Ostrich sediment

The S&P continues to hit new highs, but amid renewed enthusiasm for risk-taking and technology stocks, especially those related to artificial intelligence, there are many companies that have failed to join the bandwagon and are lingering. Fundamental issues throw them into the box.

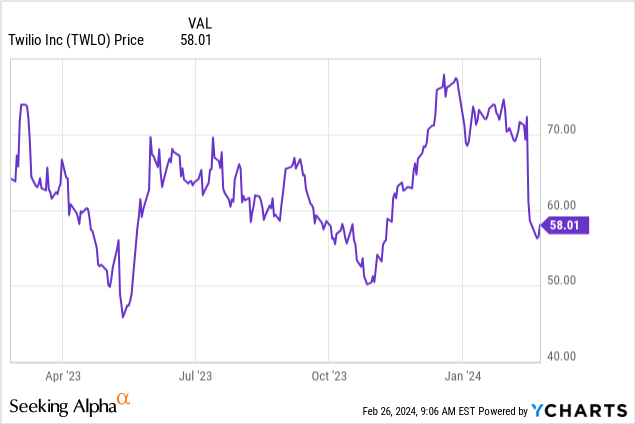

Treviglio (NYSE:TWLO) is the chief among these die-hards. The software company, best known for its communications platform-as-a-service (CPaaS) solutions, has seen its shares fall nearly 20% so far this year, with losses deepening after the company’s fourth-quarter earnings report. In my opinion, there is no light at the end of the tunnel.

Twilio faces basket of risks as segment woes mount

I wrote a report in January downgrading Twilio to Bearish, and since then, something new has happened Appear. First, Twilio released its fourth-quarter results, and while the company thankfully didn’t see any further declines in growth metrics or net customer retention, it also didn’t show any signs of a meaningful rebound. Second, the company decided to conduct a strategic review of its business segments that accounted for less than 10% of revenue.

Segment’s story may serve as a warning to tech companies trying to grow too fast at all costs.company spend US$3.2 billion Acquired Segment in late 2020, a customer profile platform that helps consolidate customer profiles into a single view for more relevant and seamless communications. The company temporarily renamed the business “Twilio Data & Analytics” and placed the unit under the high-profile hire of Elena Donio (an SAP Concur executive and previously a Twilio board member) . Donio resigned late last year, and Twilio has since renamed the unit “Segment.”

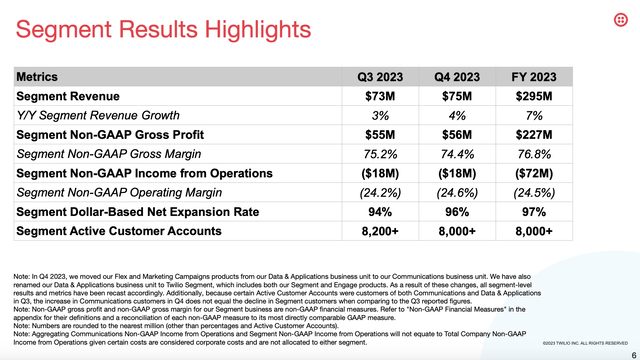

Twilio segments (Twilio fourth quarter financial report)

Today, as the chart above shows, the Twilio division is growing at a slightly slower pace than the rest of the company – growing 4% annually in the fourth quarter, while the company overall grew 5% year over year.be opposed to FY23 Revenue, Twilio pays a company about 11 times its revenue no Profitable and little to no growth. The only bright spot is that Twilio paid for Segment’s stock when its stock was about 6 times higher than it is now. Regardless, when Twilio completes its operational review of Segment later this quarter, if it decides to offload the business, it’s unlikely to earn anywhere near the amount it originally paid.

In addition to the market segment failure, here is also a reminder of other core risks facing Twilio:

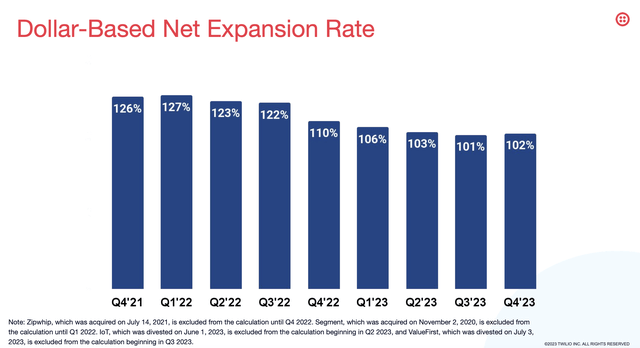

- Slowing net expansion threatens one of the company’s most critical growth engines. A few years ago, Twilio claimed a net revenue retention rate of over 120%, showing a significant increase in customer usage. Now, that number is closer to 100%, which the company attributes in part to weakness in the cryptocurrency and social media sectors. Still, Twilio’s “land and expansion” potential is a core element of its appeal to investors, and the fact that it’s currently unable to spur growth on its installed base is deeply concerning.

- Gross margins are stuck in the low $50s. Twilio’s gross margins have long been lower than those of other software peers (gross margins were more common in the 1970s and 1980s). As net expansion slows, so does Twilio’s opportunity to leverage scale to improve margins and profitability, especially since expansion within the installed base is a relatively “free” way to do so without depleting sales resources. earn new income.

