Its skin/E+ via Getty Images

Ctrip (NASDAQ: TCOM) is a leading online travel agency/OTA with more than 1.1 million accommodation listings, such as restaurants, flights, and other travel needs such as car rentals and tours. They have a large inventory, global reach, user-friendly mobile app, and frequent promotions.Telecommunications company It also owns Skyscanner, a well-known travel search aggregator.

Like leading OTAs such as Expedia or Booking, TCOM utilizes a multi-brand strategy to capture global market share across the entire online travel value chain. For example, in addition to owning Ctrip and Qunar.com for Chinese tourists, TCOM also owns Trip.com and Skyscanner, which are more globally recognized, to meet the needs of international tourists.

I believe this ecosystem building strategy provides TCOM with considerable competitive advantages.In addition to enhanced brand recognition in specific markets due to localization and internationalization, this strategy should also provide greater cross-selling and up-selling Gain opportunities by redirecting traffic based on booking needs within the TCOM ecosystem. In addition, cost synergies can be achieved between brands because TCOM can bring together technology and other resources.

Overall, share price performance has been relatively strong. The historical return since the IPO in 2003 is over 1,700%. The company’s stock price has also risen 16% in the past year, and although it currently trades at $45, it is still some way off its all-time high of $58 in 2017.

I begin my coverage with a neutral rating. My 1-year price target is $48, which represents a 7% upside from the current price of $41. At current levels, the stock looks a bit expensive today.

financial review

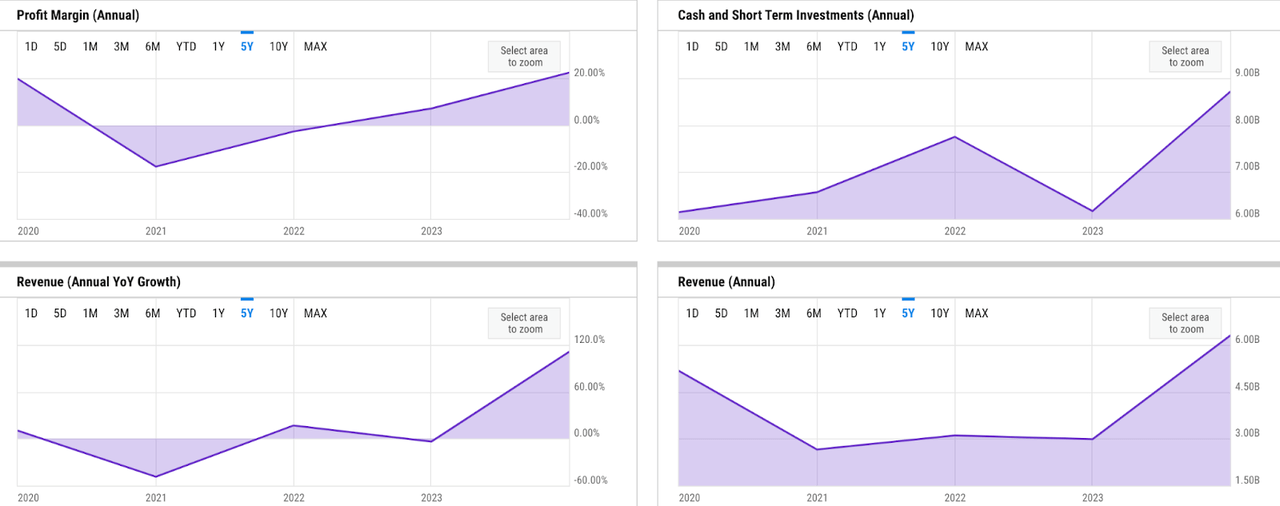

Y chart

Overall, TCOM has relatively solid fundamentals. Aside from the first and second waves of COVID-19 in China in 2020 and 2022, revenue growth has been good over the past five years. Twice, revenue growth shrank by -48.6% and -3.8% in a row. However, there was a strong rebound in 2023, with TCOM achieving fiscal year revenue of $6.3 billion, an astounding 110% annual increase. At the same time, profitability also improved. Net margins have expanded since hitting a 5-year low during COVID-19. In fiscal 2023, TCOM’s net profit margin was 22%.

