Yarikin

Although summer holdings (NEOE:VRNO:CA) (OTCQX: VRNOF) (“Verano”) reported fairly positive fourth quarter 2023 and full year 2023 financial results on February 29, 2024, and while other MSO stock prices have generally risen over the past 2 days, Verano’s The stock price fell The $5.45 per share since the morning of February 29 fell to about $5.00 on March 1 (down nearly 10%), likely because it was unable to file its 10-K on time. Despite the risks, I think this presents a good opportunity for investors to buy Verano stock at a discount, anticipating market sentiment to reset and invest in the U.S. cannabis industry. Therefore, I give Verano a “Buy” rating.

Verano Holdings Company Profile

Verano is one of the largest vertically integrated, multi-state cannabis operators (“MSOs”) in the United States. Verano is also located in Chicago, similar to Green Thumb Industries (“GTI”). Interestingly, the headquarters offices of Verano and GTI are very close to each other, only a 4-minute drive from each other.

Verano operates in the medical and adult markets under the Zen Leaf banner™ and MÜV™ dispensary banner and produces a full line of cannabis products sold under its portfolio of consumer brands including Verano™MÜV™shrewd™Bit™Encore™and Avesia™. Verano operates in 13 states in the United States (Arizona, Arkansas, California, Connecticut, Florida, Illinois, Maryland, Massachusetts, Michigan, Missouri, Nevada, New Jersey, Ohio, Pennsylvania and West Virginia), consists of 14 manufacturing facilities covering over 1,000,000 square feet of farming capacity. GTI is located in 10 of the 13 states where Verano operates (California, Connecticut, Florida, Illinois, Maryland, Massachusetts, Nevada, New Jersey, Ohio, Pennsylvania), making them overlap with each other .

Late filing of 10-K

Although Verano reported fairly positive financial results via a press release and earnings call on February 29, 2024, Verano fails to file 10-K Contact the SEC on time. Verano management stated that they were unable to file the 10-K on time due to factors related to the testing and recording of the company’s internal controls. Management further explained that this is the first year they have had to expedite their 10-K filing and the first year they have provided an annual report on the company’s internal controls over financial reporting.

As a result, the market has reacted negatively to Verano’s price decline of approximately 10% since the morning of February 29, 2024.

If Verano is able to file its 10-K by March 15, 2024 within the 15-day extension granted by the SEC, and Verano does not have to change any financial results reported on February 29, 2024, this will indicate to investors that Verano’s internal Controls over financial reporting are sound and prior negative reactions were unjustified. However, if that doesn’t happen, Verano’s stock price could fall further.

Investing in Verano is almost a gamble right now, but I’m inclined to believe that the stock price decline was an overreaction and that Verano was able to file its 10-K on time. If Verano’s auditors had material concerns about Verano’s financial performance, the auditors would not have permitted Verano to release its financial results on February 29, 2024. Now that the auditor no longer has to deal with filings from other MSOs after the Feb. 29 deadline, it should be able to allocate more resources to complete documentation of tests of internal controls and help Verano file its 10-K on time.

Fourth Quarter Summer 2023 Financial Results

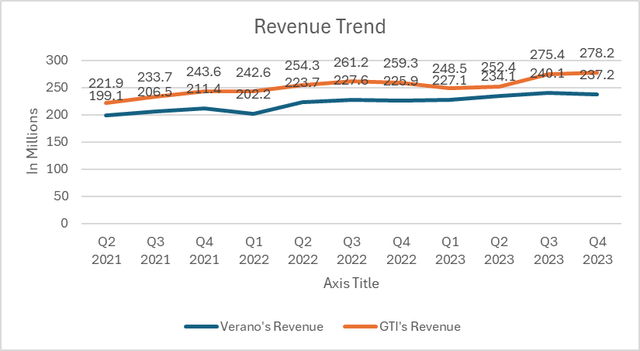

Verano reported revenue of US$237 million in the fourth quarter of 2023, an annual increase of 5%, close to analysts’ high expectations of US$238.3 million. Revenue growth was primarily driven by sales growth in New Jersey, Maryland and Florida.

Verano’s quarterly revenue has kept pace with the GTI’s.

investors.verano.com

Interestingly, Verano and GTI generate very similar revenue per employee, which means their operating structures and efficiencies are also very similar. As of December 31, 2023, GTI has approximately 4,400 employees Verano has approximately 3,780 employees. Based on quarterly revenue in the fourth quarter of 2023, Verano and GTI had average earnings per employee of $62,800 and $63,200, respectively.

