Joya Sousa

I wrote about Ultrapar Participações SA (NYSE:UGP) twice in the past 10 months.First, in July, I highlighted why the company was a buy amid changes in Petroleo Brasileiro SA – Petrobras (PBR) gasoline prices). Investors who acted on the article achieved a total return of 53.5% through March 29, compared with the S&P 500’s total return of 18.3%.Then I wrote My second article in December argued that the best was over and smart investors should start taking profits from their positions as market-beating returns were unlikely to materialize. The stock still has some room to rise, eventually peaking at $6.33 before falling back to its current price of $5.72, for a total return of 10.5% versus the S&P 500’s 13.7% total return.

Now, I want to downgrade Ultrapar Again a sell rating. This doesn’t mean you should short stocks, but it does mean that, in my opinion, market-beating returns are simply out of the question right now. Season 4 turned out to be a peak, as I will prove in this article. Beyond that, the valuation I proposed in my first article has already been achieved, and there are no obvious catalysts to drive the stock higher.Finally, I think Ultrapar announced some Questionable mergers and acquisitions Recently, as it may raise some questions about its consistency with current portfolios.

Q4 Overview

It’s perhaps telling that Ultrapar stock peaked just before its fourth-quarter earnings report, its best performance in several years. The stock price peaked on February 23, and the earnings call was held on February 28. The company’s EBITDA, net profit, operating cash flow and leverage all improved significantly, driven primarily by Ipiranga, which accounts for over 90% of its revenue.

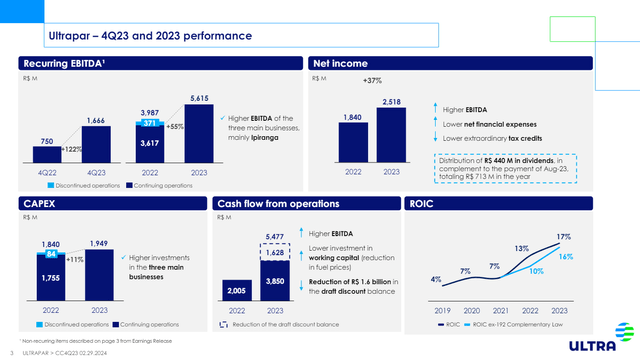

Ultrapar – 2023 Q4 and 2023 Financial Performance (Ultrapar IR)

As you can see from the slideshow above, all indicators appear to be positive and likely support a rise in the stock price. However, with shares up nearly 200% since the start of 2023, all of this growth is likely already priced into the stock price and these numbers are no surprise to the market. Mainly because this improvement occurred in the second half of 2023, which can be partially observed in the Q4 earnings: Q4’23 EBITDA was R$1 billion higher than Q4’22, and FY23 total was higher than High 1.6 billion reais in FY22.

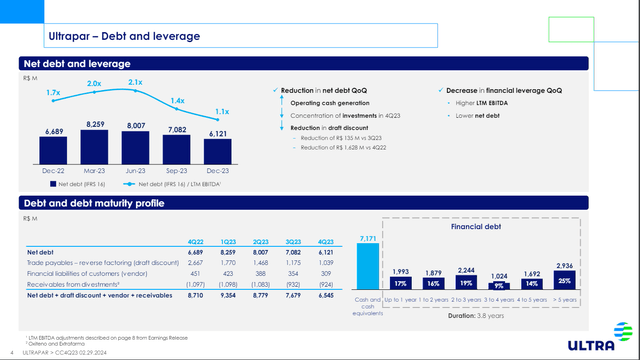

Ultrapar – Debt and Leverage (Ultrapar IR)

Another important improvement is the ongoing deleveraging process. Net debt peaked at R$11.8 billion in FY21 and has now fallen to R$6.1 billion, with net debt/EBITDA of 1.1x compared to 3.2x in FY21. Its cash and cash equivalents are sufficient to cover short-term debt service and can easily support additional capital expenditures or M&A.

