design unit

United Therapeutics Corporation (NASDAQ:UTHR) is a biotechnology and pharmaceutical company focused on cardiovascular disease treatments such as pulmonary arterial hypertension (PAH), pulmonary arterial hypertension associated with interstitial lung disease (PH-ILD) and pediatric oncology drugs.Its research pipeline advances its lung disease platform, developing novel Biological agents treat sepsis and have led to various organ manufacturing programs that are changing the paradigm of organ transplantation through innovative new systems. Unfortunately for UTHR, its main source of revenue (Tyvaso) is subject to legal challenges, jeopardizing its future growth rate. So this could be a significant headwind to the stock’s valuation, and I don’t think investors should ignore it. Therefore, I am neutral on the stock, with a current rating of “Hold.”

Tyvaso at the Center: Business Overview

United Therapeutics is a biotechnology and pharmaceutical company founded in 1996.Headquartered in Silver Spring, MD and Research Triangle Park, NC, it has UTHR, a legal and creative arm based in Washington, D.C., has additional facilities in Bromont, Quebec; Melbourne and Jacksonville, Florida; and Manchester, New Hampshire. UTHR specializes in transplant organ manufacturing and the development and commercialization of cardiovascular disease drugs. UTHR generates revenue primarily through the commercialization of drugs and medical devices used to treat PAH and related cardiovascular diseases.

Source: United Therapeutics, Inc. Q4 2023 Financial Update. February 21, 2024.

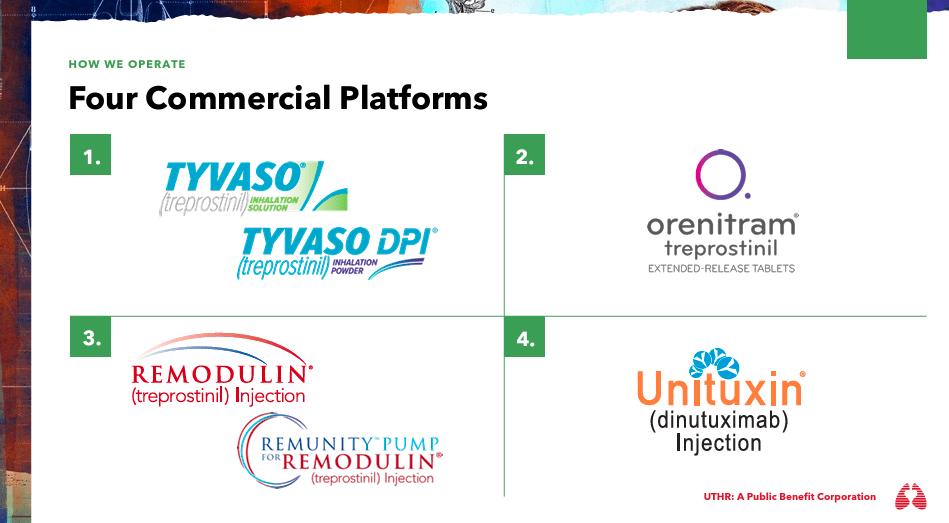

Let’s take a closer look at the company’s intellectual property portfolio. There are many types of UTHR product description Treatment of vascular diseases such as pulmonary arterial hypertension (PAH) and pulmonary hypertension associated with interstitial lung disease (PH-ILD). UTHR expands its offering into pediatric oncology with treatment of high-risk neuroblastoma. The company has five FDA-approved drugs to treat these vascular diseases: Orenitram, Tyvaso, Tyvaso DPI, Remodulin and Adcirca (tadalafil). UTHR also offers the FDA-approved drug Unituxin (dinutuximab), a monoclonal antibody used in the treatment of neuroblastoma.

