Mario Tama

introduce

Last year, I started covering healthcare giants Johnson & Johnson (NYSE:JNJ)my most recent article about the company was written on January 4 this year, titled “Johnson & Johnson: One of the World’s Safest Stocks Could Return +10% Annually.”

In that article, I did a lot of things, including explaining that its AAA credit rating makes it one of the safest stocks in the world. In fact, this rating is so high that nothing could be higher. No AAA+.

Even better, while it’s a bit unfair to compare a company to a sovereign country, there are only ten developed countries with similar credit ratings – and the United States is not one of them.

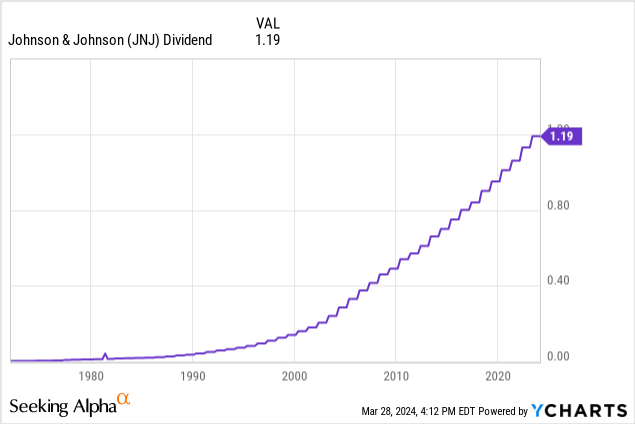

It is also the company that has raised its annual dividend more than 60 times in a row!

Another important theme I highlighted in that article was The company is embroiled in major litigation, which has capped the company’s stock price.

It doesn’t help that spin-offs and general post-pandemic weakness have created some uncertainty that investors want to avoid.

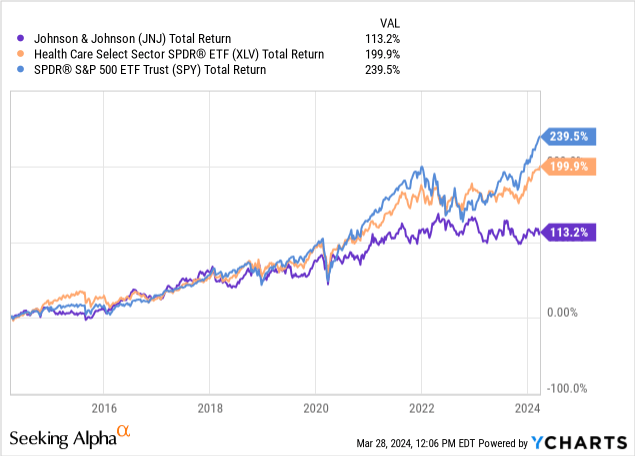

As a result, as we see below, the stock has begun to ignore the upward trend of the S&P 500 and the Healthcare Select Sector SPDR ETF (XLV) since 2020. Over the past decade, including dividends, Johnson & Johnson has returned just 113%. The XLV ETF returned 200% during this period. It’s also lower risk because it’s a diversified ETF.

That said, I think there are reasons to be optimistic. Even better, I believe JNJ can deliver tremendous shareholder value!

For example, we’re seeing new litigation headlines that could be very positive for the company. We’re also witnessing new acquisitions that could reshape Johnson & Johnson and fuel its future growth.

In this article, we will discuss all this and more.

So, let’s get started!

Litigation Headlines

If there’s one thing that can create huge uncertainty for investors, it’s litigation. After all, it’s often impossible to estimate how bad things could get.

Like many health care giants, Johnson & Johnson has been embroiled in multiple lawsuits in recent years. One of the biggest concerns is the potential health risks of the talc in Johnson’s Baby Powder.

The good news is that there may be light at the end of the tunnel, as Bloomberg just noted report The company may see a tailwind in terms of damage control.

Bloomberg

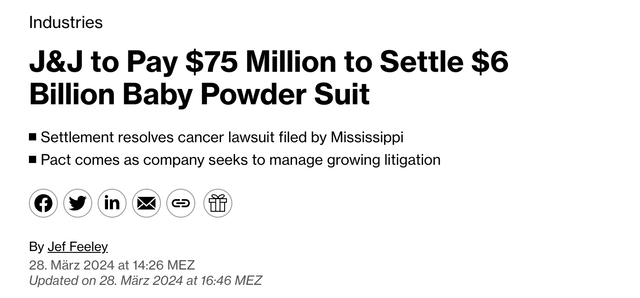

Essentially, the company will pay $75 million to settle a consumer protection lawsuit filed in Mississippi over its talc baby powder.

This is good news for JNJ, as the state initially requested up to $6 billion in funding.

To put that in perspective, JNJ’s free cash flow last year was $18.2 billion. $6 billion would be a third of that. $75 million represents just 0.4% of that figure.

