big country

Treviglio (NYSE:TWLO) appears to be one of the few tech stocks still trading at lower valuations. It’s not entirely unworthy. The company’s revenue growth has been lackluster at a time when many technology peers have begun to take action. See some acceleration. Still, there are plenty of reasons to hold on to the stock. The company has more than $3 billion in net cash, accounting for more than 25% of the market capitalization, and management has committed to aggressive stock buybacks and a solid GAAP earnings schedule. TWLO is no longer the exciting, fast-growing tech stock it was during the pandemic, but judging from its current valuation, it doesn’t necessarily have to be that way. I reiterate my buy rating on the stock as valuation remains too cheap.

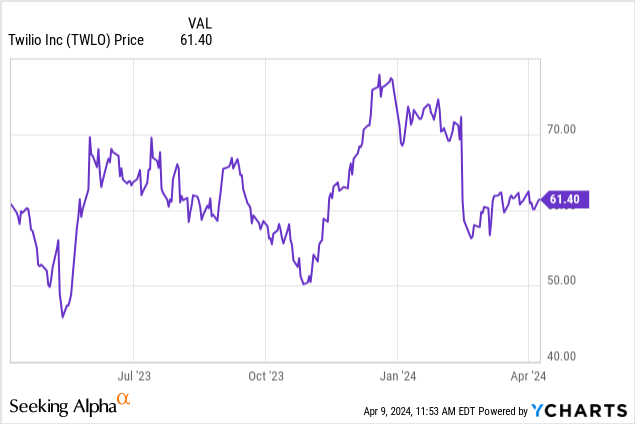

TWLO stock price

The last time I covered TWLO was in January, I called it “Rare value stocks in the technology industry.” Since then, the stock has lagged the broader market by about 20%.

No doubt part of the underperformance is due to dampened enthusiasm for radical change, but it also creates another buying opportunity.

TWLO Stock Key Indicators

TWLO is a customer engagement platform that helps companies promote their products and services to customers, usually through text messages