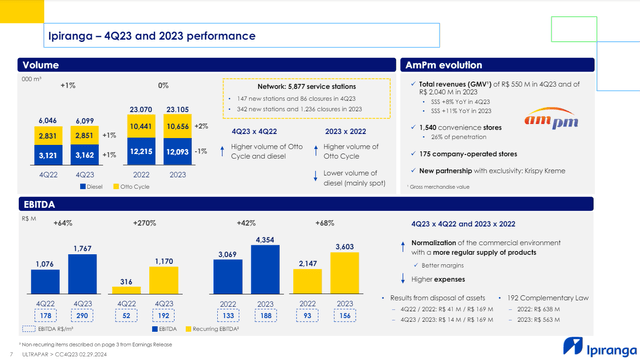

Ipiranga – 4Q23 and 2023 Results (Ultrapar IR)

In my previous article, I praised the growth of Ultragaz and Ultracargo, but these only accounted for 10% of Ultrapar’s revenue. The main development driving the stock’s gains over the past 12 months has been improvements in Ipiranga’s margins. As shown in the slideshow above, volume was flat year over year, but if we consider the “recurring EBITDA” metric, EBITDA grew by +68%.This is driven by Petrobras New price policyAll in all, this means that they do not increase or decrease the price of gasoline based on international oil prices. Stable gasoline prices reduce volatility, make forecasting easier, and help Ultrapar improve its profits.

Valuation inspection

In the valuation model presented in the first article, I stated a fair price of $5.3 if the outcome of gasoline price policy was favorable to Ultrapar and $6.6 if the outcome was very positive. Ultrapar’s fuel consumption appears to be less than 10% below my $6.6 price target. I won’t go into detail about all the assumptions I used, but the important expectations are:

- Gross profit margin bottomed out at 3.5% in 2022 and may rise back to the 2016 high of 6.8%. In 2023, Ipiranga’s growth rate reached 5.6%, which is much better than 2022. The fourth quarter was even better, reaching 7.7%, surpassing the peak of 7.5% in the fourth quarter of 2016. However, the quarter after Q4 2016 fell by 1.4p. In terms of gross profit margin. The reasoning behind this is that Petrobras is legally obligated to sell gasoline at the same price to any gas station, whether it’s Ultrapar, which has nearly 6,000 stations, or a mom-and-pop station. Whenever profit margins increased, small gas station owners were less willing to join the Ultrapar (or any other major brand) umbrella and therefore thought it would be better to have no brand at all, buy gasoline from other middlemen, and earn higher profits. That’s why I believe we’ve seen a peak in Ultrapar’s performance and the financials are likely to stabilize in FY24.

- The deleveraging process will continue and succeed. In fact, that’s the case, as Ultrapar currently has one of the lowest net debt/EBITDA levels ever. That means any uncertainty about Ultrapar’s ability to repay its debt and stop interest payments is gone. In addition, interest rates have dropped to 10.75% from the peak of 13.75% in FY23, resulting in a significant reduction in interest expenses.

Based on the progress of these two catalysts and the fact that Ultrapar stock has lost some momentum recently, I believe the top of the cycle has arrived (if it hasn’t already passed). Compared to the start of fiscal 2023, I think Ultrapar’s ability to surprise the market with improved financials has diminished.

Questionable mergers and acquisitions

Finally, Ultrapar’s M&A record isn’t the best. In 2013 they Acquisition of Extrafarma for R$1 billion,until For sale in 2021 for R$ 700 million and suffered losses of R$1.5 billion during these years.Now, management decides that the best use of the company’s cash is Acquisition of strategic shares in Hidrovias do Brasilis a company that owns and operates ships that transport agricultural products on Brazilian rivers and coasts. The company will buy an additional 17% of the shares (they already own about 10%) for R$500 million, giving a total of 27% ownership in Hidrovias do Brasil. There may be some synergy with Ultracargo, but it’s probably the same synergy they think chain drug stores have with gas stations. Although Hidrovias do Brasil has a long-term debt profile, it is a highly leveraged company, with net debt/EBITDA of 4.2x and FY23 net profit of just BRL18 million. It is currently valued at R$3.2 billion on the Brazilian stock market.

Excess cash can be used to buy back shares or pay a special dividend in FY23. It can also be used to continue developing Ultracargo or any other more related business. Instead, it was used to buy a 17% stake in a company that just a year ago was valued at less than half of what it is now. Furthermore, if Ultrapar doesn’t own more than 50% in the near future, why acquire 27% of the company? Are they waiting for it to appreciate in value before fully buying it?

last comment

All in all, Ultrapar seems to be back to square one. From an unreasonable valuation of R$10 billion at the beginning of FY23, it has now exceeded R$30 billion. Investors have little margin of safety in this company, and all positive financial performance appears to be fully priced in its stock price. As usual, if Ultrapar continues to post gross margins above 7.0% in fiscal 2024, I could be dead wrong. This could push the stock higher and generate market-beating returns. However, I think this outcome is less likely than it was a year ago. Investors would be better off exiting their entire position and waiting for the next cycle.