Even better, the news couldn’t come at a better time:

The state sued Johnson & Johnson over its nearly 50-year failure to warn consumers about the powder’s alleged cancer risks. The settlement comes as the world’s largest maker of health care products seeks to respond to a growing number of consumer lawsuits accusing it of concealing the risks of its products., after two unsuccessful attempts to use bankruptcy courts to settle with former users. – Bloomberg (emphasis added)

Johnson & Johnson, which also must put warning labels on baby powder in the Magnolia State, reached a $700 million lawsuit settlement with 42 U.S. states in January. The agreement excludes Mississippi and New Mexico.

In addition, the Bloomberg article mentioned that Johnson & Johnson is approaching 60,000 lawsuits from former talc users who claim that talc caused their cancer.

A large portion of these cases will be consolidated for pretrial information before U.S. District Judge Michael Shipp in Trenton, New Jersey.

This is important because the Deccan Herald has just report The company will be able to challenge evidence linking its talc powder to cancer.

In a brief written order, U.S. District Judge Michael Shipp in Trenton, N.J., who is overseeing the consolidated lawsuits in court, said recent changes in the law and new scientific evidence necessitated an investigation into the case involving Johnson & Johnson. The evidence for ovarian cancer products is re-examined. – Deccan Herald

As a result of the decision, the company has until July 23 to present new arguments to support its claim that it does not cause cancer.

Results so far have been mixed, including a $2.1 billion victory for 22 women with ovarian cancer in 2021 and a failed $223.7 million lawsuit in October.

What matters is the expert opinion. In cases like the one facing Johnson & Johnson, a federal judge will decide what expert testimony is allowed at trial. This is based on the 1993 decision in Daubert v. Merrell Dow Pharmaceuticals.

According to Deccan Herald, if there is no reliable scientific evidence that a product causes cancer, Daubert’s decision could be a huge turning point.

Right now, this seems like a huge potential win for the company:

Shipp Wednesday orders Noting December changes to the federal rules of evidence governing expert testimonywhich emphasizes The role of courts in examining experts Draw conclusions and methods before allowing them to give evidence to the jury.

Johnson & Johnson says rule changes will help Exclude defective evidence, and attorneys for the talc plaintiffs said their evidence was strong enough to meet the revised standard. – Deccan Herald

In other words, we are now facing a favorable situation because there is a greater emphasis on “science”. Unless plaintiffs find conclusive evidence that talc causes cancer, Johnson & Johnson could make significant progress.

Pathways to higher growth

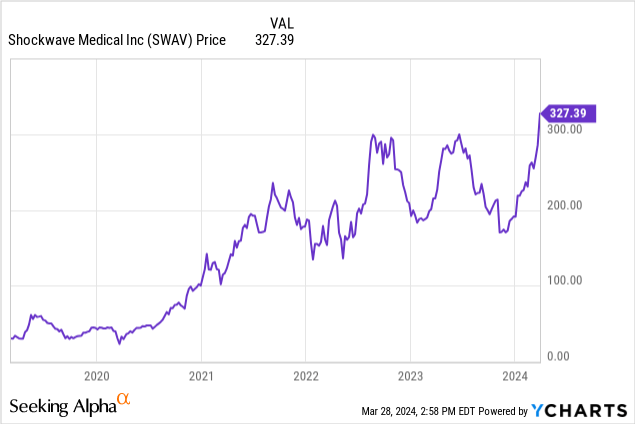

March 26, “Wall Street Journal” wrote Johnson & Johnson will acquire medical device maker Shockwave Medical (SWAV).

The deal could be completed in the coming weeks. Before the market started pricing in merger agreements, Shockwave had a market capitalization of about $11 billion. It is currently trading at an all-time high.

SWAV is dedicated to one of my favorite areas: cardiovascular health.As some of you may know, cardiovascular disease is main reason In the United States, nearly 700 million people die each year.

This year, SWAV is expected to generate at least $910 million in revenue, a 27% increase from 2023! This is a great example of the growth potential of this market.

Acquiring SWAV makes sense because Johnson & Johnson acquired cardiac device maker Abiomed in a $16.6 billion deal in 2022.

On top of that, the company is well positioned to complete the deal, as it received $13.2 billion in cash from the Kenvue (KVUE) spinoff.

Even better, for JNJ, creating synergies is relatively easy because both SWAV and Abiomed have partnerships in training and dedication programs in the United States and Germany.

Johnson & Johnson

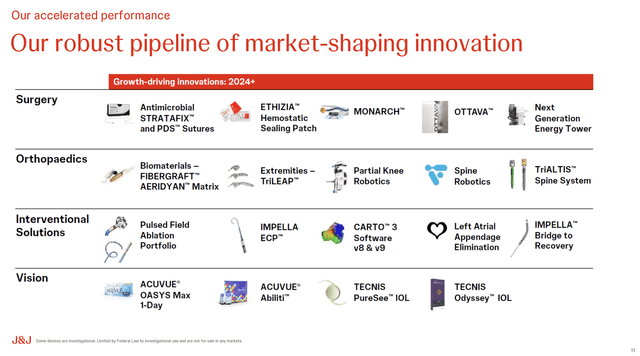

Overall, I’m very bullish on medical technology, which is an increasingly important area for Johnson & Johnson.

