Machimina 29

introduce

We wrote about Unifi, Inc. (NYSE:UFI) In July 2022, we rated this maker of recycled and synthetic products a Hold for a number of reasons. Despite its high valuation at the time, the company’s margins were under pressure due to the impact of the U.S. economy. Staffing restrictions and rising costs of goods sold. To cope with margin pressures, companies such as Unifi must turn over as much product as possible (by increasing production) so that economies of scale can compensate to some extent for rising input costs over time. Nonetheless, Unifi’s sales at the time were also affected due to ongoing pandemic-related lockdowns, primarily in Asia.

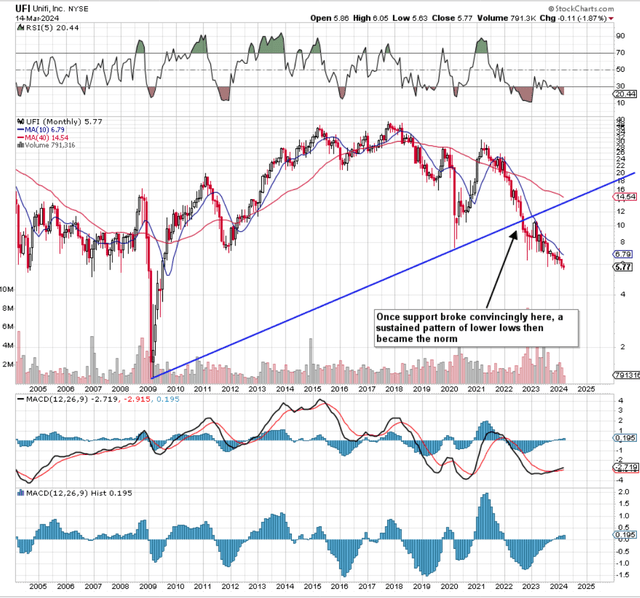

Suffice it to say, given the growth and profitability challenges Unifi was facing at the time, the jury was still out on whether the stock could maintain years of technical support.like us However, as shown below, long-term support failed across the board shortly after we published our 2022 commentary, as buyers failed to come to the rescue at around $11 per share. This lack of convincing support drove the stock to lows for several months, causing the stock to drop approximately 58% over the past 20 months or so. Considering the S&P 500 is up nearly 29% over the same period, that’s a sizable opportunity cost.

UFI long-term technical picture (Stockcharts.com)

Second Quarter 2024 Earnings

In the company’s second-quarter report released on February 1 this year, net sales were $136.9 million and profit was negative ($19.8 million). While revenue and profit figures are very close to the same period 12 months ago, a recovery may be starting to take shape despite Unifi still following the market conditions in which it sells.

First, management’s accelerated cost-cutting efforts to protect the profit and loss statement have begun to have a positive impact on gross margins. Additionally, further gains are expected due to an overhaul of sales processes, improvements in streamlining efforts and a more prudent inventory management model. In addition, through continued reductions in headcount and multiple senior appointments, Unifi aims to become a more efficient organization that remains at the forefront of innovation.

It remains to be seen whether the raft of innovations in REPREVE and Beyond apparel can lead to growth in a cost-cutting environment. From our perspective, we believe investors need to see significant improvements in Unifi’s gross margins and free cash flow before the stock price can begin to move higher on a sustained basis.

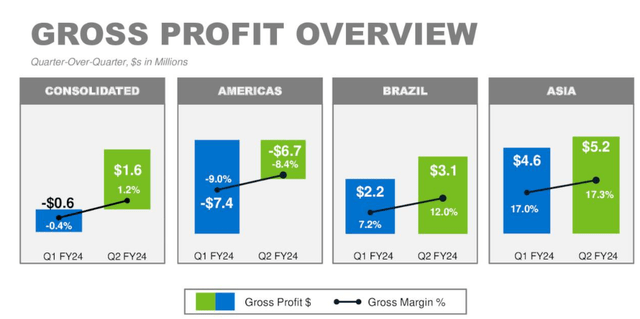

Gross profit margin

From a margin perspective, the encouraging trends are that gross profit ($1.6 million in Q2) and gross margin (1.2% in Q2) in the second quarter of this year, both post-quarter and in line with FY12 There has been an improvement compared to the same period. months ago. In view of the company’s rising interest expenses, it is imperative to maintain an increase in gross profit. Below, the CFO explains the rise in this key metric during this year’s second-quarter earnings call.