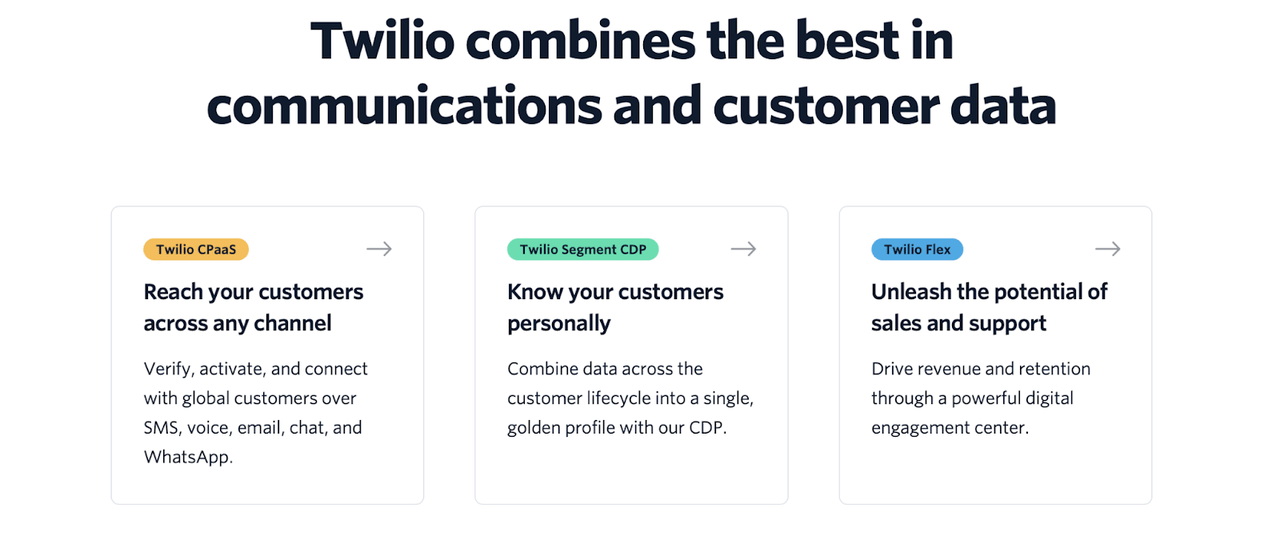

twillio

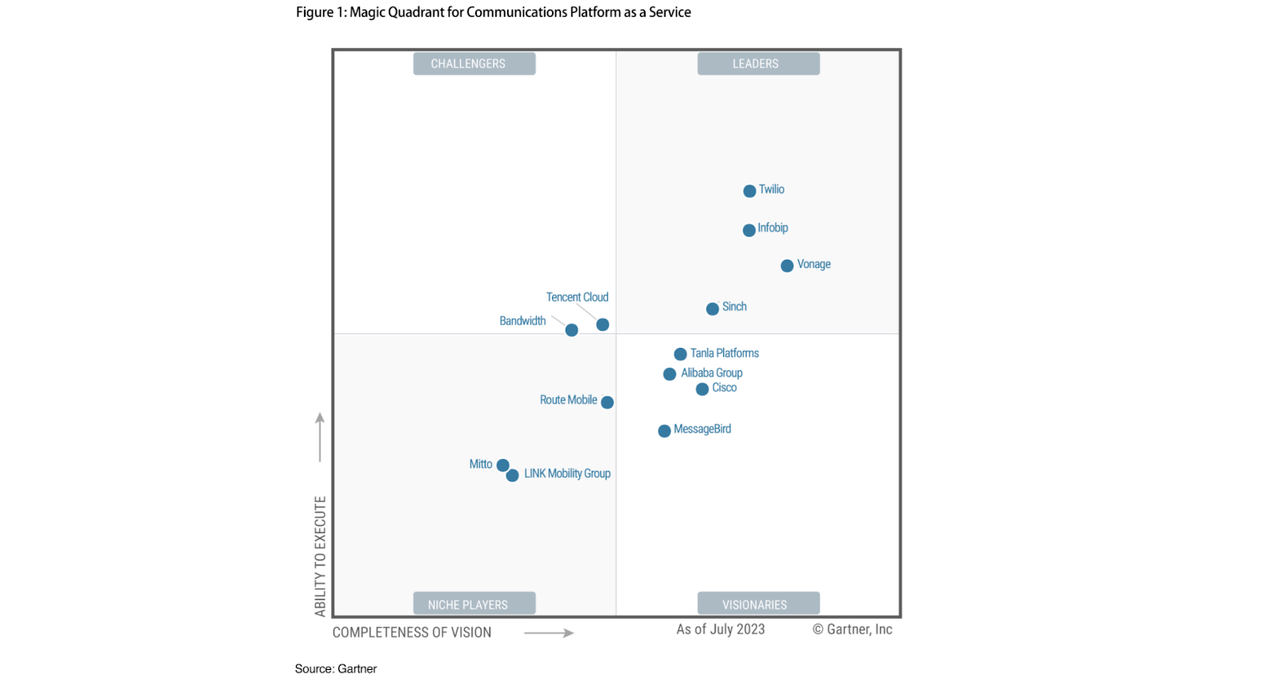

TWLO is one of the most reputable platforms in this highly competitive industry.

