Kevin Winter

investment thesis

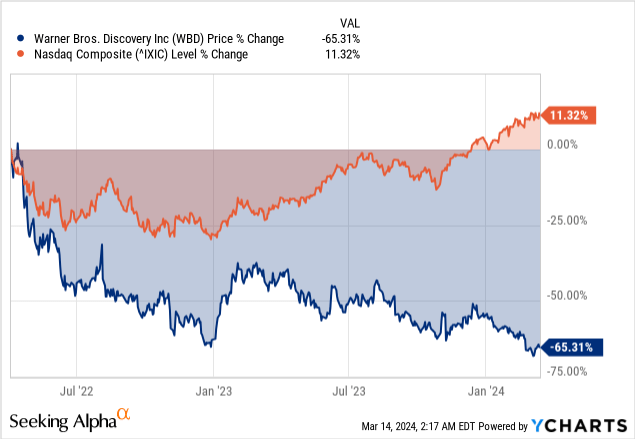

In a world of media and entertainment giants, Warner Bros. Discovery (NASDAQ: WBD) represents the losers who own the most valuable intellectual property rights in the industry.

This is an epic story about survival and strategy and a never-ending pursuit of profitability in the face of adversity, resulting in stunning swings in the company’s stock performance amid a strong market. In addition to disappointing earnings, WBD is reeling from operating losses and the aftershocks of a strike in Hollywood, with layoffs at WBD’s television division just beginning.

Warner Bros. Discovery Channel is experiencing a period of transformation and opportunity that reflects the challenges and tremendous potential in media and entertainment. In an era of volatile valuations, WBD stands out with its significantly lower valuation, making it an attractive entry point for investors.

Coupled with a significant increase in free cash flow generation and a bright outlook for strategic consolidation, the story of recovery and growth is unfolding compellingly.So we start covering WBD Buy ratingbecause we see a beacon of hope for the company.

Hollywood strike hurts Warner Bros. revenue stream

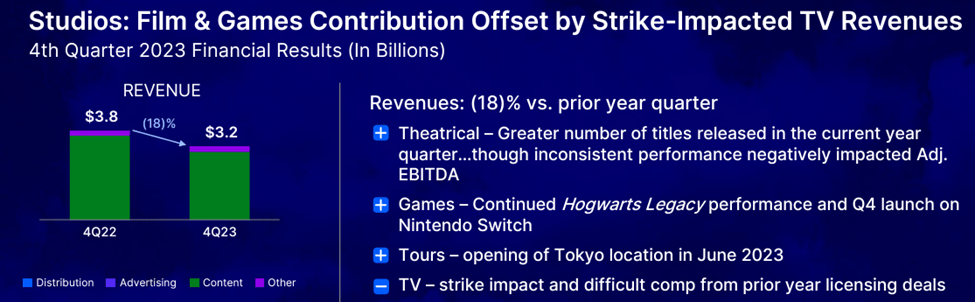

Warner Bros. was one company that bore the brunt of last year’s actors and writers’ strike in Hollywood. The strike affected its ability to produce new shows and movies, forcing the company to cut its full-year guidance by $300 million to $500 million. The double shutdown of writers and actors was the first in nearly 63 years, affecting production across the industry. While this has cost the California economy billions of dollars, it has also impacted the production of new productions, with sacrifices being made to allow writers and actors to return to work.

The company has been forced to adjust its schedule for releasing new films as a strike by actors and writers disrupts production. Warner Bros. Discovery, for example, had to postpone the release of its big-budget sequel Dune until March of this year.The company also warned that its adjusted earnings would be US$300 million and US$500 million in season four.

