Luis Alvarez/DigitalVision via Getty Images

Whitestone Real Estate Investment Trust (NYSE:NYSE:WSR) is a promising passive income investment as the REIT is growing FFO related to its concentrated real estate business.

The portfolio also experienced growth in occupancy rates The trust guides its FFO to achieve double-digit growth by 2024.

Considering Whitestone REIT has been steadily paying its dividend via FFO, and the trust just increased its dividend by 3%, I think the risk/reward relationship is very attractive for passive income investors.

My rating history

A few months ago, I listed Whitestone REIT as a Buy, primarily because the REIT was concentrated in a handful of The core markets of Texas and Arizona offer strong potential for FFO growth.

The trust raised its dividend last month and forecast strong FFO growth this year. With its rising dividend and low FFO payout ratio, Whitestone REIT is worthy of inclusion in a passive income portfolio.

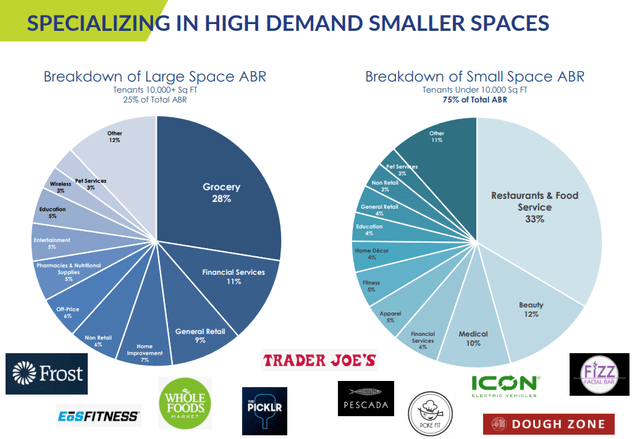

Portfolio concentration remains a key advantage

Whitestone REIT acquires, operates and develops open-air retail shopping centers in a limited number of markets, including Texas and Arizona. As of December 31, 2023, the Trust’s portfolio consisted of 55 properties with a total leasable area of 5 million square feet.

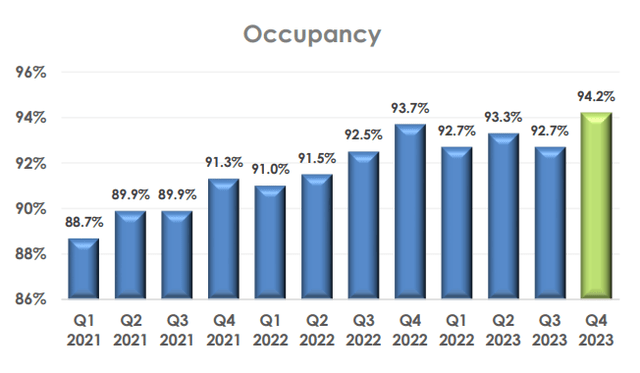

As of the end of 2023, Whitestone REIT’s properties were leased to a total of 1,453 tenants, with a portfolio occupancy rate of 94.2%. Space for rent in strip malls.

Portfolio Overview (Whitestone Real Estate Investment Trust)

The trust’s occupancy rates have been rising over time as real estate dynamics in Texas and Arizona favor property owners (limited mall supply, strong population growth, Whitestone REIT active on household income above average market).

As a result, Whitestone REIT has a strong rental position that translates into strong same-store net operating income growth potential.

occupy (Whitestone Real Estate Investment Trust)

FFO Trends, Dividend Increases and Payout Ratios

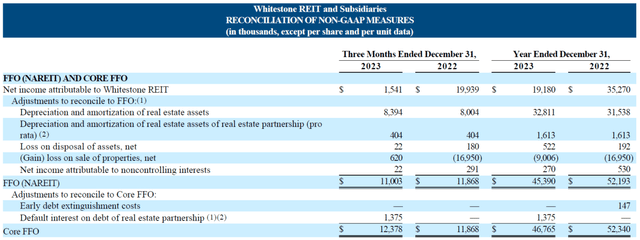

Whitestone REIT generates $11-12 million in FFO per quarter, which makes the trust relatively small, especially compared to retail REIT giants such as Kimco Real Estate Inc. (KIM) or Real Estate Income Corporation (O).

