bjdlz

I think most of my readers are familiar with Western Midstream Partners LP (NYSE: WES). In short, WES is a midstream operator whose main business is natural gas gathering, operation and transportation.The other two businesses are oil and LNG transportation; and parties and treatment of produced water. Please see other sources for more detailed company descriptions.

Occidental Petroleum Corp. (OXY) owns approximately 49% of WES, including its limited and general partners’ shares, and controls WES through the latter. For OXY, WES was part of the 2019 Anadarko acquisition. Former OXY employee Michael Ure has served as WES CEO since the acquisition. OXY is also a major customer of WES.

WES appears attractive with its forward tax-deferred yield of approximately 10%, investment-grade credit rating, and likely capital appreciation over the next 2-3 years. In this article we will examine this opportunity.All figures except per share are In millions.

Chronology

The last decade of February have been eventful for WES.

- On February 20, Reuters reported that OXY was considering selling WES to reduce debt. Enterprise Products (EPD), Williams (WMB), Kinder Morgan (KMI) and private equity firms are reportedly interested.

- Later the same day, WES released Press release illustrate

Western Midstream Partners, LP is aware of recent news reports indicating that WES is working on a sales process. WES has not yet initiated a sales process and has not hired a banker or other advisor to do so. We know that, as publicly stated, Occidental Petroleum Corporation (“Oxy”) has expressed interest in divesting assets. We are unable to discuss the composition of assets that Oxy may seek to divest, and any questions regarding Oxy’s ownership interest in WES should be directed to Oxy.

- On February 21, WES reported fourth-quarter and full-year 2023 results and held an earnings call the next day. In addition to results and forecasts, WES also made two important announcements related to 2024. Namely, the company has signed an agreement to sell $790 million in non-core assets, and its quarterly distribution per share will increase from $0.575 in the fourth quarter of 2023 (payable in the first quarter of 2024) to the first quarter of 2024 $0.875 (paid Q2 2024). On February 22, the unit price jumped to $33.60, compared with $30.18 the day before.

- After a rapid rise, Raymond James and Citi downgraded WES to neutral with a $34 price target.At the time of writing, WES is trading at around $35

Valuation

The typical MLP investor is a yield seeker. However, while allocations surged by 52% in February, units did not follow suit and only increased by about 15%. Investors were skeptical that the announced distribution was sustainable (it was made directly by Raymond James) and suspected that the jump in distribution was OXY’s strategy to add WES units before selling the company.

Management wasn’t shy about saying that WES was cheap even before allocations increased.

company

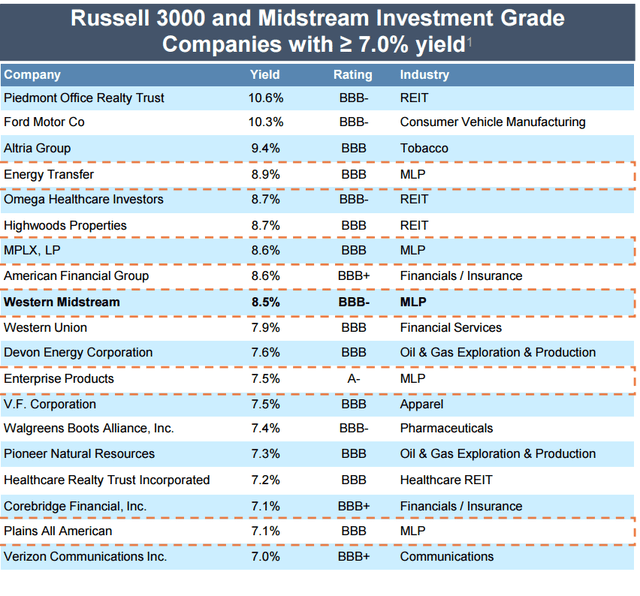

WES and its TTM distribution and share price as of December 31, 2023 are listed on the slide. With its new yield, WES should be near the top of the list in the long term, trading cheaper than other midstream stocks.

Let’s examine the numbers that matter to WES.

Author, company

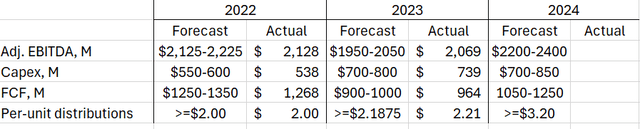

Unlike other midstream MLPs, WES emphasizes that its FCF (rather than distributable cash) is approximately equal to operating cash flow minus interest and all capital expenditures (including growth and maintenance). WES is committed to returning all FCF to unitholders, mainly through distribution. But the company has also regularly bought back its divisions in large amounts over the past few years.

WES will increase its base distribution as long as the FCF proves to be permanent and free of any quarterly cyclicality. Therefore, rate hikes could happen every quarter (like 2021) or only in the first quarter (like 2022).

If some FCF remains after the base distribution and repurchases, WES will pay the enhanced distribution at the end of the year as it did in 2023 (including the 2022 enhanced distribution, which WES paid $2.49 in 2023).Importantly, both the forecast and actual distributions in company materials (and in my table above) refer to only base distribution.