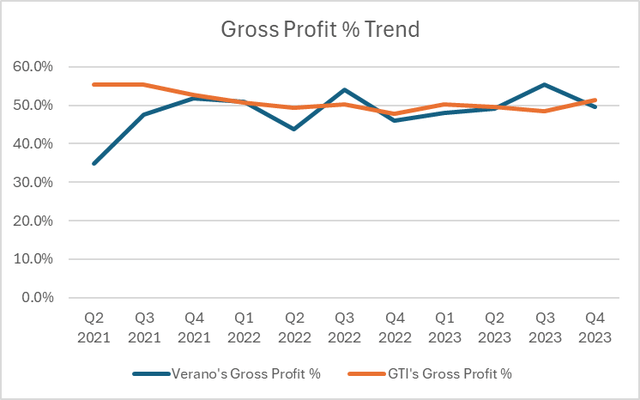

Verano reported gross profit of $117.6 million in Q4 2023 or 49.6% of income. Although gross profit margin decreased slightly from 55.5% in the third quarter of 2023, it increased from 46% in the same period last year. Historically, the Verano’s gross profit percentage has fluctuated more than the GTI’s, but the overall trend has been the same due to price compression in each state.

investors.verano.com

However, the Verano’s cash generation capabilities are lacking compared to the GTI. For all of 2023, GTI generated $225 million in cash from operations and invested $200 million in capex, while Verano generated just $110 million in cash from operations and invested $36 million in capital expenditures.

Capital Structure and 280E Tax Status

Verano’s stock price has been fairly suppressed in the past, in part because its capital structure compares unfavorably to peers like GTI.

While GTI only has $244 million in notes payable with an interest rate of 7%, Verano is in a completely different world. In addition to about $84 million in expensive adjustable-rate mortgages, Verano has a $350 million line of credit that floats at prime rate plus 6.5%, currently at 14%.

Verano paid up to $60 million in interest in 2023 while generating about $110 million in cash from operations.

So it’s no surprise that Verano might be quick to follow Trulieve’s lead in terms of 280E tax status and claiming rebates to help reduce expensive lines of credit if prepayment terms allow it. Verano management said on the earnings call that it was actively evaluating before taking action.

Savvy Thread E-Commerce

While both Verano and GTI recognize the importance of involving artists in promoting their products, converting their followers into their customers, their approaches are somewhat different but similar. While GTI launched the Rhythm Artist Series to vertically target local communities through local artists’ favorite cannabis strains, Verano launches Savvy Threads in Q4 2023is the plant-free e-commerce extension of the Verano Savvy brand, which features limited-edition, artist-driven streetwear that is sold and shipped to all 50 states, targeting a wider audience laterally.

It remains to be seen whether a vertical or horizontal artist-driven approach will be more effective in future seasons.

In addition to the launch of Savvy Threads e-commerce, Verano continues to expand by opening additional retail stores in Florida, Connecticut and Pennsylvania as the legalization of the cannabis industry continues to grow in Maryland. This should increase revenue contribution, offsetting the relatively lower impact. Wholesale revenue growth slowed as dispensary opening rates in New Jersey normalized.

Verano Stock Valuation

As of March 1, 2024, GTI has a market capitalization of approximately $3.12 billion (approximately 3 times revenue or 6.14 times gross profit), while Verano has a market capitalization of $1.74 billion (approximately 1.85 times revenue or gross profit 3.66x), slightly lower than Trulieve at $1.95 billion (1.73x revenue). Similar to other MSOs, Verano’s share price has been rising significantly since August 2023, increasing 34.67% in the past 6 months, while GTI and Trulieve’s share prices have increased 37.32% and 79.7% respectively in the past 6 months. While Trulieve stock has started to rise significantly since January 2024, likely due to factors such as its bold tax strategy and its focus on Florida and the upcoming potential legalization of recreational marijuana, Verano’s stock growth has been roughly in line with GTI Wait for other MSOs to be consistent. The sharp decline in Verano’s stock price between February 29 and March 1 further widened the valuation gap. However, the valuation gap between GTI (6.12 times gross profit) and Verano (3.66 times gross profit) doesn’t entirely make sense.

As mentioned above, the Verano is a similar business to the GTI, but with slightly lower revenue. While interest rates are trending downward from now on and Verano can gradually reduce this line of credit using cash generated from operations, in 1-2 years Verano’s capital structure compared to GTI should be less concerning. Therefore, Verano should be valued at close to 5.2 times its gross profit for the year (about 85% of GTI’s multiple, given the disparity in total revenue), which, similar to GTI, would give Verano a market cap of about $2.47 billion.

While obtaining a 280E tax rebate similar to Trulieve could significantly help Verano accelerate the process of optimizing its capital structure, it is unclear whether Verano can execute the tax strategy as effectively as Trulieve.

Additionally, it remains uncertain whether Verano can file its 10-K in a timely manner without any adjustments to its financial results between now and March 15, 2024.

in conclusion

Despite the setback due to the 10-K filing delay and subsequent price decline, Verano still presents a compelling investment opportunity despite its temporarily unfavorable capital structure compared to GTI. Verano reported strong financial results for the fourth quarter of 2023, demonstrating its continued growth potential in key states such as Florida, New Jersey and Maryland and its ability to reduce debt. The current market overreaction presents a potential window of opportunity between now and March 15, 2024, for investors looking to take advantage of Verano’s long-term prospects. Therefore, I have a Buy rating on Verano, anticipating that it will manage to file its 10-K on time by March 15, 2024, after which market sentiment will reset.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.