Miscellaneous Photography/iStock Editorial via Getty Images

investment thesis

Union Pacific Company (NYSE: UNP) is rated a Buy as operations improve. We believe new management will continue to implement significant improvements that will position UNP to achieve superior shareholder returns.Earlier Management has had years of poor operating performance, and at current valuations, UNP is a long-term buy.

introduce

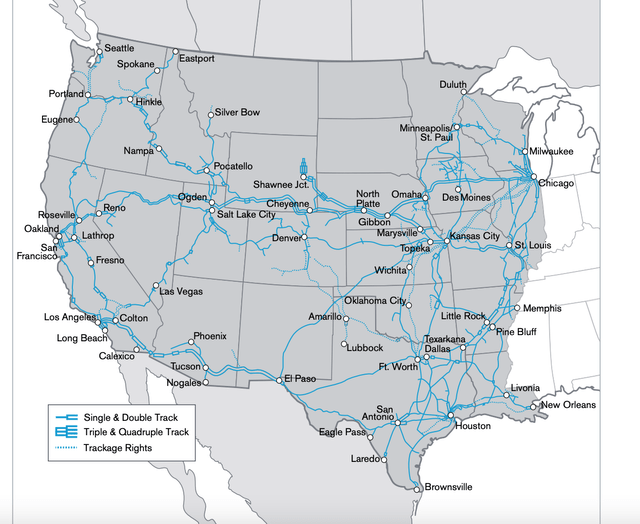

UNP is one of the Class I freight railroads in the United States. The company is 161 years old and its rail network covers 23 states. UNP’s rail network is as follows, showing good coverage across the United States

UNP Overview

We firmly believe that UNP will embark on many years of improvement and growth, unlocking shareholder returns. There are two main reasons for this. First, UNP appointment Jim Vena serves as the company’s new CEO, effective August 2023.We believe The new CEO is the right person to transform UNP into a high-performance rail company and unlock shareholder returns. He has over 40 years of industry experience and knows UNP well, having served as chief operating officer and advisor to the chairman. Second, U.S. railroads will benefit from a variety of favorable factors. If management achieves operational improvements, the impact will be huge as they will be able to capitalize on these tailwinds. Tailwinds for Amtrak include increased investment in U.S. industry and the fact that rail is a greener mode of transportation compared with alternatives like trucking. The U.S. investment cycle is driven by supply chain outsourcing, which will require significant investment to reverse the old trend of offshoring and government and industry decarbonization efforts.An obvious example is recent The U.S. government signed a $1.2 trillion infrastructure bill. Many new investments and projects require the support of rail transport. Additionally, we expect rail to gain market share from areas such as trucks, as businesses and society become more sensitive to the sustainability of freight.Railways are considered More environmentally friendly With limited additional investment required to take advantage of this alternative, we expect their market share to increase over the next few years.

The key to superior shareholder returns, therefore, is management’s ability to deliver. We discuss early signs below.

Management and operational performance

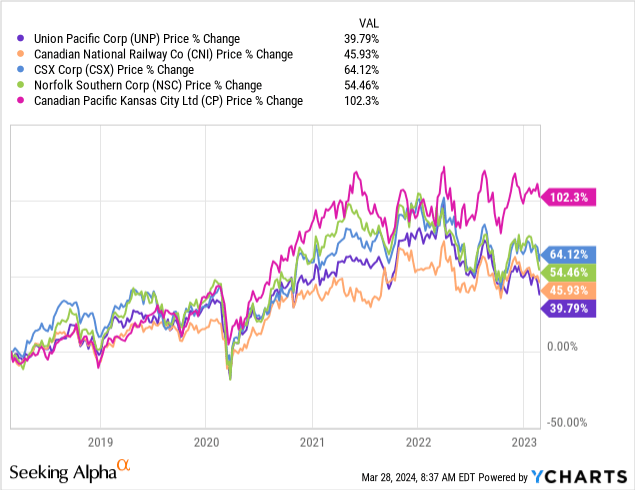

Our view is that UNP’s old management failed to unlock much of UNP’s value, and therefore shareholder returns have been lower than those of competitors.

This is shown in the chart below, which is a 5-year chart as of February 26, 2023, date When UNP announced they were looking for a new CEO. As shown below, UNP has significantly underperformed compared to its industry competitors.

As we mentioned above, the new CEO takes office on August 13, 2023. Since then there have been some key changes that we believe are important in building UNP to enhance and unlock shareholder value.

First, the company appointed different people as CEO and chairman.Until Lance Fritz fills both positions Role. The fact that the CEO is accountable to the board and therefore to the chairman means that having different people in different roles creates a certain amount of responsibility. Having the same person as CEO and chairman means the company can give too much influence to one person and absolve them of responsibility. The separation of these roles means boards can focus on setting the right targets and incentives for the CEO to ensure shareholder value is unlocked. Additionally, boards can more easily fire CEOs if they don’t perform well enough (if they don’t serve as board chair with significant influence).

