Ryasik

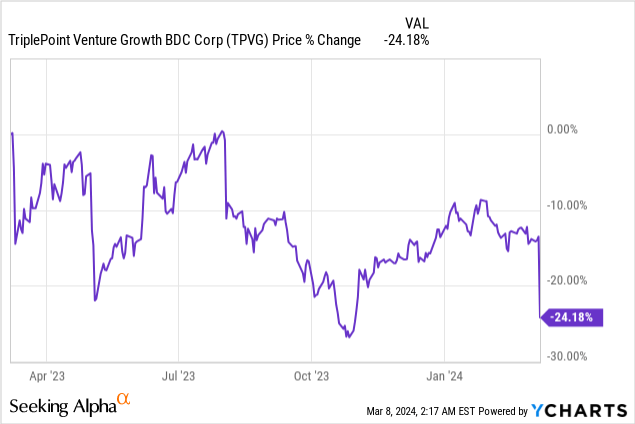

TriplePoint Venture Growth (NYSE:TPVG) 4Q net investment income per share is expected to be just $0.01 lower, and BDC’s 4Q23 NII is enough to support a dividend of $0.40 per share. However, as BDC also reported, BDC shares fell 12% Large realized investment losses and an 11% drop in net asset value raised new concerns about dividends. Since the investment company reported high net investment income relative to its dividend, I think the market overreacted to the earnings release. However, I recognize that the shares are riskier than those of other BDCs such as Ares Capital (Asian Studies Center).

previous reports

In October, I presented my initial work on BDC, in which I stated that TriplePoint Venture Growth was a high-risk company given its above-average non-accrual percentage. BDC’s The stock was trading for a yield of nearly 16% at the time, but considering the non-accrual percentage has declined since then and TriplePoint Venture Growth pays a dividend, I think a Hold rating is still justified.

Small, niche BDCs address credit challenges…

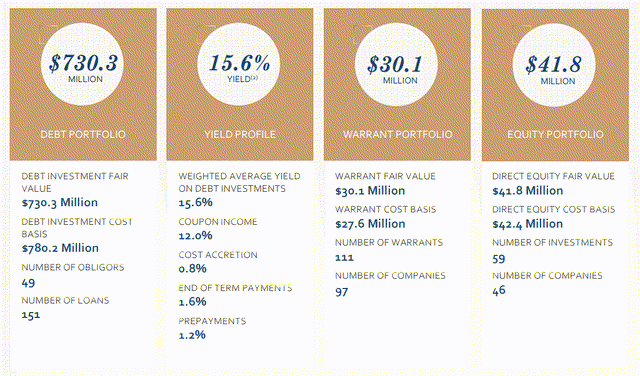

TriplePoint Venture Growth is a closely held BDC with significant investments in the technology and life sciences industries. TPVG’s core investment strategy is similar to Hercules Capital’s (HTGC), which also focuses on technology and life sciences companies in need of growth capital. TriplePoint Venture Growth invests primarily in debt, but also takes “bets” on certain companies through equity/warrant investments.

On a fair value basis, TriplePoint Venture Growth’s investments totaled $802.1 million in the fourth quarter…a 7.8% decrease from the quarter. BDC posted a loss of $52.1 million in 4Q23, compared to $28.8 million in the same period last year. Niche BDC also owns a number of other assets worth a total of $71.8 million, most of which are equity interests and warrants in investment companies.

TriplePoint Venture Capital Growth

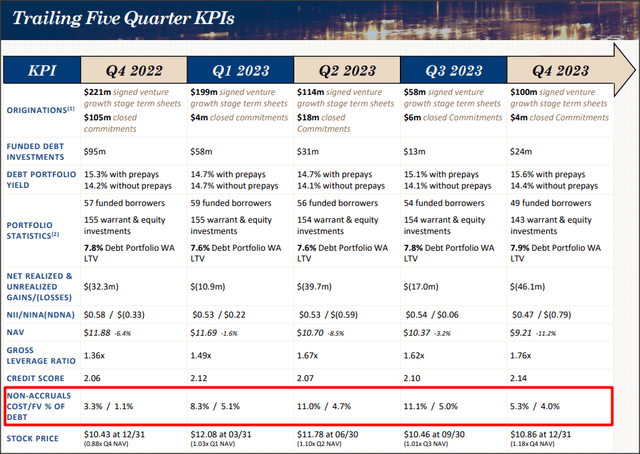

TPVG has had loan problems in the past that resulted in higher-than-average non-accrual charges. BDC’s non-accrual percentage as of December 31, 2023 was 4.0%, compared to 5.0% in the prior quarter. BDC wrote off its investments in four portfolio companies (resulting in the $52.1 million realized investment losses noted above). A non-accrual percentage of 4.0% is still quite high, indicating problems with the company’s underwriting approach. Going forward, this number should be watched closely, along with TPVG’s NII/dividend ratio.

TriplePoint Venture Capital Growth

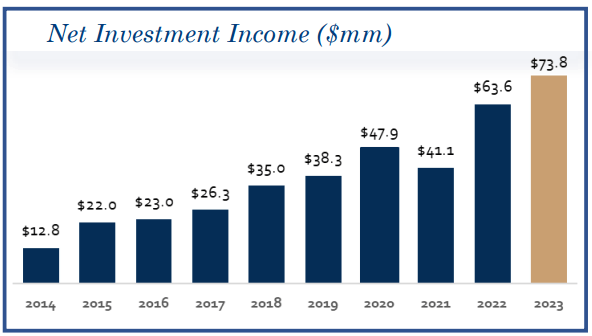

Full-year net investment income hits record, NII sufficient to support dividends

TriplePoint Venture Growth has two specific factors supporting the bull case: 1) BDC still supports its dividend through cash flow (primarily from interest income), and 2) TPVG generates high investment yields.

