Fin Tap

The following data comes from trading activity on the Tradeweb Markets institutional European and US-listed ETF platform.

European Listed ETFs

total trading volume

Trading activity in the Tradeweb European ETF market reached €56.4 billion in February, while The proportion of transactions processed through Tradeweb’s Automated Intelligent Execution (AiEX) tool reached 87.4% of the platform’s records.

Adam Gould, head of equities at Tradeweb, said: “February was another strong month, with trading volumes on our European ETF market up 10.2% on the same period last year. The proportion of trades completed through AiEX once again broke the record, reaching 87.4%, which shows that the number of trades completed through AiEX is increasing. More and more customers are turning to automation for their daily transactions.”

Volume breakdown

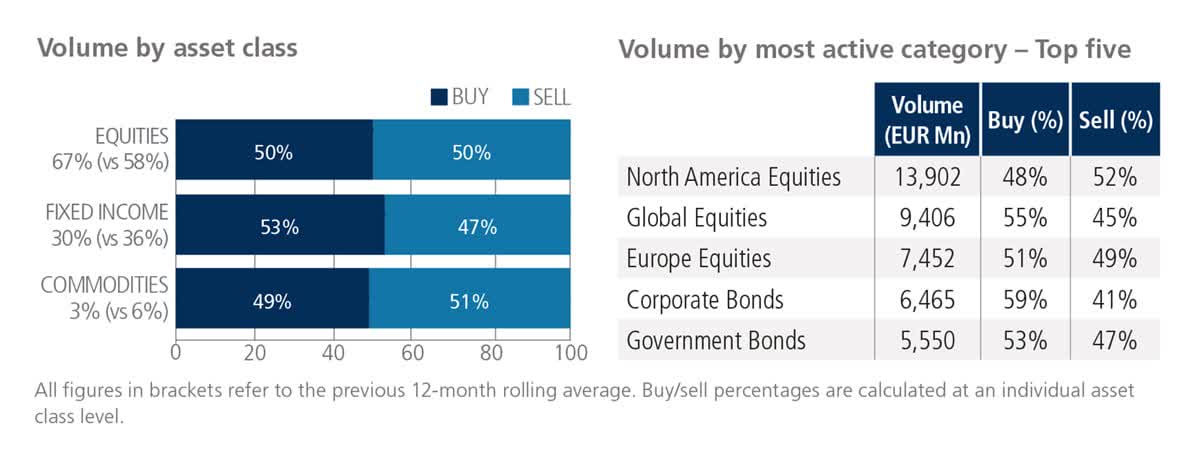

In February, equity ETF trading activity accounted for approximately two-thirds of total trading volume, reaching 67%, while fixed income and commodities accounted for 30% of trading volume. 3% respectively.

Commodities were once again the only ETF asset class where “sells” exceeded “buys,” while stocks’ “sells” equaled “buys.” North American stocks are the most traded ETF category, with a total trading volume of nearly €14 billion.

Top ten names in transaction volume

In February, seven of the top ten were occupied by equity products, three of which offered investors exposure to global equities.

However, at the top of the list is a U.S. stock-focused fund, the iShares Core S&P 500 UCITS ETF, which holds the top spot for the second month in a row.

US-listed ETFs

total trading volume

The total value of combined US ETF project transactions in February reached US$66 billion.

Adam Gould, head of equities at Tradeweb, said: “In the U.S., Tradeweb institutional ETF trading volume increased 21.7% year-over-year, reflecting the strong growth of our platform. This growth is mainly due to the continued adoption of ETF trading by customers through Tradeweb’s electronic inquiry, and our Increased use of ETF portfolio trading features.”

Volume breakdown

In terms of percentage of total fund value, equities accounted for 43%, fixed income accounted for 47%, and the remainder included commodities and specialty ETFs.

Top ten names in transaction volume

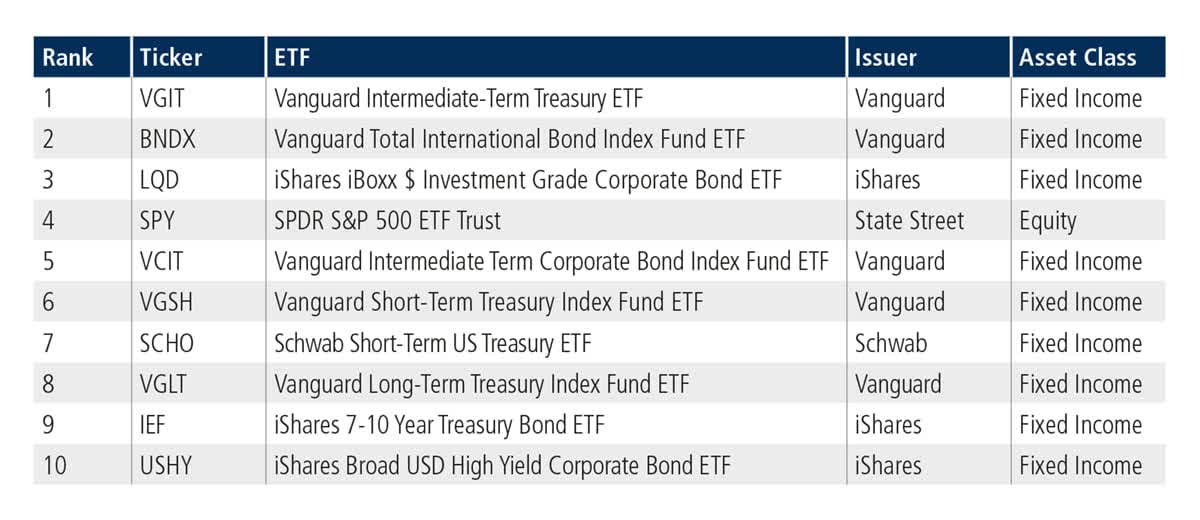

Nine of the top ten ETFs by name are fixed income ETFs. The Vanguard Intermediate-Term Treasury Bond ETF, which last ranked in the top 10 last February, ranks first.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.