Second, Jim Weiner developed a new multi-year strategy to address UNP’s problems.this Strategy It is “Safety + Service and Operational Excellence = Growth”. In the 2023 annual report, Jim Weiner succinctly summarized the purpose of this strategy.

Safety is a primary focus area at UNP as it establishes the right mindset, culture and personal responsibility. Service is the focus of fulfilling our commitments to customers. Finally, operational excellence is the ability to operate efficiently and effectively. Achieving these three points will result in UNP growing the business and positioning UNP as an industry leader, thereby delivering superior shareholder returns.

Why is this important? Because previous management failed to achieve these goals, shareholder returns were lower. Lance Fritz’s tenure as CEO has been marked by poor shareholder returns, poor safety, poor revenue growth and poor cost management. UNP becomes rail company of choice to highlight Don’t do it as a railroad company.For example, in the third quarter of 2023, UNP received letter Regulators said the trains and the equipment used were highly unsafe.

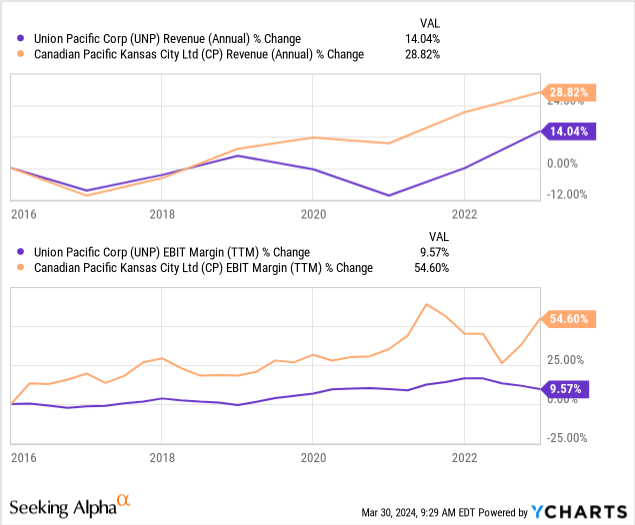

In terms of revenue and cost management performance, we can compare UNP’s performance to Canadian Pacific Kansas City Ltd. (CP), which we consider to be a well-run railroad.As we see below reserve Under the leadership of Lance Fritz, CP has enjoyed excellent revenue growth and higher EBIT margins.

The question then becomes what happened to Jim Weiner? We think the positive results are already showing up in the business results.

First, let’s take a look at weekly performance in 2023 index Data since Jim Vena took over relative to a year ago (we compare August-December 2023 to average weekly data August-December 2022).

| new CEO | Old CEO | |

| truck speed | 211 | 191 |

| Train speed (MPH) | 20 | number 17 |

| Switches and through-car stays | 8 | 9 |

| Operate car inventory | 171,624 | 189,367 |

Jim Vena outperformed his predecessor’s performance across all four metrics. For truck speed and train speed, The higher the number the better For switching and running car stays and running car stock, The lower the number, the better.

If you’re wondering what these metrics are, we’ve provided some explanations below.You can also find definitions here.

Car Speed: Measures the average number of miles traveled by a car per day. More miles means better utilization of the van.

Train speed: Measures the time from departure to final arrival, including intermediate terminals. More miles per hour means better utilization of trains.

Transition and through-car dwells: Measure dwell time at a railway station for any car classification or through-train activity. The higher the number, the longer the dwell time and the lower the utilization.

Operational Car Inventory: A daily snapshot of cars that are normally moved, reserved, or released in customer status. Indicates the situation of inventory management. If the numbers go down, it means your inventory management is more efficient.

Improvements in these operating metrics compared to the same period a year ago are also reflected in the 2024 year-to-date data.

Operational improvements will also be realized in the fourth quarter of 2023 result. Quarterly freight traffic speed increased by 14% year-on-year. Quarterly locomotive productivity increased by 14% year-on-year. The average maximum train length increased by 2% compared with the same period last year. Quarterly employee productivity increased 4% to 1,051 miles per employee and, finally, fuel consumption was 1.091 gallons (measured in gallons of fuel per 1,000 GTMs), down 3% from a year ago. All of these performance metrics are moving in the right direction, and their continued improvement will generate strong returns for shareholders.