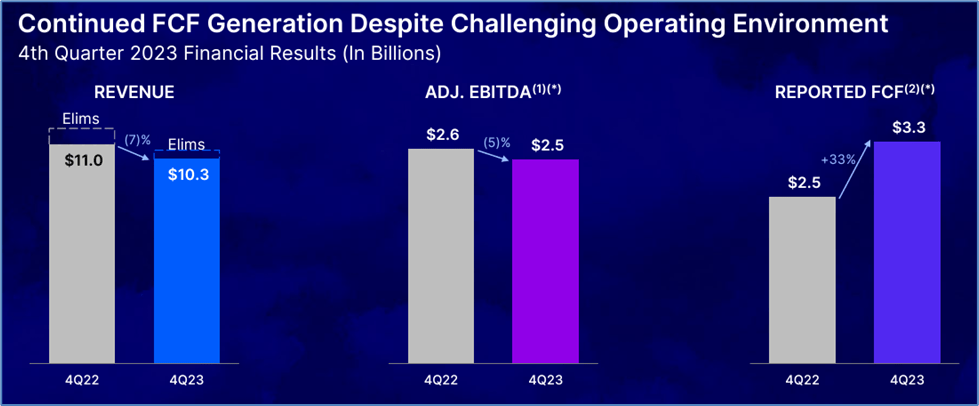

As a result, Warner Bros. shares fell nearly 9% after reporting lower-than-expected revenue figures for the fourth quarter of 2023.Total revenue for the quarter was $10.28 billion, compared with $11.0 billion in the prior year, and WBD also missed consensus estimates US$10.35 billion.

Chart showing WBD’s fourth-quarter revenue decline (Warner Bros. Discovery Channel)

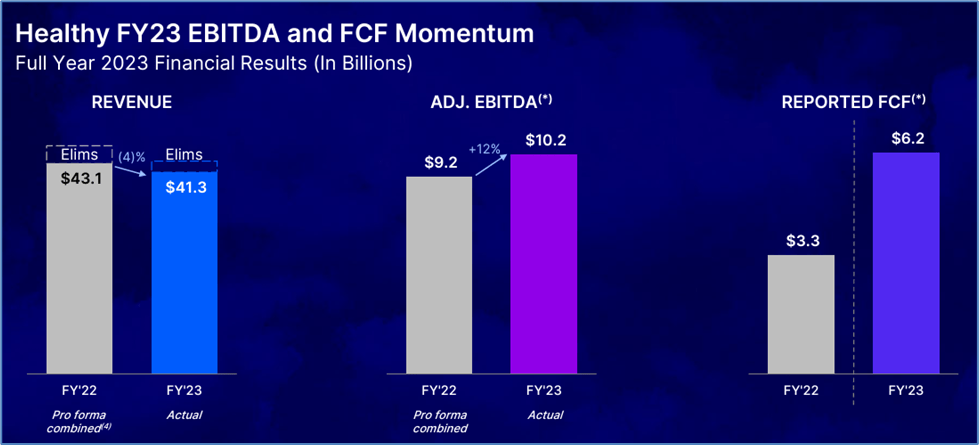

Chief Executive David Zaslav defended the year-over-year decline, insisting the company faces disruption in the pay-TV ecosystem and disruption in the linear advertising ecosystem. Revenues fell for the year as a result of a writer’s and actor’s strike that lasted much of last year and a drop in TV advertising and studio revenue.

Likewise, excluding the impact of foreign exchange, advertising revenue fell 14% this year. The 14% decline can be attributed to Warner Bros. feeling the impact of declining domestic general entertainment audiences. The softening of the U.S. linear advertising market also had an impact on revenue in this area.

Chart showing WBD’s fourth quarter revenue metrics (Warner Bros. Discovery Channel)

Additionally, distribution revenue fell 3% due to a decline in U.S. pay-TV subscribers and the company’s exit from the AT&T SportsNet business.Warner Bros. also paid the price for lower international sports licensing, which resulted in Content revenue drops 20%.

