Aeon’s

go through James Knightley, Chief International Economist

U.S. inflation remains disturbingly high

U.S. core consumer price inflation came in at 0.4% month-over-month, above the consensus of 0.3% – only one forecaster had predicted such an outcome, so like last Friday’s jobs report, this is another report The significant upside surprise should remove expectations of a rate cut from the Fed in June. A 15 basis point rate cut was priced in early, but has now fallen to just 5.5 basis points. We still have two jobs reports and two CPI reports, but to achieve June’s cut we will likely need to see employment growth fall closer to 100,000 and core CPI numbers rise 0.2% month-on-month – the latter of which was on the day FOMC meeting on June 12.

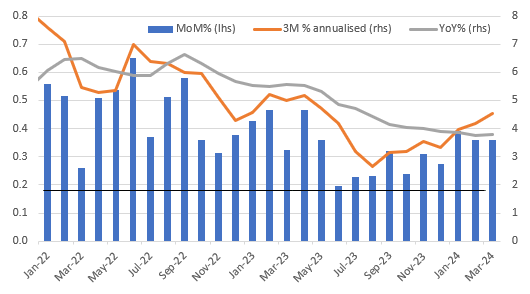

Detailed information shows that core growth increased by 0.4% month-on-month. 0.359% is accurate to three decimal places, so we’re not that far away from 0.3%, but that’s still too hot for the Fed. Ideally, we need to hit 0.17% month-over-month growth every month, and over time our year-over-year growth will drop to 2%, so we’re still running at twice the pace we need.

Core CPI month-on-month, 3M annualized and year-on-year changes

Source: Macrobond, ING

No rate cut before September

This strength stems from super core services (services other than energy and housing), which increased by 0.65% month-on-month, health care services increased by 0.6% month-on-month, and transportation services increased by 1.5% month-on-month (including maintenance services, which increased by 1.7%, Transportation services grew 2.6%). Vehicle insurance increased monthly/yearly by 22.2%). Housing costs increased by 0.4%, while energy costs increased by 1.1%, and food prices increased by 0.1%, indicating that overall inflation also increased by 0.4% from the previous quarter (0.378%, rounded to three decimal places). There was better news for car buyers, with both new and used car prices falling, while entertainment prices and airfares both fell for the first time since November.

Given this scenario, a June rate cut will not happen unless economic fortunes reverse quickly. July is also in doubt, meaning September is more likely to be the starting point for any easing, which would limit the Fed to three rate cuts this year.

Content Disclaimer

This publication has been prepared by ING for information purposes only and has no bearing on the economic situation, financial situation or investment objectives of a particular user. This information does not constitute investment advice, investment, legal or tax advice or an offer or solicitation to buy or sell any financial instrument. read more