twillio

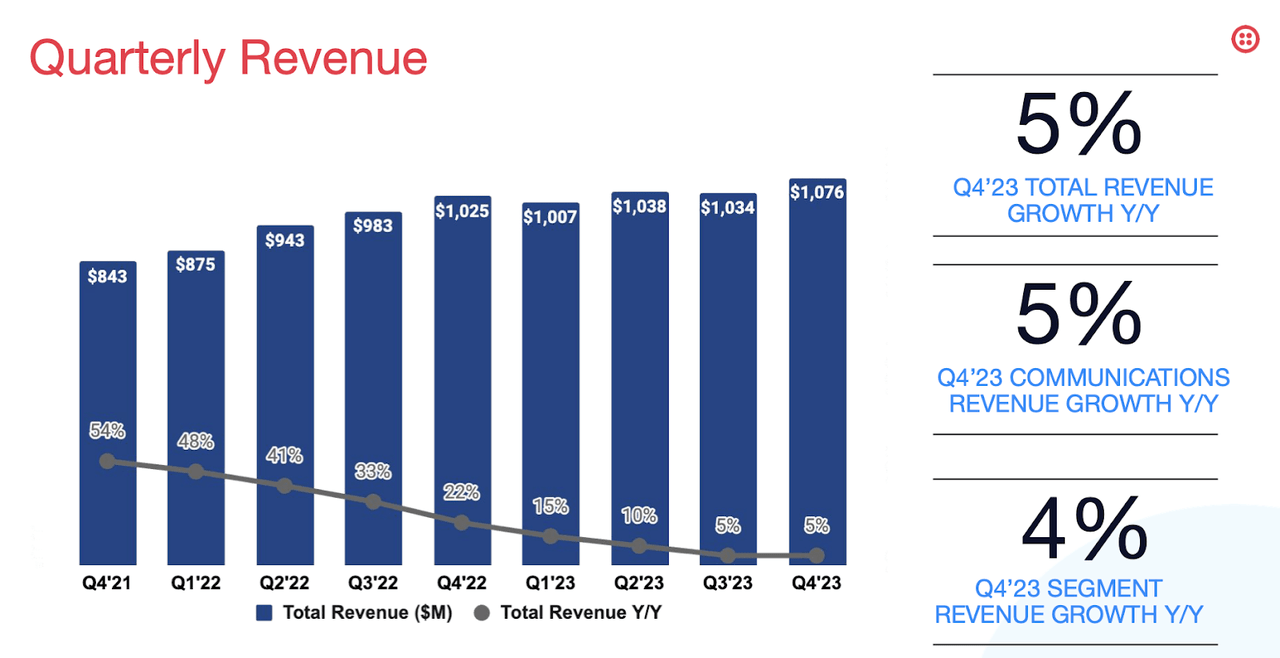

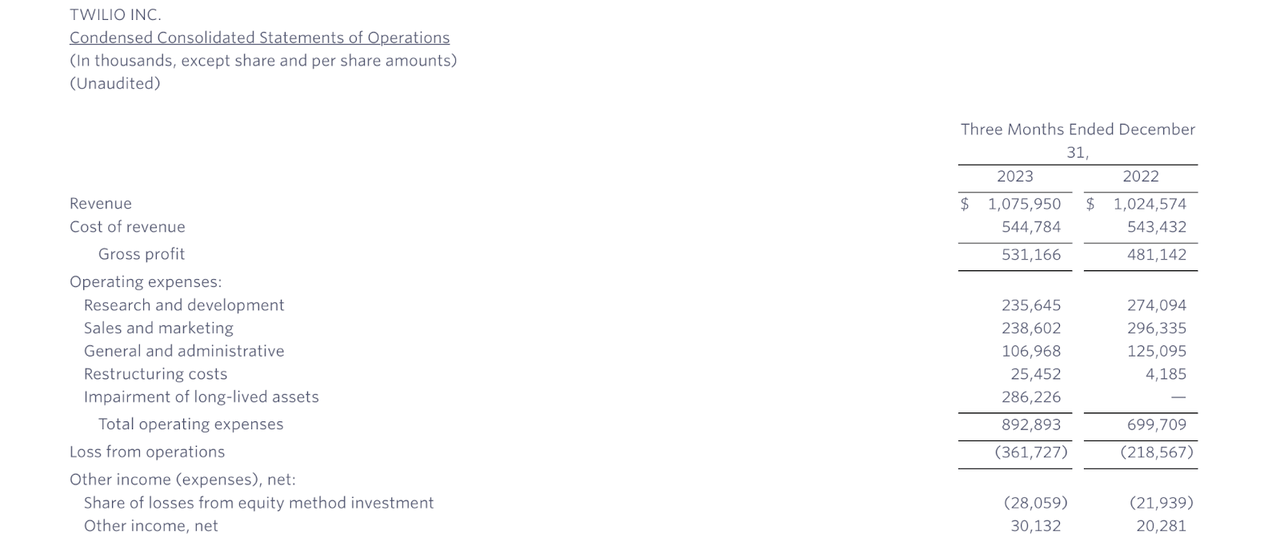

In the latest quarter, TWLO’s revenue increased 4% year-over-year to $1.076 billion, exceeding guidance by $1.04 billion.

Q4 2023 Demo

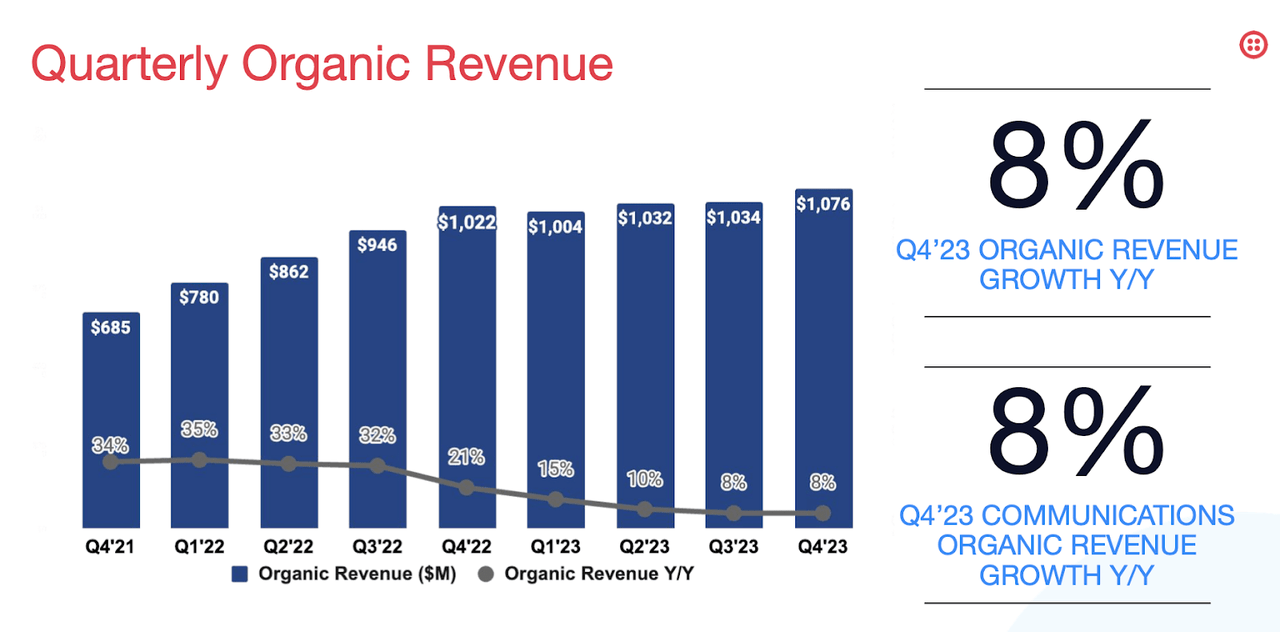

On an organic basis, TWLO’s revenue grew 8% year over year. Recall that TWLO has exited some underperforming businesses last year.

