Stuart Franklin/Getty Images News

investment thesis

I think Volkswagen has the ability to rise to $18 due to strong demand for the company’s electric vehicle products.

In a previous post in June In 2022, I proposed Volkswagen AG (OTCPK: Volkswagen) has the ability to rise in the future based on its growing inventory ratio and strong quick ratio performance.

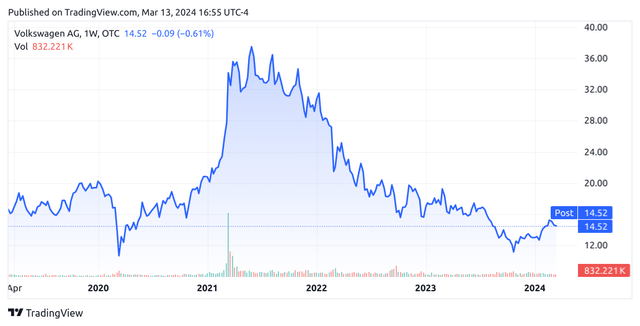

The stock has since fallen to $14.52 as of this writing:

TradingView.com

The purpose of this article is to assess whether Volkswagen AG is capable of a growth rebound given its recent performance.

Performance

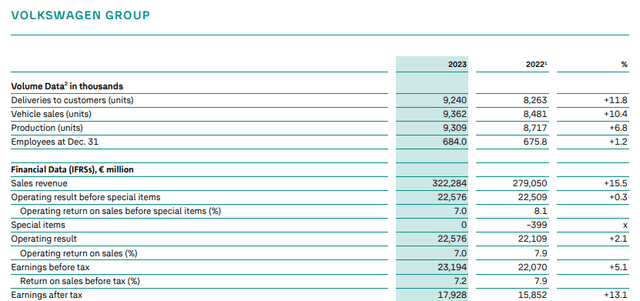

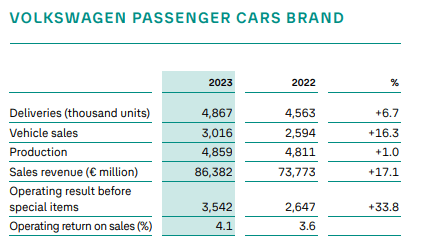

When looking at recent earnings result For the data released by Volkswagen on March 13, 2024, we can see that car sales increased by 10.4%, and profits increased by 10.4%. After tax, it rose 13.1%.

Volkswagen Annual Report 2023

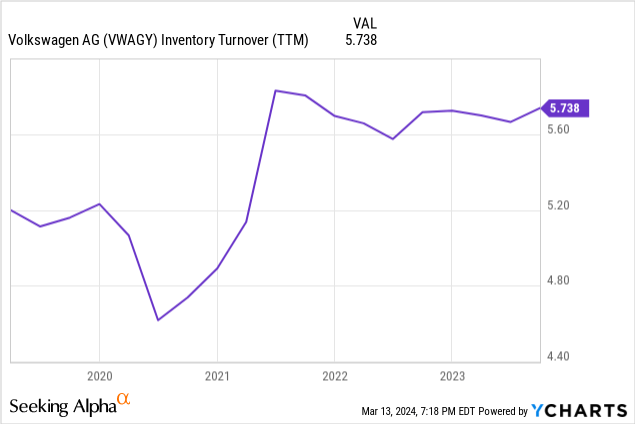

I’ve previously praised Volkswagen for improving its inventory turns, which suggests the company is selling inventory at a faster rate despite supply chain issues and inflationary pressures.

That being said, we found that while the ratio grew as of mid-2021, the inventory turns rate has since stabilized:

ycharts.com

When looking at Volkswagen’s balance sheet, we can see that the long-term debt to EBITDA ratio has declined and remains below 1, which is encouraging as it suggests the company has been able to pay down its debt while still financing profitable growth. .

| 2022 | 2023 | |

| long term debt | 33717 | 29101 |

| Interest, tax, depreciation and amortization advance profit | 37325 | 36513 |

| EBITDA long-term debt | 0.90 | 0.80 |

Source: Data from Volkswagen’s 2023 annual report. Author’s calculation of long-term debt to EBITDA ratio.

While short-term debt has increased from over €82 million in 2022 to over €112 million in 2023, this reflects that the company is now repaying its long-term debt load over a shorter period of time, and I think that while the long-term debt load – Term debt continues to fall and earnings continue to rise – then the company should be well-positioned to fund further growth in sales and earnings.

