Falco

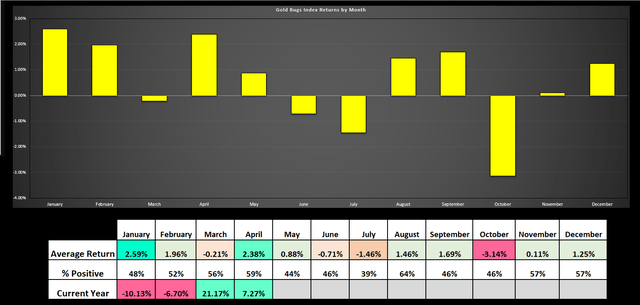

Despite a rocky start to the year, the Gold Miners Index (GDX) has rebounded significantly since March.This is consistent with my view that we are likely to Given that unusually weak January and February typically lead to a very strong March, GDX would stage a significant recovery in the second half of Q1, with the index’s strength exceeding my expectations, returning 21% for the month. Fortunately, the index has continued to follow suit in April and is now outperforming the Nasdaq 100 (NDX, QQ) year to date.

One major beneficiary of the index’s rise is Victoria Gold Corporation (OTCPK:VITFF), is preparing to release first-quarter production results.In this update, we’ll take a closer look at the company’s fourth quarter and fiscal 2023 The results and where the stock’s updated low-risk buying zone lies:

Gold Bug Index Historical Monthly Returns Compared to Current Year – Author’s data and charts

All U.S. dollar figures discussed below are in Canadian dollars (C$) unless U.S. dollars precede the U.S. dollar figure.

Fourth Quarter and Fiscal Year 2023 Results

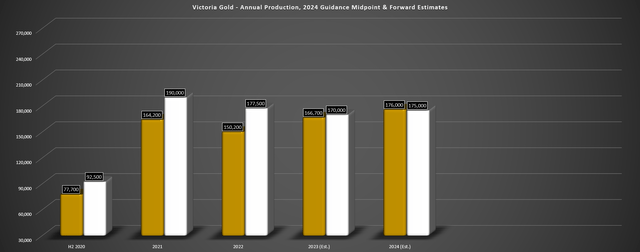

Victoria Gold released its fourth quarter and fiscal 2023 results at the end of February, reporting quarterly gold production of 42,000 ounces and annual production of approximately 166,700 ounces. The company still had a record year (11% year-over-year growth) despite lower production in the fourth quarter, which was affected by wildfires in July and August. Fortunately, revenue in Victoria increased year-on-year despite lower volumes (sales timing and production), and full-year revenue was at a record high, helped by higher average realized gold prices. As for operating results, it has been a much better year overall for the junior gold producer, with an increase in stacked tonnage (34% year-on-year) and a shift to full-year stacking, offsetting a lower grade ranking due to mine reasons, including higher Additional low-grade ore, and some impact from low-grade stocks.

Victoria Gold Annual Production, 2024 Guidance Midpoint and 2024 Estimates – Company Documents, Author Charts and Estimates

Digging further into the results, Victoria stockpiled approximately 9 million tonnes of ore in FY23 (FY2022: approximately 6.62 million tonnes of ore), meaning a daily stockpile rate of approximately 24,600 tonnes, up from approximately 18,100 tonnes in FY22 Ton. At the same time, the mining rate was also higher, reaching approximately 55,300 tons per day (FY2022: approximately 48,000 tons per day), and the accumulation grade was 0.72 grams of gold per ton, down from 0.85 grams of gold per ton in the same period last year. The increase in tonnage mined is due to shorter haul distances, while the tonnage of ore mined is due to a lower stripping ratio. While last year’s production was just below the midpoint of guidance (around 166,700 ounces) compared to last year’s production of 170,000 ounces, I think the company deserves a pass as the East McQuiston fire is on track to deliver and just shy of difference. This was clearly beyond the control of Victoria, who prioritized safety and partially evacuated the site.