Lower raw material costs and variable cost management efforts improve overall profitability. However, seasonal sales declines and soft apparel demand in the Americas, coupled with sales price pressure in Brazil, continue to have an adverse impact on gross margin. In the second quarter, variable cost management benefited the Americas and Brazil divisions.

Unify Q2 2024 Gross Profit Overview (Seeking Alpha)

Regardless of Unfi’s forward growth plans, REPREVE’s continued growth looks to be the fastest way to improve profitability. In the second quarter, REPREVE sales increased from the previous quarter and were up compared with the same period in the previous 12 months, accounting for 33% of top-line sales. One would think that continued growth here would need to be coupled with a recovery in China’s economy and an overall increase in apparel production.

Free cash flow is a strong valuation driver

Given that the company’s free cash flow was negative ($0.42) in the second quarter of this year, it’s no surprise that Unifi’s net debt position increased by nearly $7 million during the quarter. This goes back to our earlier point, when we said there were doubts about Unifi’s ability to grow significantly in a low-investment environment. For example, capital expenditures in the second quarter of this year were only $3 million, compared with $12.8 million in the same quarter of fiscal 2023.

This “low investment” environment is key to company valuations, and here’s why. While the company’s sales and book multiples remain compelling, as shown below, they don’t truly represent Unifi’s intrinsic value as an investment due to the company’s inability to report positive earnings and cash flow and its low investment amount. This begs the question whether management made a mistake in not investing aggressively during the recent down cycle (despite increased working capital commitments).

| many kinds of | UFI | Department Median | UFI 5-year average |

| Price to sales ratio (TTM) | 0.18 | 0.94 | 0.43 |

| Booking price (TTM) | 0.36 | 2.15 | 0.82 |

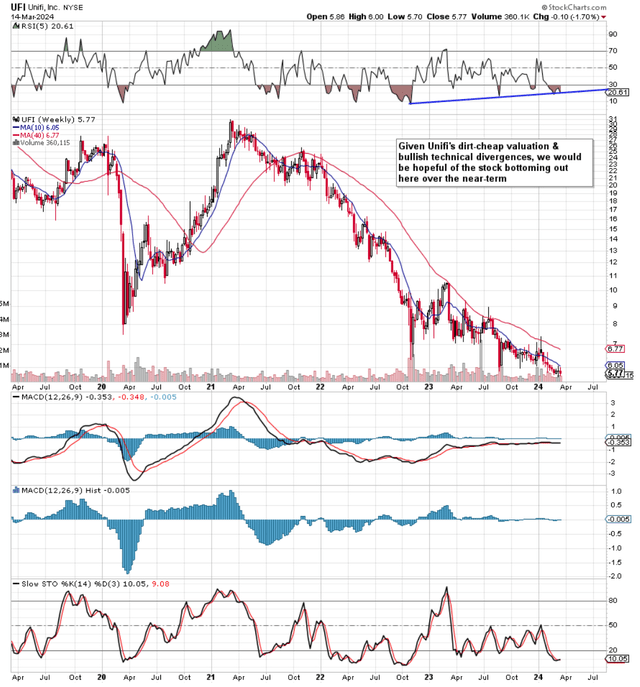

Intermediate Golden Cross required

Continued increases in gross margin and free cash flow should result in the stock finally being able to end the bear market as shown below. The first technical sign of a potential long-term multi-year bottom for Unifi would be an intermediate golden cross (a bullish crossover of the stock’s 10-week moving average above its 40-week moving average) amid strong buying.

Unifi Intermediate Technology (Stockcharts.com)

in conclusion

All in all, Unifi has had a terrible time since peaking in March 2021, losing nearly 80% of its market cap in the process. The capitalization of stocks in recent years means that every $1 invested now earns nearly $3 in company assets and more than $5 in company sales. Considering the lack of intangible assets and goodwill on Unifi’s balance sheet, this looks like a great deal. However, as mentioned above, the lack of positive earnings and cash flow and reduced capital investment means investors should wait here for the tide to turn. Let’s see what season three brings. We look forward to continuing the coverage.