For example, at the latest Cowen annual healthcare conference, the company detailed the growth of its medical technology.

So far, it has three active projects, including the VELYS project in orthopedics and the MONARCH flexible robotic endoluminal system for pulmonology and urology.

For example, the MONARCH system has made significant progress, performed more than 35,000 surgeries in the United States, and was approved in China to address a significant unmet need in lung cancer diagnosis.

Even better, the company’s advancements across multiple surgical specialties have made it a leader in the rapidly growing field of robotic surgery, which makes stocks like Intuitive Surgical (ISRG) an outperformer.

Johnson & Johnson

The only thing better than an optimistic growth story is strong results.

Johnson & Johnson’s medical technology business has shown impressive growth so far, with organic revenue growing from 1.5% in 2017 to 7.8% at the end of the last fiscal year. This does not include Abiomed.

Going forward, we may be dealing with a company that generates a greater share of revenue from high-growth products.

So if you look at our portfolio in 2018, you’ll see that 20% of that portfolio is what we consider to be high-growth segments, segments that are growing above 5%. Last year, that number was 50%. So all of this tells you that the fundamentals of Johnson & Johnson’s medical technology business are very strong. What’s to come is exciting. Robotics will definitely be part of what makes us excited about the future. – Johnson & Johnson

So, what does this mean for its valuation?

Valuation

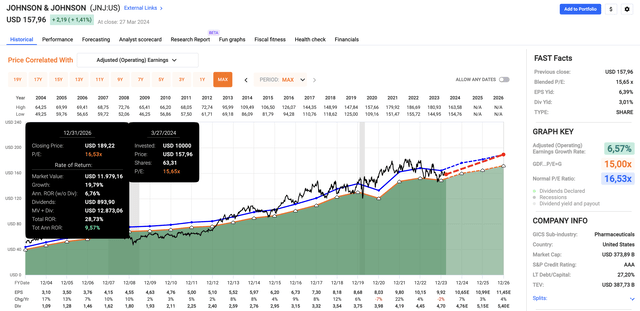

Since 2004, JNJ stock has returned 7.3% annually. Going forward, I believe this number will increase significantly.

According to the data in the chart below, Johnson & Johnson is expected to see earnings per share grow 7% this year, followed by growth of 3% in 2025 and 4% in 2026.

Based on the success of its medical device business and potential synergies from new acquisitions, I expect long-term growth to remain substantially higher.

quick chart

With this in mind, Johnson & Johnson currently trades at a combined price-to-earnings ratio of 15.6 times. This is lower than its normalized price-to-earnings ratio of 16.5 times.

Combining a 16.5x P/E ratio with a 3.0% dividend (less than a 50% payout ratio and 61 consecutive annual hikes) and expected EPS growth, the company’s conservative annual return outlook is about 9.6% per year .

While this may obviously change, I believe JNJ is in the best position to generate higher returns than it has over the past 20 years.

It also helps that China has one of the best balance sheets in the world, possibly forcing the Fed to maintain its “longer higher” stance if interest rates and inflation continue to rise.

As a result, I still think JNJ is an undervalued dividend king with a good chance of accelerating growth over the long term and a potential litigation tailwind following this week’s ruling.

take away

Johnson & Johnson faces significant challenges, particularly ongoing litigation over its talc products.

However, recent legal developments suggest relief may be forthcoming for the company, which could lead to a return of investor confidence.

Additionally, Johnson & Johnson’s potential acquisition of Shockwave Medical suggests a path to higher growth prospects, particularly in cardiovascular health.

Overall, Johnson & Johnson’s strong focus on medical technology is paving the way for long-term growth.

Despite poor performance over the past 20 years, the company’s strong balance sheet and dividend history make it a compelling choice for long-term investors looking for stability and growth.

Advantages Disadvantages

advantage:

- Favorable legal developments: Recent settlements and favorable legal rulings suggest that ongoing litigation may be mitigated, reducing investor uncertainty.

- Strategic acquisitions: Johnson & Johnson’s potential acquisition of Shockwave Medical marks a greater focus by Johnson & Johnson on high-growth areas such as cardiovascular health.

- Medical technology growth: With a strong product pipeline and impressive advances in robotic surgery, Johnson & Johnson’s medical technology segment offers exciting growth opportunities.

- Stable Dividend History: Johnson & Johnson has a consistent dividend record, making it an attractive choice for income investors.

shortcoming:

- Litigation pending: Despite recent developments, the company remains vulnerable to lawsuits if plaintiffs can prove that its talc causes cancer.

- Performance issues: Johnson & Johnson’s stock price has lagged the S&P 500 over the past two decades. It takes good execution to change that.

- competition: Competition in healthcare, particularly in the medical technology industry, may weigh on growth.