Le Chatrenoy

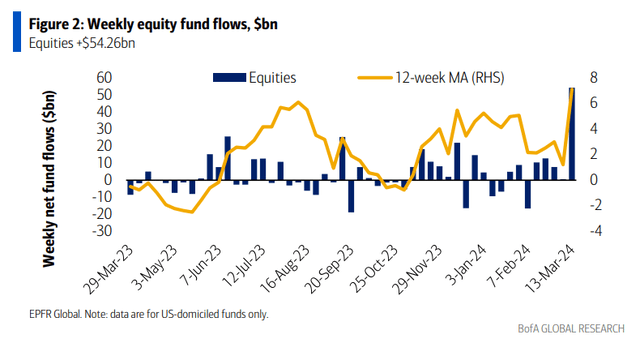

Investors have pour money Enter U.S. stocks.According to EPFR’s fund flow update this week, equities received huge capital inflows of $56 billion, the largest inflows since March 2021, a period characterized by heavy fiscal stimulus with an accommodative Fed. Today, the effective funds rate is at 5.32%, and the prospect of a rate cut continues to be pushed back – we’ll talk more about that later.

Let’s look at a series of key market charts to determine the S&P 500’s outlook. reiterate Vanguard S&P 500 ETF’s Hold Rating (New York Stock Exchange: Flight) As the sector rotation evolves, some of the leaders in the recent bull market are showing signs of weakness.

EPFR Weekly Equity Funds Flow Data: Huge Inflows Last Week

Bank of America Global Research

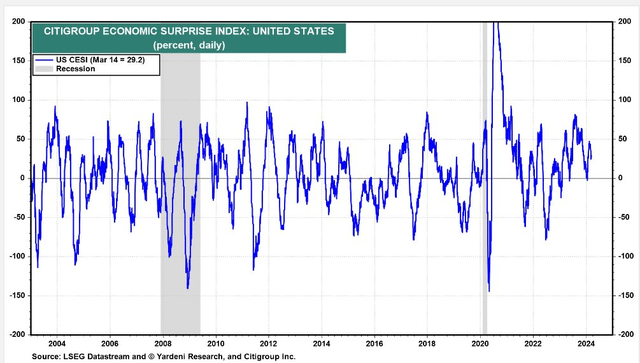

Big picture, recent economic data The index held there despite continued weakness in manufacturing surveys, a weak retail sales report in February and a disappointing spending picture in January.

It is becoming increasingly clear that consumers, especially those on lower wages, are reining in their spending. On Friday, Goldman Sachs cut its first-quarter GDP tracking forecast to just 1.6%, below the Atlanta Fed’s GDPnow model. still, VOO Exhibits Stock Price Momentum ETF Levels Seeking Alpha of a A, which improved from three months ago, remains Bullish compared to September 2023.

Citi Economic Surprise Index: Off Highs, But Still Optimistic

Yardeni Research

But are there risks emerging that could threaten the rally? One concerning data point is the situation with gasoline futures. RBOB spot monthly fees are now close to $2.70, the highest level since the third quarter of last year. Add 95 cents to that price and you’ll get the national average retail price for a gallon of regular gasoline in a few weeks. So with the spring break season approaching and the Easter long weekend later this month, motorists will be spending more money to fuel their trips and workday commutes.

Generally speaking Bullish trend in energy commodities However, it’s been a boon for the S&P 500’s energy sector. Sector ETFs tracking oil and gas names are currently posting record total returns. I think this is a positive for VOO as long as consumer-oriented industries and high-growth technology groups can persist.

RBOB gasoline futures rise to $2.70 – multi-month high

trading view

Another headwind? interest rate. The benchmark 10-year Treasury yield is now above 4.3%. It was also on track to post its highest weekly close since September last year.

Typically, in times of inflation, interest rates and commodities move in tandem – which is what we saw in the first half of 2022. Recall that VOO was struggling during that time.