Q4 2023 Demo

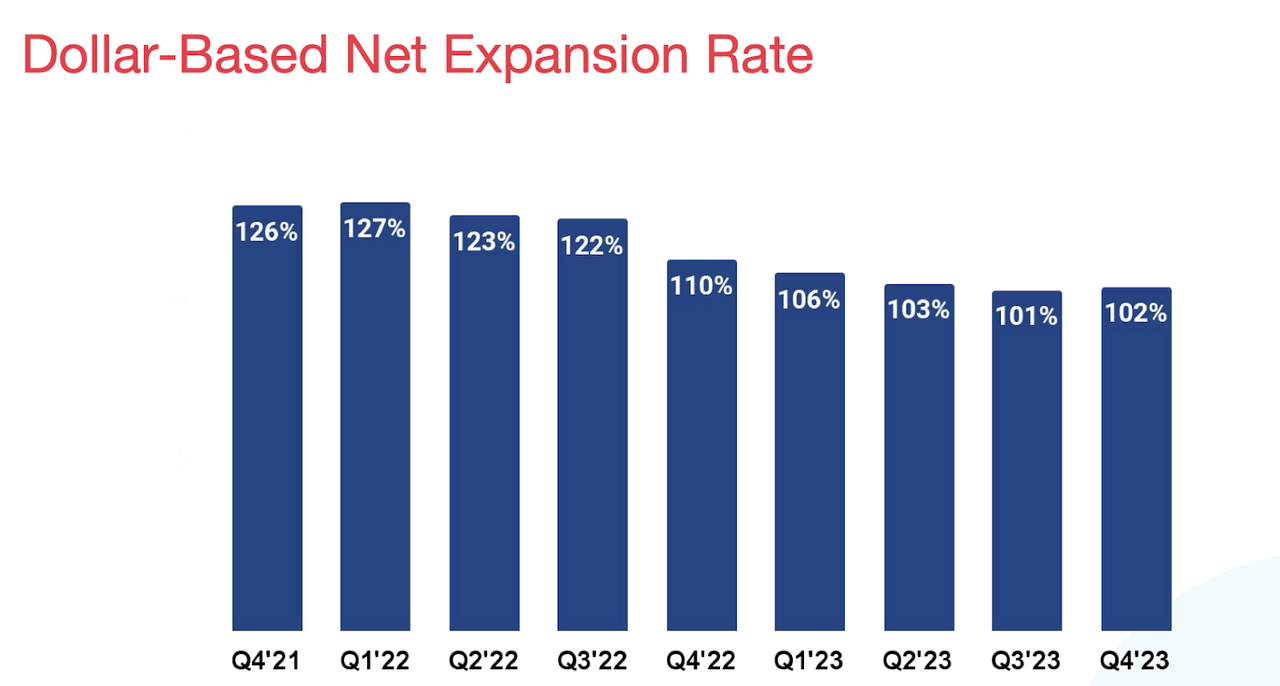

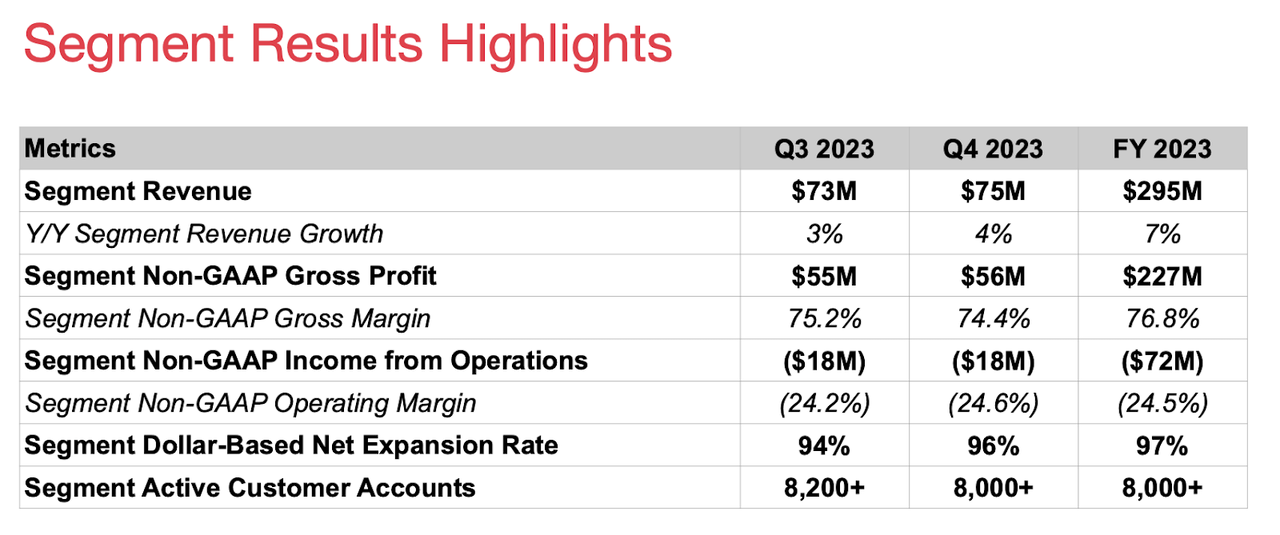

The company’s net expansion rate in dollar terms edged up to 102%, while the segment dragged down performance at 96%.

