively expanding its commercial base, with new and existing customers not only joining in but also investing in additional products. This highlights the compelling value proposition that Toast offers, helping restaurant operators improve operational efficiency and drive revenue growth. This is evident as they are now in 106,000 locations, adding 7,000 new locations as of 2023, and 6,000 new locations were added in 2022, in part due to international expansion.

Toast accounts for 12.3% of the 860,000 restaurants in the United States, underscoring its dominance in restaurant technology. While this number may be lower due to its presence in international markets and the corporate space, it still shows that Toast is the first choice among restaurant operators, reflecting its strong brand reputation, strong product offerings and effective marketing strategies.

Furthermore, the market for Lightspeed (LSPD) is similar to that of Toast, report last year:

“Excluding customer locations for Ecwid’s e-commerce standalone products, as of March 31, 2023, of our approximately 168,000 customer locations, approximately 51% were located in North America and 49% were located in the rest of the world. These customer locations are distributed across the retail and retail industries. time. The hotel industry accounts for approximately 62% and 38% of our total customer locations respectively.”

Since restaurants are part of the hotel industry, using a rough approximation, we can calculate that Lightspeed has approximately over 33,000 locations in the North American hotel industry (168,000 * 51% * 38%). Considering that North America encompasses more than just the United States, and the hospitality industry extends beyond restaurants, this means the number of locations in the United States will likely be lower. This shows that Lightspeed’s market share is less than 3% (33000/880000), which is much lower compared to Toast.

With a large customer base already using the Toast platform, it can leverage network effects to attract more merchants, as restaurants are more likely to adopt a system widely used in the industry. This creates a barrier to entry for competitors and solidifies Toast’s position as the market leader.

2) Fintech revenue

Lower-margin fintech revenue makes up the largest component of its total revenue, rising 41% annually to $3.2 billion in 2023. This significant growth is primarily due to continued adoption of the Toast POS platform, which has resulted in significant growth in gross payment value (GPV). It is worth noting that GPV increased by 38% annually to US$126 billion in fiscal 2023, up from US$91.7 billion the previous year.

This is a segment of Toast whose revenue is primarily a transaction-based fee paid by customers to facilitate payment transactions, typically calculated as a percentage of the total transaction amount processed plus a per-transaction fee. Toast Capital, which accounts for a smaller portion of fintech solutions revenue, provides restaurants with access to financing through loans issued by Toast’s banking partners. In return, Toast Capital receives a fee for facilitating transactions. Each day, a portion of the merchant’s credit card transactions will be used to repay the loan until all is paid off. This is to allow merchants to manage their cash flow without having to pay large upfront costs.

Although my previous article highlighted concerns about Toast’s higher payment processing fees compared to its competitors, the issue of higher processing fees seems minor compared to the overall value Toast provides.

For 2023 GAAP profitability, losses further declined 25% year over year to -$287 million. In terms of EBIT margin, it currently stands at -7.47%, a significant improvement from -14% a year ago, and much of this improvement is driven by Toast’s strong operating leverage.

In order to further improve profitability, Toast also recently announced that it will lay off 10% of its employees, mainly in non-customer-facing positions. Additionally, management stated that they expect to reach GAAP profitability by the second half of 2025. Especially in today’s stock market, where companies are rewarded for achieving profitability,

Focus on shareholder value

Two points were particularly noteworthy during the recent Q4 2023 earnings call.

1) Tighter management of stock-based compensation expenses

During the conference call, Toast management discussed managing SBC expenses more closely:

“We manage stock-based compensation with the same rigor and discipline as other expenses… We target stock-based compensation as a percentage of our recurring gross profits to decline to the low double digits in the mid-term from 27% of our recurring gross profits in 2023. Managing our The equity plan will also improve equity dilution. We are committed to maintaining a net share dilution rate of less than 2% annually on a fully diluted total share count, including all stock awards.”

In a low-interest-rate environment characterized by rapid hiring, companies incurred excessive SBC fees. These SBCs dilute existing shareholders by issuing additional shares. Additionally, there is a real cost to investors.

2) Share buyback

Management also talked about how they plan to return capital to shareholders:

“In addition, as we begin to expand free cash flow, our approach to capital allocation will evolve. This includes prioritizing organic investments in areas where we have signal and belief that we can grow, considering M&A if we see the right opportunity, and Return capital to shareholders. To support this goal, our board of directors has approved a $250 million share repurchase authorization, which we will utilize as appropriate based on market conditions.”

