Christmas treasure

Since my launch report in June 2023, Trane TechnologiesNYSE:TT) shares soared more than 56%. I point out that their strong growth is driven by decarbonization and electrification, as well as strong pricing power.They offer 8.7% organic products Revenue grew in fiscal 2023, and adjusted operating profit grew by 21.4%. I admire their structural growth and reiterate a Strong Buy rating with a one-year price target of $339 per share.

Commercial HVAC bookings grow strongly

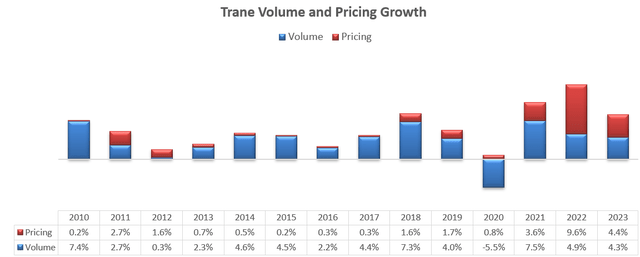

Trane achieved organic revenue growth of 8.7% in fiscal 2023, with pricing growing by 4.4% and sales volume growing by 4.3%. As the chart below shows, Trane has experienced strong organic growth over the past two years.

Trane Technologies 10Ks

In my opinion, strong growth in commercial HVAC has been the company’s primary growth driver, and I expect this growth momentum to continue The reasons for the future are as follows.

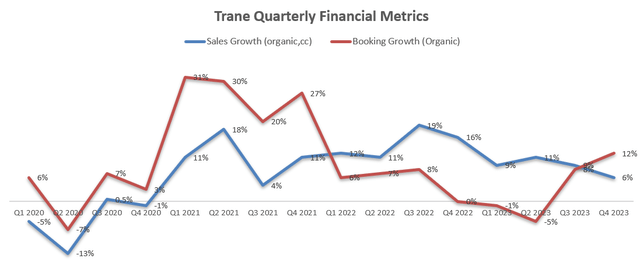

As they revealed in their fiscal 2023 fourth quarter earnings call, their backlog in the commercial HVAC segment increased by $700 million in fiscal 2023, and over the past three years, their backlog has increased by almost two percent. times. The company is seeing a strong pipeline of HVAC application projects. Historically, Trane has been able to convert backlog into actual revenue within 6-12 months. The chart below examines the relationship between organic booking growth and organic revenue growth. It is clear that booking growth is a leading indicator of its revenue growth. So, in my opinion, strong backlog may translate into actual top-line growth in the coming quarters.

Trane Technologies quarterly results

In addition, according to the IEA ReportEnergy efficiency is the second largest contribution to reducing CO2 emissions over the next decade, with many energy efficiency measures in industry, buildings, appliances and transport now ready for implementation. Efficient HVAC systems have the potential to reduce energy consumption in buildings/factories.

In March 2024, the U.S. Securities and Exchange Commission (SEC) passed rule Strengthen and standardize climate-related disclosures by public companies. I think the requirement for climate-related disclosures may force public companies to pay closer attention to their energy consumption, water usage and other related key performance indicators.according to Schneider Electric, CO2 emissions from buildings account for 37% of global annual emissions. Therefore, in my opinion, companies have an incentive to upgrade their inefficient HVAC systems to newer applications, which can reduce energy bills and improve ESG. Therefore, strong growth in commercial HVAC is more likely to continue in the near future.

Challenging residential and transportation refrigeration markets

As I highlighted in my launch report, Trane’s residential business is impacted by the current high interest rates and depressed residential market.exist Fourth quarter fiscal year 2023, Trane’s residential business experienced negative year-over-year growth (an undisclosed amount) while witnessing continued normalization in the market. Their management expressed confidence that the market will return to long-term GDP growth.

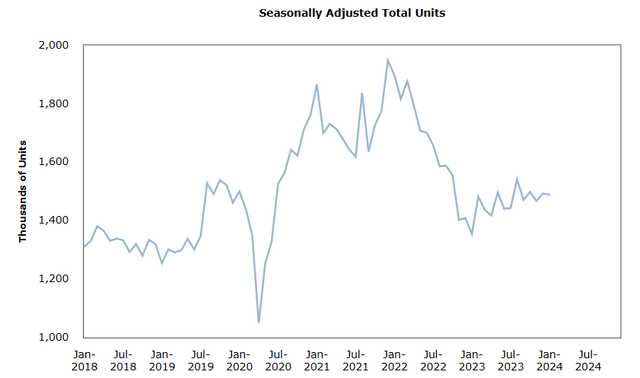

The current high interest rates are really putting a lot of pressure on new housing starts. The chart below shows the seasonally adjusted total number of new residential construction in the U.S. market. The residential market has been quite weak since late 2022 due to rising interest rates.