The forecast of at least $3.20 in 2024 includes a payment of $0.575 in the first quarter (Q4 2022) and at least $0.875 in each of the remaining three quarters. On a forward basis, WES commits to a base distribution of at least $3.50 or a forward yield of at least 10%.

WES also forecasts a leverage ratio of approximately 3.0 by the end of 2024. As of December 31, 2023, WES had net debt of $7,088. Once all asset sales are completed (most likely in the second quarter), the company will receive $790 in cash and its net debt will be approximately $6,300. Even at the low end of the EBITDA forecast, its leverage would be ~$6,300/2200~2.9. EPA has similar leverage and an A- credit rating. While I’m far from comparing the two companies, this suggests WES may be on the verge of a further credit upgrade.

It has not yet been reflected in the bonds. BBB-WES bonds due in 2048 are trading at about 6.4-6.5% to maturity, while ET bonds with a BBB rating and the same maturity are trading at about 5.4%.

Looking at our first slide, WES has a TTM yield of 8.5% at the end of 2023. Assuming the same yields at the end of 2024, WES should be trading at $3.20/8.5%~$38, even ignoring credit rating developments and possible scenarios. Cutting interest rates could make dividend yields more attractive. One year from now, WES should be trading at $3.50/8.5%~$41. The latter figure shows an annual return of about 30%, with capital appreciation of about 20% and a yield of about 10%.

EBITDA valuations are less optimistic. As of the end of 2023, the EV/EBITDA multiple is 8.8. The same midpoint forecast of 2024 EBITDA of 8.8x and $2,300 yields an EV of 8.8*2300=$20,240. The net debt is US$6,300, the unit is 389.6, and the corresponding unit price is (20240-6300)/389.6=36 US dollars. In other words, based on EBITDA, we expect very little capital appreciation and our returns will consist primarily of yield.

WES and OXY

The current unit price suggests that the market considers the yield indicator to be less reliable than EBITDA. This is not surprising since yield is simply a derivative of cash flow.

Looking back at our last table, the 2024 FCF forecast was $1050-1250, while the 2023 forecast was $900-1000 and the actual was $964. This equates to FCF growth of only 9-30% and distribution growth of 52%.

The base allocation in 2024 requires at least $3.20, and the FCF is 3.20*389.6~$1250. This is equal to the upper end of the 2024 forecast, showing that the last allocation hike was quite aggressive, possibly in preparation for sales. Does this mean the new distribution is unsustainable?

My answer is no. In 2024, the risk of allocation cuts is low. Even if FCF isn’t enough to cover distributions, the company will have cash on hand and leverage of about 3.0, which is very low for a BBB- company. Borrowings will provide additional cash if needed.

I also believe, and this is pure speculation, that the company plans to hit the upper end of its free cash flow forecast. The 2024 FCF forecast range is twice as large as that of 2022 or 2023 ($200 vs $100). This is unlikely to be accidental. WES plans to commission its new natural gas plant Mentone III in the Delaware Basin in the second quarter of 2024. The factory is already sold out and cash will start flowing in immediately after commissioning. I believe the increased forecast range reflects the risks associated with this new large capital project.

In early 2025, the company plans to commission another natural gas plant (North Loving) in the Delaware Basin. This means another increase in cash flow and a reduction in capital expenditures. On the last earnings call, Michael Ure mentioned that in terms of capital expenditures, 2025 will likely spend $200 million less than 2022. So even if WES falls slightly short of FCF compared to the 2024 allocation, they could catch up in 2025 and beyond.

Still, aggressive rate hikes mean OXY’s participation. Assuming OXY plans to sell WES later in 2024, it should be interested in increasing WES valuation and extracting as much cash as possible from WES before selling.

Based on relevant comparisons, what is the likely selling price for WES?

- WES’s asset sales price in early 2024 is 9.6x EV/EBITDA.

- In late 2023, Energy Transfer completed the acquisition of Crestwood (CEQP) for approximately 9.6 times projected 2023 EV/EBITDA. While Crestwood may be the best company, it’s much smaller and has a junk credit rating compared to WES’s investment grade.

Therefore, during the acquisition process, WES expects to sell for at least 9.6 times its projected 2024 EBITDA midpoint, or 9.6×2,300 ~ $22,100.

The latter figure translates into a stock price of (22,100-6,300)/389.6~$40, but it may be slightly higher.

in conclusion

If the sale of WES occurred in late 2024, investors would likely receive approximately $5 in capital appreciation plus approximately $2.60 in distributions, for a total of $7.60 over 9 months or $7.60/35 of approximately 22%.

Assume WES is not sold. In this scenario, investors would continue to receive a 10% yield, plus possible capital appreciation, when WES will again increase its distribution due to the upcoming start-up of the North Loving plant.

Both scenarios should please investors, except perhaps for older WES holders, who would face significant taxes if acquired for cash.

There are many risks associated with both situations. The most obvious ones are the major problems with the commissioning of the Mentone III and North Loving plants, WES’s lower acquisition price, operational risks, etc. Still being employed at WES seemed very attractive to me.