To specialize or not to specialize? If that’s a problem, the private equity world is responding with the former. According to Bain’s 2023 Global Private Equity Report (Global Private Equity Report 2023 | Bain & Company), limited partners and deal teams have been pursuing increasingly specialized strategies in recent years, and this trend away from one-size-fits-all approaches is “certain to continue.”

Research from Mantra Investment Partners helps explain why. Between 2010 and 2020, Mantra found that the average IRR of PE funds it classified as “niche” was 38%, while mainstream PE funds only achieved 18%. Now, like many things, it’s hard to tell whether this relationship is more of causation or pure correlation (niche funds tend to have lower assets under management, for example, so that could also account for the benefits of being smaller). However, with so much new money pouring into private equity markets (which we called a “tsunami” in our previous article (Private Equity in Recessions | A Simple Model)), specialization does provide a way from A stand-out and engaging approach from the crowd aimed at limited partners looking to diversify into interesting and less focused niches in the buyout space.

What does private equity specialization mean?

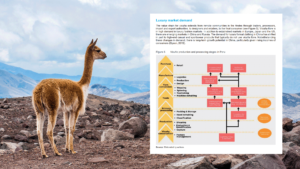

In private equity, specialization can take different forms, from focusing on one or a few related industries (agriculture, tourism, etc.), to a certain industry (services, manufacturing, etc.), to a specific stage of business development (new startups, late-stage, etc.), defined geographic areas (countries, regions, etc.), and even specific investment methodologies (turnarounds, rollovers, etc.).

Last March, HEC Paris and Dow Jones released a new ranking of middle-market private equity firms (HEC Paris Mid-Market Exhibition 2022). Specialty funds – from Accel-KKR to Water Street Healthcare Partners – are well represented in the top 20. For example, Accel-KKR focuses on technology, leveraging its global familiarity with the industry to introduce portfolio companies to potential service providers, partners, and customers around the world. Accel-KKR also uses a proprietary model (built on data from more than 300 B2B technology companies) that allows its portfolio companies to compare themselves to their peers and identify ways to improve.

To better illustrate the power of specialization, let’s delve into the case of Riverstone Holdings, which specializes in the energy sector. The company has found success by hiring industry experts who are not necessarily investors and combining their expertise with a group of highly skilled investors.partner Elizabeth K. Weymouth Calling the result “a highly sophisticated team in the energy community, with a wealth of expertise in addition to a wealth of expertise.”

An essential skill for private equity investors is understanding and comparing the qualities of alternative businesses and opportunities. It’s crucial to act quickly and confidently to defeat your competitors. Understanding nuances and being able to speak the same language fluently with target company management are important factors for success. In the current economic climate, where new deals are becoming increasingly rare, operational improvements at existing portfolio companies are more important than ever. This is likely to continue as long as interest rates remain high, thanks to nuanced expertise.

How much specialization is too much?

Having said that, we must still ask an important question: How much specialization is too much? At what point does intimate knowledge of certain trees prevent you from seeing the forest? This is a legitimate concern because overly narrow specialization limits diversification and may prevent investors from adjusting when conditions begin to favor industries, sectors, or approaches outside of their niche.

The best advice I can offer is this: If you’re new to private equity, be open to a variety of experiences, at least early in your career. Build a broad network. Think about how your job and eventual place of employment overlap with your personal interests and passions and the areas where you see long-term market promise, and don’t be afraid to explore a variety of sectors and investment styles as you go. Over time, you’ll find a niche that works for you. My friend Adam Rodman is an incredible example. Rodman’s belief in an idea grew until he was willing to bet his career on it. The downturn in uranium prices caught his attention in early 2013, and in 2018 he restructured his hedge fund to focus exclusively on the radioactive metal’s resurgence. It proved to be a very successful venture. (Interview with Adam Rodman: Starting an Industry-Focused Hedge Fund.)

At the end of the day, there are a lot of successful investors who never specialize in a niche, but if you find a niche that particularly appeals to you, think carefully about whether it’s something you want to build a career around, because having one in the future Expertise can be a real asset when looking for a job or trying to start a fund. With this in mind, I will talk more about the advantages of specialization as it relates to fund performance in a future article. stay tuned!

Related: Private Equity Industry Focus

Related: Venture into private equity from non-traditional backgrounds (If you work in a niche industry and want to get into private equity)

Learn more about private equity transactions with ASM’s private equity training courses. ASimpleModel.com’s private equity training courses are developed by industry professionals. The following content goes beyond the leveraged buyout model to explain how private equity professionals find, structure and close deals.