10-year Treasury bond rate jumps above 4.3%

trading view

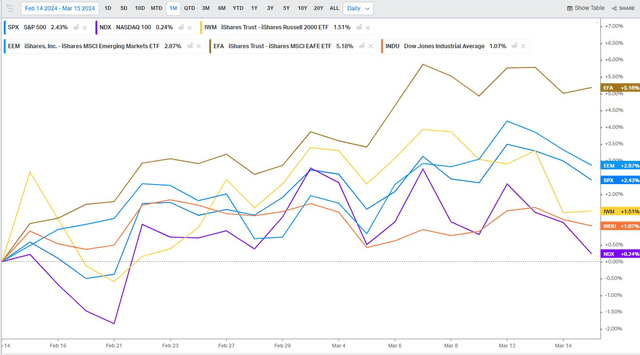

In the near term, domestic large-cap stocks have performed well over the last month, although the pace of gains we saw in the last 10 weeks of last year has certainly slowed.

In fact, it’s foreign stocks that have attracted the bulls’ attention. Developed market stocks outside the United States are up sharply from a month ago, while the Nasdaq 100 gave back some of its early-year gains.

1-month stock performance: EFA leads SPX

Coifen Chart

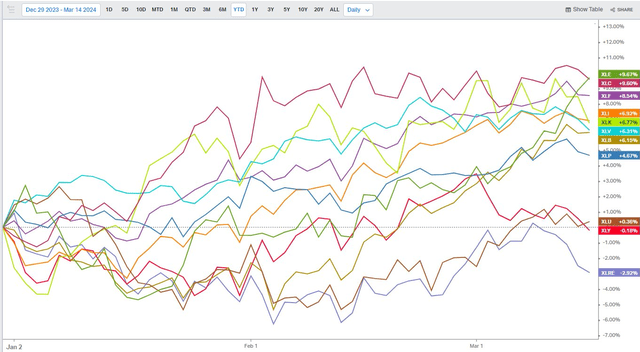

Looking at the industry, the leading S&P 500 stock group so far this year is indeed the Energy Sector ETF (XLE). Communication Services (XLC) has been, for all intents and purposes, tied to the Oil & Gas ETF since early 2024.

Rising interest rates continue to leave a mark on earnings-sensitive industries such as real estate (XLRE) and utilities (XLU). While the picture is mixed in some respects, we will definitely see the rally extending as the shakeout in “magnificent” stocks continues, with cyclical and value sectors at or near all-time highs.

YTD S&P 500 Industry Performance: Energy Now Leading

Coifen Chart

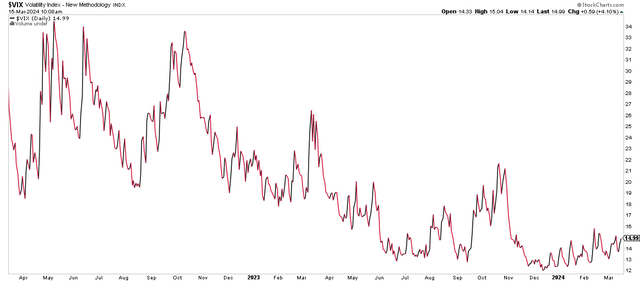

Speaking of volatility, the VIX index has been trending higher all year. Few strategists talk about this, but it should be a concern for bulls. The modest increase in protection costs could signal more volatile price action in the coming weeks, further leading me to remain cautious on the stock for the time being.

CBOE Volatility Index: Climbs as stocks rise

Stockcharts.com

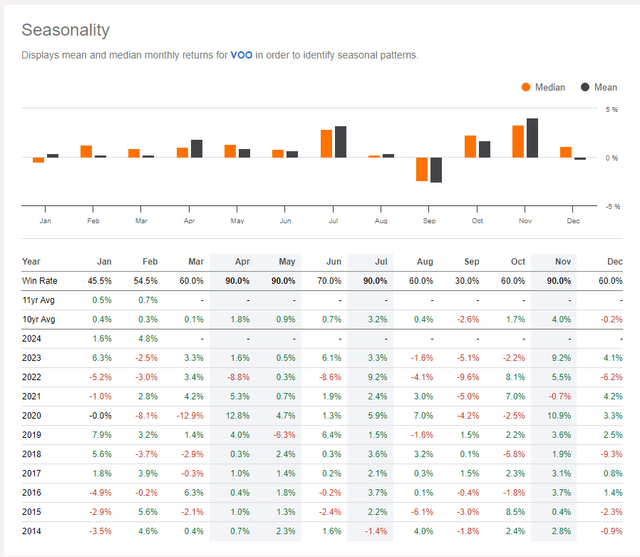

Of course, seasonality is now playing into VOO’s tailwind. Fifty-two weeks ago, the S&P 500 bottomed during a brief bout of regional banking turmoil. Since then, VOO has returned about 35% (including dividends).