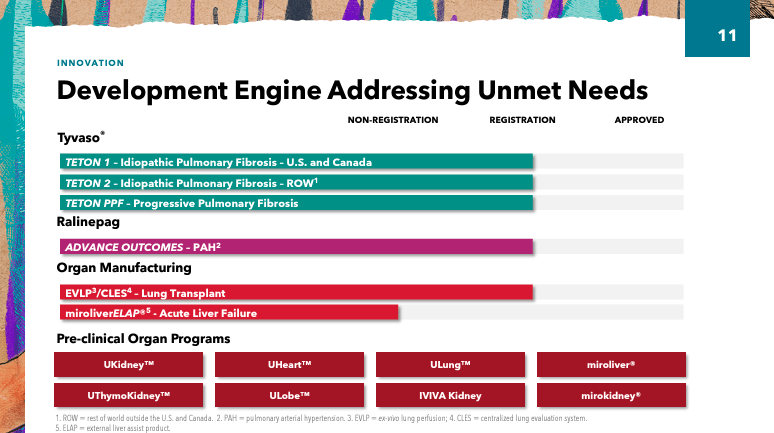

In addition, UTHR pipeline Various projects include organ manufacturing, novel biologics, Tyvaso and Remodulin platforms. Teton (inhaled treprostinil) for the treatment of idiopathic pulmonary fibrosis (IPF) and Advance (an IP receptor agonist) for the treatment of PAH are in Phase 3 clinical trials. RemoPro (injectable treprostinil prodrug) is in Phase 2 for the treatment of PAH.

Another promising R&D project is UTHR’s genetically enhanced mesenchymal stem cells (Gem management system) Phase II study. This study explores the potential use of stem cells with enhanced regenerative capabilities to rejuvenate damaged tissue. UTHR’s GEMS technology could be revolutionary for the treatment of sepsis, a severe response to infection that triggers inflammation and can lead to organ failure and death due to organ damage. Additionally, sepsis has a high mortality rate, so UTHR’s technology is invaluable in some cases, and further advancements in the field could unlock additional shareholder value as progress is made.For context, sepsis affects approximately 1.7 million adults is conducted annually in the United States, so these underserved populations may become one of the future value drivers for UTHR.

Source: United Therapeutics, Inc. Q4 2023 Financial Update. February 21, 2024.

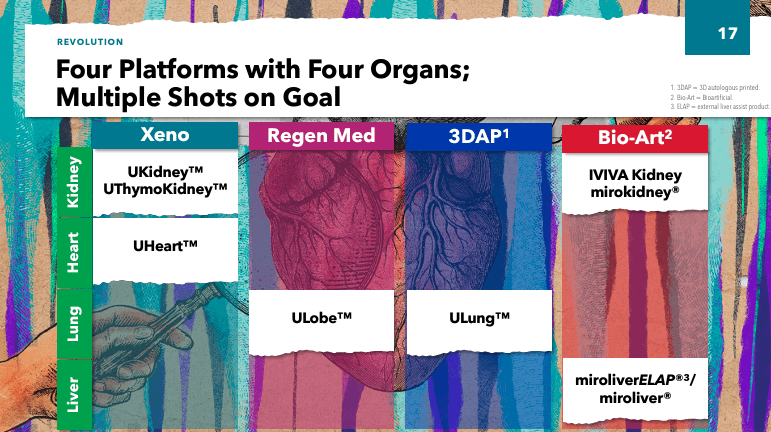

In addition, UTHR has developed programs as part of its organ manufacturing Preclinical stage platform. These studies include Kidney (xenokidney), ThymoKidney (xenokidney), Uheart (xenoheart), ULobe (Lung Lobes), and ULung (3DAP Lungs). These studies involve the use of modified animal organs for xenotransplantation, combined with bioengineering techniques (such as 3D printing) to create functional organs for transplantation to address the shortage of human organ donation and thereby save the lives of patients with severe organ failure.

Source: United Therapeutics, Inc. Q4 2023 Financial Update. February 21, 2024.

UTHR is also conducting clinical trials of centralized isolated lung perfusion service devices under the EVLP (Ex vivo Lung Perfusion) system. The device can repair lungs previously thought unsuitable for transplantation by circulating a nutrient-rich solution outside the body. This intervention could therefore increase the number of lungs available for transplant and save lives. Long wait times for lung transplants can cost lives because without a lung transplant, a patient’s condition rapidly deteriorates.according to SomeThe gap between patients waiting for lung transplants and available organs has widened in recent years, and if these clinical trials are successful, it will in time demonstrate the market potential of UTHR.