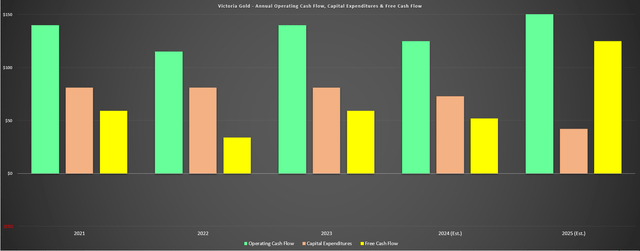

Eagle Gold Mine – Company Website

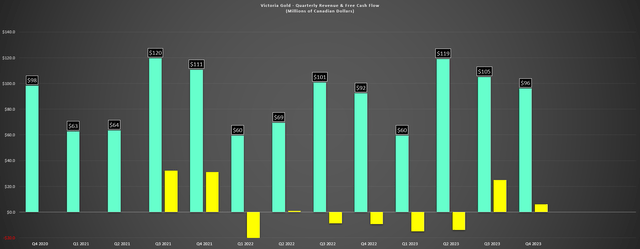

As for financial results, Victoria Gold reported revenue of approximately CAD 95 million and CAD 417 million in the fourth quarter of 2023 and fiscal year 2023, respectively, with annual revenue increasing approximately 30% annually. This was a significant improvement compared to fiscal 2022, driven by an increase in ounces sold and an average realized gold price of $1,929/oz, compared to $1,772/oz in the same period last year. Meanwhile, Victoria reported full-year operating cash flow of approximately C$141 million (FY2022: approximately C$152 million), while expenditure on exploration, property, plant and equipment was lower at approximately C$89 million, while Approximately C$122 million in fiscal 2022. period one year ago. The result was that, despite another difficult year from an inflation perspective and lower overall results, free cash flow generation improved, with Victoria ending the year with approximately $15 million in cash and approximately $236 million in debt. yuan, with net debt of approximately CAD 221 million.

Victoria Gold Quarterly Earnings and Free Cash Flow – Company Filings, Author Charts Victoria Gold operating cash flow (USD) before changes in working capital, capex and free cash flow – Company filings, author chart

cost and profit

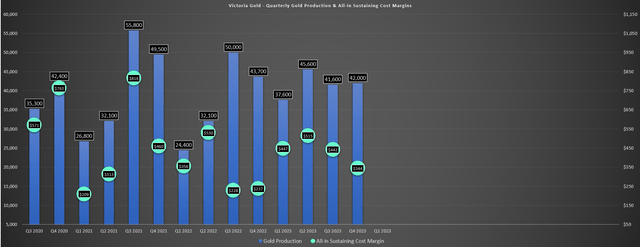

Looking at Victoria’s cost performance, the fourth quarter was another high-cost quarter for the company, impacted by lower volumes (c.36,600 ounces vs. c.40,600 ounces) and inflationary pressures, offset by lower year-on-year maintenance capital . This resulted in fourth-quarter all-in sustaining costs (AISC) of US$1,592 per ounce, an increase of nearly 16% from the same period last year. The good news is that increases in average realized gold prices more than offset this, with Victoria reporting AISC profits of $344/oz, up from $237/oz in Q4 2022. On a full-year basis, costs also declined. Margins improved to $441/oz (22.9%) compared to $331/oz, despite easier grinding (belt joint failures and cooler temperatures leading to lower production in 2022) to $1,488/oz (18.7%), the average realized gold price hit a record high of US$1,929 per ounce.

Victoria Gold Quarterly Gold Production and AISC Profits – Company Documents, Author Charts

As for cost effectiveness, Victoria noted during the fourth-quarter conference call that labor remains the stickiest and its largest source of costs. It’s not helped that this part of the Yukon is getting busier with Hecla Mining (HL) moving into Keno Mountain next door and taking over ATAC’s mineral rights in the area, as well as deals with several North American and Australian producers The appeal was unanimous.Other areas where inflation is taking a toll on producers include consumer goods. Victoria also calls parts a headwind, but parts are one area. Think we could see some improvementsand “Opportunities to replace parts for different suppliers.” Finally, while fuel becomes a thorn in the side of miners in 2022 and rising labor/fuel costs take a heavy toll on large volume and low-grade operators like Victoria, stronger gold prices have led to expectations for a lower gold/oil ratio than in 2022 level, the profit margins of the entire industry have been squeezed.

