JuSun

Income stocks have largely missed out on the market’s rise over the past six months, even though it’s easy to get FOMO and want to chase outperforming companies like Super Micro Computer (SMCI) or Nvidia (NVDA).), I continue to favor actual cash flow over paper earnings in stocks with speculative valuations.

Therefore, I believe REITs with strong balance sheets and durable hard assets remain good options for value and income, which brings me to UDR Inc.NYSE: UDR), which I last reported in September last year, noting that it was undervalued and that the portfolio was well positioned.

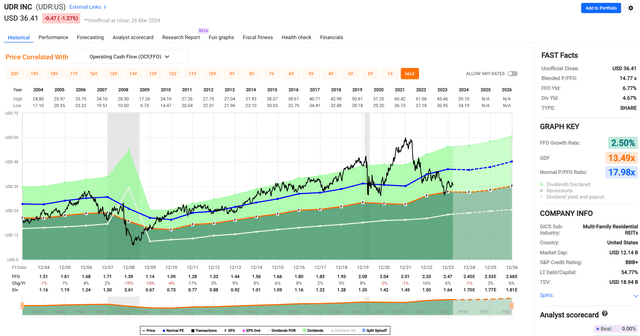

It looks like the market still hasn’t taken advantage of this opportunity, as UDR is down almost 3% since my last post (almost flat on a total return basis including dividends). As shown below, UDR is currently well below the $60 high reached in 2022.

UDR Stock 5-Year Trend (Seeking Alpha)

In this article, I’ll take a fresh look at UDR and provide a key update on its operating metrics and discuss why it’s still a great deal for revenue and potentially strong long-term earnings, so let’s get started!

Why UDR?

UDR is a large-cap multifamily REIT, but for some reason it’s not as well-known as other favorites like AvalonBay Communities (AVB) and Essex Property Trust (ESS).The 51-year-old company is a member of the S&P 500 Index (SPY) and has ownership interests in 60,000 apartment units across the United States

What sets UDR apart from its peers is its “hedged” real estate portfolio, which is located in both primary U.S. markets and secondary markets like the Sunbelt. This makes UDR somewhat of a hybrid between a Tier 1 multifamily REIT like Equity Residential (EQR) and a Tier 2 REIT like Mid-America Apartment Communities (MAA).

This balanced approach helps UDR respond to different market environments and supply and demand dynamics between primary and secondary markets. As shown in the chart below, UDR’s 10-year total return of 99% beats the Vanguard Real Estate ETF’s (VNQ) 75% total return and is sandwiched between Tier 1 peers AVB and EQR’s 87% and 69%, as well as Tier 2 peers AVB and EQR’s 10-year total return of 75% Market peer MAA is 166%.

UDR vs. peers 10-year total return (Seeking Alpha)

Notably, UDR has seen slower tenant demand and rental growth since hitting inflation- and migration-driven highs in 2021-2022. Same-store NOI grew only 2.4% year over year in the fourth quarter, reflecting this slowdown. In the second quarter of last year (the last time I visited the stock) it was up 7.7% year over year. Due to higher SSNOI growth earlier in the year, UDR still managed to achieve 6.0% SSNOI growth for full-year 2023.

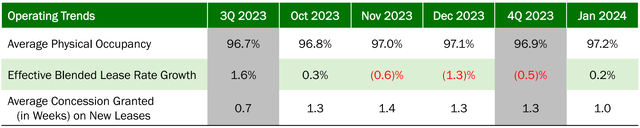

Despite lower SSNOI growth, UDR still achieved strong occupancy rates, ending the fourth quarter at 96.9%, which was 30 basis points higher than the 96.6% at the end of the second quarter when I last reviewed the stock.

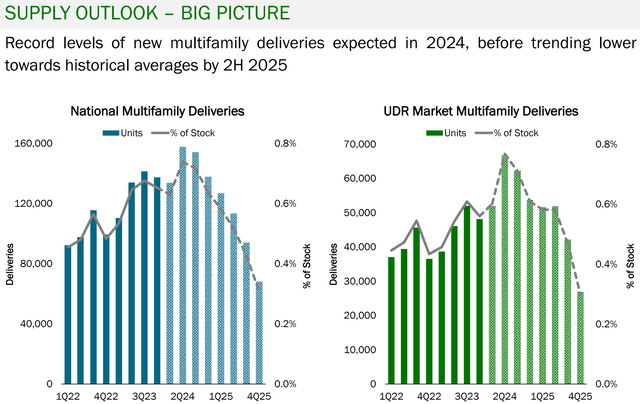

One of the main concerns for UDR and its peers is the impact of new supply in the market, which is one of the reasons why SSNOI growth has slowed, in addition to normalizing demand. Management expects pressure from new supply to continue this year, causing recent market rental growth to be lower than the long-term average.