Despite a 7% revenue decline in the fourth quarter, Warner Bros. is still inching closer to profitability, highlighting improvements in operating efficiency. Although the company lost $400 million in the fourth quarter, this was an 81% improvement from the $2.1 billion net loss reported in the same period last year.The company is still losing money $400 million Linear TV advertising revenue fell 14%.Management has acknowledged that the company faces the impact of pay TV ecosystem disruption and a challenging advertising ecosystem

Improved profits also led to free cash flow growing 33%, soaring to US$3.3 billion from US$2.48 billion in the fourth quarter of last year. Likewise, the company ended the year with free cash flow of $6.2 billion, an increase of 88% from the previous year. The increase was driven by the CEO’s prioritization of free cash flow generation as part of ongoing restructuring activities.

Chart showing free cash flow growth (Warner Bros. Discovery Channel)

Part of a plan to boost free cash flow requires cost cutting, which has led the media and entertainment giant to lay off thousands of employees. The company is also making a series of strategic changes in its largest divisions, including CNN.

The change in strategy includes canceling CNN’s expensive original documentaries and canceling dozens of rarely-watched TV series and movies. The company also had to put plans for Batgirl and SCOOB 2: Vacation Hunt on hold.Therefore, the company’s goal is Cost savings of $3.5 billion as part of a strategic change.

Warner Bros. Discovery Channel gears up for big comeback

In another bright spot amid disappointing revenue and earnings numbers, the media giant gained new subscribers during the quarter. The number of streaming customers increased to 97.7 million from 95.9 million in the previous quarter.

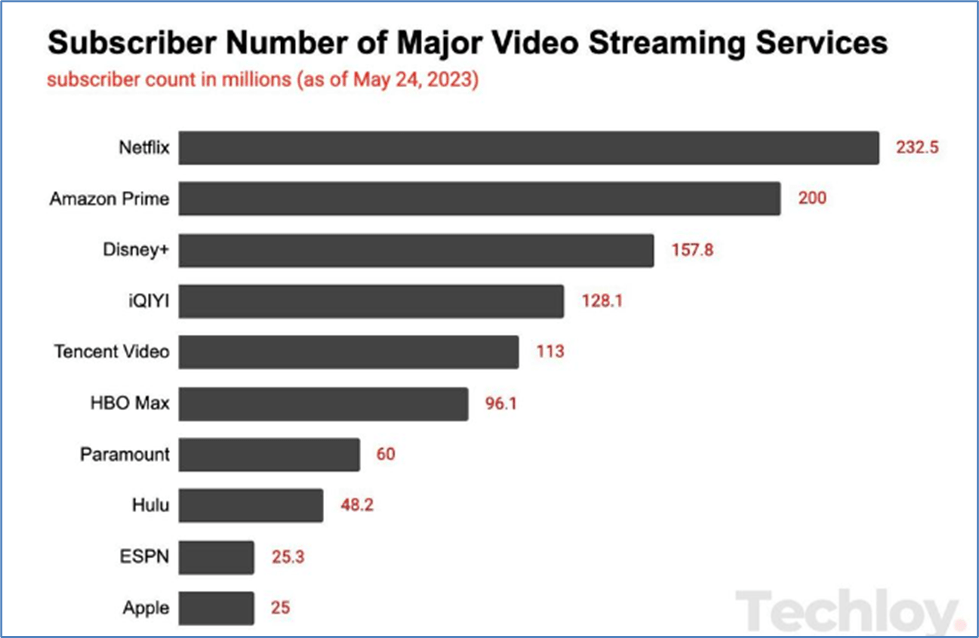

The company is already considering Potential merger with Paramount (PARA) creates an entertainment conglomerate that can compete with other streaming giants. The deal with Paramount should shake up the entertainment industry, as Warner Bros. will gain more than 60 million Paramount and streaming subscribers.

Paramount Worldwide would be a great addition as the company is experiencing a surge in fans watching games on one of its networks, CBS. Additionally, the company continued to deliver solid revenue and earnings numbers, driven by a significant increase in streaming subscribers.

Additionally, a merger with Paramount would put Warner Bros. in a strong position to compete with Netflix (NFLX) and Walt Disney (DIS), which have been calling the shots in the streaming business. Max, the company’s main content streaming service, is profitable ahead of traditional media rivals Disney, Comcast and Paramount Worldwide.

