Kevin Winter

investment thesis

I still think Universal Music Group (OTCPK:UMGNF) (the “Company”) is an exceptional investment that will likely continue to outperform the market over the long term. With this in mind, I downgrade the company to Buy I do believe that it is no longer asymmetrically tilted to the upside but is at a more “neutral” point from a valuation perspective.

In my last article in September 2023, I argued that Universal Music Group was significantly undervalued, with a compelling valuation behind it, a strong value proposition, and a dominant position in the low-cost entrainment industry .

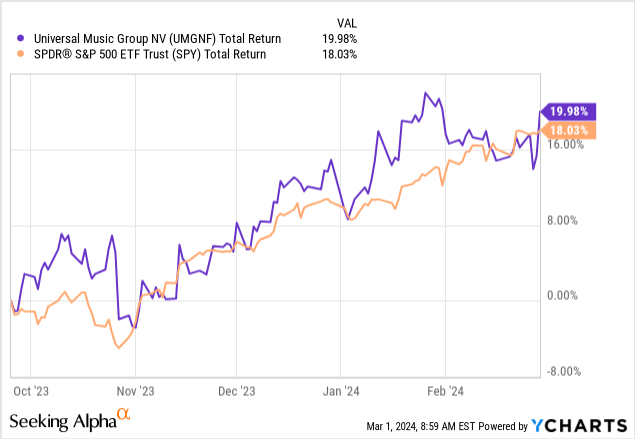

Since then, the stock has performed positively and was able to provide alpha relative to the S&P 500:

4Q23 Results Overview

The market reacts to Universal Music Group’s stock price after it releases fourth-quarter 2023 earnings In response to such developments, it rose about 5%.

Revenue in the fourth quarter was €3.21B, with full-year revenue at €11.1B or growth of approximately 7.4%, with all three operating segments showing continued strong momentum, particularly physical and merchandise sales (growth of approximately 14.2%) Powered by global stars like Taylor Swift.

In the short term, I do expect revenue to be driven primarily by sales rather than price, as consumers are vulnerable to further growth as Universal Music expands its global reach (especially in China) and invests in local labels, among other initiatives Impact, etc. are key drivers.

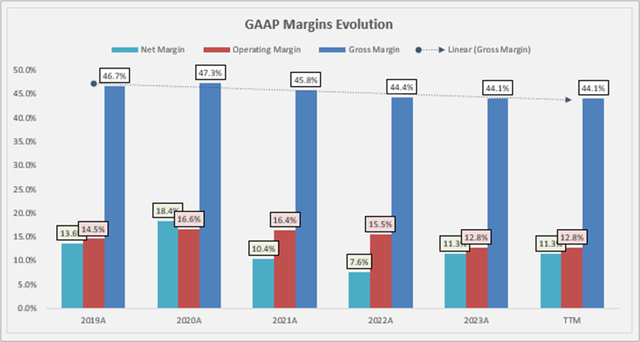

Still, margins look healthy despite input inflation eating into some of the business’ profits.

Author’s estimate

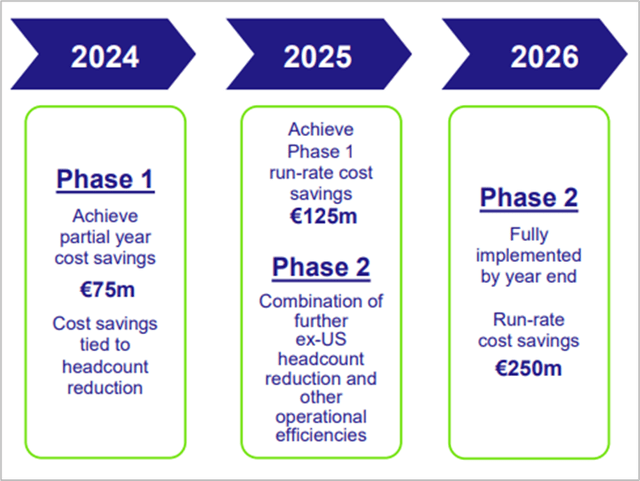

Gross margin fell to 44.1% due to higher artist costs and lower margins in the physical and merchandise sales divisions, which accounted for a larger share of total revenue. Operating profit performance was less positive due to higher stock-based compensation expenses, however, this will no longer be a headwind in 2024, and the tailwind is there once we factor in Universal Music’s cost-saving plans.