A visionary path to growth and medical innovation

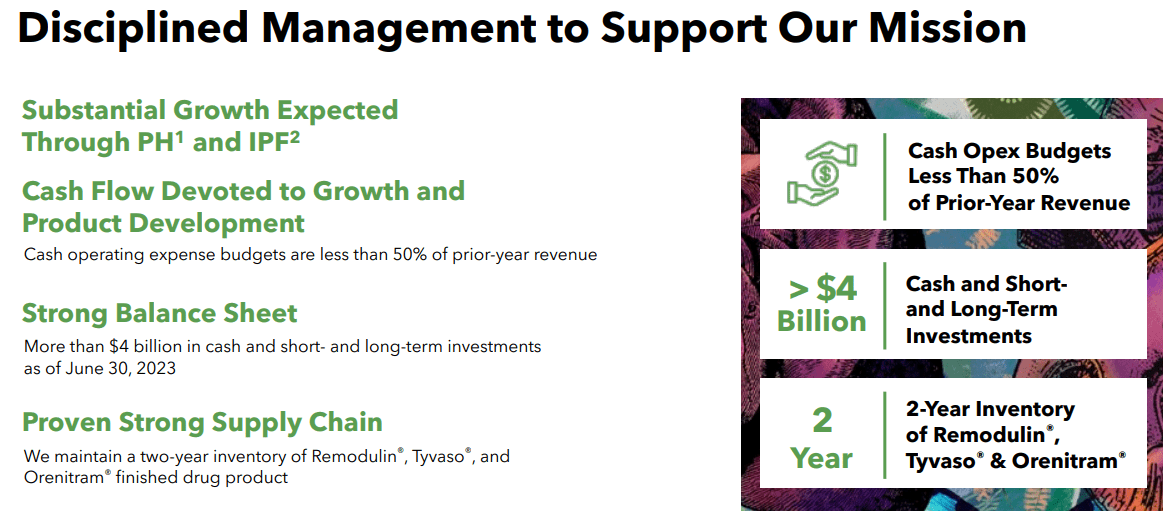

In the company’s latest earnings call, UTHR executives celebrated a consecutive quarter of record revenue, with revenue growing by more than 20% in the fourth quarter of 2023 and good performance for the full year of 2023. Additionally, management announced a royalty transaction related to the Tyvaso dry powder inhaler (DPI) product, executed by UTHR’s partner MannKind Corporation, Sell They will pay one-tenth of the royalty stream to Sagard Healthcare Partners for $150 million, with 1% of the royalty stream plus additional potential milestone payments. UTHR executives emphasized that this value could mean that 100% of Tyvaso’s DPI revenue would value its product at $15 billion, which is much higher than UTHR’s current market capitalization and represents an important value driver, but it does not appear to be the case. exist. This is reflected in its market capitalization today.

Source: United Therapeutics, Inc. Q4 2023 Financial Update. February 21, 2024.

Additionally, UTHR’s management outlined their strategy, which is based on: 1) leveraging existing business, 2) advancing the near-term pipeline, and 3) pursuing long-term growth through the development of artificial organ technology. This is a mature company, so it’s not your typical small-cap biotech stock with high risk and high reward potential, but rather a relatively stable business in the industry. As a result, executives provided updates on xenotransplantation and regenerative medicine, such as the FDA’s IND for Miroliver’s Extracorporeal Liver Assist Product (ELAP) program, which uses tissue engineering, cell biology and biomaterials technologies to create livers. The primary function of the MiroliverELAP system is to externally support liver function in patients with acute liver failure to reduce the need for transplantation and provide time for the patient’s liver to heal.

Overall, I believe UTHR’s product portfolio is robust and has promising clinical trials underway. Therefore, I think it’s safe to assume that UTHR is well-positioned for continued growth due to its strategy of investing in innovative research and groundbreaking projects while leveraging its commercial offerings.

Neutral Ground: Risk and Valuation Analysis

Amid this positivity, a storm is brewing as a U.S. appeals court takes up one of the company’s products. reject UTHR sought to reinstate a Tyvaso patent that had been canceled by an administrative court. The Patent Trial and Appeal Board concluded that the abstracts of the two scientific papers “were sufficiently disseminated that each constituted a printed publication.” The ruling confirmed the revocation of the patent. The move would bring smaller rival Liquidia’s Yutrepia drug, such as Tyvaso, closer to FDA approval. The situation represents a major challenge for UTHR as it affects the market exclusivity of the company’s key product, Tyvaso.