The Max ad level is only available in the U.S., but will soon be available globally. Warner Bros. Discovery Channel plans to launch the film in 40 other international markets by the end of this year. The launch is part of Warner Bros.’ Discovery Channel plan to expand its subscription base and compete with Netflix and Disney in the race for subscribers.

Number of subscribers to streaming services (//www.techloy.com)

As it expands, the company also hopes to strike a balance between increasing spending on new programming to attract new subscribers and retain subscribers while improving profit margins. Warner Bros. plans to expand Max Reach beyond familiar fans of HBO’s acclaimed edgy programming by expanding into children’s programming and unscripted programming.

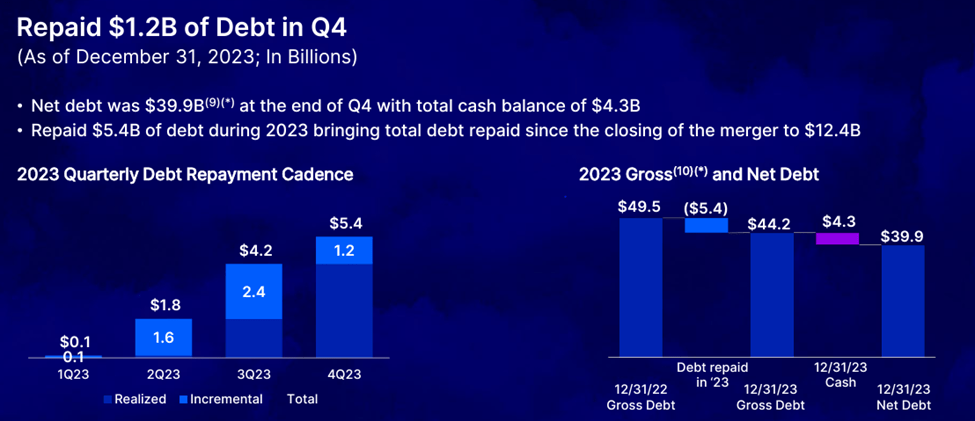

The turnaround plan will also require cutting the company’s massive debt load. Warner Bros. once had $50 billion in debt, tens of billions more than its market capitalization.It has started pruning it in stride and is paying the price US$1.2 billion As part of the restructuring, fourth-quarter revenue was $5.4 billion, and full-year revenue was $5.4 billion.

Although the company still has about $5 billion in debt maturing in 2024, it has begun cutting costs to free up more cash to pay down debt. In addition, it is considering delaying the maturity dates of some of its bonds. However, its efforts face significant challenges due to the high cost of refinancing due to high interest rates. However, when interest rates normalize over the next 1-2 years, WBD’s financial position will be much better.

Chart showing decline in WBD debt (Warner Bros. Discovery Channel)

Coping with Rising Costs and Streaming Competitors

One of the biggest risks to Warner Bros. Discovery’s turnaround and improved profit margins is the prospect of soaring content costs. The company must spend more on content as part of a deal struck after last year’s cast and writers’ strike.

Media giants led by Warner Bros., which complained about meager salaries last year, are now being forced to increase spending as part of a way to retain writers and actors. The argument has been that companies need to be paid more given the revenue they generate in the streaming era.writers seek Full compensation The pre-production and post-production process will force companies like Warner Bros. to incur additional costs.

Finally, Warner Bros. also faces a huge test in the fierce competition in the content streaming business.Specifically, Netflix and Disney remain the leaders in the space, with their respective spending $12.6 billion and $27 billion They are the contents of last year.

bottom line

Management reiterated its cost-cutting strategy to shore up Warner Bros. Discovery’s declining profits and eliminate its massive debt load. These efforts have borne fruit and the company has become a cash flow generator. Although Warner Bros. faces stiff competition in the streaming business, it is slowly becoming a beacon of light in the changing world of entertainment, as evidenced by its free cash flow (“FCF”) growth. Therefore, downsizing is still the core strategy of large media and entertainment companies, and the company will still be in a favorable position in the next 1-2 years.