Whitestone REIT’s properties generated $45.4 million in FFO in 2023, down 13% due to strategic asset sales. Given the 2024 guidance, the trust clearly expects FFO to return to positive growth this year.

Although Whitestone REIT has a small amount of FFO generated by its real estate assets, the trust’s payout ratio is very low, meaning investors have a very solid margin of safety for its dividend.

Reconciliation of Non-GAAP Measures (Whitestone Real Estate Investment Trust)

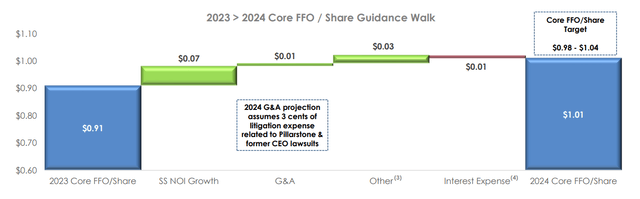

For obvious reasons, it is critical for passive income investors to determine the safety of a REIT’s underlying dividend. The trust announced a monthly dividend of $0.04125 per share in March, an increase of 3%, equivalent to an annualized dividend of $0.495 per share. Core FFO earnings per share are expected to be $1.01 in 2024, giving the trust an implied dividend payout ratio of 49%.

In 2023, Whitestone REIT paid out 53% of its core FFO. Kimco Realty paid out 59% of its core FFO in 2023, so Whitestone REIT offers a higher margin of dividend safety.

A lower FFO payout ratio allows the REIT to invest more cash into the growth of its underlying real estate portfolio and focus on expansion.

I expect Whitestone REIT will also want to invest in other states with attractive economic fundamentals to expand its revenue base and diversify its income. States where I could see Whitestone REIT making a move are New Mexico and Florida, which are also growing rapidly and have strong economic fundamentals.

FFO multiple

Whitestone REIT expects 2024 core FFO earnings per share of $1.01, representing annual growth of 10.9%, driven by strong expected growth in same-store net operating income from its existing portfolio. Based on the share price of $11.14 at the time of writing, the REIT is valued at 11x FFO.

Having said that, shares in the trust fell 5% on Wednesday as investors reacted to the latest inflation data, which showed rising consumer prices. up 3.5% March. However, inflation data should not affect Whitestone REIT’s cash flow outlook or portfolio performance.

In early February, shares of Whitestone REIT were selling for 12.9 times core FFO, and I think the trust will likely return to this valuation plateau over the long term (implied intrinsic value of $13). Of course, passive income investors can gain At the same time, the 4.4% dividend isn’t bad either.

Working capital (Whitestone Real Estate Investment Trust)

Why investment thesis is riskier

Whitestone REIT is clearly much less diversified than other retail-focused heavyweight REITs like Kimco Realty or Realty Income. Since REITs are very concentrated in just two states, a lack of diversification can be a double-edged sword.

Simply put, if the Texas or Arizona economies went into recession, Whitestone REIT’s FFO would be hit harder than a more diversified REIT with properties in more states.

Texas’ economy is grow faster higher than the overall U.S. economy, the fact is Also established By 2022, the state will become a net migration state, meaning more people are moving to Texas than leaving the state. 2023, close to half a million People moved to Texas.Arizona’s economy is grow slowly than Texas, but the state is also a net migration state and its population grown up 115,900 for the period July 1, 2022 to July 1, 2023.

my conclusion

I think it makes sense to add Whitestone REIT to a broader diversified passive income investor portfolio that includes other REITs.

Whitestone REIT’s concentration in only two states allows the company to participate in those states’ strong economic growth, resulting in above-average FFO growth. From a valuation perspective, I believe Whitestone REIT has 17% rerating potential, with an implied intrinsic value of $13.

The trust also raised its dividend by 3% last month, with an expected FFO-based payout ratio below 50%, leaving plenty of room for Whitestone REIT to invest in new properties in its core markets or even expand into new states. . purchase.