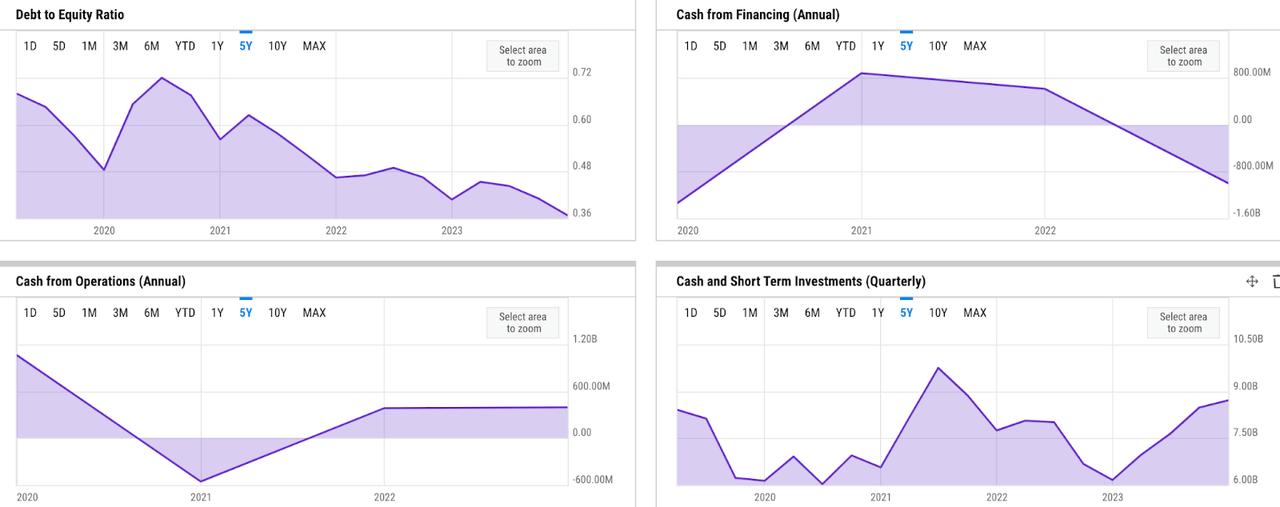

Y chart

Liquidity is also good. In addition to operating cash/OCF, TCOM relies on debt and equity issuance to support its liquidity needs. OCF generation has remained stable recently, supporting the upward trend in cash levels. Cash and short-term investments were $8.7 billion in fiscal 2023. Over the past five years, the debt-to-equity/DE ratio has declined from nearly 1x to 0.36x, indicating good balance sheet management. Last year, TCOM also paid down more than $2 billion in debt.

catalyst

I believe TCOM is well-positioned to benefit from multiple catalysts in 2024. These catalysts include a share buyback program and management’s focus on growing both outbound and inbound markets. I believe these strategies should help TCOM maintain growth and drive share price appreciation.

As of February, TCOM had reduced its stake by 1% through share repurchases and announced an authorization to repurchase more shares, also suggesting that the stock was undervalued. Combined with the new $300 million share repurchase program, I believe management’s comments further demonstrate bold action and confidence in the business, which should attract market confidence and help lift share price performance in 2024:

In view of the rapid business growth this year, the group’s cash flow has significantly enhanced. We firmly believe that the company’s share price is undervalued. As of February 22, 2024, we have repurchased $224 million worth of shares, reducing our share count by approximately 1% compared to 2022.

Source: Fourth-quarter earnings call.

At the same time, I also predict that the outlook for outbound and inbound tourism will show strong momentum in 2024, driven by the visa-free policy for Chinese citizens and foreigners from certain countries traveling abroad. hope to enter china. According to management, China’s visa-free policy has resulted in a 30% increase in inbound tourism during the November-December season:

Currently, China has implemented a visa-free policy for citizens of 10 countries, including France, Germany, Italy, the Netherlands, Spain, Ireland, Switzerland, Singapore, Malaysia, and Thailand. According to statistics from the National Immigration Administration of China, since the implementation of the visa-free policy, inbound tourism to China from these countries has grown significantly, with an increase of nearly 30% in December compared with November.

Source: Fourth-quarter earnings call.

TCOM is already seeing the benefits of the policy, with management noting a steady recovery in inbound flights in the fourth quarter. Given the early success of the visa-free policy in 10 countries, I predict that in the long run, China’s visa-free policy may be extended to more countries and TCOM’s bookings will see higher growth.

In addition, I also believe that although the overall fiscal year revenue growth has exceeded that of 2019, considering that as of the fourth quarter, TCOM’s outbound tourism ratio is still 80% of pre-epidemic levels, I also believe that there will be greater outbound tourism in 2024. upside potential. I believe there are two factors driving this trend: 1) strong demand from Chinese tourists for overseas destinations; 2) an increase in outbound visa-free policies for Chinese tourists.

in particular, Reuters recent reports The visa-free travel policy for Chinese tourists to Thailand, Malaysia, and Singapore in February 2024 perfectly matches the preferred outbound travel destinations selected by TCOM for Chinese citizens.This streamlined travel process is likely to benefit TCOM by further increasing travel demand to these popular destinations:

In the fourth quarter, Ctrip The group’s outbound air tickets and hotel bookings have recovered to more than 80% of pre-epidemic levels, exceeding the overall market recovery rate of 60%. Thailand, Singapore, Japan, South Korea, and Malaysia are still the top outbound travel destinations on our platform.

Source: Fourth-quarter earnings call.

risk

In my opinion, the risk is still very small. Nonetheless, I believe it is important to monitor the development of the following potential risk factors.

Given that TCOM’s revenue grew 110% in fiscal 2023, my first expectation is that travel patterns may normalize, which may lead to slower revenue growth. It is worth noting that the surge in travel demand in China in 2023 is mainly due to the government’s cancellation of the zero-COVID policy implemented between 2020 and 2022.