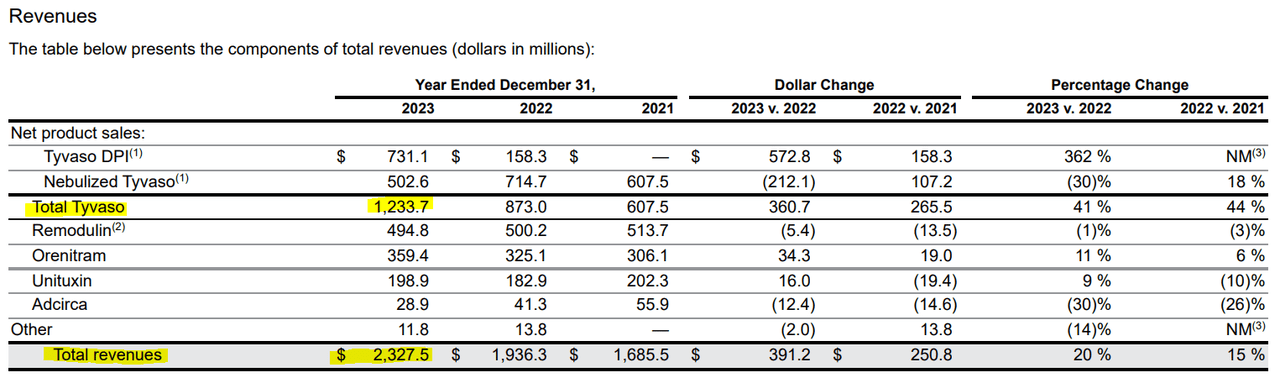

Source: UTHR 2023 10-K Report.

For context, UTHR’s total revenue in 2023 was $2.33 billion, 53.0% of which came from Tyvaso’s IP. This means that if Liquidia is successful in its legal challenge, a significant portion of UTHR’s revenue will be directly challenged. This poses a significant risk to the stock’s investment thesis, and given that the stock’s P/E ratio has reached a relatively high level of 4.7, it could become a significant headwind to future valuations if revenue growth slows due to increased competition. For context, the industry’s median P/E ratio is 3.8, suggesting that UTHR trades at a premium relative to its peers. This weakens my optimism about the stock itself, although I remain optimistic about its underlying business. The good news is that UTHR has a solid balance sheet, with about $3 billion in cash and equivalents, compared with $732.8 million in total debt. As a result, the company has sufficient resources to fund its legal proceedings, ongoing operations and invest in its research and development programs.

Therefore, as of February 2024, UTHR continues litigation An amendment to Liquidia’s objection to the FDA’s processing of its new drug application (NDA) related to PH_ILD for its proposed inhaled dry powder treprostinil product. UTRH claimed that Liquidia should seek approval for the second indication by submitting a new NDA to ensure proper review of the new drug application. The legal action, intended to protect UTHR’s market interests and ensure competitors comply with regulatory standards, may seek to delay Liquidia’s products from entering the market. However, from an investment perspective, I believe the short-term narrative for UTHR will be primarily focused on legal matters at this time. If UTHR’s challenge succeeds, this would pose significant risks and should serve as a good “buy” opportunity for long-term investors. But for now, I acknowledge that this legal uncertainty is too great to ignore, which is why I am temporarily neutral on UTHR.

UTHR stock has been stagnant over the last year. (Source: TradingView.)

Reserved for now: Conclusion

Overall, UTHR has very promising intellectual property and appears to be quite profitable while continuing to develop its upcoming product pipeline through clinical trials. Currently, however, UTHR derives approximately half of its revenue from its Tyvaso IP and faces potentially increased competitive pressure. This ongoing legal challenge could set the tone for the company’s long-term revenue growth rate and its appropriate valuation multiple. Since UTHR appears to be trading at a premium to its peers already, I think it’s prudent to acknowledge the legal risks affecting its main source of revenue. Therefore, despite the promising fundamentals, I remain neutral on the stock until this legal dispute is resolved.