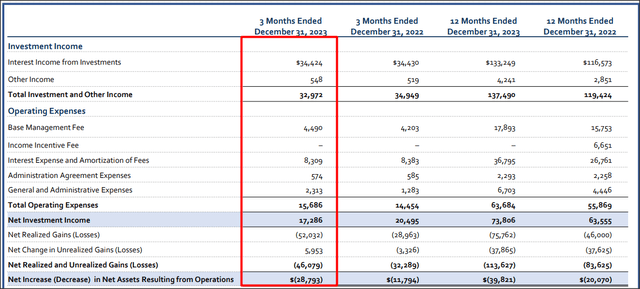

Despite challenges with loan quality, fiscal 2023 was still a good year from a growth perspective: TriplePoint Venture Growth achieved its highest annual net investment income of $73.8 million, an increase of 16% year over year.

TriplePoint Venture Capital Growth

Total interest income in 4Q23 was US$34.4 million, basically the same as last year. However, TriplePoint Venture Growth’s net investment income decreased 16% annually to $17.3 million in 4Q23, primarily due to higher general and administrative expenses.

This net investment income was enough to support the dividend, which currently remains at $0.40 per share (just confirmed). Based on net investment income of $0.47 per share in the fourth quarter, I calculated the NII/dividend coverage ratio to be 118%. In fiscal 2023, TriplePoint Venture Growth generated NII of $2.07 per share, giving it a NII/dividend coverage ratio of 129%…so despite a fairly poor credit profile, TPVG managed to support its quarterly dividend of $0.40 per share . Therefore, I think a dividend cut is unlikely in the short term. Based on an annual distribution of $1.60 per share, TriplePoint Venture Growth stock currently yields 16.8%.

TriplePoint Venture Capital Growth

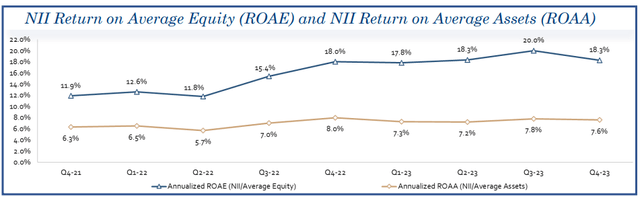

As for the second point, yield, TriplePoint Venture Growth earns a good NII return on its invested equity capital. In the fourth quarter, BDCs’ average return on equity NII was 18.3%, down slightly from 20.0% in the third quarter of 2023, as returns were driven by interest rate tailwinds. BDC’s relatively strong NII/dividend coverage and double-digit NII yield are two reasons why I maintain a Hold rating on TPVG despite the significant NAV decline in 4Q23.

TriplePoint Venture Capital Growth

TriplePoint Venture Growth’s Valuation

After Thursday’s losses, TriplePoint Venture Growth is trading at a P/E ratio of 1.03x, meaning BDC is trading at only a slight premium to its NAV… NAV ended the year down 11% at $9.21 per share . The December quarter was due to investment write-offs. BDC has averaged a P/E ratio of 1.09x over the past three years, while its below-average loan quality profile has resulted in its valuation multiples being much lower than those of its niche competitors.

Hercules Capital is the gold standard in the venture-focused BDC niche, with a significantly higher NAV premium due to its strong portfolio and NII growth over time. I recently downgraded HTGC to Hold due to the company’s elevated valuation (nearly 60% premium to NAV, well above the 3-year average, see below). Horizon Technologies (HRZN) is a more affordable BDC option for investors who want to increase their exposure to the technology/venture space. I think Horizon Technologies is a promising income investment for dividend investors.

Although TPVG’s NAV ratio is much lower than that of its niche BDC competitors, I believe that considering all the important factors – an 11% sequential decline in NAV, large realized losses, and supporting dividends – BDC remains in Held here. My fair value estimate is TPVG’s updated NAV of $9.21 per share. I expect TPVG to trade at or below NAV for some time following the Q4’23 report, as falling NAV and investment losses rarely attract new dividend buyers.

| Name | Fourth quarter net asset value/share | share price | Price to Earning Ratio/Net Asset Value | Front/Disc.net asset value | 3-year average premium |

| TriplePoint Venture Capital Growth | $9.21 | $9.53 | 1.03 times | 3.5% | 9.1% |

| Hercules Capital | $11.43 | $18.15 | 1.59 times | 58.8% | 43.9% |

| Horizon Technology | $9.71 | $11.57 | 1.19 times | 19.2% | 23.0% |

(Source: Author)

TriplePoint Venture Growth Risks

TriplePoint Venture Growth is one of the BDCs where you’ll want to closely track the quality/performance of your debt portfolio as well as the non-accrual percentage. The dividend appears to be well supported from an NII/dividend coverage perspective, at least for now, and it doesn’t look to me like it will be cut anytime soon. However, given the relatively high non-accrual percentage of 4.0%, I believe dividend investors will invest only a small portion of their available resources into a high-risk BDC like TriplePoint Venture Growth.

final thoughts

TriplePoint Venture Growth is not a BDC that you can buy and hold forever. You have to be vigilant and pay close attention to what’s happening at the portfolio level, largely because of TriplePoint Venture Growth’s poor loan quality profile. However, BDC did manage to support its quarterly dividend of $0.40 per share through NII, and non-accrual profits did improve from the previous quarter. Given the FY23 NII/dividend ratio of 129%, I think dividends should be fairly safe in the coming quarters, but overall risk has increased following reports of an 11% sequential decline in NAV. Holding TPVG is arguable given that TriplePoint Venture Growth also achieves a high NII average ROE, but it shouldn’t be an overly large position. Therefore, after taking profits in 4Q23, I maintain a HOLD rating.