Bhim

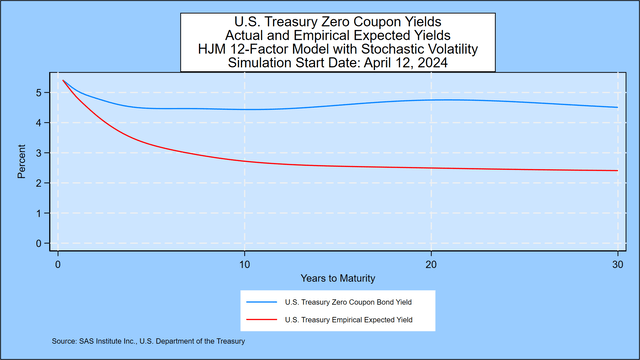

As explained in Professor Robert Jarrow’s book cited below, forward rates contain a higher risk premium than the market expects for 3-month forward rates.We document the size of the risk premium in this chart showing the implied zero-coupon yield curve Comparing the current price of government bonds with the annualized compound yield of 3-month government bonds (United States Armed Forces), which is what market participants expected based on daily changes in government bond yields in 14 countries since 1962. ($30). The graph also shows that expected yields decline sharply in the first few years and then continue to decline at a slow but steady rate throughout 30 years. We explain the details below.

SAS Institute Inc.

for For more information on this topic, see the analysis of government bond yields for 14 countries as of March 31, 2024 in the appendix.

Inverted yields, negative interest rates, and U.S. Treasury bond odds over the next 10 years

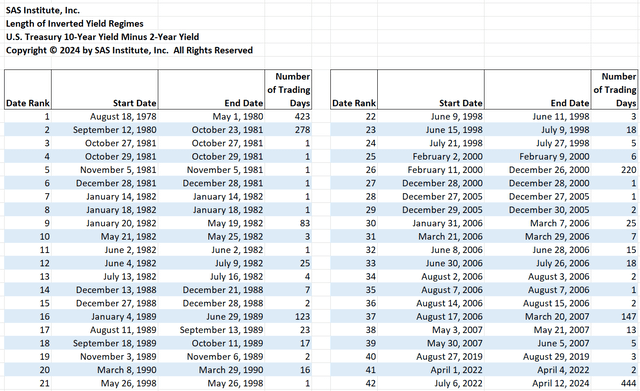

The negative spread between 2-year and 10-year Treasury bonds has now lasted 444 trading days. The interest rate spread is currently negative 38 basis points, an increase of 4 basis points from last week. The table below shows that the current inversion of the yield curve in the U.S. Treasury market is the longest since the 2-year Treasury yield was first announced on June 1, 1976. 423 trading days.

SAS Institute Inc.

This week’s forecast focuses on three elements of interest rate behavior: the future chances of an inverted yield curve predicting a recession, the chance of negative interest rates, and the probability distribution of U.S. Treasury yields over the next decade.

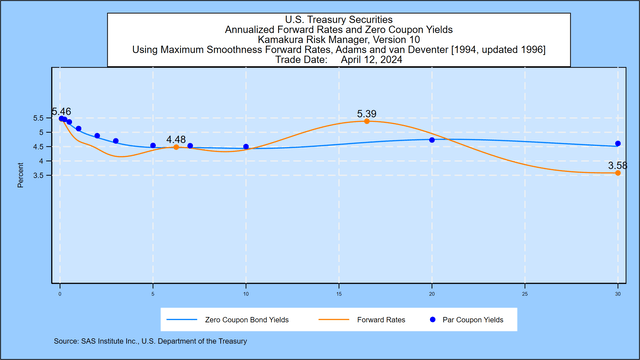

We start with the closing U.S. Treasury yield curve, which is released daily by the U.S. Treasury. Using the maximum smoothed forward rate method, Friday’s implied forward rate curve showed a rapid rise in 1-month forward rates to an initial peak of 5.46%, compared with 5.45% last week. After the initial rise, there will be declines and brief increases until rates peak again at 4.48%, compared to 4.42% last week. The rate eventually peaked again at 5.39%, compared to 5.34% last week, before falling to 3.58% at the end of the 30-year period, compared to 3.57% last week.

SAS Institute Inc.

Using the methodology outlined in the appendix, we simulated 100,000 future paths of the U.S. Treasury yield curve over 30 years. The next three sections summarize the conclusions we draw from our simulations.

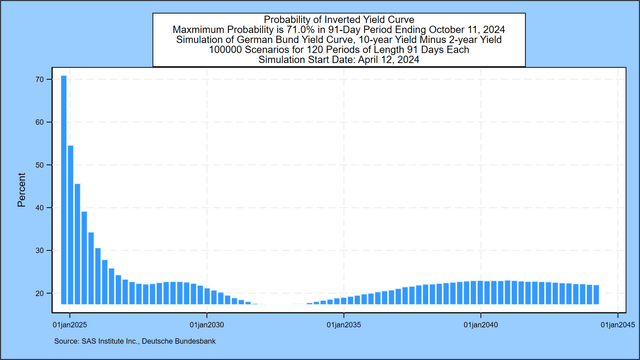

Treasury yields are inverted: Now inverted, the probability by October 11, 2024 is 71.0%

Many economists have concluded that a downward-sloping U.S. Treasury yield curve is an important indicator of a future recession.A recent example is this paper Alex Domarsh and Lawrence H. Summers. We measure the probability that the 10-year coupon yield (US10Y) is lower than the 2-year coupon yield (US2Y) under each scenario over the first 80 quarters of the simulation.(1) The chart below shows that the odds of a yield inversion now peak at 71.0% in the 91 days to October 11, 2024, compared with 65.9% a week ago.