Gold/Oil Ratio – Stock Chart

Given continued inflationary pressures, Victoria expects 2024 to be another high-cost year, albeit with higher production, with AISC guidance at $1,550/oz (midpoint). If the midpoint is reached, this would result in a cost increase of another 4% compared to fiscal 2023 levels, and costs would be more than 7% higher than the industry average in fiscal 2024. However, while this may be a reason to avoid the stock in an environment of flat or falling gold prices, gold prices have certainly come to the rescue of low-margin producers that have struggled to repay debt in recent years. In fact, gold prices are currently more than 10% above the breakout level of $2,070/oz, and even if we assume AISC rises to closer to $1,620/oz in Q1 2024, margins in Victoria should be roughly flat year-over-year. In the first quarter of 2023, it benefited from the fact that the average gold price in the previous quarter was US$2,070/ounce, which was US$200/ounce higher than the level in the first quarter of 2023.

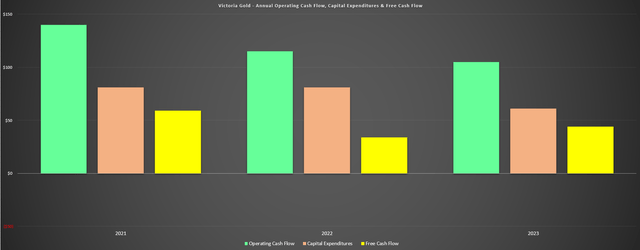

Meanwhile, for the full year, I think a conservative gold price assumption of $2,160/oz would give Victoria Gold an AISC margin of $600/oz assuming an AISC of $1,560/oz in FY24. This would represent a 500 basis point year-over-year improvement in margins (27.9% vs. 22.9%), but it’s important to remember that fiscal 2024 is a year of rising costs due to increased waste stripping. If we look ahead to FY25, I think an AISC of $1,220/oz is achievable and, assuming a gold price of $2,200/oz, AISC margins will improve to $980/oz (44.5%). So while Victoria will be free cash flow positive this year and end the year with a stronger balance sheet, FY25 will be a huge year if gold prices can hold on to most of their gains.

Valuation

Based on approximately 68 million shares and a share price of $5.90, Victoria has a market capitalization of approximately $400 million and an enterprise value of approximately $570 million. This leaves the company with a P/E/NAV of only about 0.55x and a projected NAV of about $730 million (long-term gold price of $1,900/oz), a valuation that remains high despite the recent gains. Attractive, has the potential to generate about $50 million in free cash flow this year and about $120 million in 2024. So while Victoria trades at around 11x FY2024 EV/FCF, I think it’s fully valued for a small single asset, with producers trading at only around 4.5x FY25 EV/FCF. times, and for patient investors, assuming gold prices can maintain their recent breakout, that means huge upside potential.

Victoria Jinannua; Operating cash flow, capital expenditures and free cash flow – company filings, author chart

So, what is the fair value of the stock?

Using what I consider to be a conservative 0.90x P/NAV and 5.0x P/CF (average 2024/2025 estimates) and a 65/35 weighting of P/NAV to average 2024/2025 P/CF, I see the stock’s The fair value is $9.60. This upward revision to estimated fair value represents a 65% increase in fair value, suggesting Victoria could trade at a higher price next year, especially with free cash flow set to increase significantly in 2025. That said, I’m looking for a starting position that has at least a 45% discount to fair value when it comes to a single asset producer, and if we apply that discount to its updated fair value estimate of $9.60, Victoria updated The subsequent low-risk buy zone is at $5.30 or lower. So while its fair value is undoubtedly reasonable, it’s difficult to justify a move above $6.00 as the stock begins a short-term extension.

generalize

Victoria Gold is set for a strong 2023, with production ramping up and free cash flow generation set to improve significantly over the next two years. This could not come at a better time than gold prices are surging, and although inflationary pressures have yet to abate, stronger gold prices will help offset lost profits in the 2021-2023 period.

That said, as highlighted in my previous update, the ideal buying area for Victoria Gold shares is below $4.00. With this buy zone charging over the past month, I don’t think the current price of $5.90 is a low-risk setup. So while I think Victoria is one of the better buy-on-the-dip candidates as margins are expected to improve significantly this year and next and valuations are attractive, I think a better course of action is to prepare for a pullback and buy Enter instead of chasing the stock above $6.00.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.