Q4 2023 Demo

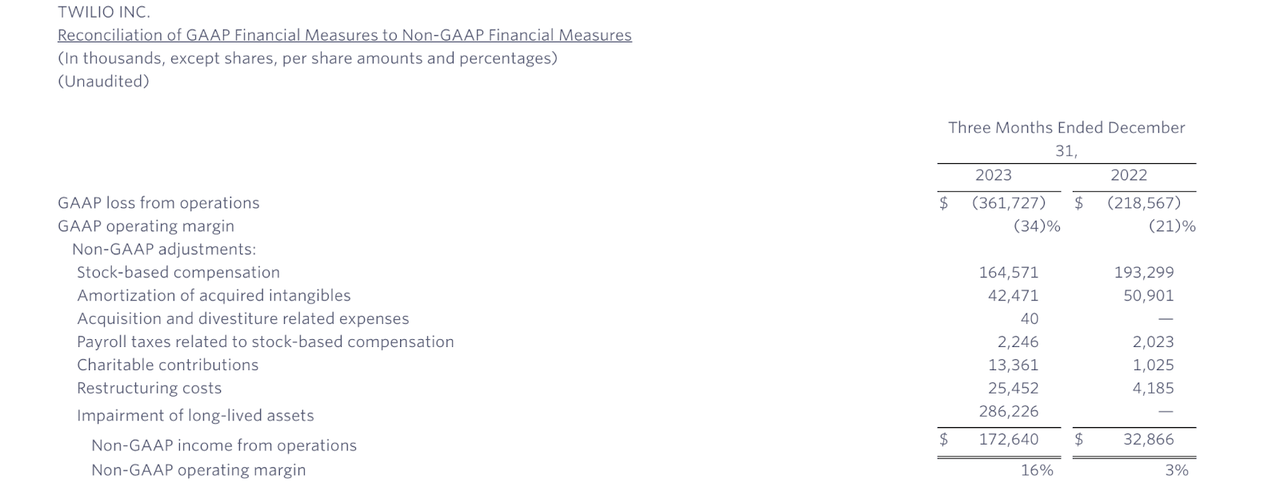

The company is trying to offset slow revenue growth with continued profit margin expansion. Non-GAAP operating income totaled $173 million, exceeding management’s guidance of $125 million, with a margin of 16%. Notably, non-GAAP margins increased an impressive 13% year over year, and the company essentially generated positive operating income even after accounting for stock-based compensation.

Q4 2023 Press Release

TWLO ended the quarter with $4 billion in cash and $989 million in debt, keeping its balance sheet pristine.

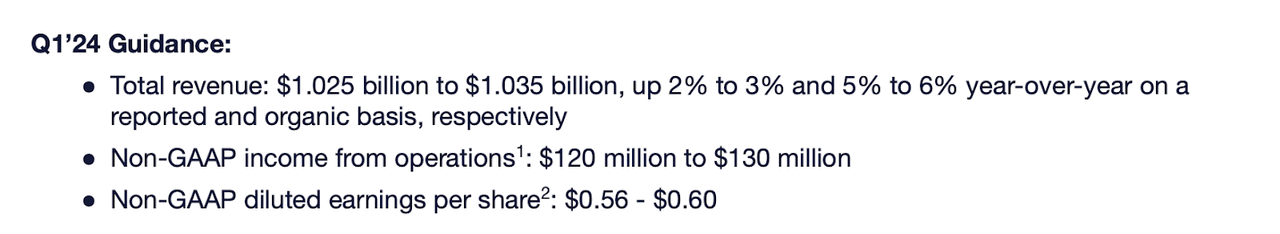

Looking ahead, management expects first-quarter revenue to rise as much as 3% annually to $1.035 billion (consensus is $1.03 billion) and non-GAAP earnings per share are $0.60 (consensus is $0.59).

Q4 2023 Demo

This represents a sequential decline in revenue, but as noted on the call, this is due to “increased seasonal activity” that is not expected to be repeated in the first quarter.

Many investors’ attention may be focused on the fate of Segment, which TWLO acquired for $3.2 billion in stock in 2020. Segment was a disappointing acquisition, with revenue for the year only $295 million even 3 years later.

