Larry Busacca

In today’s article, we bring you the latest update in our regular series based on our analysis of 13F filings and the latest moves from some of the world’s most prominent funds and asset managers.Our original article on this matter and The main papers behind it can be accessed through this link.

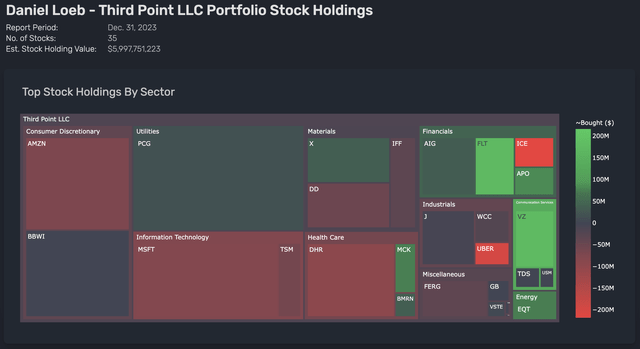

The third point Q4 ’23 heat map (Quiver quantitative)

Quarterly Overview

Last quarter, we discussed the growing similarities between Loeb’s third point and the composition of the Nasdaq 100. Historically, Loeb has invested in energy and health care stocks, which still account for a large portion of the fund’s holding concentration. It remains top-heavy; 10 stocks account for about 70% of its AUM, with PG&E Corp. (PCG) and Microsoft (MSFT) still at the top and Amazon (AMZN) taking over Danaher (DHR)) is third. Turnover this quarter is higher than we’ve seen before. They eliminated a total of 7 locations and significantly reduced 2 locations. This includes their Google (Google)(Google) and Uber (Uber) positions, both of which were opened last year, suggest Third Point’s composition is increasingly similar to that of the Nasdaq. They hold a total of 35 stocks, down from 36 last quarter, and AUM remains almost unchanged, changing only about $10 million.

New positions:

Verizon Communications (VZ): In what may have been the fund’s biggest trade of the fourth quarter, it bought 4,675,000 shares of telecom giant Verizon while closing its T-Mobile position. Shares were purchased at prices between $30 and $38. Today, the stock trades around $40, giving the position a market cap of nearly $190 million. It currently accounts for about 3% of Third Point’s assets under management.

Frico Technology (FLT): This appears to be a more value-oriented strategy, which is more in line with what we’ve seen from Loeb before with investing. The company, which provides payment processing software and trades at an attractive price-to-earnings ratio of 14 times, has posted its fourth consecutive year of revenue growth. Shares were purchased at prices between $222 and $282, and are trading near $280 today. With 615,000 shares, this brings the value of their position to $172 million.

A total of 6 new positions were added in the fourth quarter. Others include Apollo Global Management (APO), another healthcare company owned by McKesson Corporation (MCK), as well as BioMarin Pharmaceutical (BMRN) and EQT Corporation (EQT).

Extended positions:

United States Steel Corporation (X): In December, the company agreed to be acquired by Japan’s Nippon Steel Corporation for $55 per share, a deal that valued the company at more than $14 billion. Interestingly, Loeb opened the position in the third quarter before the deal closed, while other companies such as Cleveland-Cliffs were still publicly bidding for X. In the fourth quarter, he added another 750,000 shares to his portfolio, an increase of about 16%. Third Point currently holds 5.5 million shares of X stock, making it its sixth-largest holding.

Only 4 positions were expanded in the fourth quarter, and no positions other than X are particularly noteworthy. They slightly increased their position in PCG, adding 1 million shares to their previous holding of 56 million shares. American International Group (AIG) rose 17%, and a microcap stock in the renewable energy sector called Vast Renewables Limited (VSTE) rose 27%.

Reduce positions:

Uber Technologies (UBER): Although the stock more than doubled last year, Loeb appeared to have lost interest as his fund sold 70% of the ride-sharing giant. They sold a total of 3.2 million shares throughout the fourth quarter while the stock was trading between $40 and $64, which likely provided them with handsome gains as they closed the second quarter of 2023 at $30 to $40 The price between when the stock was first purchased. Still, the stock price rose to as high as $80 in the first quarter of this year, so they missed out on some potential gains but still have 1 million shares in their portfolio.

Taiwan Semiconductor Manufacturing Co., Ltd. (TSM): Third Point’s TSM position has essentially halved over the past six months, despite being opened only six months ago. Considering the performance of China’s financial markets and the political and economic ties between Taiwan and the mainland, it is not surprising that the position was significantly reduced after it was first opened. At the same time, the semiconductor industry has been very hot lately, as evidenced by Nvidia stock, and TSM not far behind, up more than 40% since Third Point opened its position, so they may just be taking profits along the way. They still hold nearly 1.2 million shares.

Intercontinental Exchange (ICE): ICE reduced its holdings by more than 70% in the fourth quarter, rising from the eighth-largest holding to the 17th position. Third Point also recently opened this position in Q2 2023 at prices between $104 and $114 per share. Shares remained flat for much of the rest of the year until December, when they jumped to nearly $130 per share, and have since risen to nearly $140 per share. Third Point still owns 700,000 shares of the financial markets technology company, but considering when they sold such a large portion of their shares, that may be different from what they did on TSM or UBER.

A total of 11 positions were reduced. Other stocks that reduced positions include Amazon and Microsoft (both among the fund’s top 10 holdings), as well as industrial, manufacturing or materials-oriented companies such as Ferguson (FERG), DuPont (DD) and Jacobs Solutions (J) stock.

Positions closed:

Alphabet (GOOGL): At the end of the first quarter last year, it was Third Point’s fifth-largest holding, with a market value of about $500 million, and it has now been completely liquidated. Still, the stock is up more than 30% in that period and has never fallen below the fund’s acquisition price, which likely makes this a very solid deal for them.

T-Mobile US (TMUS): Loeb does appear to have some kind of role in telecom, as he sold a brand new and relatively large T-Mobile job and replaced it with a Verizon job that was nearly the same size. Third Point just bought 1,000,000 shares of TMUS stock in the third quarter at prices between $133 and $140, which they could have sold at the end of December for as much as $160.

Loeb and his fund also exited Option Care Health (OPCH), RBC Bearings Incorporated (RBC), ProPetro Holding Corp. (PUMP) and Fidelity National Information Services (FIS).

final overview

Overall, the portfolio’s time as a “mini-Nasdaq” appears to be relatively short-lived, as many tech stocks have been trimmed or liquidated entirely. The fund appears to have resumed its interest in health care and energy stocks, almost as if to say the 2023 rally in tech stocks may be over. With uncertainty surrounding a rate decision later this month and rising inflation indicators, Loeb may have made some of the best-timed trades in 2023, but only time will tell. He now owns only two of the seven stocks in the S&P 500 this year; previously he held five of seven.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.