Furthermore, geopolitical risks remain high today. In addition to the ongoing Russia-Ukraine war, any escalation in tensions between China and the United States or Taiwan could impact the travel industry, and more specifically TCOM’s bookings and revenue forecasts.

Another thing I recommend investors keep an eye on is China’s economic outlook.In particular, research by the International Monetary Fund admit The gap in transparency of China’s economic data In case of economic slowdown. I think this lack of transparency further demonstrates the uncertainty of China’s economic prospects in 2024.

Valuation/Pricing

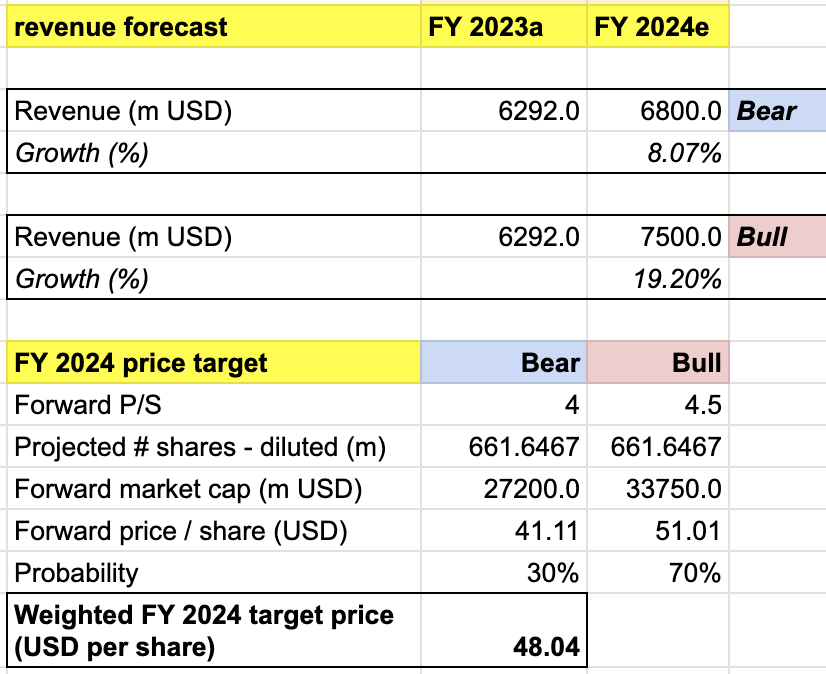

My TRIP price target is driven by the following assumptions for the forecasted bull and bear market scenarios for fiscal 2024:

-

Bull market scenario (70% probability) assumption – TRIP will achieve revenue of $7.5 billion in fiscal 2024, growing 19%, which is at the high end of market expectations. I give TRIP a forward P/E ratio of 4.5x, which is lower than the current P/E ratio of 4.8x but still implies the stock will appreciate to $51, above its one-year high. Despite a return to growth from 110% to 19%, TRIP’s performance levels will still exceed any revenue growth in the pre-COVID-19 and post-COVID-19 periods.

-

Bear market scenario (30% probability) assumption – TRIP revenue in fiscal 2024 is $6.8 billion, falling short of expectations Low-end estimate of the market An increase of $500 million. I expect TRIP outbound bookings growth to slow by 8% due to rising geopolitical tensions or a weaker macro outlook in China. I expect the price-to-sales ratio to contract to 4x, which would imply a correction to $41.

price target (analyze by yourself)

Integrating all of the above information into my model, I arrive at a weighted price target of $48 per share for fiscal 2024, representing 7% potential upside from current levels. At this point, I would give the stock a Neutral rating.

When evaluating TCOM, I think the price-to-sales ratio will be a good metric because of its relatively low volatility, and I think TCOM is a growth stock and revenue growth should be the key factor driving the valuation.

Additionally, I think there are strong catalysts heading into 2024, driven by the visa-free policy for both outbound and inbound destinations. In my forecast, with a weighted probability allocation of 70-30, this tilts me towards a bull case scenario.

However, while TCOM’s valuation does not look attractive right now, I would like to point out that my bearish case and share count forecasts are conservative. I assume growth in the pessimistic scenario of just 8%, which is significantly lower than during the post-COVID rebound in 2021, but still close to the double-digit range.

Barring disruptions due to COVID-19 in 2020 and 2022, TCOM has consistently delivered double-digit revenue growth over the past five years. I also assume that the share count is reduced by another 1% from current levels, which is likely conservative given the recently authorized share repurchase program.

in conclusion

While TCOM is well-positioned to capitalize on several promising catalysts in 2024, potential risks such as normalizing travel patterns, geopolitical tensions, and economic headwinds are worth considering. China’s lack of complete data transparency further increases uncertainty. I recommend that investors interested in TCOM carefully consider these factors before buying. At this level, TCOM’s valuation is strong and I would rate the stock Neutral.