Q4 2023 Demo

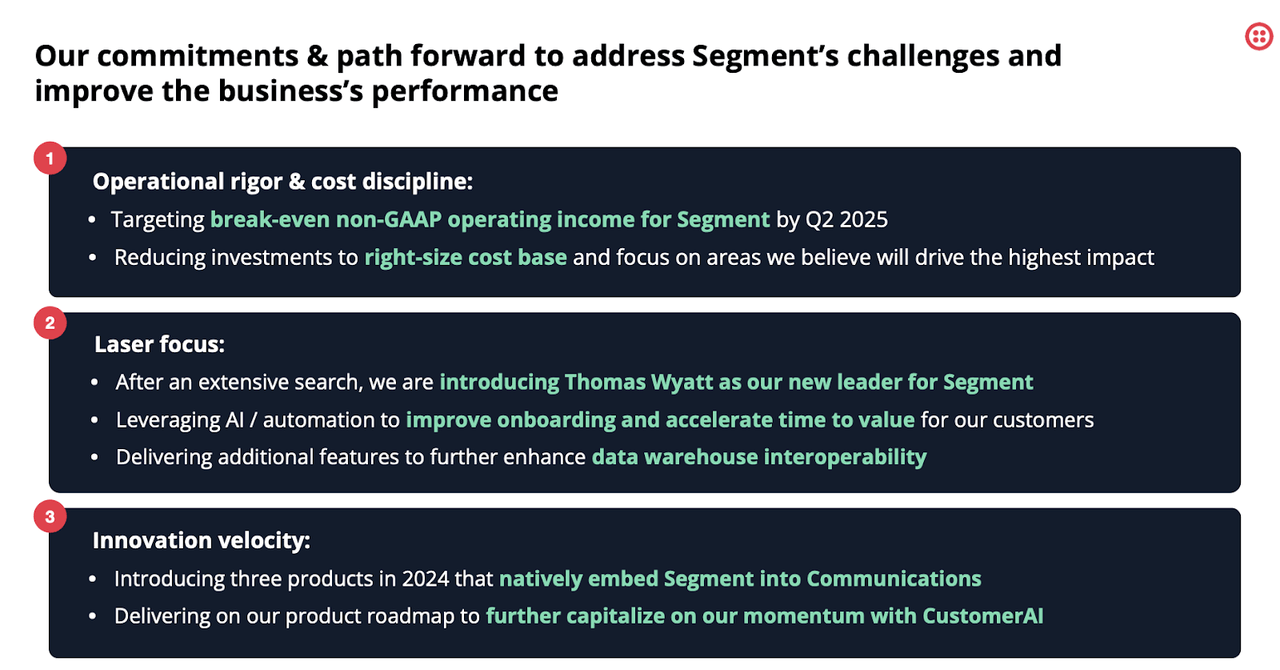

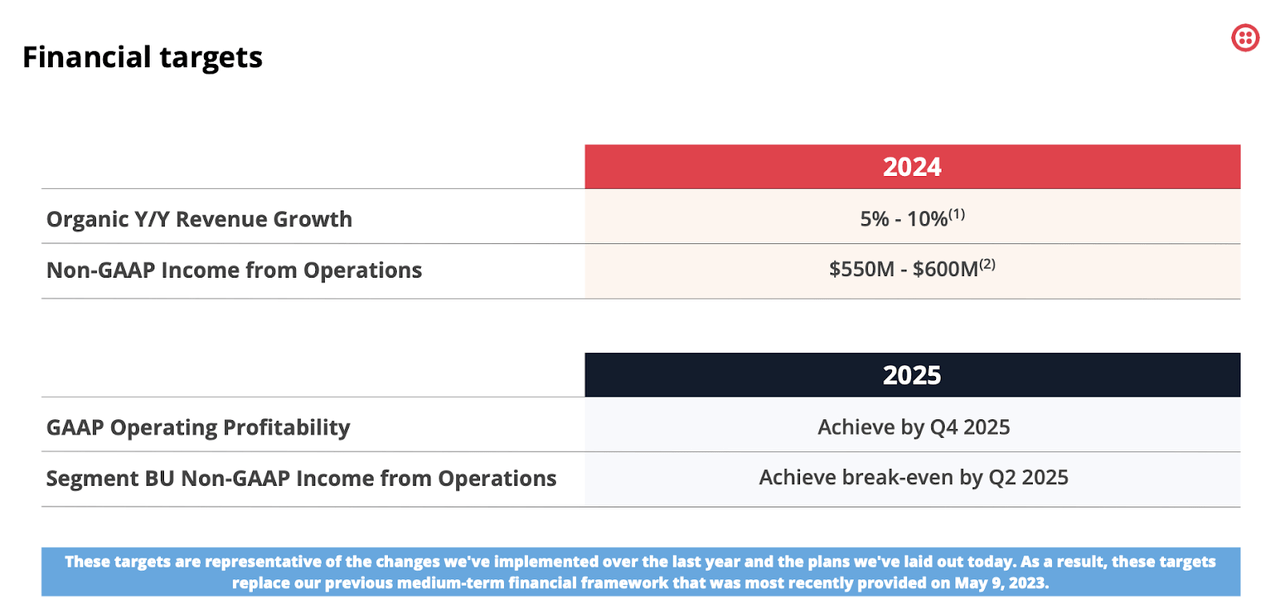

Management had hinted they were considering selling the business line, but recently said they intended to keep it together. Management has set ambitious goals for the unit, including achieving breakeven non-GAAP operating income by the second quarter of 2025 and integrating generative artificial intelligence into products.

