Former U.S. President Donald Trump speaks after attending the wake of New York City Police Department (NYPD) Officer Jonathan Diller, who died in Massapequa Park, Queens, New York, on March 25. Shot while conducting a routine traffic stop in the Rockaways. York, USA, March 28, 2024.

Shannon Stapleton | Reuters

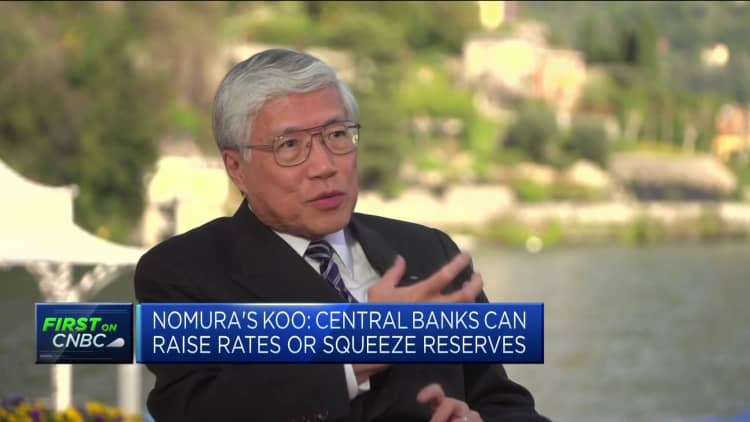

Richard Koo, chief economist at Nomura Research Institute, said decades of trade deficits and a strong dollar have created too many “losers” in the U.S. economy who are turning to Donald Trump Trump’s protectionist policies, and these conditions still exist.

Trump’s “America First” economic policy has led his administration to impose a series of trade tariffs on China, Mexico, the European Union and other countries, including a 25% tariff on imported steel and aluminum.

As the Republican candidate for the 2024 presidential election, Trump proposed imposing a 10% baseline tariff on all U.S. imported products and a minimum 60% tariff on imported Chinese products.

These policies have drawn widespread criticism from economists, who argue that tariffs are counterproductive because they make imported goods more expensive for average Americans.

In an interview with CNBC’s Steve Sedgwick on the sidelines of the Ambrosetti Forum on Friday, he said protectionism is a “terrible thing” but that Trump’s approach “does have some economic logic to it.” “.

“Especially when we study economics and free trade, we are taught that…free trade always creates winners and losers in the same economy, but the gains that the winners always gain are greater than the losses that the losers lose, so society as a whole always Benefits. So this is the benefit of free trade,” he pointed out.

Nonetheless, he believes that this is based on the assumption of a balanced trade flow or surplus, and the United States has been running huge deficits for the past four decades, which increases the number of “losers.”

“By 2016, there were enough people who thought they were losers from free trade to elect Trump as president, so we have to really look back and say to ourselves: What did we do wrong to allow so many people to stay in the United States and put themselves at risk? Seen as a loser in free trade?” he said.

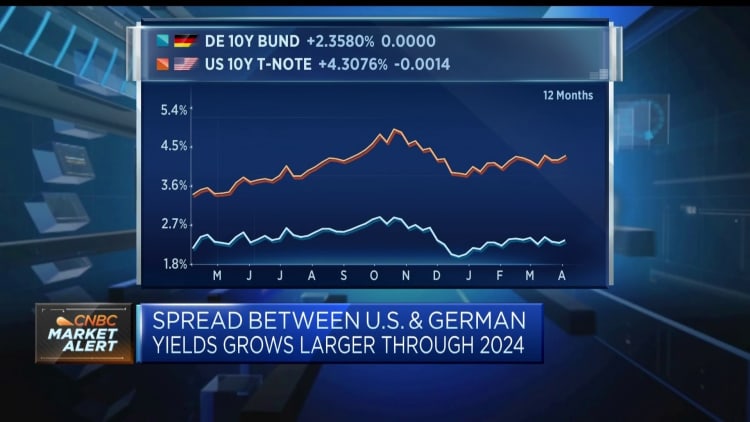

For Koo, the key issue is the currency, as the dollar’s strength spurs foreign imports and hurts U.S. companies that export around the world.

“We let exchange rates be determined by so-called market forces, by speculators, by my clients, by Wall Street types, but foreign exchange rates have to be set in a way that ensures that the number of losers doesn’t grow to the point where free trade itself disappears,” Gu said. explain.

He pointed to a similar critical moment in 1985, when President Ronald Reagan faced the same problems of a strong dollar and rising protectionism. At the time, Reagan responded by reaching an agreement with France, West Germany, Japan, and the United Kingdom to intervene in foreign exchange markets to devalue the dollar against their currencies.

“This is something we should be doing more consciously. Instead of letting the dollars flow to where the market needs them, and then those who are not as lucky as us in the financial markets, end up suffering and end up voting for Mr. Trump,” Gu added .

Economists, he argued, need to move away from the notion that the U.S. trade deficit is simply due to “too much investment” and “too little saving,” because that means the deficit can only be reduced by keeping the economy in recession until domestic demand weakens. . American companies can export more goods than is possible in democracies.

Koo once again mentioned past transactions with Japan, saying that if it is believed that overseas companies only filled the gap where American companies were unable to meet domestic demand, then American companies that competed with Japanese companies in the 1970s and 1970s should have benefited from the surplus. Huge profits. Require.

“But that’s not actually happening. It’s just the opposite. A lot of people are bankrupt, a lot of free trade losers are on the streets, because it’s not a question of savings and investment, it’s a question of exchange rates,” he said.

“The dollar should have been weaker, and Reagan knew that was why he took this action.”