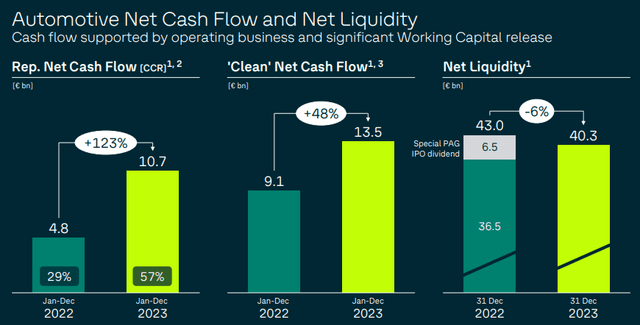

Additionally, we’ve seen Volkswagen’s cash flow grow significantly over the past year:

Volkswagen AG: Annual Media, Analyst and Investor Conference 2024

From that perspective, I think last year’s results were generally encouraging — even though we saw the stock fall.

My opinion and outlook

In terms of my take on the above results and the implications for the stock’s future growth trajectory, while Volkswagen’s results last year were impressive, the outlook for 2024 is bleaker.Specifically, Volkswagen expects deliveries to grow 3% Continued high inflation is dampening consumer demand compared with last year.

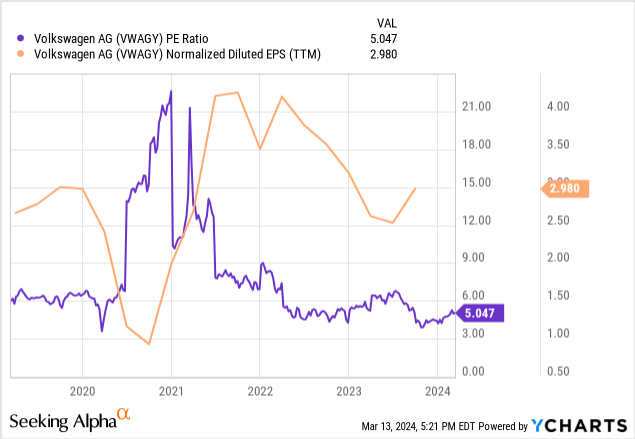

In terms of valuations, here are the ranges for P/E ratios, EPS and share prices since September 2020:

| date | P/E ratio | Earnings per share | price |

| 12/09/20 | 16.23 | 1.163 | 18.882 |

| 12/03/21 | 13.96 | 1.989 | 27.77 |

| 12/09/21 | 7.859 | 4.205 | 33.042 |

| 12/03/22 | 6.301 | 3.504 | 22.0775 |

| 12/09/22 | 5.26 | 3.821 | 20.1 |

| 12/03/23 | 5.748 | 3.187 | 18.32 |

| 12/09/23 | 5.314 | 2.529 | 13.44 |

| 12/03/24 | 5.047 | 2.98 | 15.04 |

| median | 6.0245 | 3.0835 | 19.491 |

Source: Author’s calculations. Price-to-earnings ratio and earnings per share data come from YCharts. Historical prices are from Nasdaq.

Here’s a chart of P/E ratios and EPS over the past five years:

ycharts.com

We can see from the table above that the P/E ratio currently stands at 5.047x, which is lower than the median of 6.0245x for the given period. In this regard, I believe that if the stock’s median P/E ratio falls back to 6.0245x and EPS remains at the current level of $2.980, then $17.95 would represent fair value for the stock this time around (6.0245/2.980 ) – compared to the current price of $14.52.

I’ve noted before that a potential risk for Volkswagen is lower-than-expected EV demand and the company’s inability to keep up with competition from Tesla (TSLA).

However, in 2023, Volkswagen is making significant progress in electric vehicles with the debut of the all-electric ID.7 sedan and the launch of the new Tiguan. The company produced 8,592 ID.7 models and 28,611 Tiguan models, both of which were the most produced models in 2023 with 633,147 units.

This resulted in a 16.3% increase in vehicle sales compared to the previous year.

Volkswagen Annual Report 2023

Although the company expects growth to slow this year due to expected lower consumer demand, I think the company is still capable of growing 3% above forecast this year if we see EV demand continue to grow. Volkswagen plans to launch the all-electric ID.7 Tourer to the market in 2024, and the T-Cross and Tiguan models will also undergo product upgrades.

From that perspective, I’ll be watching closely over the next few quarters to see if auto sales have the ability to achieve deliveries above 3% this year. If the response to Volkswagen’s new electric models is better than expected, then that could mean the stock has the ability to push its gains back to just under $18 (at the above valuation).

risk

In terms of potential risks for Volkswagen right now, the main risk is that consumer demand is indeed lower than last year, and higher prices ultimately lead to lower deliveries.

For example, we saw that Volkswagen had to reduce price Its several IDs. Models are spread across various European markets to maintain market share. If price competition becomes particularly fierce, then this could severely impact the profitability of VW’s EV division and we could see sales revenue decline as a result.

in conclusion

All in all, Volkswagen’s 2023 results are encouraging, with more modest growth expected in 2024. However, I think if we see continued demand from the EV segment, sales could be better than expected. If this proves to be the case, the stock has the ability to rise further. Therefore, I am bullish on Volkswagen Group.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.