March Investor Update

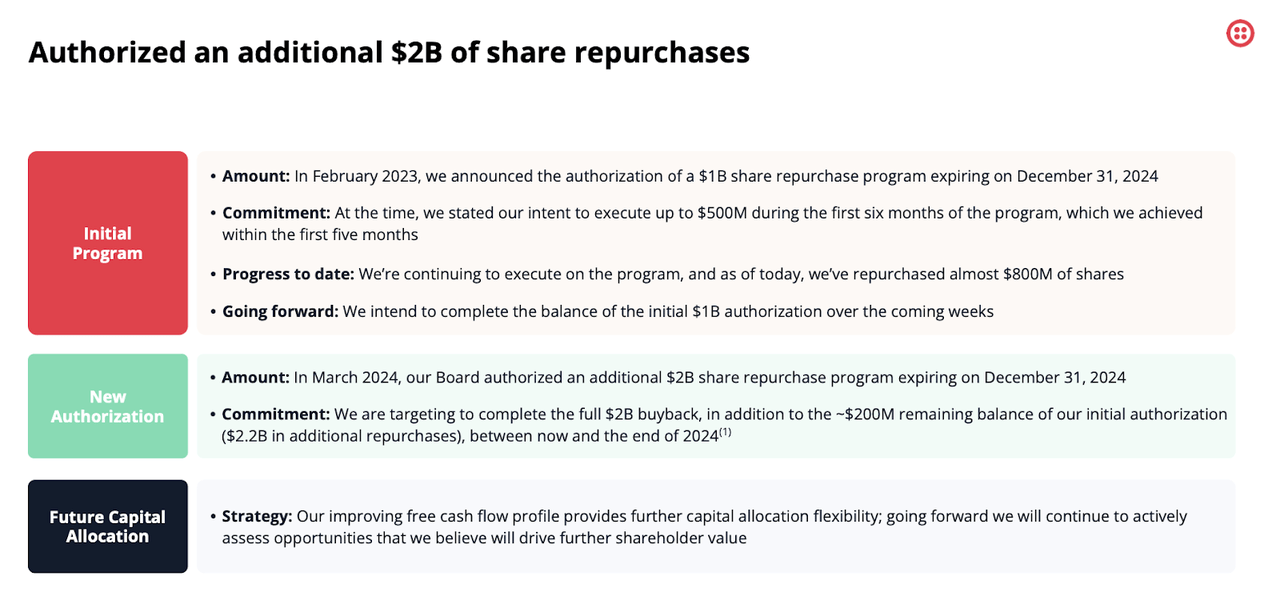

Management also authorized an additional $2 billion in stock repurchase programs, which are expected to be completed this year (the previous program also authorized $200 million). My guess is that management hopes the increased share repurchase program will appease investors who would have otherwise wanted to sell the unit. This means the company could acquire approximately 19.7% of outstanding shares this year.

March Investor Update

Management also proposed new goals, including organic revenue growth of up to 10% this year, non-GAAP operating income reaching $600 million, and GAAP operating profit in the fourth quarter of 2025.

March Investor Update

Given the company’s fourth-quarter GAAP operating margin loss of 7% (excluding impairment costs), this GAAP operating profit target looks achievable. I expect operating leverage and continued cost control will allow the company to achieve this profitability milestone even earlier. I also note that the company generated $77.7 million in interest income for the full year, which means the company may reach positive GAAP net income sooner.

Q4 2023 Press Release

TWLO has previously seen its share price rise on activist involvement.activist Anson Foundation Review While they are encouraged by some recent changes, there is still much work to be done. But I think the massive share buyback program is a big concession and the most important near-term catalyst for the stock.

Is TWLO stock a buy, sell, or hold?

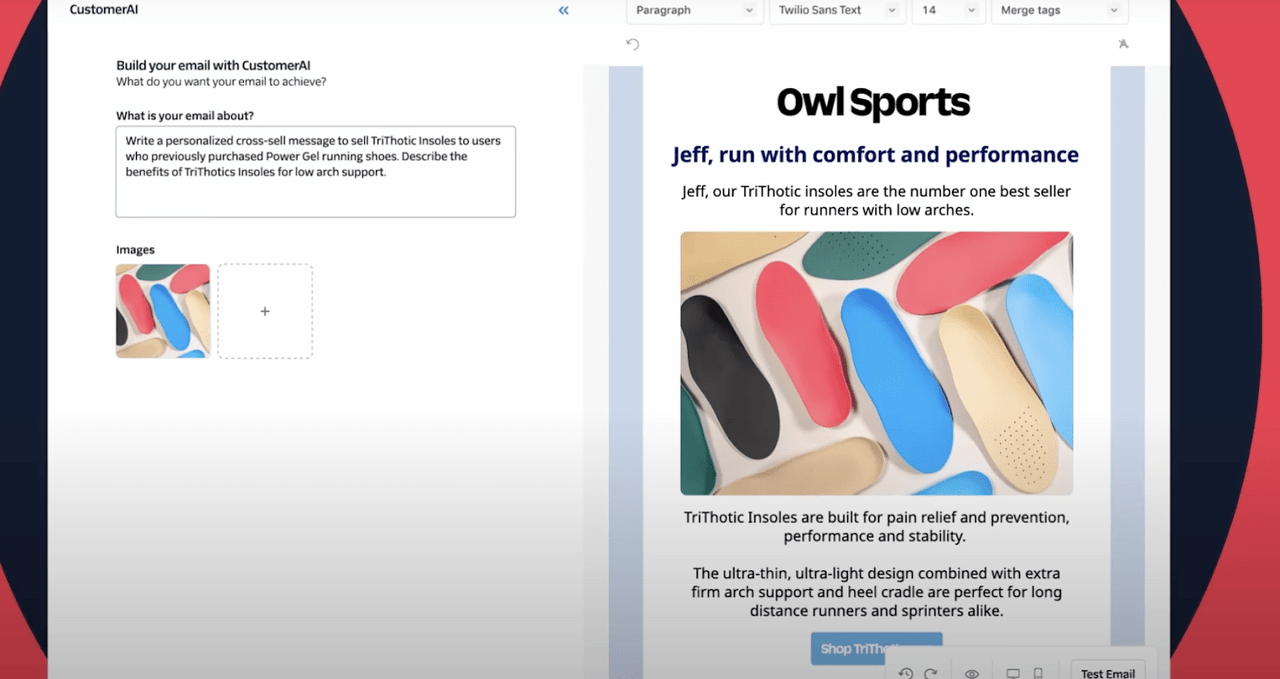

TWLO joins nearly every other tech stock in embracing generative artificial intelligence in its products – which it claims can seamlessly create marketing campaigns for clients.

