JHVE photos

Upstart Holdings (Nasdaq ticker: UPST) hopes to disrupt the lending market with its artificial intelligence platform, but so far monetization of its customer and partner base has been less than ideal, raising questions about the sustainability of its business model.

Company Profile

upstart It is a financial technology company that combines technical capabilities applied in the financial field to provide a cloud-based artificial intelligence (AI) lending platform. It was founded in 2021 and has been listed on the Nasdaq stock exchange since 2020, with a market capitalization of approximately US$2.3 billion.

Its core business is developing and delivering a lending platform that, in theory, uses machine learning to provide banks and credit unions with a better credit underwriting experience.Its goal is to reduce lending risks and costs for banking partners by using its artificial intelligence models and applications to better analyze credit risk and provide key Digital experience.

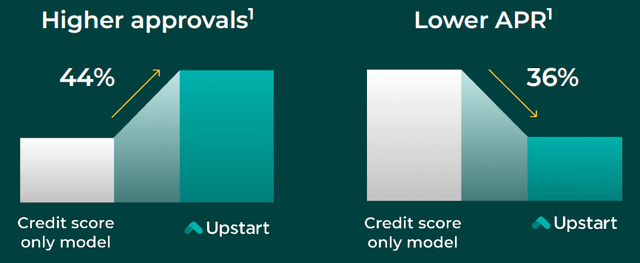

Upstart’s AI model has been trained more than 10 yearsToday, powered by over 1,600 variables, the “traditional” approach in the banking system is to analyze credit risk using FICO scores and a limited number of variables.

This means Upstart’s model takes into account more variables and long credit advance history to analyze risk, which should theoretically result in better underwriting compared to traditional methods. Additionally, as its models incorporate more data, they should perform better, so Upstart’s ability to analyze big data and improve its AI models is expected to be a long-term competitive advantage.

artificial intelligence model (upstart)

This is something that won’t be easily replicated by other tech companies or their customers because they have far less data to analyze, so by using Upstart’s platform, banks and credit unions should be able to make better credit risk assessments than they could on their own.

As of the end of 2023, more than 100 banks and credit unions were using its platform, which includes personal loans, retail auto and refinance loans, home equity lines of credit and small dollar loans.

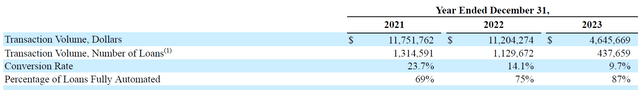

On the consumer side, it has about 2.9 million customers who benefit from its platform through access to lower interest rates, higher approval rates and a digital lending process. In 2023, approximately 87% of loans will be fully automated, allowing borrowers to be automatically approved without uploading any documents. The platform is also interesting for bank and credit union partners because it enables them to acquire new customers, reduce fraud and loss rates, and reduce the cost of originating loans.

In terms of funding sources, loans issued through the Upstart platform can be retained by lending partners, purchased by institutional investors or retained on the company’s balance sheet. In 2023, approximately 48% of loans were purchased by institutional investors, 32% were retained by lending partners, 16% were held by Upstart, and 4% were used in securitization transactions.

In terms of customer diversification, Upstart has significant exposure to its three major partners, which together accounted for about 80% of the loans issued through its platform last year and accounted for about 62% of Upstart’s revenue. This means that Upstart is too concentrated on a small number of partners, which is not positive in the long term, as if one of these important partners decides to leave the platform, it could have a significant impact on Upstart’s revenue and profitability.

Going forward, Upstart’s growth prospects come from a number of factors, including the expansion of platform partners, the addition of new products, and the potential internationalization of the business. In the short term, its growth should come primarily from higher engagement with existing partners and expansion into other types of lending, as it has recently done with home equity loans. If the company starts integrating small business lending and mortgage lending, I think it could significantly increase loan originations on its platform and achieve greater customer diversification and overall business scale over the next few years.

Financial overview

The listed company has a mixed track record in terms of financial performance as the company reported strong growth in 2020-21 and has become profitable although it is still in the early stages of growth. But over the past few years, that has happened Big changes The operating environment for new startups has become more challenging as financing conditions have become tighter.

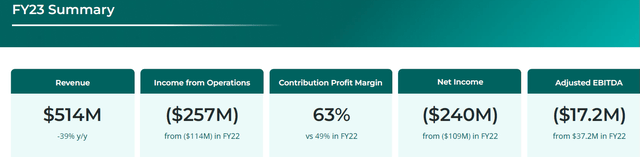

indeed, 2023Its revenue was $514 million, down 39% year over year, and the company reported an operating loss as both adjusted EBITDA and net income were negative last year.

2023 Key Performance Indicators (upstart)

This negative operating performance is justified by a more challenging macroeconomic environment over the past few years. Higher interest rates have also made it more difficult for customers to obtain loans, and on the loan side, financing conditions have become more difficult for institutional investors and banking partners. The tightening has led some lenders and credit investors to stop or reduce investments in Upstart-originated loans.

As a result of this more challenging backdrop, Upstart’s loan originations declined significantly in 2023, both in terms of loan volume and amount, as shown in the table below.

roll (upstart)

This shows that although Upstart’s business model is more focused on technology rather than directly providing loans, its business is still very vulnerable to economic and funding cycles and is directly affected by market credit conditions.

Nonetheless, its strategy is to continue operating as a capital-light operation, retaining loans as appropriate, rather than evolving its business model into a specialist finance company. I think it makes sense in the long term, but until Upstart reaches greater scale and further diversifies its bank and credit union partners and geographies, its business will continue to be cyclical.

Ultimately, I think its business can develop into something similar to the financial industry Uber Technologies (Uber) or Airbnb (ABNB) has successfully ventured into other areas, providing technology services but not owning the “underlying” assets, but so far, Upstart has not been able to apply its artificial intelligence platform to such business models.

This means Upstart may keep the loan on its balance sheet for a period of time, exposing it to potential credit losses in the future, leaving its business with a fee mix more relevant to volume and credit risk.

Longer term, I’d also like to see more revenue come from a subscription-type business, where bank partners would pay for access to Upstart’s platform, which would provide the company with more recurring revenue streams and reduce risk to loan volume .

Regarding the outlook, Upstart gave lower-than-expected guidance for the first quarter of 2024, expecting to generate approximately $125 million in revenue and report a net loss of approximately $75 million, meaning its operating momentum is not expected to improve much in the short term. . Furthermore, this backdrop is likely to remain difficult until the Federal Reserve begins cutting interest rates, which could occur in the second half of the year, potentially easing credit conditions and causing Upstart’s operating momentum to rebound.

That seems to be somewhat what Wall Street expected, considering the current consensus is for the company to post 2024 revenue of $575 million and a net loss of about $224 million, a slight improvement from the previous year. Over the next few years, it is expected to post higher revenues and smaller losses, but I think investors should treat these estimates with caution as the upstart business is highly cyclical and medium-term estimates are likely to be large mistake.

In terms of its valuation, given that Upstart is reporting an operating loss and is not expected to report positive profits in the next few years, the best metric is the EV to sales multiple, which is currently over 5x for a company reporting a loss. For the company, this is not a particularly cost-effective income, and future growth is not expected to be ideal.

in conclusion

Upstart has an interesting business proposition with its AI lending platform that could disrupt the credit space in the long run. However, its expansion in recent years has been modest, both from a partner perspective and a product diversification perspective. This makes me wary of the scalability and long-term sustainability of the business.I think Upstart is quite risky. Let’s take a look. Sophie Technology (SOFI), which I recently profiled here as a better long-term investment in fintech.