Looking ahead, April to July has been a very bullish period for VOO over the past decade, with average total gains approaching 7%. April’s performance has been positive in all but one of the past 10 years.

VOO: Bullish seasonal trend from April to July

Seeking Alpha

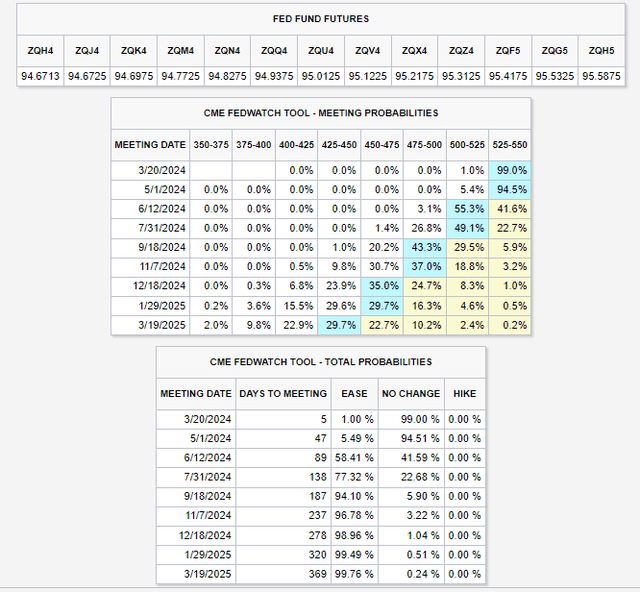

No VOO analysis would be complete without mentioning the latest monetary policy outlook.Follow more Inflation data warm this week,Right now February CPI and PPI reports show that the rate cut in 2024 is currently less than 70 basis points.

Some experts assert that the FOMC may not raise rates at all this year – in my opinion, we’d need to see continued strong growth data and a clearer peg in the inflation chart for that to happen. Truvlaki and other real-time consumer price indicators, including a Jeremy Schwartz at WisdomTreeshowing that inflation is under control.

Interest rate cuts expected to be smaller in 2024

CME Group Fed Watch Tool

Technical points

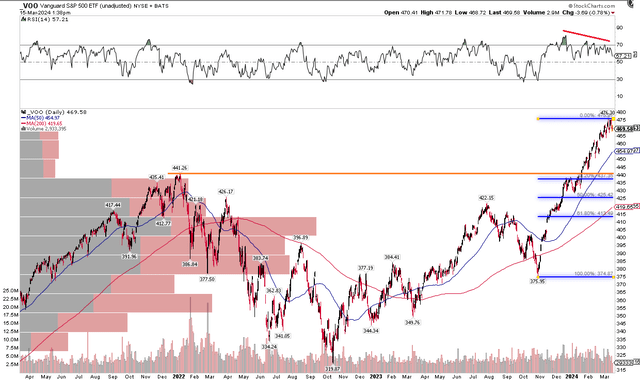

With VOO currently trading at nearly 21 times forward operating earnings estimates and current market interest rates above 4%, the value argument is becoming increasingly difficult. But what does the chart show? Let’s solve this problem together.

Note that in the image below, not much has changed over the past few months, but I have annotated potential areas where VOO could fall back. The 38.2% Fibonacci retracement level from last October’s low to earlier this month is in play at just under $440. The price overlaps with the all-time high from early 2022 at $441. A normal 10% correction would take VOO to $428 – right near the lows seen at the start of the year.

VOO remains 12% above its long-term 200-day moving average, which has been stretched. Given that the RSI momentum trend continues to be bearish as price rises, at least a partial pullback toward the 200-day moving average would make sense.

VOO: Focus on key areas on the downside

Stockcharts.com

bottom line

Overall, I reiterate my Hold rating on VOO. I think valuations are at a premium, but continued sector rotation has proven to be a bullish force as large-cap tech stocks struggle. Rising gasoline prices and borrowing rates are macro risks, while bullish seasonal patterns will support higher VOO prices. Keep an eye on the skill levels as Season 2 begins.