twillio

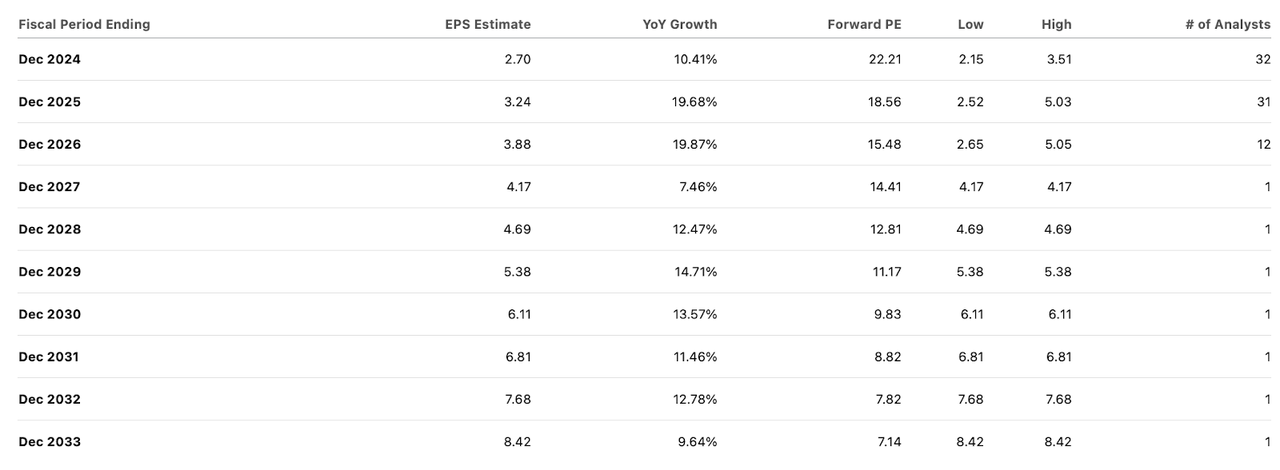

Even so, TWLO’s rebound hasn’t been as strong as many other tech stocks, which is reflected in its conservative valuation, with the stock trading at 22 times non-GAAP earnings.

Seeking Alpha

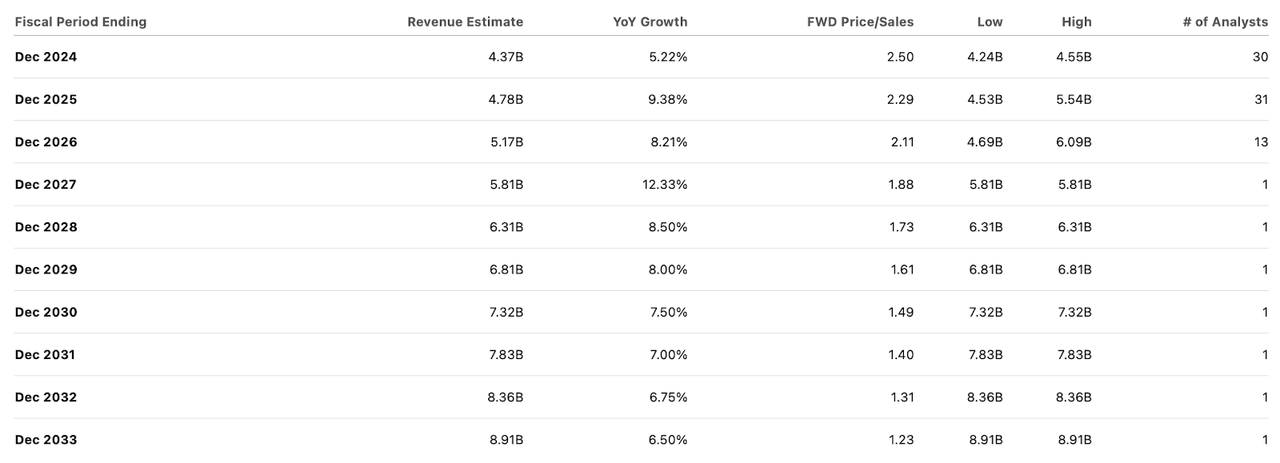

The low valuation is even more evident when looking at the price-to-sales ratio, with the stock trading at 2.5 times this year’s sales estimates. Even after adjusting for low gross margins of 50%, the stock still looks cheap.

Seeking Alpha

If management can hit the upper end of its 2024 organic revenue growth target of 5% to 10%, overall revenue could top $4.56 billion, which would beat the consensus estimate of $4.37 billion. However, investors can’t be blamed for the lack of confidence in management’s ability to beat revenue growth targets, as revenue growth has been a real struggle since the pandemic. I no longer expect management to achieve its 15% to 25% revenue growth target as outlined in their report. 2022 Investor Update. Instead, I’m targeting a P/E ratio of 15x, assuming 20% long-term net profit implies a sales target of 3x. This means there is solid upside between multiple expansions and continued growth. With a net cash balance sheet and management committed to further driving profitability growth, I think 3x sales is an appropriate target. Management’s revised $2.0 billion stock repurchase program ($2.2 billion includes previously authorized programs) is a major near-term catalyst.

What are the main risks? Whenever we are faced with a slow-growing tech stock, an important risk to consider is slow growth turning negative. While management is optimistic that revenue growth can accelerate, I again point out that management does not have a strong recent history of beating or even meeting revenue growth expectations. Given that many other tech companies in my coverage area have reported improvements in the macro environment, it may be concerning that revenue growth has not yet accelerated. While management hasn’t made any major acquisitions in recent years, I can’t ignore management’s poor track record with M&A, most notably in the niche segment. Instead of executing a stock buyback program, management may begin making expensive acquisitions. If the company is unable to drive further profitability growth, the valuation could come under pressure, as my targets depend on management’s ability to continue working toward long-term profit targets.

in conclusion

Management continues to promise accelerated revenue growth, but Wall Street appears sceptical. Even so, between a net cash balance sheet, improving margins, and a massive stock buyback program, there’s more than enough reason to buy the stock at 2.5x sales. I reiterate my Buy rating on the stock.