gear

By Joseph Attia and Jeremy Schwartz, CFA

In 2024, the financial world passed a milestone: For the first time, assets under management in passive investment strategies in the United States exceeded assets under active management, marking the culmination of a decade-long transformation toward indexation. At the expense of actively managed fund managers’ market share.

Last year’s S&P Annual Asset Survey showed that assets currently in the S&P 500 index reached a staggering $11 trillion, and rightfully so.1 The SPIVA 2023 Scorecard highlights a clear trend: Less than 13% of U.S. large-cap funds have outperformed the S&P 500 over the past decade.2

However, the explosive growth of passive investing has created a paradox for investors. Every announcement of a change in the S&P 500 prompts a whirlwind of activity among fund managers to adjust their holdings to align with the index.However, this storm Trading often triggers short-term price fluctuations that may affect future returns.

Interpreting the Rebalancing Act

Behind the S&P 500, the S&P Committee carefully curates the index through a process that carefully considers factors such as market capitalization, liquidity, and industry representation.3

However, index rebalancing goes beyond administrative maintenance and profoundly affects stocks that are welcomed or bid farewell. As mutual funds and ETFs tracking the S&P 500 rebalance their holdings to include new stocks, demand often surges, temporarily affecting stock prices.

Likewise, a decline in the index can lead to selling pressure on stocks that the committee avoids.

This phenomenon is known as the “exponential effect” and sets the stage for significant trading activity, with arbitrageurs often looking to profit from these short-term fluctuations.

As more traders try to take advantage of the index effects between announcements and effective dates, once a stock is added or removed from the index, its actual movement may deviate from our expectations, especially over the long term.

The new dynamic upends the traditional index effect narrative: The stocks the committee chooses to add often already have high valuations, and they now enjoy a pre-addition uptick but then face a post-addition downturn. Meanwhile, stocks that typically choose to fall after short-term headwinds are hit by additional waves of selling, after which they often rebound from lower levels and emerge as winners again.

Recent changes and their impact

To better understand what’s happening around the announcement and effective date of the change, let’s take a look at the two most recent high-profile rebalances.

The first is the rebalancing on December 21, 2020. November 16, S&P announces Tesla will be included in S&P 500 Indexbut only later announced which companies would be eliminated.4 From November 16 to December 18, Tesla’s (TSLA) total return was over 70%, compared with the S&P 500’s total return of 3%.

A few weeks later, Standard & Poor’s announced that Apartment Investment and Management, Inc. (AIV) would be eliminated.5

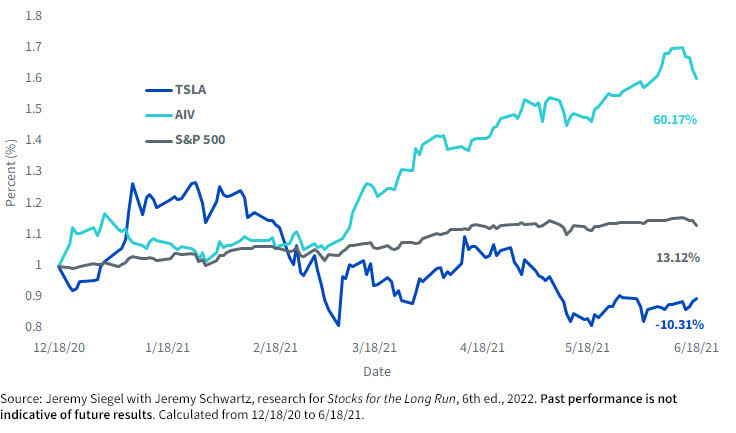

Figure 1: Performance after rebalancing – taking the 2020 S&P 500 rebalancing as an example

In the six months following the rebalancing, TSLA underperformed the S&P 500 by more than 23%, while AIV outperformed the S&P 500 by more than 47%.6

Recently, there was a Rebalanced on December 18, 2023.

