big river

Envision Energy (NYSE: VIST) is one of Argentina’s largest oil producers and exporters and the only purely listed oil company in the Vaca Muerta Basin on the market.

I have been recommending Vista since October 2021 (the first analyst to recommend name in Seeking Alpha) and has since returned over 400%.My latest article comes from December 2023 The company’s development plans were analyzed and the name continued to be recommended.

In this article, I review the fourth-quarter 2023 results, earnings call, and fiscal 2024 guidance, and get back closer to the valuation after it rose 40% since the December article. My conclusion is that the stock is still a buy given the high return on capital at current oil prices, low breakeven price, incremental investment opportunities, and modest valuation.

Operational improvements in all aspects

Vista’s fiscal year 2023 saw progress in nearly every area.The company’s operational excellence has has been the backbone of its successful growth and consequent stock price rise.

Production increased by 17%: When comparing FY22 and FY23 data, Vista production growth appears to have stalled.However, we must remember that the company divested its conventional assets In February. After adjusting for divestment, unconventional production increased by nearly 20%, with the annual average daily production reaching 52,000 barrels, and the withdrawal rate in the fourth quarter was 60,000 barrels.

cost improvement: The company’s ramp-up costs have declined and currently stand at US$4.3/boe, with drilling and completion costs of US$14.3 million per well, equivalent to a D&A cost of US$10 per barrel (Investor Relations Introduction). Management commented that cost reductions should stabilize as most of the scale gains have been achieved.

Still, this represents projected total operating expenses (including SG&A and D&A) for non-routine operations of $592 million (Note 30 Excluding other operating income from foreign exchange gains in the financial statements), divided by the 19 million barrels of oil equivalent produced during the year, the breakeven for the entire business was US$31.

Gore’s improvement: The proportion of natural gas in total production dropped to 14.6% in fiscal 2023, compared with 16.5% in fiscal 2022. By 4Q23, this ratio dropped to 13.1%. Primarily extracting oil is essential because oil can be easily exported, which means its price is more stable. In contrast, the ability to export natural gas is highly constrained (Argentina has no LNG terminals and lacks adequate pipeline connections to neighboring countries), which can easily lead to oversaturated markets.

Invest in high ROI growth

Buffett believes that the best type of business is one that can earn a high return on capital and be able to reinvest in the business at a high rate of return.

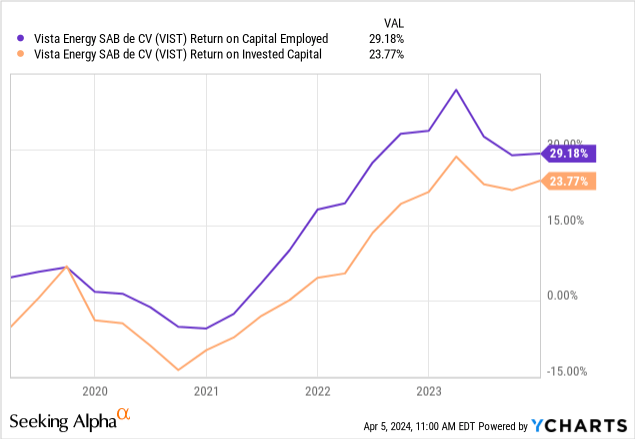

With such low mining costs and low overall operating costs, Vista’s return on capital is impressive. My favorite metric is ROCE because it doesn’t include changes in capital structure, but ROIC (return on equity) is also excellent.

And the company still has a lot of room for growth. Its P1 reserves are 320 million barrels, equivalent to 15 years of production (60,000 barrels per day). The current healthy inventory is about 1,200 wells, and the company plans to add about 50 wells per year. The inventory is likely to expand as the company develops more operations in the Aguilamora and Baja del Palo Este areas, where only a few wells have been drilled and estimates will have to be more conservative.

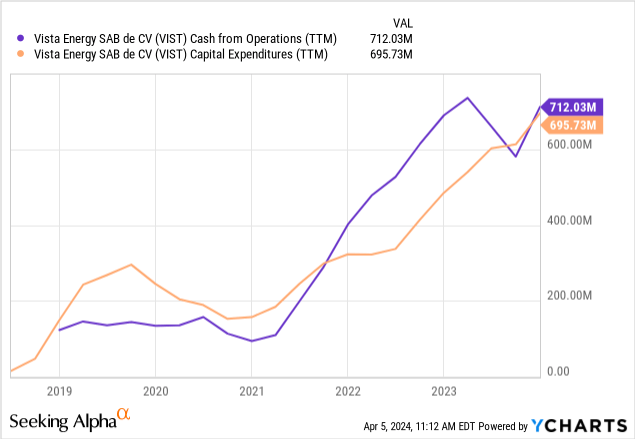

The company does not need to take on debt to fund this expansion. The company plans to spend approximately $900 million in capital expenditures over the next few years to drill 46 wells per year (of which $150 million will be spent on general infrastructure). With Argentina’s current realized oil price of about $65, the company can generate well over $1 billion in CFO (fourth quarter CFO was $350 million) to self-sustain this level of investment. Vista’s net debt was just $200 million, compared with the CFO’s $350 million in debt in the first quarter. The company is almost entirely self-funded.

Management also mentioned on the conference call that they will focus on the central development centers (Bajada del Palo Oeste, Este and Coiron Amargo). The BPO is the company’s main asset and is responsible for the production of 40,000 barrels per day. The company appears uninterested in acquiring the properties of ExxonMobil (XOM), which is in the process of divesting assets in Vaca Muerta.

Brent crude oil price is $65, growth valuation is not attractive

Vista has many quality characteristics: long run, operational excellence management, low production costs, high returns on capital, tremendous opportunity to deploy additional capital, and negligible leverage.

However, while the stock has appreciated over 400% in the past three years, 100% in the past year and 40% since December alone, given that there is no further growth after FY2024 and Brent crude oil prices Constantly changing, its pricing remains attractive. to US$65 per barrel.

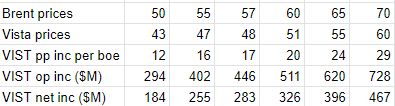

In my previous article, I provided a table showing the company’s net profit at different prices, taking into account the 10/15% discount Argentinian exporters receive from Brent crude, and the total cost per barrel of oil equivalent is US$27, with an income tax of 35%, assuming production of 70,000 barrels of oil equivalent per day, which is the company’s 2024 target. For this article, we can adjust the total annual cost to $30 and the interest cost to $10 million. The modified form is as follows.

Simple Vista profit model of 70k barrels of oil equivalent/day (author)

The company is currently valued at approximately US$4 billion, and FY24 Brent crude oil production of US$65 per barrel could achieve a profit margin of 10% compared to current production of US$90 per barrel. With oil prices down 30% and production stagnant, the company’s pricing can be considered fair.

This valuation leaves open any upside potential from market unification in Argentina, the elimination of the 8% export excise tax, and continued expansion of production (the company plans to reach 100,000 barrels in 2026).

In my opinion, this is the definition of an undervalued security, even though the price has risen significantly. The company’s valuation is driven by a worse oil situation and the absence of any production expansion. However, the company can continue to expand at very high incremental returns and has a management team that has proven capable of delivering that growth.

Therefore, despite the appreciation for Vista, I still view Vista as an opportunity and maintain my Buy rating.