Daniel Grizzell

Small-cap stocks have performed poorly relative to large-cap stocks. Value has been performing poorly relative to growth. But the one fact associated with all situations is that they all change.At some point I think the small and valuable should take the lead again.If you agree, then Vanguard Russell 2000 Value Index Fund ETF Stock (Nasdaq ticker: VTWV) is worth a look. VTWV is an exchange-traded fund designed to track the Russell 2000 Value Index, which represents U.S. small-cap value stocks. The idea of combining value and size factors forms the core of VTWV’s investment strategy, an approach rooted in the Fama-French three-factor model.

The VTWV Fund has been operating since September 2010 and provides investors with the opportunity to invest in small-cap stocks on the U.S. stock market.It has a portfolio of over 1,400 holdings with a 12-month distribution yield is 1.93%, and the total expense ratio is 0.15%. VTWV is a direct competitor of the iShares Russell 2000 Value ETF (OK), which follows the same index but has a slightly higher total expense ratio of 0.24%.

Look at the shares held

The top 10 holdings account for just 4.67% of the portfolio, reflecting the diversified nature of the fund. Let’s take a closer look at the top 5 positions:

- Chord Energy Corporation (CHRD): Chord Energy Corp., which makes up 0.53% of the fund, is one of the leading players in the energy sector.

- Nanzhou Company (single sideband): South State Corp., with a weight of 0.50%, is a well-known name in the financial sector.

- Commercial Metals Corporation (Sodium carboxymethyl cellulose): Commercial Metals Co. holds 0.49% of the fund’s portfolio. The company is engaged in the basic materials industry.

- Murphy Oil Company (Moore): This energy company makes up 0.46% of the fund’s portfolio.

- Matador Resources Corporation (mean failure reporting): Matador Resources, another company in the energy industry, holds a 0.46% weight in the fund.

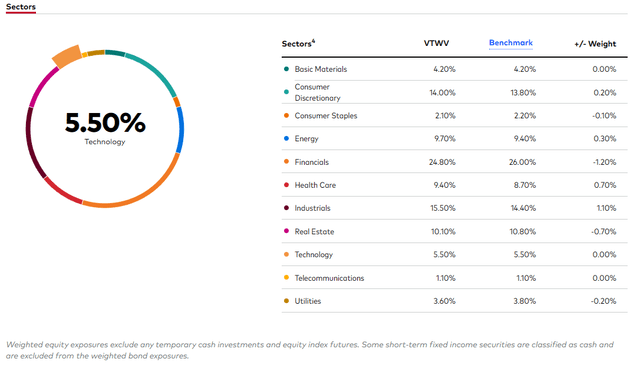

Industry composition and weight

A closer look at the sector composition reveals that the heaviest sector in the portfolio is the financial sector, accounting for 24.8% of the asset value. Industrials is the second largest industry, followed by consumer discretionary.

Pioneer Network

Peer comparison

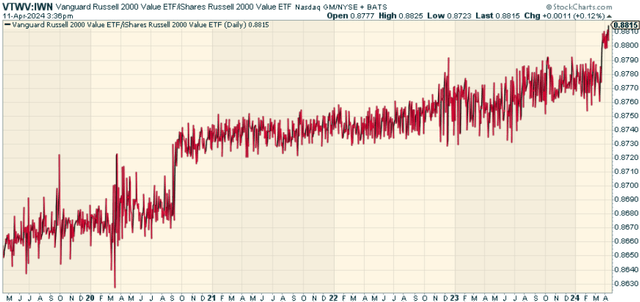

Compared to peers tracking the same index, VTWV’s returns since inception have been slightly higher than IWN’s. A lot of this has to do with the difference in fees between the two funds, which makes VTWV the winner.

StockCharts.com

Pros and cons of investing in VTWV

As with any investment, there are pros and cons to investing in VTWV. On the plus side, the fund offers value investments in small-cap stocks, which have historically provided higher returns than large-cap stocks. It also has a low expense ratio of 0.15%, making it a cost-effective option for investors.

However, the fund is more of a victim of the cycle we’re in, with both small-cap and value stocks falling out of favor. At some point, things will change, but your guess is as good as mine as to when.

in conclusion

Vanguard Russell 2000 Value Index Fund ETF shares offer investors the opportunity to invest in U.S. small-cap value stocks. While the fund shows a slight advantage over its direct competitor IWN, the decision to invest in this fund depends more on your view of the market’s rotation from large to small and style rotation from growth to value.

The challenge here is timing. With value styles largely focused on financials, any better bets here are on a reacceleration of lending and domestic consumers. At this stage of the cycle, that’s not necessarily a bad bet. Just be aware that the large-cap growth-dominated world we’re in may continue for much longer.

Markets are not as efficient as conventional wisdom suggests. There are often gaps between market signals and investor reactions, which help indicate whether we are in a “risk-on” or “risk-off” environment.

this Lead-lag reporting Gives you an edge in reading the market so you can make asset allocation decisions based on award-winning research. I’ll give you the signal – it’s up to you to decide whether to go on the offensive (i.e., increase exposure to risky assets like stocks when risk “is there”) or go defensive (i.e., lean toward more conservative assets, like when risk As bonds/cash at “closing”).