JasonDoiy/iStock via Getty Images

By Arthur Jones, Senior Director, Global Research and Strategy

The U.S. multifamily housing industry faces challenges from overdevelopment and capital market pressures, and these issues are expected to persist through 2025.

However, solid macroeconomic fundamentals and continued demand, especially In the medium term, the younger generation’s preference for renting presents potential opportunities for well-capitalized investors to take advantage of market distress.

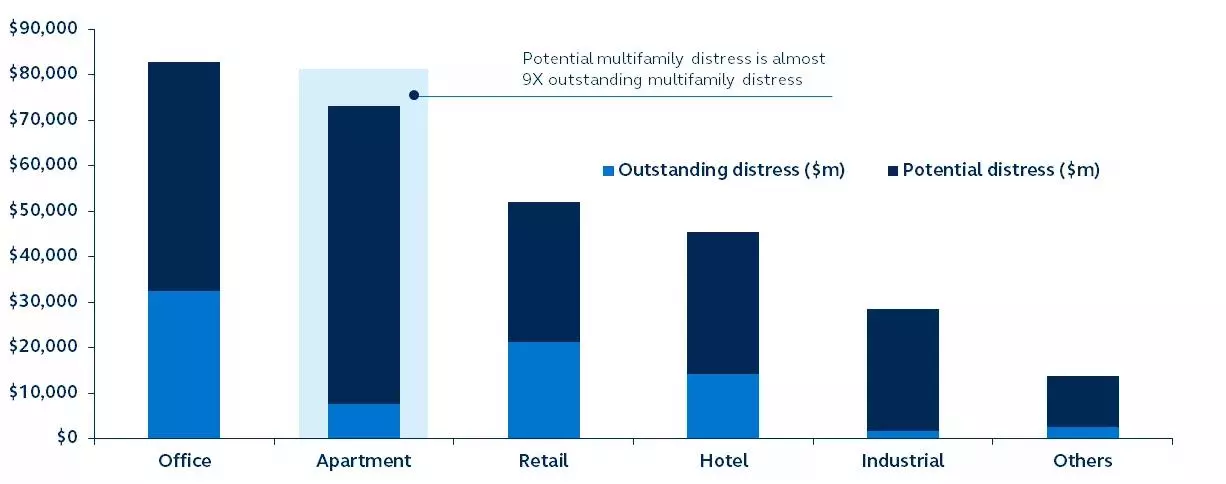

Total pending and potential real estate distress per sector

Non-performing assets, billions of dollars

Note: Distressed assets are assets that face financial and/or legal challenges that could lead to foreclosure.

source: Real Capital Analysis, Major Real Estate. Data as of the third quarter of 2023.

The multifamily real estate industry currently faces a number of challenges stemming from high levels of development, lower transaction volumes, declining values, and expiring properties that can create some distress.However, it is This dilemma, along with steady demand, creates a unique entry point into the industry for well-positioned investors.

It’s worth noting that while the industry accounts for less than 10% of total commercial real estate distress, underlying distress is prominent, accounting for nearly one-third of the market.

Additionally, distress is likely to persist in 2024 and 2025 as rents continue to be low, vacancies rise, and $470 billion in multifamily loans mature during a period when less well-capitalized operators face difficulty refinancing on favorable terms. .

However, the industry has been buoyed by strong demand despite volatility in the rental market and challenges in loan refinancing. In particular, younger generations are extending their leases, driven by economic headwinds in the homebuying market, liquidity needs, and lifestyle choices that prioritize experiences over home ownership.

For investors, despite near-term challenges, the strong fundamentals underpinning demand conditions for the multifamily industry point to a bright medium-term recovery outlook.

Investors with significant capital are well positioned to take advantage of these conditions, with markets expected to rebound in three to five years, providing a strategic window for investing over the next 12 to 18 months.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.