Ugur Khan

Viper Energy (NASDAQ: VNOM) now expects to generate free cash flow per share of $3.76 by 2024 at current strip prices. That’s an increase of $0.26 per share compared to when I looked in 2020. January, mainly due to stronger oil prices. About 56% of Viper’s production is oil, and it fully participated in the rise in oil prices until oil reached around $90.

Viper also raised its total 2024 production guidance by 1,000 BOEPD, which should benefit from Diamondback’s Massive Endeavor Transactions leading to future decline opportunities.

That being said, I’m neutral on Viper right now given that it’s up 30% since my January report. Currently, it appears to be fairly priced for the long-term WTI oil environment of over $70.

hedge

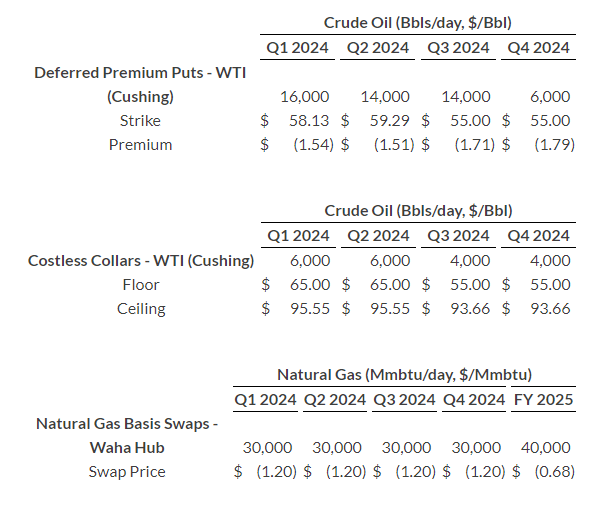

Viper’s oil hedge didn’t really make much of an impact Its financial performance, in addition to the need to pay $7 million in deferred put option premiums. Viper has some protection against a sharp drop in oil prices, typically to $50, while it is capped at 17% of its projected oil production from the second quarter of 2024 to the fourth quarter of 2024. However, that cap averages around $90, so strip prices are essentially likely to rise by more than $10 before Viper’s upside exposure to oil prices diminishes. Viper currently has no oil hedges beyond 2024.

viper hedge (viperenergy.com)

Approximately 48% of Viper’s natural gas production is also hedged through the Waha basis hedge. In 2024, Waha has a negative $1.20 hedge against NYMEX, which seems slightly negative for the full year, but provides some near-term production as well as immediate contract Waha basis Reaching negative $2. Viper’s 2025 Waha basis hedge trades at negative $0.68 against NYMEX, 52 cents higher than the 2024 hedge.

2024 Outlook and Valuation Notes

Viper maintained its 2024 oil production guidance at 25,500 to 27,500 barrels of oil per day but increased its overall production guidance by 1,000 BOEPD to a new range of 45,500 to 49,000 BOEPD.

In 2024, WTI oil strip prices have risen to about $82, but Henry Hub prices have fallen to $2.40. At these commodity prices, Viper could generate $937 million in revenue after hedging.

|

type |

Bucket/Mcf |

Realized USD per barrel/Mcf |

Revenue (USD million) |

|

Oil (barrel) |

9,672,500 |

$81.00 |

$783 |

|

NGL (barrel) |

3,786,875 |

$24.00 |

$91 |

|

Natural Gas(MCF) |

22,721,250 |

$1.40 |

$32 |

|

Lease dividends and other income |

$40 |

||

|

Hedge value |

-$9 |

||

|

all |

$937 |

Viper currently expects to generate $665 million in free cash flow in 2024, including free cash flow attributable to Diamondback’s non-controlling interest in Viper.

Free cash flow is expected to total approximately $3.76 per share in 2024.

|

One million U.S. dollars |

|

|

Production taxes and ad valorem taxes |

$63 |

|

cash management fees |

$16 |

|

cash interest |

$69 |

|

cash tax |

$124 |

|

Total cost |

$272 |

Based on Viper’s 75% payout ratio, expected 2024 shareholder returns are $2.82 per share, or a quarterly average of $0.70 to $0.71 per share.

Viper’s basic quarterly dividend is $0.27 per share. It spent $95 million on stock repurchases in 2023. If it spends $100 million on stock repurchases in 2024, that would allow it to pay a base and variable dividend of about $2.26 per share in 2024, or an average quarterly rate of $0.56 to $0.57 per share.

I raised my Viper value estimate by $2 per share, to $37 to $38 per share based on long-term (post-2024) $75 WTI oil. This reflects expectations for improved free cash flow in 2024 and a slight increase in Viper’s production guidance.

Diamondbacks Endeavor Trade The future may also bring more opportunities for Viper. However, I haven’t put a value on this yet and will revise the Viper’s estimated value based on future announcements of pull-down deals.

in conclusion

Viper Energy currently expects free cash flow to reach $665 million in 2024, or approximately $3.76 per share. It was not fully exposed to rising oil prices until the mid-1990s, so it has benefited from recent increases in oil-belt prices.

Viper’s 2024 production guidance also increased from initial estimates. While it did not raise its oil production guidance, total production guidance was raised by 1,000 BOEPD.

I now believe Viper Energy is close to being reasonably priced for a long-term $75 WTI oil environment. I raise my long-term oil valuation to $37 to $38 per share.

Viper trades slightly above that level, more reflecting an oil environment of long-term highs in the $70s or 2024 production at the upper end of its guidance. Viper’s value could also be boosted through a pull-down trade involving Endeavor’s assets, although I haven’t actually factored that into Viper’s current estimated value. I now have a Neutral rating on Viper as its shares are up 30% since January.