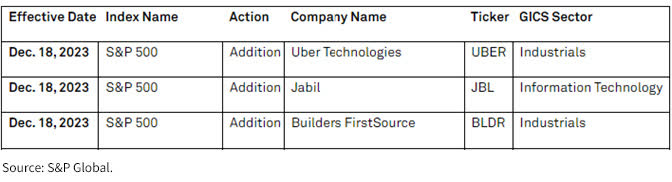

Figure 2: S&P 500 announces additions to 2023 rebalancing

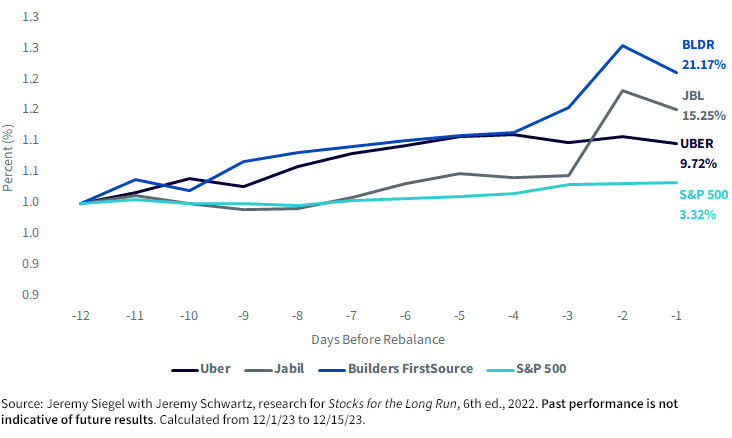

Looking at this rebalancing date, we find that all three proposed stock additions outperformed the S&P 500 in the two weeks between the announcement date and the effective date. Uber (UBER) outperformed the market by more than 6%, Jabil (JBL) outperformed by nearly 12%, and Builders FirstSource (BLDR) outperformed by nearly 18%.7

Figure 3: Performance of New S&P 500 Components – 2023 Rebalancing Example

Expanding Perspectives: Five Years in Review

To better understand the impact, we collected all the changes that have occurred in the S&P 500 since 2019. This takes into account five years of compositional changes, specifically focusing only on stocks that have changed in companies selected by the committee.

Figure 4: View historical S&P 500 index rebalancing, comparing the performance of additions and deletions before and after the event.

Replenish: Specifically, stocks poised for inclusion in the S&P 500 tend to outperform the broader index by about 2.6% in the two weeks following their inclusion. However, once officially included, these stocks tend to underperform the index, underperforming the index by an average of 4.7% over the following 12 months.

Drops: Instead, companies on the verge of extinction experience an initial downturn and are sold off before they are actually eliminated. However, once removed, these stocks often begin to recover, outperforming the index by an average of nearly 5% over the next 6 months and nearly 16% over the following 12 months.

This pattern we see in index rebalancing highlights how passive investing and the explosion of index changes can have a long-term impact on the rise/fall of an index.

We believe investors and market strategists should consider these trends when responding to index rebalancing events, as they can have significant implications for investment strategies.

Stay tuned for an upcoming in-depth research article that will explore these index changes in more detail, provide a more complete understanding of their impact on the market, and gain a deeper understanding of how this impact intersects with the prevailing value and low volatility narrative together.

- Source: “S&P Dow Jones Indices Annual Asset Survey” S&P Global

- Source: “SPIVA® U.S. Scorecard” S&P Global

- Source: “S&P U.S. Index Methodology” S&P Global

- Source: “Tesla to join S&P 500” S&P Global

- Source: Brian Scheid, “Apartment Investment & Management Drop from S&P 500 to Make Way for Tesla” S&P Global

- Source: “Uber Technologies, Jabil and Builders FirstSource to join S&P 500; others to join S&P MidCap 400 and S&P SmallCap 600,” S&P Global

- Source: Jeremy Siegel and Jeremy Schwartz, Long-Term Equity Research, 6th Edition, 2022. Past performance is not indicative of future results. The calculation period is from 12/1/23 to 12/15/23.

Joseph Attia, Intern, Research

Jeremy Schwartz, CFA, Global Chief Investment Officer

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021, leading WisdomTree’s investment strategy team in building WisdomTree’s equity index, quantitative active strategies and multi-asset model portfolios. Jeremy joined WisdomTree in May 2005 as a senior analyst and was added as associate director of research in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. WisdomTree, who is a principal research assistant to Professor Jeremy Siegel and co-author of the sixth edition of the book in 2022 long term stocks.Jeremy is also the co-author of the book financial analysts magazine The paper “What happened to the original stocks in the S&P 500?” 》 He received a bachelor’s degree in economics from the Wharton School of the University of Pennsylvania and hosted the Wharton Business Radio Show Behind the market SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.