U.S. Census Bureau

However, I think the housing market should be able to recover when the Fed starts cutting interest rates. Still, the residential market accounts for only 20% of Trane’s total revenue, so its financial impact is fairly limited.

Management expects the transportation refrigeration market to enter a mild downcycle in the near future. Interestingly, the transportation refrigeration business grew 20% in the first half of fiscal 2023 and then declined 20% in the second half. Their management expects the business to decline in fiscal 2024 as the market enters a down cycle.

Two-thirds of Trane Transportation’s refrigeration revenue comes from trailers, trucks and auxiliary power units (APUs), and one-third comes from ocean/bus/rail/air and aftermarket. Kuehne + Nagel ( OTCPK:KHNGF ), one of the world’s largest road logistics companies, saw revenue from its road logistics business grow by -15% in 2019. Fourth quarter fiscal year 2023, -11% for the full year. Full-year sales fell by 6%, and prices dropped by another 5%. These data indicate that the overall logistics market faced significant challenges in the fourth quarter. To me, it seems unlikely that logistics companies will expand capex on trucks given the decline in volumes and prices. Therefore, Trane’s transportation refrigeration may encounter growth challenges in fiscal 2024.In addition, Trane calculated The weighted average of the North American transportation market will decline by 12% Behaviorforecast data. Having said that, the business accounts for about 15% of group revenue; again, I think the overall impact should be fairly limited.

Recent results review and outlook

Trane achieved 6% organic revenue growth and 12% organic bookings growth in the fourth quarter of fiscal 2023. Due to strong profit margin expansion, adjusted operating profit increased by 23% year-on-year, and earnings per share increased by 19% compared with the same period last year.

There are several reasons why their profit margins have expanded significantly.

As I mentioned in my launch report, Trane has demonstrated superior pricing power to customers. In the fourth quarter of fiscal year 23, Trane’s U.S. business sales increased by 4% and prices increased by 3%. Strong pricing growth is expanding the company’s gross margins. Additionally, Trane has been expanding its service operations over the past few years, particularly in applied HVAC products. As disclosed in the earnings call, the profit margin of the services business is much higher than that of the group. Therefore, the growth of their services business will expand their operating profits over time.

The final factor is sales growth, which will give the company significant operating leverage. Sustainable growth in sales will be beneficial to the company’s utilization rate and will also help expand profit margins.

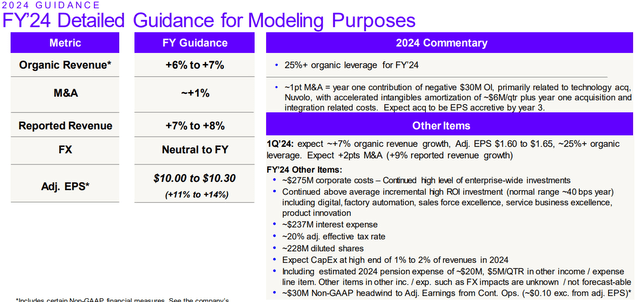

For FY24, the company expects organic revenue to grow 6%-7%, acquisitions to grow 1%, and adjusted earnings per share to grow 11%-14%, as shown in the slideshow below.

Trane Technologies Investor Presentation

Macroview Research predict The global HVAC market is expected to grow at a CAGR of 7.4% from 2024 to 2030, driven by rising demand for cost-effective and energy-saving cooling and heating applications in the industrial and commercial sectors. In my opinion, Trane’s revenue guidance appears to be quite conservative simply considering market growth.

During the earnings call, Trane made it clear that pricing will continue to be its growth driver in the near future. Assuming pricing growth of 3.5%, Trane only needs to grow sales by about 4% to meet full-year guidance. Trane sales have grown an average of 5.6% over the past three years; therefore, their full-year guidance appears to be quite conservative to me.

