SOPA Photo/LightRocket via Getty Images

Big dividend increase shows confidence

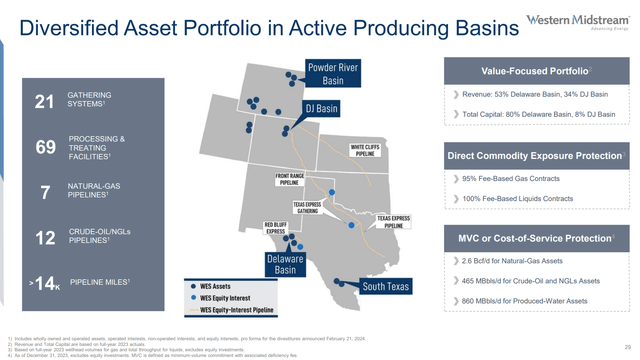

when i override Western Midstream Partners Limited Partner (NYSE: WES) Last quarter, I noticed that the partnership units had fluctuated around $20 since the start of 2022.I rated these units Buy, saying the stock will break out of that range based on throughput growth in its core Delaware and DJ basins and its acquisition of Meritage Midstream Partners in Wyoming’s Powder River Basin.The partnership continued to trade sideways for most of the quarter thereafter, but finally broke above $30 on February 20, 2024, a year earlier benefit.

Seeking Alpha

This breakthrough is not related to WES’s financial or operating performance. Rather, it’s due to rumors that general partner and largest shareholder Occidental Petroleum Corp. (OXY) is considering selling its stake. WES throws out quickly Pour cold water on such speculation by clarifying the partnership itself Not exploring sales And any transactions will be limited to OXY shares. WES co-op units retreated pre-profit but are now expected to resume their upward trajectory due to strong EBITDA growth 2024 Forecast About 11%, the quarterly distribution increased significantly to $0.875 from the previous $0.575.

On the operational side, throughput for all three products handled by WES will grow in 2023. Natural gas production increased by 5%, crude oil and natural gas liquids production increased by 7%, and produced water increased by 21%. This growth is seen in the two main basins of the WES, the Delaware Basin in western Texas and the DJ Basin in Colorado. WES’s growth isn’t entirely dependent on OXY, as the partner has been actively signing up third-party products over the past few years. Only 42% and 51% of natural gas volumes in Delaware and DJ respectively come from non-OXY producers. As I discussed last quarter, WES also doubled its collection and processing capacity in Wyoming’s Powder River Basin through its acquisition of Meritage.

WES does not rely on commodity pricing as 95% of its natural gas and 100% of its liquids contracts are toll-based. In addition, the partnership is protected by minimum production commitments of approximately 2/3 of its gas and liquids volumes and more than 80% of its produced water volumes.

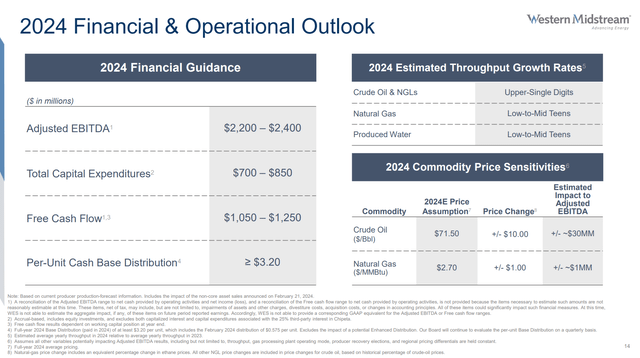

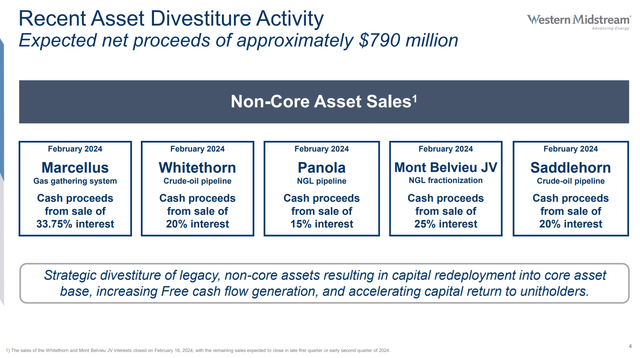

West and middle reaches

From a financial perspective, WES’ 2023 results are slightly above where I modeled them in last quarter’s article – the upper end of the EBITDA range and the midpoint of the capex and free cash flow ranges. The partnership will not pay special distributions in 2024 as it did in 2023 because it took on additional debt from the Meritage acquisition. In a big surprise, however, the partner increased its quarterly base distribution to $0.875, a 52% increase from the previous quarter. Looking at growth over the years, WES will pay at least $3.20 in 2024, a 50% increase from $2.1375 in 2023. This is supported by EBITDA returning to growth of 11% in mid-2024 after being flat in 2023. Capital projects are underway to deliver strong throughput growth in the coming years, and the partnership has completed a series of non-core asset sales to streamline operations, further reduce debt and support distribution. Since WES is already rated investment grade (BBB-/Baa3), there is no need for further deleveraging. This much larger but broader distribution puts WES at the top of its peers in terms of yield and deserves an upgrade to Strong Buy.