Management’s decision to authorize $250 million in stock repurchases not only demonstrates their confidence in the company’s prospects, but also signals that they believe the stock is currently undervalued. By opportunistically utilizing stock repurchases based on market conditions, management seeks opportunities to acquire shares at attractive prices. By deploying capital for share repurchases, management aims to reduce the number of shares outstanding, thereby increasing earnings per share. Management actively manages the Company’s capital allocation to drive long-term growth and enhance shareholder returns by prioritizing organic investments, pursuing strategic M&A opportunities, and returning capital to shareholders.

Future growth and valuation

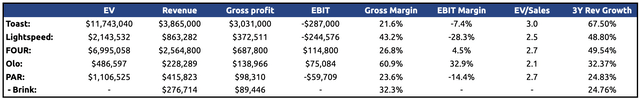

Toast Relative Valuation

Based on EV/sales, it’s clear that Toast commands a premium over its peers. However, this premium is justified by its extraordinary growth trajectory, with its three-year revenue growth rate of 67.50%, outperforming peers with growth rates of less than 30%+ and 40%+ during the same period. In addition, Toast’s gross profit margin has improved significantly and it is expected to become profitable in 2H25. Therefore, the market may have factored in Toast’s potential to achieve higher profit margins compared to peers, further supporting its premium valuation.

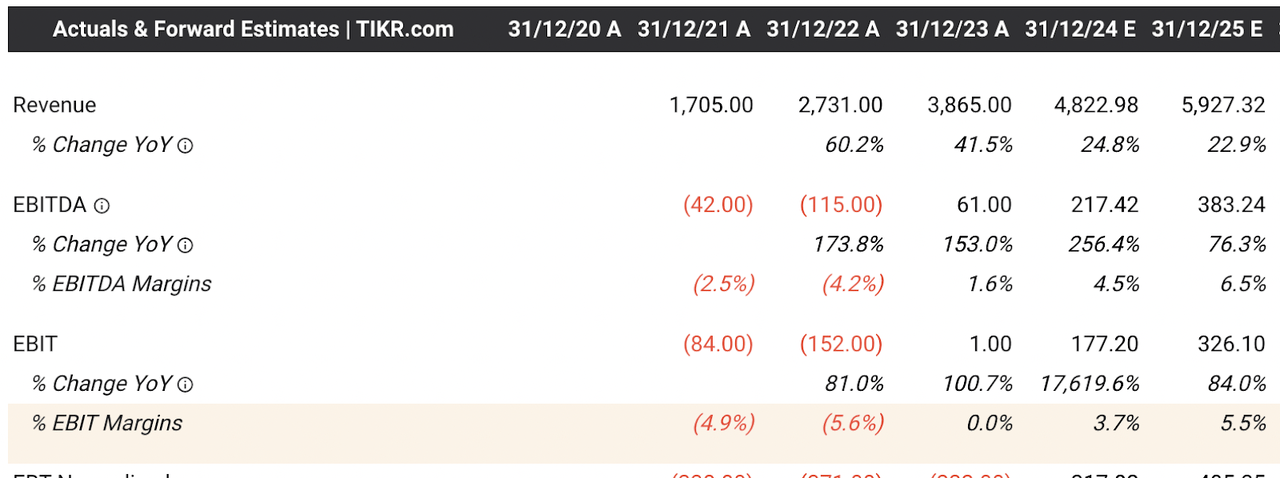

actually

The market consensus forecasts that Toast’s revenue in fiscal year 2024 will be US$4.8 billion (an annual increase of 24.8%), and that in fiscal year 25 it will be US$5.97 billion (an annual increase of 21%). This estimate also means that Toast will maintain revenue growth similar to fiscal 2023. These forecasts are achievable given Toast’s dominant market share in the small and medium-sized restaurant segment, continued strong sales momentum, and expansion outside of its core markets, which will continue to support Toast’s growth. This makes the electric vehicle sales forecast for fiscal year 2024 and fiscal year 2025 to be 2.53 times and 2.05 times respectively.

in conclusion

Toast is a cloud-based POS platform designed for small and medium-sized restaurants. The company has demonstrated continued strong growth, as evidenced by the rapid expansion of its commercial base.Its aggressive growth approach and operational efficiency have made it a dominant player in restaurant technology, capturing a significant market share in the U.S.

Additionally, management’s focus on managing SBC’s expenses and implementing its stock repurchase program underscores its commitment to enhancing shareholder value. By prioritizing a prudent capital allocation strategy and returning capital to shareholders, Toast aims to optimize its financial position and drive long-term growth.

All in all, Toast has shown promising improvements in reducing losses and has a clear path to profitability, justifying its premium valuation.

In the meantime, however, investors should closely evaluate the company’s ability to maintain its growth trajectory and achieve targeted profitability in the second half of 2025, as management stated.