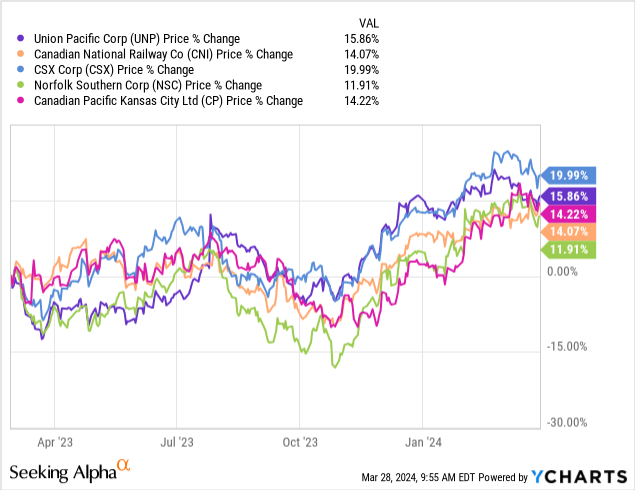

What about shareholder returns? The chart below begins with the period after the old management announced their resignation. Since then, UNP has outperformed most of its competitors.Additionally, the surge in UNP stock prices around July 26th was Influence Jim Vena announced as new CEO of UNP.

Overall, in its first few months, it is clear that the new management is taking the right actions to improve UNP’s operational performance. We believe that if management continues to gradually improve UNP’s operating performance and achieve industry-leading metrics, shareholders will benefit from superior returns. Small incremental improvements over the long term will have a significant impact on the business.

relative valuation

Below we compare UNP’s relative valuation to Canadian National Railways Inc. (CNI), CSX Corp. (CSX), Norfolk Southern Corp. (NSC), and Canadian Pacific Kansas City Ltd. (CP).

| united nations program | CNI | CSX | National Security Council | CP | |

| P/E ratio moving forward | 21.9 | 22.4 | 18.7 | 20.9 | 28.3 |

| P/cash flow forward | 15.8 | 15.0 | 12.3 | 13.1 | 19.0 |

| Enterprise value/EBIT | 18.6 | 18.8 | 15.7 | 17.4 | 23.2 |

| Fourth quarter operating rate 23% | 60.9 | 59.3 | 64.1 | 68.8 | 58.7 |

As we saw above, UNP sits in the middle of the valuation range, with CSX being the relatively cheap option and CP being the most expensive option based on valuation multiples. From a relative valuation perspective, UNP appears to be fairly valued.

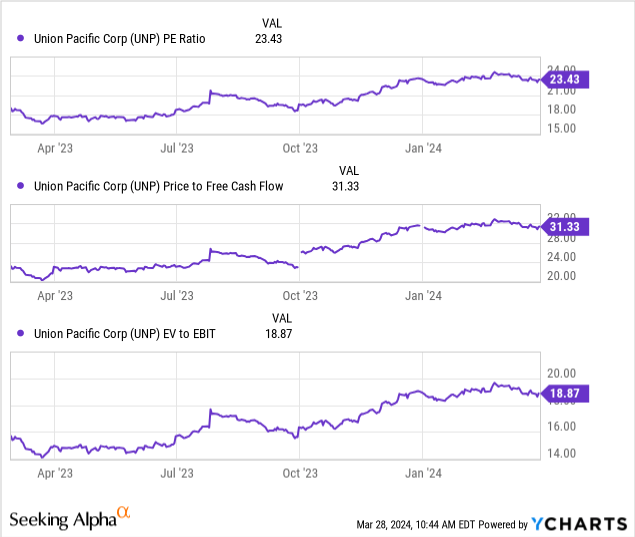

Secondly, let’s take a look at the absolute valuation multiple since the old management announced their resignation.

As you can see from the chart above, all valuation multiples have expanded in absolute terms since February 2023. More specifically, the P/E ratio increased by 24%, the P/E ratio increased by 36%, and the value of corporate EBIT increased by 20%. While these multiples have expanded over the last year, we believe the multiples will expand further if UNP delivers industry-leading operating results.

If management can improve its operating ratio (operating expenses divided by revenue) closer to CP’s operating ratio, we expect the valuation multiple to further improve to a ratio closer to CP.

This goes back to the importance management plays in unlocking shareholder value. Long-term incremental improvements will lead to higher profitability, higher valuation multiples and higher shareholder returns.

risk

As we discussed above, our paper focuses on management unlocking superior shareholder returns. The new management proved early on that they could improve the company’s operations. Initial signs are encouraging, but there’s also a risk management won’t be able to deliver meaningful additional improvements. Given that UNP appears to be in the middle of that range on a relative valuation basis, operational improvements are key to superior returns. These early signs of positive operating performance may be attributed to bad luck. Operating performance needs to be monitored over a longer period of time to declare a victory for management. In addition, UNP’s business is sensitive to economic cycles. If the economy falls into a severe recession, economic activity is likely to fall, which will impact demand and, in turn, businesses as a whole. If the economy goes into recession, any improvement in management will not result in strong shareholder returns.

in conclusion

New management has provided early signs that UNP’s operating performance could improve. Improving their performance over time will position them as an industry leader and capitalize on the tailwinds we discussed above. Relatively speaking, UNP is in the middle of the valuation multiple range. Therefore, management needs to continue to improve the company’s operating performance. We believe management will continue to deliver meaningful improvements over the long term, translating into superior shareholder returns. We rate UNP a long-term buy.