- Leadership change, including CEO. The company’s chief executive, Jeff Lawson, recently resigned; he was replaced by former company president Khozema Shipchandler. It also lost former unit chief Elena Donio; former SAP Concur leader.

- Competition and DIY. Twilio faced high profile defection In the past, this has included clients such as Uber (UBER) and Meta (META). As companies review their operating expenses and technology stack, many may choose to develop CPaaS solutions in-house rather than outsource to expensive vendors like Twilio that charge per message/minute.

All in all, I still bearish on Twilio. Avoid here and invest elsewhere.

Season 4 download

Unfortunately, Twilio’s latest quarterly results did little to convince investors that a turnaround is on the way. Check out the results for Season 4 below:

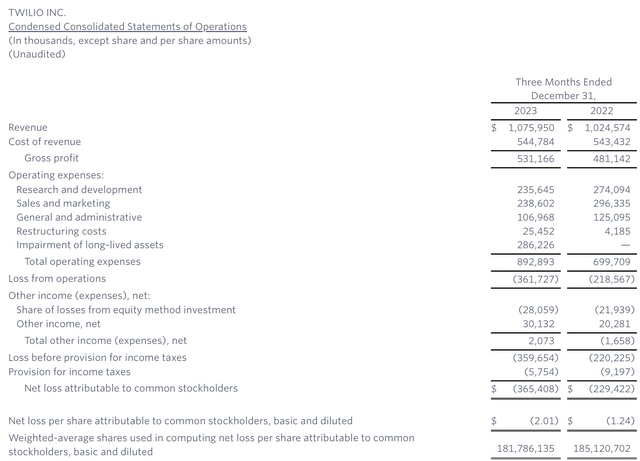

Twilio Season 4 Results (Twilio fourth quarter financial report)

Revenue increased 5% year-over-year to $1.08 billion, beating consensus estimates of $1.05 billion (up 2% year-over-year). From an organic perspective, excluding the impact of divestments, Twilio’s revenue increased 8% year-over-year, which was the same as the third quarter.

Perhaps the most encouraging news of the season is that Twilio’s dollar-based net retention rate at least did not deteriorate as much as it has in past quarters. Net expansion rate was 102%, compared with 101% in the third quarter:

Twilio retention rate (Twilio fourth quarter financial report)

However, the company continues to cite weak cryptocurrency activity and difficult year-over-year comparisons as major drags on performance. According to Chief Financial Officer Aidan Viggiano’s speech on the fourth-quarter earnings call:

Sales of our usage-based products continued to be solid throughout the quarter, as well as strong seasonal activity around the holidays, which helped drive our fourth quarter top line growth. Similar to the previous two quarters, our fourth quarter revenue growth rate was negatively impacted by headwinds from customers in the cryptocurrency industry. Total organic revenue excluding crypto customers increased 10% annually in the fourth quarter, and for the full year of 2023, total organic revenue excluding crypto customers increased 13% annually. We expect first quarter cryptocurrency headwinds to be broadly consistent with fourth quarter, after which we will overcome the overwhelming majority of crypto effects. “

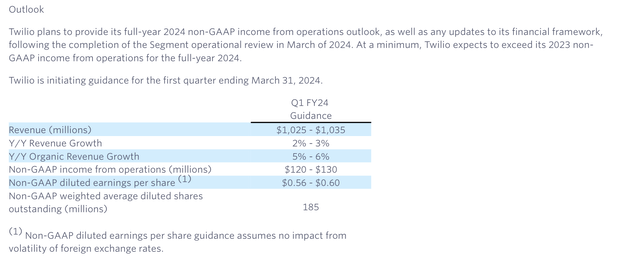

Management also expects trends to get worse before they get better. The company neglected to provide a full-year FY24 outlook, as much of the year hinges on what it decides to do with its segments, but for Q1, note that Twilio’s outlook calls for organic revenue growth to fall back to 5-6% , representing up to three deceleration points starting from the fourth quarter:

Twilio Outlook (Twilio fourth quarter financial report)

The company also expects expected operating margin to be 12-13%, compared with 16% in the fourth quarter.

Valuation and Key Points

With shares currently trading at nearly $58, Twilio has a market capitalization of $10.5 billion.Twilio’s final results are after we exclude the $4.01 billion in cash and $989 million in debt it had on its most recent balance sheet The enterprise value is US$7.48 billion.

At the same time, Wall Street analysts predict that Twilio is expected to earn $2.68 per share and revenue of $4.35 billion this fiscal year, an annual increase of 5%. This gives Twilio a valuation multiple of:

- 22x FY2024 P/E

- 1.7x EV/FY24 revenue

The latter trades at a fairly cheap revenue multiple, but the valuation also reflects serious operating challenges that are unlikely to be resolved in the near term.

In my opinion, with the stock market at all-time highs and cash still earning high interest, now is not a good time to bank on speculative plays like Twilio. Stay on the sidelines and invest in higher-quality tech stocks (names I’m particularly fond of right now include Okta (OKTA), Toast (TOST), and Asana (ASAN)).