Ryasik

The outlook for inflation is looking increasingly uncertain, and while the Federal Reserve has signaled that it intends to cut interest rates this year, the reality is that no one really knows for sure what will happen next.If you are an investor looking for stable income and low portfolio duration To eliminate the risk of interest rates not falling or even rising further, you may want to consider Invesco Variable Rate Investment Grade ETF (NASDAQ: VRIG). VRIG is an actively managed ETF that invests primarily in advanced variable rate instruments. The fund’s objective is to generate current income while maintaining low portfolio duration. The second goal is capital appreciation.

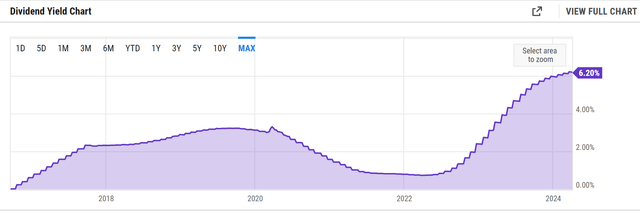

The fund’s appeal is the variable rate dynamic, which explains why the yield has risen sharply over the past two years and currently yields 6.2%

ycharts.com

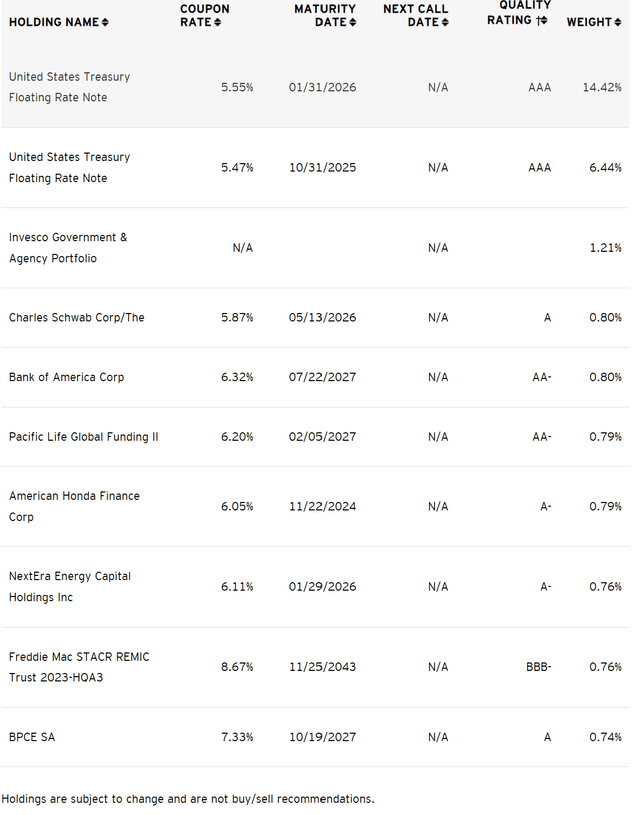

Take a look at ETF holdings

this The VRIG ETF’s diverse portfolio includes floating-rate U.S. Treasury securities, government-sponsored agency mortgage-backed securities, U.S. agency debt, structured securities and floating-rate investment-grade corporate securities. It can also invest up to 20% in non-investment grade securities. The fund’s main holdings are mainly U.S. Treasury floating-rate notes and high-grade corporate bonds issued by companies such as Bank of America and Charles Schwab.

invesco.com

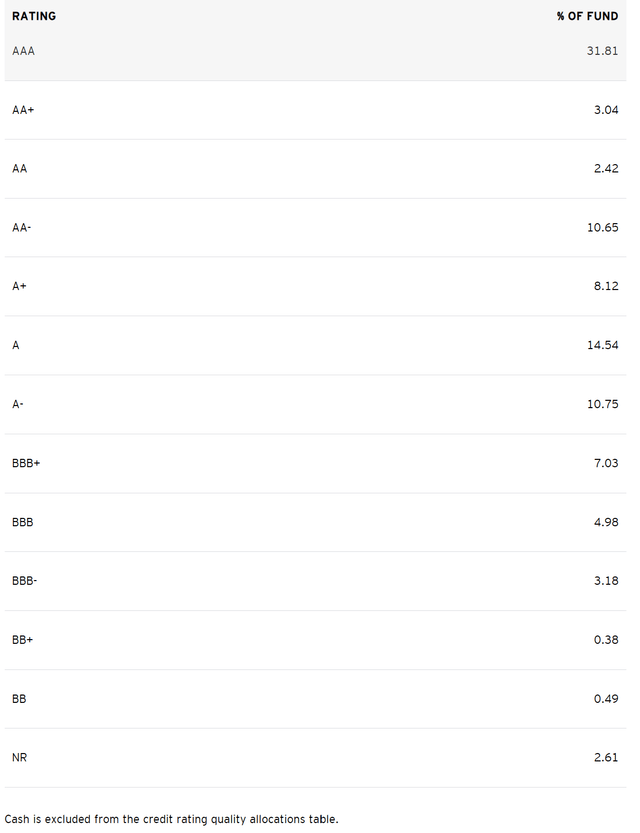

Importantly, the fund’s holdings have high credit quality ratings, indicating minimal default risk. This is important to me given my concerns about credit events.

