59 yuan

This article is part of a series that provides an ongoing analysis of the changes made to Ruane, Cunniff & Goldfarb’s 13F portfolio on a quarterly basis.This is based on their supervision Form 13F Submission date: February 14, 2024.please visit our track Portfolio of Ruane, Cunniff and Goldfarb Article to learn about their investment philosophy and ours Previous updates Moves for Q3 2023.

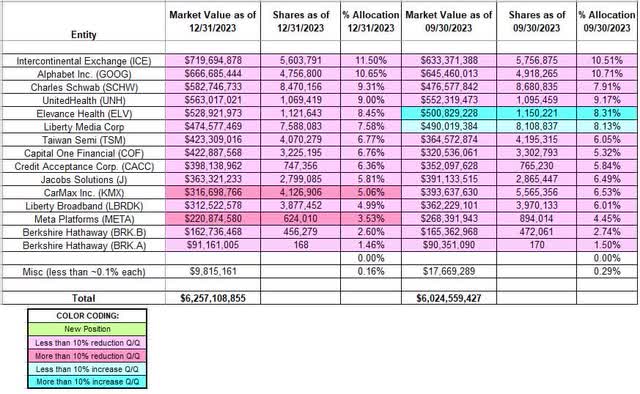

Ruane, Cunniff, and Goldfarb’s 13F portfolio value increased from $6.02B to $6.26B this quarter. The number of positions is reduced from 36 to 33. Fifteen of these holdings are very large (more than 0.5% of the portfolio each) and they are the focus of this article. The top three accounted for 31% of 13F assets, while the top five accounted for 49% of 13F assets: Intercontinental Exchange, Alphabet, Charles Schwab, UnitedHealth and Elevance Health.

this The firm is best known as an investment adviser to Sequoia Funds (MUTF: next) has a long track record of approximately 53 years (incorporated on July 15, 1970, with annualized returns of 13.18% versus 11.12% for the S&P 500). The performance in 2022 was terrible: down 30.52%, while the S&P 500 lost 18.11%. In 2023, they slightly outperformed the S&P 500: 27.83% vs 26.29%. After new management took over in the first quarter of 2016, the portfolio has shifted from asset-intensive manufacturing and retail to information and services businesses. Additionally, cash distributions have averaged around 20% since inception and are now below 5%. The following significant holdings in Sequoia’s portfolio do not appear on the 13F report because they are not 13F securities: Constellation Software (OTCPK: CNSWF), Eurofins Scientific SE (OTCPK: ERFSF), Luming Group (OTCPK:LMGIF), Rolls-Royce Holdings plc (OTCPK:RYCEY), SAP SE (sap) and Universal Music Group (OTCPK:UMGNF). Bill Ruane was a student of Benjamin Graham.To understand the teachings of Benjamin Graham, check out the classics smart investor and Securities analysis.

Share reduction:

Intercontinental Exchange (ICE): ICE is currently the second largest 13F position, accounting for 11.50% of the portfolio. It was purchased in the third quarter of 2020 at prices ranging from approximately $92 to approximately $107. In the second quarter of 2022, shares increased by approximately 90%, with prices ranging from approximately $90 to approximately $133. The stock is currently trading around $136. It has been cut by about 17% over the past six quarters.

Alphabet Inc. (GOOG): GOOG is now the second largest 13F position at 10.65% of the portfolio. It was first acquired in 2008 and the original stake was almost sold out the following year. In 2010, larger positions were established in the sub-teens price range. Recent activity is as follows: In the second quarter of 2019, prices fell by a third, with prices ranging from about $52 to about $64. Subsequently, prices fell by approximately 60% in the six quarters through the fourth quarter of 2020, between approximately $53 and approximately $107. Over the past seven quarters, prices have declined further by approximately 45%, with prices ranging from approximately $83 to approximately $139. The stock is currently trading at around $149.

Charles Schwab (SCHW): SCHW currently accounts for 9.31% of the portfolio. It was first purchased in Q2 2016 and cost approximately $29. In the first quarter of 2020, shares increased by approximately 40%, with prices ranging from $28.50 to $49. About 17% of next season’s sales will be between $32.50 and $43. The stock is currently trading at $69.67. In the second quarter of 2023, stake increased by approximately 9%, while it decreased by approximately 6% in the past two quarters.

United Health Insurance (UNH): UNH represents a large portion of portfolio equity (top five) ~9%. It was established in the fourth quarter of 2019 at a price range of $215 to $296 and increased by about 300% the next quarter with a price range of $195 to $305. In the third quarter of 2020, shares increased by approximately 30%, with prices ranging from approximately $291 to approximately $324. In the second quarter of 2022, approximately 25% of homes were sold for between approximately $452 and approximately $546. Subsequently, the price dropped by approximately 15% in the fourth quarter of 2022, with prices ranging from approximately $499 to approximately $555. The stock is currently trading at around $494. There have been minor cuts over the past few seasons.

Highly Healthy (ELV): 8.45% ELV shares were established in the first half of 2021 at prices ranging from approximately $288 to approximately $402. In the second quarter of 2022, prices fell approximately 42% between approximately $444 and approximately $530. Subsequently, sales volume in the fourth quarter of 2022 was approximately 16%, with prices ranging from approximately $454 to approximately $547. In the second quarter of 2023, the stake increased by approximately 30%, with prices ranging from approximately $436 to approximately $496. There was also growth of about 10% last quarter. The stock is currently priced at about $514. This quarter saw a slight cut of about 2%.