SAS Institute Inc.

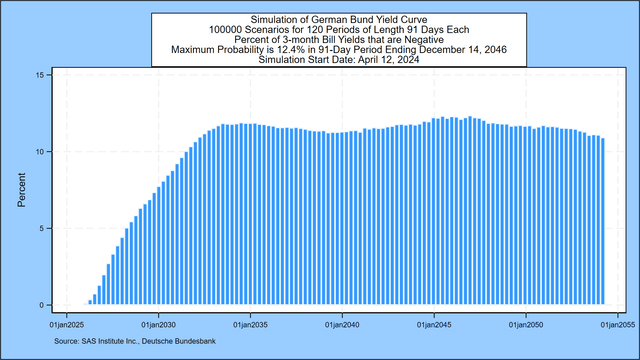

Negative Treasury yields: 12.4% chance by December 14, 2046

The chart below depicts the odds of negative 3-month Treasury bill rates over the next 3 decades for all but the first 3 months. Over the 91 days to December 14, 2046, the chance of negative interest rates started near zero but peaked at 12.4%, up from 12.4% a week ago.

SAS Institute Inc.

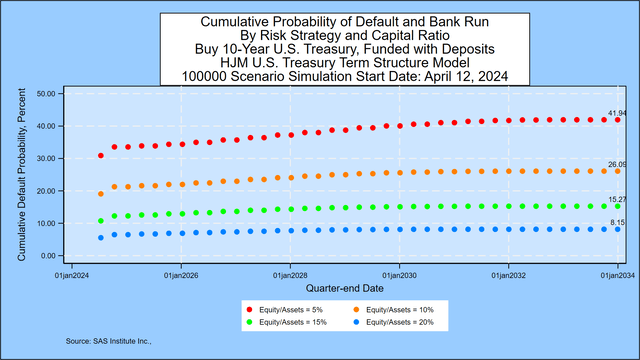

Calculate the default risk caused by interest rate maturity mismatch

In light of the interest rate risk-driven collapse of Silicon Valley Bank on March 10, 2023, we have added a table that also applies to mismatches among banks, institutional investors, and individual investors who borrow short-term funds to purchase long-term Treasury securities. We assume that the only asset is a $100 10-year Treasury note purchased at time zero. We analyze default risk for four different ratios of initial market value of equity to market value of assets: 5%, 10%, 15% and 20%. For the banking example, we assume that the only liability category is deposits that can be withdrawn at face value at any time. In the case of institutional and retail investors, we assume the liability is essentially a margin borrowing/repurchase agreement with the potential for margin calls. For all investors, the liability amount (95, 90, 85, or 80) represents the “strike price” of the put option held by the liability holder. When the value of assets falls below the value of liabilities, insolvency can result through margin calls, bank runs, or regulatory takeovers (in the case of the banking industry).

The chart below shows the 10-year cumulative probability of failure for each of 4 possible capital ratios when the asset maturity is 10 years. For the 5% scenario, the probability of default is 41.94%, compared with 42.36% last week.

SAS Institute Inc.

This default probability analysis is updated weekly based on the U.S. Treasury yield simulation described in the next section. The calculation process is the same for any portfolio of assets that contains credit risk.

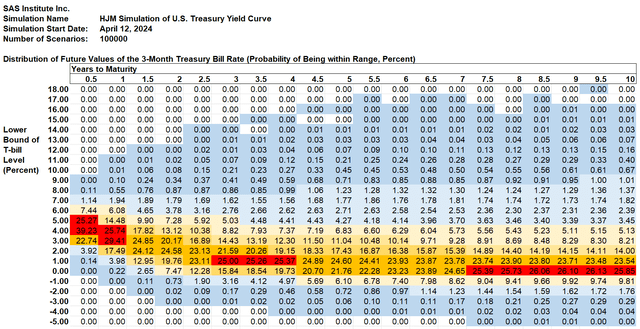

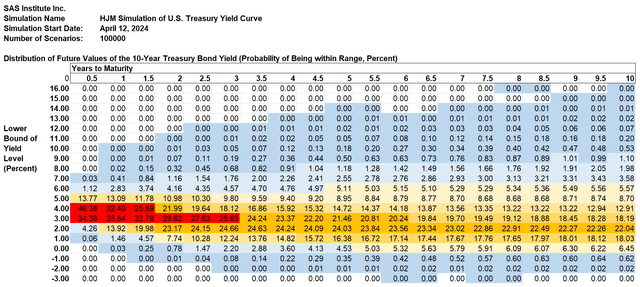

U.S. Treasury debt odds over the next 10 years

In this section, the focus turns to the next decade. Simulations this week showed the most likely range for the 10-year U.S. three-month Treasury yield to be 0% to 1%, unchanged from last week. The chance of the 3-month yield falling within this range is 25.85%, compared with 25.90% a week ago. The most likely range for the 10-year Treasury yield is 2% to 3%, also unchanged from last week. The chance of being in this range is 22.04%, compared with 22.11% a week ago.