invesco.com

Industrial composition and geographical distribution

VRIG has significant allocations in the securitization, corporate and financial sectors. As of the end of 2023, 40.63% of the fund’s investment portfolio was securitized securities, 37.64% was corporate securities, and 21.73% was Treasury bonds.

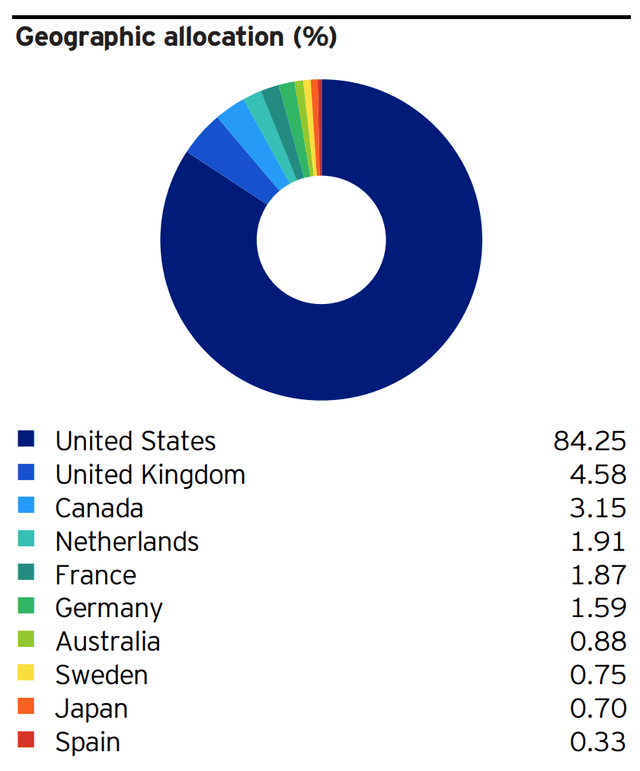

Geographically, the fund’s investment focus is the United States, with 84.25% of its portfolio invested in U.S. assets. The rest are in the United Kingdom, Canada, the Netherlands, France, Germany, Australia, Sweden, Japan and Spain.

invesco.com

VRIG Compares to Peer ETFs

Both VRIG and the iShares Floating Rate Bond ETF (FLOT) cater to investors seeking exposure to floating-rate bonds, thereby minimizing interest rate risk. VRIG is an actively managed fund under Invesco that focuses on investment-grade floating rate instruments, primarily denominated in U.S. dollars and issued in the United States. FLOT, on the other hand, is a passively managed ETF from iShares that tracks the Bloomberg U.S. Floating Rate Notes <5-Year Index, which emphasizes short-term, high-quality notes with a rating of A or higher, 82%. FLOT's larger asset base and lower expense ratio of 0.15% make it more attractive to cost-conscious investors seeking stability and lower volatility amid rising interest rates.

VRIG performs better than FLOT relative to FLOT, but the difference is not significant.

stockcharts.com

Weigh the pros and cons

One of the most significant advantages of investing in VRIG is its short duration (near 0), which reduces sensitivity to changes in interest rates. This feature, coupled with its focus on investment-grade securities, makes it an attractive option for conservative investors looking for stable income.

However, the fund’s reliance on floating-rate securities means its yields could fall if short-term interest rates fall. Additionally, although the fund focuses on high-grade bonds, it does have some credit risk, particularly exposure to non-investment grade securities and corporate bonds.

Should you invest in VRIG?

The decision to invest in VRIG should be based on your investment objectives, risk tolerance and market prospects. If you think interest rates will stay high or rise, and you’re comfortable with the fund’s credit risk, VRIG may be a good choice. Its attractive yield and short duration provide some protection against rising interest rates. However, if you expect interest rates to fall or are concerned about credit risk, other investment options may be more suitable.

Overall, this is a good fund that fits well into a conservative asset allocation mix. Just understand that every time we go back to a lower interest rate environment, it’s going to behave differently.