Liberty Media Corporation (FWONK) (LLYVK) (LLYVA): Sequoia Capital’s fourth-quarter 2016 letter revealed Liberty Media’s new Formula 1 stake. They participated in Liberty’s takeover of Formula 1 and acquired shares at a discounted price of $25. The stakes have been shaken. FWONK is currently around $68. The stake currently represents 7.58% of the portfolio. There will be a slight reduction of approximately 2% in the second quarter of 2023 and approximately 6% in this quarter.

Taiwan Semiconductor Manufacturing Company (TSM): 6.77% of the portfolio’s TSM shares were purchased in Q4 2019 at prices between $46.50 and $59. In the second quarter of 2020, the stake was increased by approximately 130% at roughly the same price range. Sales in the first quarter of 2021 were approximately 12%, while holdings increased by approximately 20% in the third quarter of 2021. In the third quarter of 2022, approximately 30% of sales were priced between approximately $69 and approximately $92. The stock is currently trading around $137. There have been minor cuts over the past few seasons.

Capital One Financial (COF): COF represents 6.76% of portfolio positions established during the third quarter of 2022 at prices ranging from approximately $91 to approximately $116, with the stock currently trading at approximately $142. In the second quarter of 2023, the stake increased by approximately 25%, with prices ranging from approximately $86 to approximately $114. The past two quarters have seen modest cuts of about 6%.

Credit Acceptance Corporation (CACC): CACC held a 6.36% stake in Q1 2017 at prices between $185 and $221. In the fourth quarter of 2020, shares increased by approximately 25%, with prices ranging from $288 to $356. In the third quarter of 2021, sales volume was approximately 18%, and prices ranged from approximately US$438 to approximately US$670. Then, the price dropped by a third the next season, with prices ranging from about $582 to about $696. The stock is currently priced at approximately $562. There have been minor corrections over the past few quarters.

Note: They own approximately 6% of Credit Acceptance Corp.

Jacob Solution(J): Jacobs Solutions first purchased a 5.81% long-term stake in 2012. Recent activity is as follows: In the second quarter of 2018, prices rose by approximately 20% between $56.50 and $67, while the following six quarters saw minor corrections. In the first quarter of 2020, approximately 25% of sales were priced between approximately $63 and approximately $104. This was followed by a similar price drop in the second quarter of 2021, with prices ranging from approximately $129 to approximately $143. The stock is currently trading around $151. It grew by about 12% in the second quarter of 2023, while it decreased by about 6% in the past two quarters.

CarMax Corporation (KMX): KMX currently accounts for approximately 5% of the 13F portfolio. The product was purchased in the second quarter of 2016 at prices between $46 and $56 and increased by approximately 70% in the fourth quarter of 2016 at prices between $48.50 and $66. In the fourth quarter of 2017, sales at prices between $64 and $77 were about 30%, and the next quarter, sales at prices between $59 and $72 were up about 80%. In the 11 quarters ended in the fourth quarter of 2020, approximately 45% of sales were priced between approximately $44 and approximately $109. The current share price is about $83. Prices have dropped by about 25% again this season, with prices ranging from about $60 to about $79.

Liberty Broadband (LBRDK): LBRDK represented approximately 5% of portfolio positions purchased in the first quarter of 2018 at prices between $86 and $97, increasing by approximately 20% the following quarter at prices between $69 and $85. In the first quarter of 2020, prices fell approximately 18% between approximately $91 and approximately $139. In the first quarter of 2021, shares increased by approximately 23%, with prices ranging from approximately $143 to approximately $157. In the second quarter of 2023, the price increased by another third, with prices ranging from about $71 to about $85. The stock is currently trading at $57.23. There have been minor corrections over the past two quarters.

Meta Platform (META): In the first quarter of 2018, META’s holdings of 3.53% increased significantly by approximately 600% at prices between $152 and $193. Over the next two quarters, prices rose another roughly 27% between $155 and $218. The first quarter of 2019 saw a reversal: prices fell by approximately 23% between $124 and $173. In the first quarter of 2021, shares increased by approximately 13%, with prices ranging from approximately $246 to approximately $299. In the third quarter of 2022, the shareholding also increased by approximately 11%. In the first half of 2023, approximately 70% of sales were priced between approximately US$125 and approximately US$289. Prices have dropped by about 30% again this season, with prices ranging from about $288 to about $358. The stock is currently trading at around $506.

Berkshire Hathaway (BRK.B) (BRK.A): Berkshire Hathaway’s shares currently account for about 4% of the portfolio. This is a very long-term position and was the largest holding in their first 13F filing in 1999. Recent activity is as follows: In the first quarter of 2018, one-third of sales ranged from approximately $191 to approximately $217. Over the nine quarters ending in the first quarter of 2022, substantial shares sold at prices ranging from approximately $169 to approximately $359. Next quarter another third will be priced between $268 and $353. The stock is currently priced at about $416. There have also been smaller cuts over the past six quarters.

The spreadsheet below highlights the changes in Ruane, Cunniff, and Goldfarb’s 13F stock holdings during the fourth quarter of 2023:

Ruane Cunniff and GoldFarb – Sequoia Fund Portfolio – 2023 Q4 13F Report Quarterly/Quarterly Comparison (John Vincent (Author))

Source: John Vincent. Data constructed from Ruane, Cunniff and Goldfarb’s 13F filings for Q3 2023 and Q4 2023.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.