Scott Olson

Few people have noticed that Walmart (WMT) shares hit an all-time high before e-commerce giant Amazon (AMZN) did.Recent 3-for-1 stock split could help Walmart top previous all-time high of $56 That changed on November 23 last year, and tonight it was trading around $59.

Amazon hit a near-perfect “double top” of $188 in July and November 2021, but has yet to return to that level in 27 months. It’s close, but not quite there yet.

Few people noticed that Jeff Bezos’ CEO resignation happened around the time of the earnings report on March 21, so Jeff Bezos ‘pushed it higher’ after resigning own stocks.

A quick review of Walmart and Amazon earnings reports

In Walmart’s earnings preview, the blog said WMT was a margin story, but Q4 FY’24 was a gross margin story, with GM adding 122 basis points The year-over-year increase from 22.75% in Q4’23 to 23.97% is not the operating margin story, which is what artificial intelligence and supply chain enhancements bring.

Frankly, I was right for the wrong reasons, but the margin story was just beginning.

Gross profit margins benefited from advertising, which the conference call noted increased 28% year over year to $3.8 billion. Although it still accounts for a small portion of total revenue, it does improve Walmart’s profit margins.

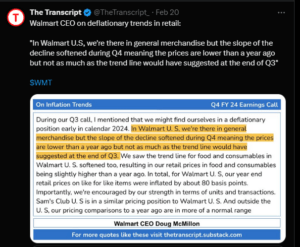

Here are key comments from the grocery inflation call (excerpted from The Transcript):

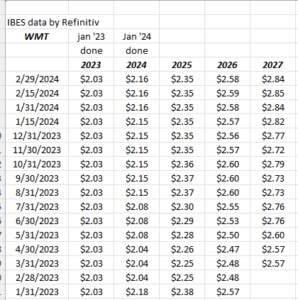

Here are Walmart’s metrics:

Walmart management has provided very tepid earnings guidance for its fiscal year ’25 (ending January ’25), and has shown little interest in raising its EPS estimates in ’25, ’26 or ’27 over the past two weeks.

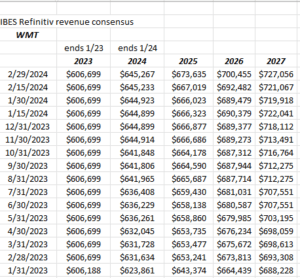

However, note the steady rise in Walmart’s revenue expectations, even after the “deflationary conditions” mentioned in the transcript note above.

Analysts haven’t been shy about boosting Walmart’s revenue forecasts for the next few years.

Summary/Conclusion: Walmart is just emerging from an inventory glut in 2021 and 2022, which means balance sheet and cash flow metrics haven’t returned to normal until recent quarters.

For a long-term “mid-single-digit” revenue grower and “high-single-digit” operating income and EPS grower, Walmart can continue to capture grocery market share – Grocery grew mid-single digits year-over-year in the March quarter Number – Walmart will need profits to fuel additional growth.

Amazon: Great quarter, shares still below all-time highs

Amazon had good growth in Q4 ’23 and a tougher Q4 ’22, but for readers, there are bigger, longer-term changes happening at Amazon:

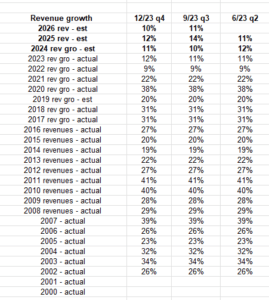

Amazon’s revenue grew by more than 20% annually from 2000 to 2021 (with one exception), but revenue growth appears to have permanently slowed to half the pace of the previous two decades.

This is manageable because Amazon (like Walmart) is also focused on profits.

Advertising and AWS drove Amazon’s 4Q23 growth, with the e-commerce giant’s operating income rising sharply. Operating income reached US$13.2 billion, exceeding market expectations of US$10.4 billion (London Stock Exchange Group), an annual increase of 26%.

Morningstar noted that Amazon’s fourth-quarter operating margin was 7.7%, its best in a decade.

Summary: There is no discussion of valuation in this article, other than to highlight Walmart’s lead relative to the S&P 500 and how far Amazon lags.

Are we entering a period where Amazon, Alphabet (GOOG) (GOOGL) and Apple (AAPL), despite their Mag 7 status, are becoming mature businesses and the burden of “growth” is being passed to AI stocks and the like other industry?

Another metric that I think is interesting: Amazon generated $575 billion in revenue in ’23, with operating cash flow of $85 billion during the same period.

Walmart generated $648 billion in revenue in FY24, with operating cash flow of $36 billion in the same 12 months.

Amazon still has a more efficient asset base, but Walmart is closing the e-commerce gap.

None of this is advice or advice. Past performance does not guarantee or imply future results. It is possible to lose principal on an investment, even for a short period of time. Readers should gauge their comfort level with portfolio and individual stock volatility and adjust accordingly.

thanks for reading.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.