Outlook to 2024 and beyond

2024 will be another big capex year for WES, with capex of $700-850 million, the same as or higher than 2023’s $735 million. 81% of the spending will be in the Delaware Basin, with 68% considered expansion capital expenditures. The largest projects are two natural gas processing plants in Delaware.the first is Muangtong Train 3, with a production capacity of 300 MMcfd, is expected to be put into production in 2024. This will be followed by North Loving, a 250 MMcfd plant due to start up in the first quarter of 2025. The combined production capacity of the two plants increased by 33%. WES’ natural gas processing capabilities in Delaware. Along with other well connections, WES plans to increase total throughput of natural gas and produced water into the high teens, and total crude oil and natural gas liquids throughput into the single digits. This drove the aforementioned 11% EBITDA growth and 19% free cash flow growth at the midpoint.

West and middle reaches

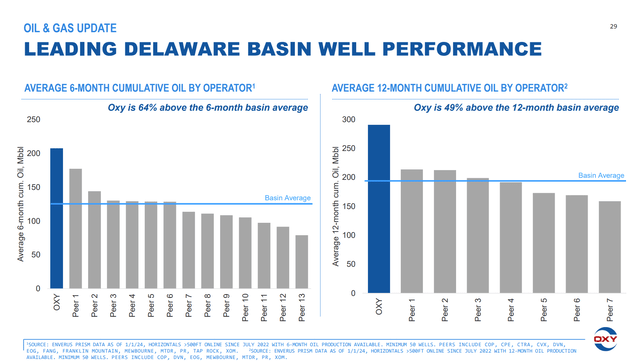

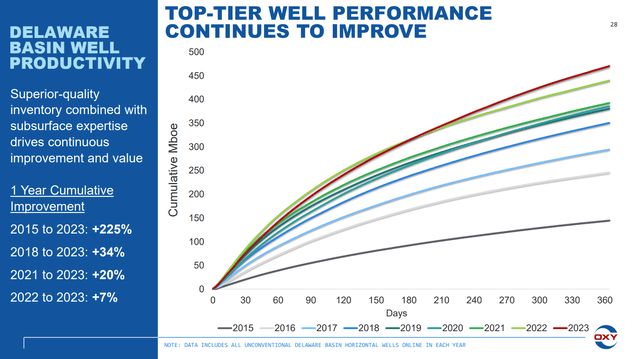

Growth in 2024 is broadly in line with what I predicted in last season’s article. With North Loving set to launch in 2025, I now expect EBITDA to grow 10% next year as well, up from 5% previously. Going forward, I still expect EBITDA to grow 5% annually. This is supported by OXY’s strong performance in the Delaware Basin, which has the most productive wells of any operator and is increasing cumulative production per well each year.

occidental petroleum corp. occidental petroleum corp.

