Thorston Asmus

Fund Overview and Historical Performance

Western Asset Diversified Income Fund (NYSE:WDI) is a fund run by Franklin Templeton. WDI is an equity closed-end fund that invests primarily in bonds and focuses on generating income for them investor.

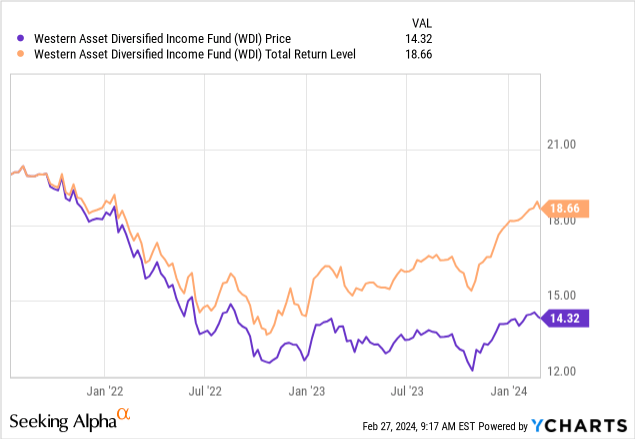

Judging from the stock price performance since the establishment of the fund, WDI’s stock price will fall by 28% (as of February 26, 2024). If you exclude dividends from the same period, you don’t see the full picture. Taking dividends into account, fund performance would be down 6.5% (as of February 26, 2024).

Performance after dividends isn’t ideal, but it’s much better than just looking at the stock price

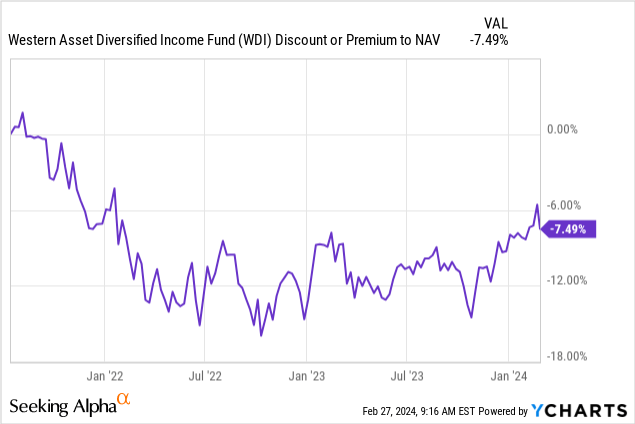

NAV discount

WDI trades at a modest 7% discount to its net asset value (NAV), presenting investors with an attractive opportunity (e.g. February 26, 2024). In this case, NAV represents the total market value of all stocks held in the fund’s portfolio. By purchasing WDI shares at a modest discount to NAV, investors effectively gain exposure to the fund’s entire underlying basket of securities at a lower price. This is similar to finding your favorite line of merchandise at a deeply discounted price.

Closed-end funds (CEFs) like WDI sometimes experience discrepancies between market price and net value. Market dynamics and investor sentiment may cause these temporary fluctuations. Historically, NAV discounts have tended to narrow as market conditions change or investors realize the intrinsic value of the discounted CEFs. This may result in capital appreciation for WDI holders, in addition to potential gains from the underlying shares themselves.

yield

WDI’s 13.45% dividend yield is attractive to income-seeking investors. In the current interest rate environment, this yield remains attractive. However, the risks inherent in stocks compared to risk-free Treasuries must be considered.

The key to realizing further potential lies in the changing monetary policy landscape. WDI’s revenue stream is likely to gain greater traction as the Federal Reserve moves toward lowering interest rates later this year. A Recent CNBC investigation This highlights market expectations for a 75 basis point (0.75%) interest rate cut. If this reduction translates directly into lower Treasury yields, then WDI could provide a significantly enhanced income advantage compared to these traditionally “safe” assets.

Notably, this rate cut scenario could create two tiers of potential returns for income-oriented investors in WDI:

-

Yield Advantage: As Treasury yields fall, WDI’s fixed yield becomes proportionately more attractive.

-

NAV Appreciation: Lower interest rates generally increase the valuation of dividend stocks, including those held by the fund. This could result in a narrowing of the NAV discount, resulting in capital gains for WDI shareholders.

Fund holding

The third and final catalyst for WDI’s rise is the composition of its funds. Because WDI is an income-focused fund, most of its holdings are concentrated in bond holdings. Looking back at WDI’s holdings as of January 31, 2024, the weighted average return was 13.05%. If the Fed starts cutting interest rates, the short-term risk will be the duration of its holdings, but given the longer period for which the fund locks in interest rates, the average duration of its holdings is 14.38 years. Their funds expose the fund to specific risks, as the maximum holding size is approximately 3% of the total fund balance. This leads me to believe that the current dividend yield is locked in for the foreseeable future.

generalize

The combination of WDI’s modest discount to NAV, respectable dividend yield, and potential for underlying asset appreciation make it a moderate buy. The current discount offers the opportunity to buy a diversified portfolio of income-focused stocks at bargain prices. At the same time, the income stream provides a cushion that – especially in times of market volatility – could become more attractive relative to Treasuries once expected rate cuts materialize.

For income-oriented investors, WDI offers a potential alternative to traditional fixed income assets, especially in a falling interest rate environment. The combination of interest rate cuts and WDI yields could create a compelling revenue advantage. Additionally, lower interest rates could act as a catalyst for a narrowing of the discount to net worth, which could lead to additional returns for WDI shareholders.