Given the cyclical nature of the industry, it may be a good idea to buy UDR when it is at or near the bottom of the cycle, as is the case now, rather than when it is at the top in 2021-2022. Furthermore, the market does not appear to be recognizing the improvement in UDR occupancy rates, which reached 97.2% in January (30 basis points higher than December), with rents returning to 0.2% growth in the same month after declining in November and December due to seasonality Sexual reasons, as shown in the picture below.

Investor introduction

At the same time, I think the market is too focused on near-term results and is missing the bigger picture that the market for new apartment building deliveries is likely to decline beyond this year. The chart below, based on data from RealPage (an apartment analytics company) and CoStar, supports this. As the chart below shows, new apartment deliveries are expected to fall back to historical levels by the second half of next year.

Investor introduction

Hedging supply imbalances is also where UDR’s diversified primary/secondary market approach comes in handy, as its East Coast/Mid-Atlantic and West Coast regions will see lower new supply (a share of real estate in 2024) compared to Sunbelt regions (less than 2% of the total), it is expected that new supply will account for 5% of the total real estate in 2024. As shown below, UDR’s real estate base is still expected to deliver 3% SSNOI growth this year, driven by growth in the East Coast/Central region. Atlantic and West Coast regions.

Risks to UDR include the potential for continued slowdown or even decline in demand for multifamily housing. This could be caused by a number of different factors, such as macroeconomic pressures and new supply of single-family homes as interest rates fall, as this could lead to higher-than-expected eviction volumes in the UDR.

I’ll be watching UDR’s occupancy rates over the next few quarters, as over 95% is generally considered good. I would also look for signs of a clear turnaround in rental growth, as that would be a sign that UDR is emerging from a supply-driven downturn.

Importantly, UDR has a strong balance sheet and a BBB+ credit rating from S&P. It also has $965 million in liquidity, above and beyond its $82 million worth of committed development projects, and $688 million worth of debt maturing in the 2024-2026 period (13% of total debt). Additionally, UDR’s safe net debt to EBITDA ratio of 5.6x is below the 6.0x level generally considered safe for REITs, and its fixed charge coverage is as high as 5.1x.

This supports UDR’s respectable dividend yield of 4.7%, which is still well covered by the 70% payout ratio. It also has a 5-year dividend CAGR of 5.4%, with 13 consecutive years of growth.

When it comes to valuation, I still find UDR attractive at its current price of $36.41, with a forward P/FFO of 14.9, slightly cheaper than the stock’s 15.2 P/FFO when I last visited. UDR is also trading below the normal P/FFO of 18, as shown below. Although UDR has had better total return performance over the past decade, its P/FFO is also lower than AVB’s 16.6 and EQR’s 15.9.

quick chart

While analysts expect FFO/share to be flat this year, growth is expected to return to 3% next year and rise to 6% in 2026. I think these are reasonable estimates, based on the assumption that new supply pressures will ease starting in 2025, and should be a cause for concern as rates fall in light of the Fed’s latest 3 rate cut guidance this year.

Over the long term, I believe UDR can achieve a conservative base case of 5% annual FFO/share growth driven by rent increases and development, which combined with dividends can give UDR market-level performance, all of which The yield rate is much higher than that of UDR. S&P 500 Index.

Important points for investors

All in all, UDR’s SSNOI has moderated due to new supply in its market and normalization of tenant demand after high rent growth in previous years. However, the company’s diversified primary/secondary market strategies and strong balance sheet provide a buffer against these challenges.

In addition, new supply is expected to decline in the next few years, providing support for future FFO/share growth. UDR also offers a substantial and well-supported dividend, making it an attractive option for income investors. Considering the future growth potential and current valuation discount, I believe UDR is currently a solid long-term investment opportunity and maintain a “Buy” rating on the stock.