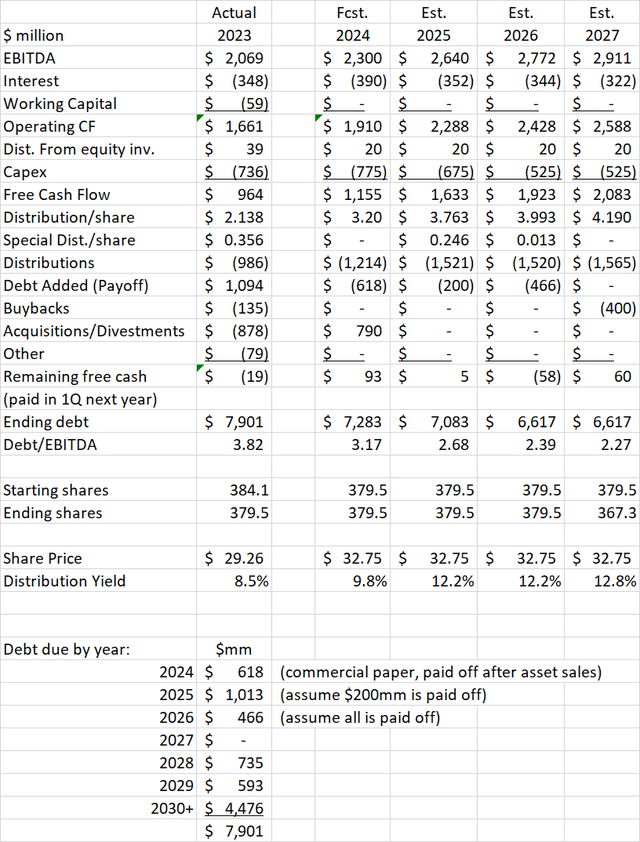

Profit model update

Taking into account EBITDA, capex and free cash flow (“FCF”) guidance, we see FCF slightly below this year’s new larger distribution of $3.20/unit. However, WES sold interests in non-core regions where it was not an operator and only had a partial stake. The $790 million in cash raised not only covers a small portion of the distribution not covered by FCF, but also repays short-term debt issued to help fund the Meritage deal.

West and middle reaches

Following the sale of these assets, I expect WES to pay a small special distribution again in 2025 due to remaining cash positive in 2024. Beyond 2025, EBITDA growth will be sufficient to cover distributions without selling any assets, especially once the two gas processing plants are completed amid a pullback in capex.

Since WES currently has an investment-grade credit rating and debt/EBITDA will fall below 3 in 2025, there is no need to reduce debt levels as has been the case in recent years. I now show that WES rolled over all but $200 million of the $1 billion in debt due in 2025. Even so, they will still be able to repay in full all notes due in 2026. Since there is no debt due in 2027, I show a scenario where WES resumes buybacks that year.

Author Spreadsheet

Assuming a unit price of $32.75, WES’s dividend yield is 9.8% based on 2024 distributions. Based on the next 4 payments of $0.875 each, the forward yield is 10.7%. WES should be able to grow distributions at a similar rate to EBITDA growth over the next few years. I show that dividends will grow at a CAGR of 9.4% over the next 3 years.

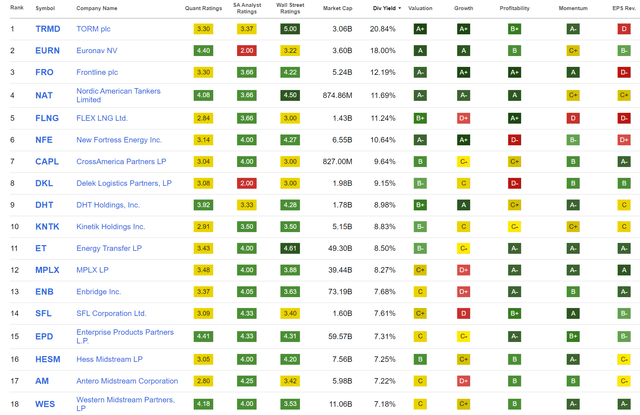

Peer comparison

Looking at the 54 stocks in the Oil & Gas Transportation & Storage industry, if we rank them by dividend yield, we see that WES ranks 18th based on previous dividends. Using the new yield, WES would rank seventh, but the only stocks above it would be shipping companies with dividend sustainability issues based on EPS revision ratings.

Seeking Alpha

Looking at Seeking Alpha Quant’s overall rating, WES ranks 11th out of 54 companies, but if we exclude small caps, shippers and LNG companies, only Enterprise Products Partners (EPD) and Plains All American Pipeline (PAA) Rank higher. Even so, there’s not much difference between WES’s letter grade and the two. In terms of growth, WES is already slightly ahead of EPD and PAA, and I believe its rating could be even higher once the new guidance of 11% EBITDA growth is factored in.

in conclusion

Western Midstream Partners, LP delivered strong results in 2023, driven by throughput growth across all three products and the acquisition of Meritage Midstream. These will also drive growth in 2024, but the partnership will further increase its natural gas processing capacity in the Delaware Basin by 33% through the construction of two plants next year. With double-digit EBITDA growth over the next few years, the partner is confident of delivering results, increasing the underlying distribution by approximately 50% from previous levels. WES’s forward yield will now exceed 10%, among the best among its peers. The only factor lowering the yield is a further break above $30 per unit.

Sales of non-core assets this year will reduce debt in the Meritage deal and help cover distributions. Capital spending should decline slightly in 2025 as new natural gas plants are completed. Going forward, debt will be at a comfortable investment grade of less than 3x EBITDA. This should cover new releases, allow it to grow over the next few years, and even offer special releases occasionally. This sustainable, shareholder-friendly distribution policy makes Western Midstream Partners, LP a Strong Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.