Miscellaneous Photography

Elevator promotion

Wipro Ltd. (NYSE: WIT) is rated a Hold.

Accenture’s (ACN) latest quarterly financial results were negative for the IT services market and WIT’s short-term outlook.On the other hand, Wipro has good long-term growth potential Consider the expected growth in engineering, research and development (ER&D) spending and the rise of artificial intelligence. Considering the above factors, I think ACN deserves a Hold rating.

Company Profile

in its Corporate website, WIT describes itself as a “technology services and consulting company” that provides “solutions to clients’ most complex digital transformation needs.”In its annual reportWipro highlights its inclusion in the “50 Best Companies to Work for in India 2022” India GPTW Institute.

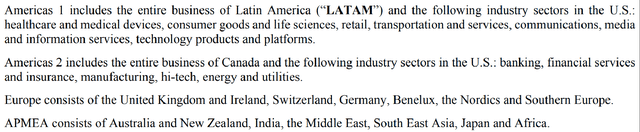

Definition of Wipro Geographical Segmentation

Wipro’s FY2023 Filing 20-F

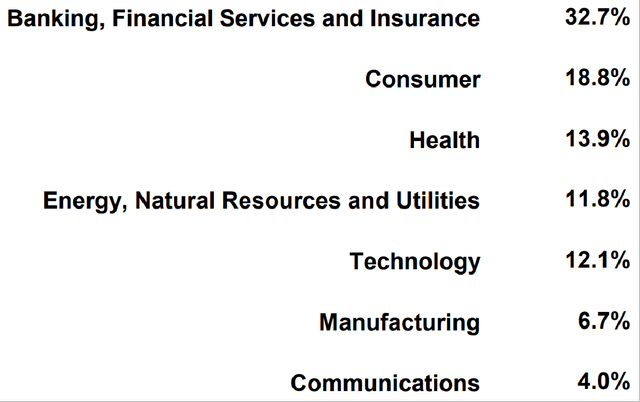

The company acquired 31%, 30%, 28% and 11% of its shares respectively Revenues from the Americas 1, Americas 2, Europe and APMEA geographic segments for the third quarter of fiscal 2024 (March 31, 2024). Additionally, Wipro’s industry exposure is detailed in the table below.

WIT’s industry exposure based on Q3 FY24 sales mix

Wipro Corporate Fact Sheet for the Third Quarter of FY2024

WIT’s customer concentration risk is limited. Wipro has more than a thousand customers, and its five largest customers accounted for just 12% of the company’s revenue in the most recent quarter.These numbers in this section are taken from Wipro Q3 FY24 Company Profile.

Latest results from peers cast a negative light on WIT’s near-term outlook

Previously, Wipro’s peer Accenture announced its financial results for the second quarter of fiscal 2024 (December 31, 2023 to February 29, 2024) on March 21, 2024. This sends a negative signal to the future performance of IT services businesses such as WIT.

In the most recent quarter, ACN’s GAAP operating profit fell -20% sequentially to $2.046 billion, and its actual operating income in the second quarter of fiscal 2024 was -5% lower than analysts’ consensus estimates (Source: S&P Capital IQ).

During its second-quarter fiscal 2024 earnings call, Accenture noted that “our client spending has further tightened” due to “an uncertain macro environment caused by economic, geopolitical and industry-specific conditions.”

Specifically, ACN revised the midpoint of its full-year fiscal 2024 (September 1, 2023 to August 31, 2024) revenue growth guidance to +2.0% from the previous +3.5%. In comparison, the market is currently forecasting WIT’s annual revenue growth (in Indian rupees or INR) for the first, second and third quarters of 2024 of -2.7%, -0.3% and +3.7% respectively. Current expectations that Wipro will show improving revenue expansion momentum in the coming quarters appear to be overly optimistic.

Wipro is expected to announce its fourth quarter fiscal 2024 (or first quarter 2024) results in the middle of this month. There are significant risks, namely WIT’s fourth quarter of fiscal year 2024 (January 1, 2024 to March 31, 2024) and the first half of fiscal year 2025 (April 1, 2024 to September 30, 2024) Actual financial performance was below sell-side analysts’ consensus forecasts, considering ACN’s latest results and management commentary.

Wipro’s long-term growth potential intact

Aside from potential short-term performance misses (as discussed in the previous section), I’m positive about WIT’s long-term growth opportunities.

The global engineering, research and development or ER&D market is expected to grow from US$1.7 trillion in 2023 to US$2.9 trillion in 2033, according to a report on January 3, 2024 JPMorgan (JPMorgan Chase) Research report (unpublished) titled “Sputtering Gets a New Life.”at this JPMorgan The report also mentioned that India’s “(ER&D) offshore spending share” is expected to grow from 28% to 35% during the same period.Additionally, Wipro ranked fourth (Accenture ranks first) Everest Group “Top Ten IT Outsourcing Service Providers” last year. This means that WIT is the main beneficiary of the expected growth in ER&D spending over the next decade.

Specifically, artificial intelligence may become a key growth driver for Wipro in the coming years.

WIT invests in Indian financial services company Nuwama’s India 2024 Conference February this year. Numa A research report (not made public) titled “Post-Meeting Notes” was subsequently released, detailing the key points of each company’s management comments at this investor event.according to Nuwama’s In a February 2024 report, Wipro emphasized at this investor event that “all (its) large deals today have an AI component” and mentioned that it was “working hard to launch (new) AI solutions”.

During its quarterly earnings call in early January 2024, WIT also revealed that it was “seeing strong interest in artificial intelligence in the automotive and manufacturing industries” and said it recently “developed an AI for a Fortune 500 investment and insurance company. Assistant powered by GenAI. ”

Wipro drew attention to it in its report last year that “digital revenue” accounts for about one-third of the Indian IT services market. Investor presentation slides. Considering the rise of artificial intelligence, it is realistic that “digital revenue” can grow at a faster rate in the future and account for a larger proportion of industry and WIT revenue.

concluding thoughts

Considering the company’s short-term and long-term prospects and the stock’s valuation, I give a Hold rating to Wipro. WIT’s near-term prospects are poor, but the company’s long-term growth prospects are good. Based on the price-to-earnings ratio and the price-to-earnings CAGR comparison, I think Wipro stock is fairly valued. The market currently values Wipro at 20.4 times FY2025 normalized P/E, while the consensus for FY2025-FY2028 normalized earnings CAGR is +18.3%. S&P Capital IQ data. For WIT, that’s a pretty fair price-to-earnings to growth or PEG multiple of 1.11x.