Introduction to Universal Music Group

On the FCFF front, there are no particular headwinds to highlight, but potential long-term tailwinds could improve Universal Music’s cash flow profile.I’m talking about corporate acquisitions. 25.8% equity Chord Music Partners trades at approximately 17.0x EV/EBITDA. In my opinion, such a tool would improve the image of the FCF by providing greater financial flexibility when purchasing “expensive” music catalogues.

Finally, the balance sheet remains healthy, with net debt/EBITDA of approximately 0.9x, interest coverage of 34.75x 2023A, and an average maturity of approximately 5 years. So I don’t think there’s any risk on that front in the foreseeable future.

Valuation and risk updates

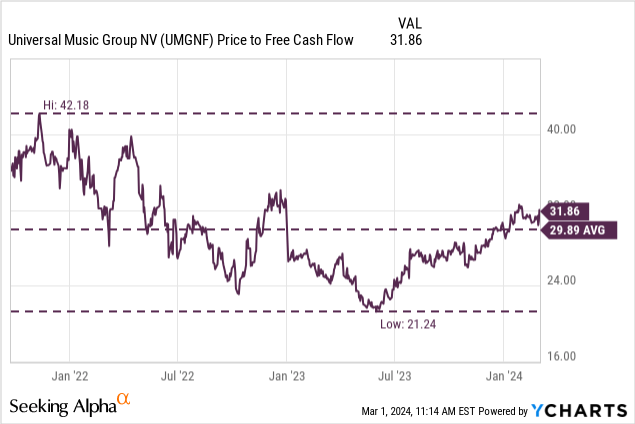

I have decided to downgrade the company from Strong Buy to Buy at this stage, with a fair value of €30.79 per share. The downgrade reflects a change in valuation conditions, which are no longer asymmetrically biased to the upside, but are now at a more “neutral” level. Universal Music Group’s P/FCFF ratio is 31.86 times, slightly higher than the historical average, but still well below the historical high of 42.18 times.

That being said, my long-term thesis remains intact, as I do believe the company will be able to capitalize on the long-term growth opportunities driven by the streaming era.

I wanted to provide an update on the risks, specifically regarding artificial intelligence and the breakup between Universal Music Group and TikTok.

First, about artificial intelligence.Management began to take first step Ensure that the company’s intellectual property rights are well protected against illegal use and are well compensated when this occurs. As stated in the 2023 Q4 Earnings Call:

Rather than waiting for AI to take hold and then trying to figure out business models that fairly compensate artists and music companies. This time we were ahead. We have a historic relationship with our long-time partner YouTube, in which we and our artists can participate, help shape technology development and determine how to leverage and monetize technology to benefit the entire creative community.

Secondly, regarding break up Between Universal Music Group and TikTok. Universal Music Group accused TikTok in the letter, claiming that TikTok did not implement issues related to artificial intelligence and did not pay fair revenue sharing to Universal Music Group artists. This is a risk for one simple reason: TikTok provides the company’s artists with significant visibility due to its global user reach. This is no longer the case.

In my opinion, this may be an issue in the short term, but in the long term I don’t think there will be a relevant impact as consumption shifts to other short film platforms may offset the impact. Additionally, I do believe that we will see them restructure the deal later this year, as a spinoff could be more damaging to TikTok than Universal Music Group (which is clearly in the driver’s seat).

last comment

Universal Music Group represents an excellent investment opportunity with a compelling valuation, strong cash flow generation, and potential catalysts for market share expansion and margin improvement.

Management continues to execute well, address risks related to artificial intelligence, and take a proactive approach to try to mitigate the headwinds associated with the TikTok breakup. That said, I do expect the company to maintain its track record, but based on current valuations, I decided to cut my position by 30% because I do believe we may experience some downside volatility in the near term.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.