Valuation update

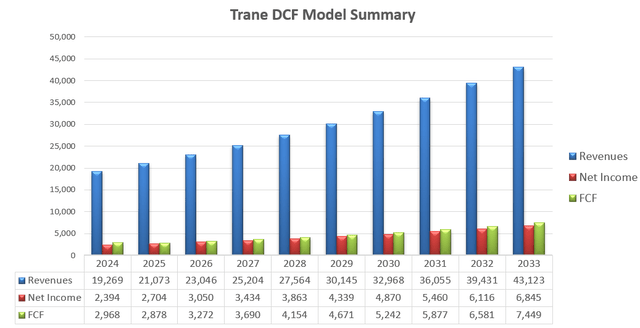

In the DCF model, I assume organic revenue growth of 8%, with sales growth of 5% and pricing growth of 3%. Growth assumptions are slightly higher than the previously mentioned long-term forecast provided by Grand View Research, as Trane’s strong commercial HVAC product portfolio will likely outperform overall market growth. Additionally, sales volume and price growth assumptions are consistent with historical averages over the past three years. M&A is expected to contribute 1% to the model’s top-line growth, which is consistent with their M&A track record.

Their margin expansion was driven by pricing initiatives and operating leverage. I estimate their operating expenses will increase 8.5% annually, resulting in margin growth of 40-60 basis points annually.

In FY23, Trane generated $2.089 billion in free cash flow, returned $684 million in dividends and $669 million in share repurchases, which in my opinion is a fairly generous capital allocation strategy. The number of outstanding common shares decreased by 2% in fiscal 2023 due to share repurchases. The company has committed to share repurchases in fiscal 2024, and I expect the total number of shares outstanding to decrease by another 2% in fiscal 2024.

Trane Technologies DCF – Author’s calculations

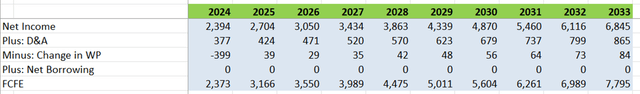

With these parameters, I calculated free cash flow to equity (FCFE) over the next ten years by adjusting net income for depreciation/amortization, changes in working capital, and net borrowings, as shown in the table below.

Trane Technologies DCF – Author’s calculations

According to (SA), the 24-month beta is 1.19 and the risk-free rate using the U.S. 10-year Treasury bill is 4.32% yield, the market premium in the model is 5%. Therefore, the cost of equity is estimated to be 10.265%. Total equity value, net of all future FCFE, is expected to be $75.8 billion. Therefore, their one-year price target is $339 per share, based on my estimates.

The key question

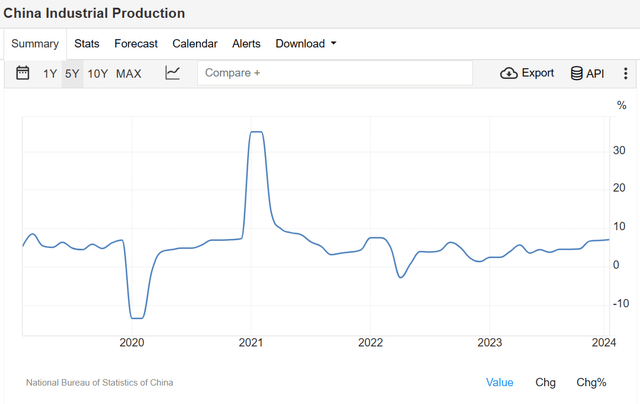

In fiscal 2023, their China bookings fell significantly due to weak local market economies and sluggish industrial production. As a result, Merck’s revenue in China fell from the same period last year. The Asia Pacific region accounts for approximately 8.2% of the group’s revenue, and I estimate China’s percentage of LSD’s total revenue. I don’t expect China’s economy to recover anytime soon, as the local economy is currently suffering from a weak real estate market and a depressed stock market.

As shown in the figure below, China’s industrial production will show considerable weakness in 2022 due to the emergence of the epidemic. Trane is selling HVAC solutions for manufacturing facilities and buildings in China. Therefore, a slowdown in industrial activity will hamper Trane’s growth prospects in China.

trade economics

Therefore, I think China should continue to be a headwind for Trane in fiscal 2024. While Trane expects continued growth in its commercial HVAC business, there are still some weaknesses, such as the office end market. HVAC in the office market was quite weak in fiscal 2023, and management expects this weakness to continue into fiscal 2024.

in conclusion

As I pointed out in my last article, I define “boring” investing as a business that will steadily grow regardless of macro conditions. Trane Technologies is one of my long-term “boring” investments because they consistently deliver superior organic revenue and free cash flow growth. Their growth is driven by megatrends in energy efficiency and global decarbonization. I reiterate a Strong Buy rating and a one-year price target of $339 per share.