In a recent article on Seeking Alpha, we pointed out that predicting “heads” or “tails” when flipping a coin misses critical information. What experienced bettors need to know is that on average, for a fair coin, the chance of heads is 50%. For investors, the prediction that the next coin toss will be “heads” is effectively worthless because the outcome is purely random.

The same goes for interest rates.

In this section, we present detailed probability distributions for the 3-month Treasury bond rate and the 10-year U.S. Treasury bond yield using a half-year time step.(2) We give the probability of each time step rate in the form of 1% “rate buckets”. The forecast for the 3-month Treasury bond yield is shown below:

SAS Institute Inc.

3-month U.S. Treasury yield data:

SASMarch UST20240412.xlsx

Column 4 shows the chance that the 3-month Treasury bill yield will be between 1% and 2% in 2 years: 19.76%. The chance that the 3-month Treasury bill yield will be negative over a 2-year period (which is often the case in Europe and Japan) is 0.73% plus 0.02% plus 0.00% = 0.75% (difference due to rounding). Cells shaded blue represent a positive chance of occurrence, but the chance has been rounded to the nearest 0.01%. The shading scheme works as follows:

- Dark blue: The probability is greater than 0% but less than 1%.

- Light blue: The probability is greater than or equal to 1% and less than 5%.

- Light yellow: The probability is greater than or equal to 5% or 10%.

- Medium yellow: The probability is greater than or equal to 10% and less than 20%.

- Orange: The probability is greater than or equal to 20% and less than 25%.

- Red: The probability is greater than 25%.

The chart below shows the same odds for the 10-year Treasury yield derived as part of the same simulation.

SAS Institute Inc.

Ten-year U.S. Treasury bond yield data:

SAS10yearUST20240412.xlsx

Appendix: Financial Simulation Methods

The probabilities are derived using the same method recommended by SAS Institute Inc. to its KRIS® and Kamakura Risk Manager® clients. A moderate technical explanation is given later in the appendix, but we summarize it in plain English first.

Step one: we take Closing U.S. Treasury yield curve as our starting point.

Step 2: We use the point on the yield curve that best explains the changes in the historical yield curve. Using daily government bond yield data for 14 countries from 1962 to March 31, 2024, we concluded that 12 “factors” drive nearly all changes in government bond yields. The countries on which the analysis is based include Australia, Canada, France, Germany, Italy, Japan and New Zealand. Russia, Singapore, Spain, Sweden, Thailand, United Kingdom and United States of America. Data from Russia is not included after January 2022.

Step 3: We measure the volatility of changes in these factors and the change in volatility over the same period.

Step 4: Using these measured volatilities, we generate 100,000 random shocks at each time step and derive the final yield curve.

Step 5: We “validate” the model to ensure that the simulation accurately prices the starting Treasury curve and is as historically consistent as possible. The method for doing this is described below.

Step 6: We take all 100,000 simulated yield curves and calculate the probability that the yield falls in each 1% “bucket” shown on the chart.

Do U.S. Treasury yields accurately reflect expected future inflation?

We showed in a recent article on Seeking Alpha that, on average, investors buying long-term bonds almost always perform better than rolling short-term Treasury bonds. This means that market participants usually, but not always, accurately predict future inflation and add a risk premium based on that prediction.

The above distribution helps investors estimate the probability of success in going long.

Finally, as Corporate Bond Investor notes weekly in Friday’s Overview, the future expenses (amount and timing) that all investors are trying to cover with their investments are an important part of their investment strategy. The author follows his own advice: meet short-term cash needs first, then work your way up to longer-term cash needs as savings and investment returns accumulate.

technical details

The daily government bond yields of the above 14 countries form the basic historical data for the number of factors and their volatility in the fitted yield curve.United States historical data provided by U.S. Treasury Department. Using international bond data increases the number of observations to more than 106,000 and provides a more complete experience of high and negative interest rates than the US data set alone.

The modeling process was published in a very important paper David Heath, Robert Jarreauwith Andrew Morton in 1992:

Econometrics

For technically inclined readers, we recommend Professor Jarrow’s book Modeling fixed income securities and interest rate options For those who want to know exactly how the “HJM” model is built.

The number of factors in the 14-country model has remained stable since July 2017 at 12.

Footnote:

(1) After the first 20 years of the simulation, the 10-year bond yield cannot be derived from the first 30 years of bond yields.

(2) The complete simulation uses a 91-day time step of 30 years into the future. This note summarizes only the first 10 years of the complete simulation.